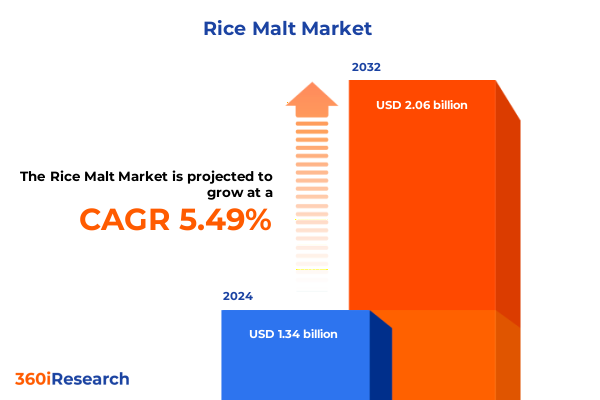

The Rice Malt Market size was estimated at USD 1.34 billion in 2024 and expected to reach USD 1.41 billion in 2025, at a CAGR of 5.49% to reach USD 2.06 billion by 2032.

Rice malt is redefining ingredient innovation through enzymatic functionality, clean-label appeal, and sustainable cultivation practices

Rice malt has emerged as a powerful functional ingredient that is redefining product formulation across the food, beverage, brewing, and confectionery industries. Drawing upon the natural enzymatic properties of rice grains, rice malt delivers clean-label appeal and enhanced nutritional benefits, allowing manufacturers to formulate products that resonate with health-conscious consumers. Recent years have witnessed a surge in demand driven by gluten-free and plant-based trends, as well as by a growing appetite for unique textures and flavors.

As innovators seek alternatives to traditional barley malt, rice malt offers a compelling blend of hypoallergenic characteristics and enzymatic activity that supports starch conversion, sweetness modulation, and mouthfeel enhancement. Integrating rice malt into formulations reduces reliance on synthetic additives, thereby streamlining labels and meeting rigorous clean-label criteria. Beyond its functional merits, rice malt aligns with sustainability imperatives as rice cultivation can be optimized to reduce water and carbon footprints, complementing broader commitments to regenerative agriculture.

Consequently, rice malt is evolving from a niche component into a mainstream ingredient, driving product innovation from craft breweries and artisanal bakeries to industrial-scale beverage producers. This transformation underscores the ingredient’s versatility and signals a paradigm shift in how manufacturers approach texture, taste, and health attributes in their offerings. With consumer priorities continuing to emphasize natural, traceable, and health-focused ingredients, rice malt stands poised to become a staple in product development strategies worldwide.

Escalating wellness demands, advanced enzymatic innovations, and sustainable agriculture initiatives are catalyzing a transformative shift in the rice malt landscape

The rice malt industry is undergoing a series of profound shifts characterized by escalating consumer health priorities, technological advancements in enzymatic processing, and elevated sustainability benchmarks. As the global focus on wellness intensifies, product developers are prioritizing ingredients that deliver functional benefits beyond basic nutrition, and rice malt’s enzymatic profile supports this demand by enhancing flavor profiles and textural qualities without synthetic enhancers.

Simultaneously, breakthroughs in malting and fermentation technologies have enabled producers to fine-tune enzymatic activity, yielding rice malt variants that cater to specific application requirements, from high-conversion brewing malts to low-viscosity adjuncts for beverage clarity. This precision in process engineering is opening new frontiers in product differentiation, enabling manufacturers to target niche consumer segments with tailored ingredient solutions.

On the sustainability front, integrated rice cultivation practices-such as alternate wetting and drying, precision fertilization, and carbon-offsetting partnerships-are elevating the environmental performance of rice malt supply chains. Buyers and regulators alike are demanding greater transparency and accountability, prompting stakeholders to adopt traceability platforms and sustainable farming certifications.

Taken together, these consumer-driven, technological, and environmental catalysts are forging a transformative landscape in which rice malt not only enhances product functionality but also embodies the broader values of health, innovation, and environmental stewardship.

