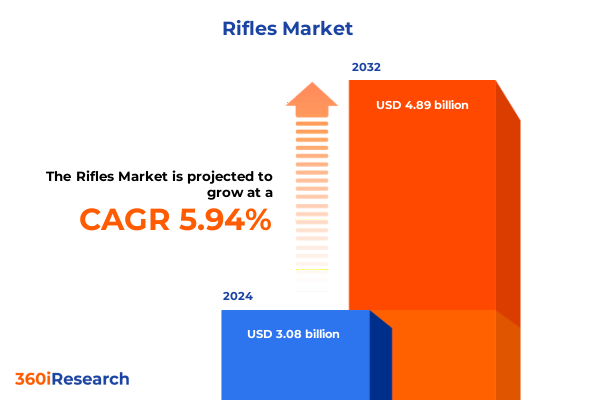

The Rifles Market size was estimated at USD 3.25 billion in 2025 and expected to reach USD 3.44 billion in 2026, at a CAGR of 5.98% to reach USD 4.89 billion by 2032.

Unlocking the Rifles Market Evolution Through Technological Innovation, Geopolitical Shifts, and Emerging End-User Dynamics in 2025

The rifles market has undergone a profound transformation driven by advances in materials science, digital integration, and shifting geopolitical imperatives. What was once defined by mechanical reliability and incremental enhancements has evolved into a landscape characterized by composite barrels, modular architectures, and AI-driven quality control processes. Manufacturers are now blending cutting-edge metallurgy with seamless electronics, yielding weapons systems that offer unprecedented accuracy and adaptability. This convergence of technology is reshaping expectations across both military applications and civilian recreational use, demonstrating that the legacy of the bolt-action rifle is alive and thriving in new configurations.

Moreover, geopolitical volatility and the resurgence of defense spending in key regions have energized demand for adaptable platforms. Governments are procuring multi-caliber modular systems capable of rapid configuration changes, while law enforcement agencies seek rifles optimized for both urban and rural deployments. At the same time, civilian shooters are embracing precision long-range competition and advanced hunting applications, further amplifying market momentum. Transitional dynamics between public and private sectors underscore the critical importance of understanding both regulatory shifts and end-user requirements as the market advances toward 2026.

Identifying the Next-Generation Transformations Accelerating the Rifles Industry With Advanced Manufacturing and Digital Integration Standards

Industry incumbents and new entrants alike are redefining conventional production paradigms by leveraging additive manufacturing and AI-enhanced processes. Carbon fiber barrels and aluminum-alloy receivers, once niche offerings, are now mainstream as manufacturers harness lightweight materials to improve handling and reduce shooter fatigue. Concurrently, smart riflescopes with integrated ballistic calculators and Bluetooth connectivity are transforming the user experience, enabling shooters to capture environmental data in real time and refine their ballistics models on the fly. These innovations are not confined to premium segments; economies of scale and design standardization are driving rapid cost declines, making advanced features accessible to a broader market.

In parallel, the industry’s supply chain architecture is undergoing a fundamental realignment to mitigate trade-war risks and optimize logistics performance. Companies are onshoring critical components, forging partnerships with domestic suppliers, and embracing lean manufacturing to offset rising material costs. This shift is enhancing resilience against tariff shocks and ensuring continuity during periods of global disruption. As a result, the rifles sector is entering an era where agility and digital integration are as pivotal as ballistic performance, marking a decisive turn away from traditional, monolithic production toward a dynamic ecosystem of interconnected capabilities.

Assessing the Comprehensive Impacts of United States Tariff Policy Changes in 2025 on Rifles Supply Chains, Production Costs, and Market Strategies

The cumulative impact of U.S. tariffs enacted throughout 2025 has reverberated across the rifles supply chain, compelling manufacturers and distributors to reevaluate sourcing strategies and pricing models. Early in the year, the imposition of 25 percent duties on steel and aluminum imports led to material cost increases, directly affecting barrel production and small component fabrication. These tariffs were applied without exclusions, heightening pressure on both domestic producers reliant on foreign alloys and overseas suppliers whose products were suddenly less price-competitive.

Subsequent rounds of duties targeted foreign firearms and related accessories, including tariffs of up to 34 percent on optics and magazines from China and 10 percent on Brazilian-manufactured rifles. Brazilian gunmaker Taurus reported that its U.S. assembly plant was critical to mitigating the tariff burden, emphasizing a strategic shift toward localized production to preserve market share. Meanwhile, retaliatory threats and initial tariff implements by Canada on U.S. sport and civilian firearms underscored the cross-border tensions influencing the North American market. Although Canada later reversed its stance following diplomatic negotiations, the episode demonstrated the vulnerability of international supply chains to rapidly changing trade policies.