Revised United States tariff regimes in 2025 are reshaping rice malt sourcing strategies, supply chain resilience, and competitive pricing dynamics

In 2025, a series of tariff adjustments enacted by the United States government have recalibrated global rice malt trade dynamics, compelling stakeholders to revisit sourcing strategies and pricing assumptions. By imposing revised duties on key rice-producing regions, these measures have narrowed cost differentials that previously favored certain export markets, prompting importers to diversify supplier portfolios to mitigate exposure to single-origin volatility.

As a direct consequence, downstream manufacturers have pursued local contract malting partnerships, seeking to anchor supply continuity and reduce lead times. Domestic malting capacity expansion has gained momentum, driven by this desire for supply chain resilience and to circumvent elevated import duties. These shifts are particularly evident in the craft brewing segment, where small-scale breweries have accelerated alliances with regional maltsters to maintain ingredient consistency and price stability.

Moreover, revised tariff structures have triggered incremental cost pass-throughs, influencing final product pricing across beverage, bakery, and confectionery categories. While large-scale producers have leveraged scale efficiencies to absorb portions of these additional duties, smaller players have confronted pressure to optimize formulations or to explore alternative adjuncts.

In response, industry participants are collaborating with policy advisors and trade associations to advocate for balanced tariff frameworks that safeguard both domestic interests and global competitiveness. This evolving tariff environment underscores the need for agile strategic planning and underlines the importance of real-time trade intelligence for market participants.

In depth analysis of form, production, application, and distribution channel segmentation unravels targeted growth trajectories and competitive advantages

A nuanced examination of rice malt’s segmentation reveals distinct application-driven growth patterns and operational considerations. Within the form dimension, liquid and powder variants serve complementary roles; liquid extracts excel in rapid solubility and flavor infusion for beverages and confectionery applications, whereas powder formats offer prolonged shelf life and ease of integration for dry-mix formulations in bakery and brewing operations. Transitioning between these formats allows manufacturers to optimize production workflows and customize ingredient performance.

Parallel insights emerge when considering the production process segmentation encompassing fermentation and malting. Fermentation-derived rice malt solutions enable the development of novel flavor profiles and probiotic potentials in functional beverages, while conventionally malted rice retains robust enzymatic activity ideal for starch conversion in beer and bakery leavening. Strategically blending these process variants yields hybrid malts that balance flavor complexity, enzymatic efficacy, and cost considerations.

Application-centric dynamics further elucidate opportunities across bakery, beverage, brewing, and confectionery verticals. In bakery, rice malt enhances crumb softness and shelf life naturally, while in beverages it contributes subtle sweetness and mouthfeel enhancement. Brewing operations benefit from tailored enzymatic profiles to optimize fermentation, whereas confectionery manufacturers leverage rice malt for flavor modulation and color stabilization.

Distribution channel segmentation underscores divergent route-to-market imperatives. Offline sales networks rely on direct sales relationships and distributor partnerships to service large-scale industrial users, whereas online channels facilitate wider access for artisanal producers and small-batch innovators. Harmonizing online and offline strategies enables suppliers to extend market reach while maintaining personalized service levels.

This comprehensive research report categorizes the Rice Malt market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Product Type

- Category

- Rice Type

- Application

- Distribution Channel

Diverse regulatory frameworks, consumer preferences, and logistical infrastructures drive distinct regional trajectories for rice malt adoption across the Americas EMEA and Asia Pacific

Geographic market analysis reveals that regional variances in consumer tastes, regulatory structures, and infrastructure investments are shaping differentiated pathways for rice malt adoption. Across the Americas, growing craft brewing communities and the maturation of functional food sectors are driving robust demand for specialty malts. North American breweries, in particular, have championed rice malt’s light-bodied characteristics for sessionable ales, while food formulators leverage local rice sourcing to reinforce sustainable supply chain narratives.

In Europe, Middle East and Africa, regulatory emphasis on clean-label declarations and allergen management has propelled rice malt into prominence, particularly within bakery and confectionery segments. The Middle Eastern ready-to-eat market has embraced rice malt for air-dried snacks and confectionery coatings, whereas European breweries value its gluten-free attributes for niche beer variants. Additionally, EMEA distribution networks are increasingly sophisticated, with pan-regional e-commerce platforms complementing traditional wholesale channels.

In Asia Pacific, historical familiarity with rice-based ingredients underpins a rich tapestry of rice malt innovation. Japanese and Korean beverage manufacturers exploit rice malt’s saccharification properties for premium rice liquors, while Southeast Asian snack producers integrate malted rice powders for textural novel snacks. Infrastructure investments in port facilities and cold chain logistics are enhancing trade connectivity, enabling rice malt producers to service export markets with improved reliability.

Collectively, these regional insights spotlight the interplay between cultural heritage, regulatory priorities, and logistical capabilities as catalysts for rice malt market expansion across the globe.

This comprehensive research report examines key regions that drive the evolution of the Rice Malt market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Global agribusinesses, specialized regional maltsters, and biotech innovators are forging distinct competitive advantages through integration, customization, and collaboration

The competitive landscape of rice malt production features a blend of global ingredient suppliers, specialized maltsters, and innovative start-ups, each pursuing differentiated value propositions. Established agribusiness firms have leveraged vertically integrated operations to ensure traceability from paddy field to product, deploying proprietary malting technologies and sustainability certifications to win large-scale contracts with beverage giants. At the same time, regional malt processors have focused on nimble production capabilities, offering customized enzyme profiles and small-batch runs to service craft brewers and premium bakeries.

Emerging players in the biotechnology space are introducing fermentation-driven rice malt variants enriched with tailored flavor compounds and prebiotic functionalities, positioning themselves at the intersection of nutrition science and gourmet applications. These innovators frequently partner with academic institutions to co-develop novel strains and secure intellectual property protections. Meanwhile, collaborative alliances between equipment manufacturers and ingredient providers are facilitating turnkey malting solutions for new market entrants, lowering capital barriers and accelerating time to market.

Across the spectrum, companies are reinforcing competitive moats through digital traceability platforms, predictive quality analytics, and direct consumer engagement initiatives. By harnessing data-driven insights into consumer usage patterns and production performance, leading rice malt suppliers are capable of co-creating product roadmaps that anticipate emerging trends. This multifaceted ecosystem illustrates how scale, specialization, and innovation converge to define market leadership in the rice malt sector.

This comprehensive research report delivers an in-depth overview of the principal market players in the Rice Malt market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- Bharat Glucose Private Limited

- Biona Organic by Windmill Organics Ltd

- Ceres Organics

- Clearspring Limited

- DOMINO FOODS, INC. by ASR GROUP

- Eckert Malting & Brewing

- Freshco Food And Beverages

- Gehl Foods, LLC

- Glucorp

- Grouse Malt House

- Gulshan Polyols Ltd.

- Habib Rice Products Limited

- Imperial Malts Ltd.

- IREKS GmbH

- Lundberg Family Farms

- Malt Products Corporation

- Master Sweetener

- MATCO FOODS LIMITED

- Meurens Natural S.A

- Nature's Flavors

- Om Foods Inc.

- Pioneer Industries Pvt. Ltd.

- Pureharvest

- Riso Melotti s.r.l

- Sasma BV

- Shafi GlucoChem Private Limited

- Titan Biotech Ltd.

- Topwill organic by Rasto Organic Food Pty Ltd

- Urban Platter

- Wuhu Deli Foods Co., Ltd.

Adopt an integrated strategy combining product innovation, diversified sourcing, and collaborative industry engagement to lead in the evolving rice malt market

To capitalize on the burgeoning opportunities in the rice malt sector, industry leaders must adopt a strategic framework that integrates product innovation, supply chain agility, and stakeholder collaboration. By prioritizing the development of enzymatically optimized rice malt variants, companies can address diverse application requirements, from low-viscosity beverage adjuncts to high-activity brewing malts. Investing in R&D partnerships with fermentation technology providers and academic institutions will accelerate access to next-generation ingredient solutions.

Parallel supply chain strategies should include dual-sourcing arrangements that balance domestic malting capacity expansions with selective imports, thus mitigating the impact of tariff fluctuations. Strengthening relationships with paddy farmers through contract farming and sustainability incentive programs will secure upstream consistency, while enhancing traceability platforms will meet the rising demand for transparency.

Collaborative marketing initiatives with end users-such as joint pilot programs with craft breweries or bakery co-creation workshops-will foster deeper insights into consumer preferences and drive early adoption of novel rice malt formulations. Additionally, establishing cross-industry forums with regulatory bodies and trade associations can influence balanced policy frameworks that support market expansion.