Collectively, these measures have accelerated onshoring investments and spurred innovation in low-cost manufacturing techniques. Companies are now evaluating regional production hubs and near-sourcing strategies to defend margins and ensure continuity, reflecting a sector in transition from global dependence to a more geographically diversified framework.

Deriving Actionable Insights From Multifaceted Rifles Market Segmentation to Navigate Diverse Applications, Designs, and Distribution Channels

The rifles market’s multifaceted segmentation underscores the diversity of applications and technological preferences shaping strategic decisions. On the end-use front, defense and law enforcement sectors demand robust platforms tailored to law enforcement use, military operations, and private security deployments spanning corporate and personal protection. Personal defense enthusiasts, by contrast, prioritize concealability and rapid deployment, driving innovations in compact carbines for concealed carry, home defense, and vehicular scenarios. Sporting and hunting disciplines further subdivide into big game, small game, and target shooting, with action enthusiasts, benchrest competitors, and precision long-range shooters each pursuing specialized configurations that optimize accuracy and reliability.

This comprehensive research report categorizes the Rifles market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Action Type

- Barrel Length

- Material

- Application

- Distribution Channel

Revealing Regional Nuances in the Global Rifles Market With Distinct Dynamics Across the Americas, EMEA, and Asia-Pacific Territories

Regional dynamics reveal distinct drivers and challenges across global markets. In the Americas, robust defense budgets and a deep-rooted culture of recreational shooting underpin sustained demand for both military-grade rifles and consumer-centric models. This region’s mature direct-sales networks and expanding online channels facilitate rapid product launches and personalized customer engagement.

By contrast, Europe, the Middle East, and Africa present a complex regulatory environment where stringent firearms controls coexist with significant law enforcement modernization programs. Here, manufacturers must navigate export restrictions and evolving licensing frameworks while responding to procurement cycles in both urban security and veterans’ sporting associations.

The Asia-Pacific region exhibits the fastest pace of modernization, driven by government recapitalization initiatives and growing interest in competitive shooting sports. Emerging markets in Southeast Asia and the Pacific Rim are actively investing in tactical training facilities and equipment standardization, fostering demand for high-performance rifles and advanced optics. As a result, the region is swiftly evolving from a cost-sensitive segment to a critical growth frontier.

This comprehensive research report examines key regions that drive the evolution of the Rifles market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Highlighting Competitive Playbooks and Strategic Priorities of Leading Rifles Manufacturers and Innovations Driving Market Leadership

Leading players in the rifles industry are differentiating through strategic investments, product innovation, and collaborative ventures. Taurus has leveraged its U.S. production facility to circumvent tariff pressures and maintain export volumes, while concurrently pursuing acquisitions to expand its precision rifle offerings. SIG Sauer and Beretta continue to invest heavily in modular weapon systems and smart-scope integrations, aligning their product roadmaps with law enforcement and military digitalization mandates.

Domestic stalwarts such as Ruger and Smith & Wesson are optimizing lean manufacturing lines to offset material surcharges, simultaneously enhancing their direct-to-consumer e-commerce channels. Barrett and Remington have responded to precision-shooting demand by introducing calibers and barrel lengths tailored to long-range competition, collaborating with optics partners to deliver turnkey solutions. Collectively, these initiatives reflect a competitive landscape where agility and innovation define market leadership.

This comprehensive research report delivers an in-depth overview of the principal market players in the Rifles market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- Aero Precision LLC

- Barrett Firearms Manufacturing, Inc.

- Beretta USA Corp.

- Bravo Company Manufacturing, Inc.

- Browning Arms Company

- CheyTac USA

- Colt's Manufacturing Company LLC

- Daniel Defense, Inc.

- Diamondback Firearms, LLC

- FN America, LLC

- Heckler & Koch, Inc.

- Henry Repeating Arms Co.

- IWI US, Inc.

- O.F. Mossberg & Sons, Inc.

- Palmetto State Armory, LLC

- Pioneer Arms USA

- Remington Arms Company, LLC

- Samsun Yurt Savunma Sanayi ve Ticaret A.Ş.

- Savage Arms, Inc.

- SIG Sauer, Inc.

- Smith & Wesson Brands, Inc.