By combining targeted product pipelines, resilient sourcing frameworks, and proactive stakeholder engagement, industry participants can position themselves at the vanguard of rice malt innovation and establish enduring competitive advantages.

Robust mixed-method research integrating primary expert consultations secondary data validation and advanced analytical frameworks underpins these rice malt market insights

The insights presented in this report are grounded in a rigorous mixed-method research design that synthesizes both primary and secondary data sources. Primary research was conducted through in-depth interviews with industry veterans, including ingredient R&D leaders, procurement heads at top beverage and bakery companies, and sustainability experts overseeing rice cultivation initiatives. These conversations elucidated emerging demand drivers, supply chain challenges, and breakthrough production techniques.

Secondary research drew upon reputable trade publications, regulatory filings, and technology whitepapers to contextualize trends and validate primary insights. Data points were cross-verified across multiple sources to ensure accuracy and mitigate bias. Advanced analytical models, including SWOT and Porter’s Five Forces frameworks, were deployed to assess competitive dynamics and identify strategic levers.

Quantitative inputs, such as trade flow statistics, production volumes, and cost component breakdowns, were extrapolated using time-series analysis to reveal directional shifts. Qualitative findings, including expert opinions and case studies, were synthesized through thematic coding to uncover nuanced growth opportunities.

This comprehensive methodology, characterized by iterative validation loops and multi-stakeholder triangulation, underpins the credibility of the report’s conclusions and recommendations, providing stakeholders with a robust foundation for strategic decision-making.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Rice Malt market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Rice Malt Market, by Product Type

- Rice Malt Market, by Category

- Rice Malt Market, by Rice Type

- Rice Malt Market, by Application

- Rice Malt Market, by Distribution Channel

- Rice Malt Market, by Region

- Rice Malt Market, by Group

- Rice Malt Market, by Country

- United States Rice Malt Market

- China Rice Malt Market

- Competitive Landscape

- List of Figures [Total: 17]

- List of Tables [Total: 1431 ]

Consolidated insights affirm rice malt’s transformative role across innovation, sustainability, and competitive differentiation in diverse industries

The aggregated evidence underscores rice malt’s emergence as a pivotal functional ingredient that transcends traditional boundaries in food, beverage, and industrial applications. From catalyzing novel flavor and texture profiles to reinforcing clean-label and gluten-free propositions, rice malt is reshaping product innovation pathways. Regional adoption patterns reflect the ingredient’s adaptability, while supply chain realignments in response to U.S. tariffs demonstrate market resilience and strategic agility.

Leading companies have distinguished themselves through vertical integration, customized enzyme portfolios, and biotechnology collaborations, illustrating how scale and specialization coexist within an evolving competitive ecosystem. Looking ahead, the interplay between health-driven consumer preferences, sustainability expectations, and technological advancements will continue to drive rice malt’s ascent.

As manufacturers refine their formulations and suppliers enhance traceability and production capacities, rice malt is poised to assume an even more central role in global ingredient strategies. The confluence of functionality, provenance, and innovation positions rice malt as a catalyst for differentiation and value creation.

Stakeholders equipped with the insights and frameworks outlined in this report will be well positioned to navigate uncertainties, harness new opportunities, and spearhead the next wave of rice malt–driven growth.

Connect directly with Ketan Rohom Associate Director of Sales and Marketing to acquire the authoritative rice malt market research report and elevate your strategic decision making

To explore the full breadth of strategic opportunities within the rice malt market and secure the comprehensive insights needed to drive growth, reach out directly to Ketan Rohom, Associate Director of Sales & Marketing. Ketan’s expertise in translating complex industry data into actionable strategies ensures that your organization will harness the latest intelligence on consumer dynamics, regulatory shifts, and competitive positioning. Engage with Ketan to tailor the report’s findings to your specific business objectives, unlock customized briefings, and receive priority access to ongoing updates. Accelerate decision-making, refine product roadmaps, and outpace the competition by leveraging this authoritative report. Connect with Ketan Rohom today to begin your journey toward leadership in the evolving rice malt landscape

- How big is the Rice Malt Market?

- What is the Rice Malt Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?