- Springfield Armory, Inc.

- Sturm, Ruger & Co., Inc.

- Taurus USA

- Weatherby, Inc.

Strategic Recommendations for Industry Leaders to Capitalize on Emerging Rifles Market Opportunities, Mitigate Risks, and Drive Growth

Industry leaders must adopt a holistic approach to remain ahead of evolving market pressures. First, diversifying supply chains through regional production hubs and nearshoring critical components will buffer against future tariff escalations. Integrating additive manufacturing for rapid prototyping and small-batch runs can reduce material waste and accelerate time to market. Concurrently, investing in smart-scope partnerships and digital ballistics integrations will satisfy the growing demand for data-driven performance.

To capitalize on shifting consumer behaviors, organizations should expand direct sales and e-commerce capabilities, leveraging advanced CRM tools to enhance personalization and after-sales support. Collaboration with materials science innovators will drive the adoption of composite and advanced steel alloys, while strategic M&A can facilitate entry into emerging segments such as precision hunting and competitive shooting. Ultimately, leaders that harmonize operational resilience with customer-centric innovation will be best positioned to capture the next wave of market growth.

Demystifying the Rigorous Research Methodology Underpinning This 2025 Rifles Market Analysis With Robust Data Validation and Triangulation

This analysis is underpinned by a comprehensive research methodology that combines primary interviews with industry executives, rigorous secondary research, and quantitative data triangulation. Extensive discussions with procurement officers in defense ministries, law enforcement agencies, and private security firms provided firsthand insights into specification requirements and procurement cycles. Complementary supply chain mapping exercises and tariff scenario modeling were conducted to evaluate cost implications across alternative sourcing strategies.

Secondary sources included regulatory filings, government defense budgets, and trade-policy announcements to capture the evolving tariff landscape. Advanced statistical techniques were applied to reconcile data discrepancies and validate trends across regions. Segmentation frameworks were rigorously tested through workshops with subject-matter experts, ensuring that application, action type, caliber, barrel length, distribution channel, and material categories accurately reflect market realities. This robust methodology guarantees actionable intelligence and strategic clarity for stakeholders navigating the rifles sector.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Rifles market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Rifles Market, by Action Type

- Rifles Market, by Barrel Length

- Rifles Market, by Material

- Rifles Market, by Application

- Rifles Market, by Distribution Channel

- Rifles Market, by Region

- Rifles Market, by Group

- Rifles Market, by Country

- United States Rifles Market

- China Rifles Market

- Competitive Landscape

- List of Figures [Total: 17]

- List of Tables [Total: 1749 ]

Concluding Perspectives on the Rifles Market’s Evolution, Key Drivers, and Strategic Pathways for Sustained Growth and Resilience

The rifles market of 2025 stands at the confluence of technological innovation, regulatory shifts, and evolving user demands. Advancements in additive manufacturing, composite materials, and digital optics have raised performance benchmarks, while U.S. tariff policies and geopolitical recalibrations have reshaped global supply chains. Market segmentation insights reveal the nuanced preferences of defense and law enforcement agencies, civilian defenders, and sporting enthusiasts, underscoring the need for tailored strategies across product lines.

Regional analysis highlights the Americas’ mature consumer base, EMEA’s intricate regulatory landscape, and the Asia-Pacific’s rapid modernization efforts. Leading manufacturers are responding with strategic investments in local production, modular designs, and direct sales expansion. As the sector moves forward, resilience will be defined by agility in sourcing, commitment to innovation, and deep engagement with end-user communities. Stakeholders that embrace these imperatives will secure a competitive edge and unlock the full potential of the dynamic rifles market.

Take the Next Step to Empower Your Organization by Securing Exclusive Rifles Market Intelligence From Our Associate Director Sales & Marketing

To gain unparalleled insights into the evolving rifles market and secure a competitive edge, reach out to Ketan Rohom, Associate Director of Sales & Marketing. Ketan brings extensive expertise in market intelligence and client solutions, ensuring your organization benefits from tailored research that addresses the complexities of tariff impacts, segmentation nuances, and regional dynamics. Engaging with Ketan will provide you with detailed strategic guidance, exclusive briefing sessions, and customizable data deliverables designed to support critical decision-making. Don’t miss the opportunity to transform market intelligence into actionable growth strategies-contact Ketan Rohom today to purchase the comprehensive rifles market research report and position your enterprise for sustained success.

- How big is the Rifles Market?

- What is the Rifles Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?