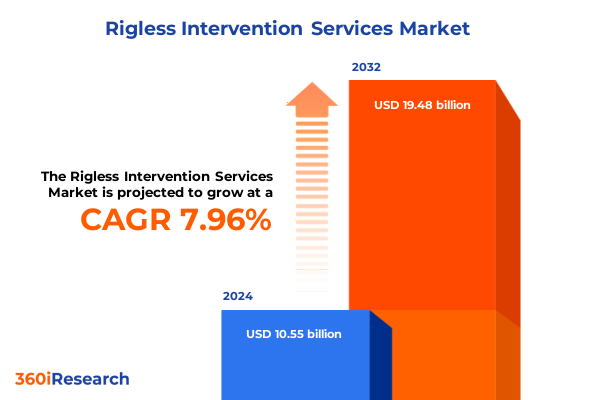

The Rigless Intervention Services Market size was estimated at USD 11.40 billion in 2025 and expected to reach USD 12.36 billion in 2026, at a CAGR of 7.94% to reach USD 19.48 billion by 2032.

Unlocking the Strategic Advantages and Operational Efficiencies Driving Rigless Intervention Solutions

The global energy industry is undergoing a profound evolution, marked by heightened demand for operational agility, reduced carbon footprints, and cost-effective solutions. As traditional well intervention methods face constraints related to mobilization time, environmental restrictions, and capital intensity, rigless intervention services have emerged as a pivotal alternative. By deploying specialized equipment and techniques without a full drilling rig, operators can perform maintenance, stimulation, and workover activities more efficiently and sustainably.

This introduction lays the groundwork for understanding how rigless approaches facilitate faster response times, lower logistical burdens, and minimized environmental impact. Beyond operational benefits, the shift toward rigless services aligns with corporate sustainability objectives and regulatory pressures, underscoring a broader industry commitment to innovation. In this context, stakeholders-from service providers and operators to investors and regulators-stand to benefit from a comprehensive overview that highlights technology enablers, market drivers, and key challenges. The subsequent sections will delve into transformative shifts, tariff impacts, segmentation insights, regional dynamics, and strategic recommendations, establishing a holistic view of this rapidly maturing market.

How Technological Innovation and Sustainability Imperatives Are Redefining Rigless Intervention Practices

In recent years, the rigless intervention landscape has undergone transformative shifts driven by technological breakthroughs and evolving industry priorities. Automation and digitalization initiatives now enable remote monitoring and control of downhole tools, enhancing precision while reducing human exposure to hazardous environments. Advanced data analytics platforms synthesized with real-time downhole intelligence have improved decision-making, enabling proactive maintenance and optimized well stimulation strategies.

Furthermore, sustainability imperatives have prompted the industry to adopt electric and hybrid-powered intervention units that significantly reduce greenhouse gas emissions and noise pollution. This evolution is complemented by modular system architectures that facilitate rapid deployment and seamless integration with existing well infrastructure. In parallel, the increasing complexity of unconventional reservoirs has spurred specialized service offerings tailored to extended-reach wells and ultra-deep offshore environments, reinforcing the role of rigless intervention as a catalyst for unlocking reserves that were previously deemed uneconomical.

Altogether, these trends signify a paradigm shift, where rigless intervention transcends its historical role as a cost-saving alternative and emerges as a core enabler of efficient, safe, and environmentally responsible well maintenance and enhancement activities.

Examining the Cascading Consequences of 2025 United States Tariff Policies on Supply Chains and Cost Dynamics

The introduction of new tariffs by the United States in 2025 has had a cascading impact on the rigless intervention segment, influencing both equipment sourcing and service deployment costs. In this environment, service providers have reevaluated their supply chains, shifting procurement strategies toward domestic manufacturers or low-tariff trade partners to mitigate expense escalations. While this realignment has bolstered regional manufacturing capabilities, it has also necessitated renegotiation of long-term contracts and recalibration of pricing models to preserve margin integrity.

Simultaneously, operators have become more selective in service package customization, prioritizing high-value interventions and deferring non-essential work to balance capital allocation constraints. To maintain service continuity, several leading providers have embraced collaborative frameworks with local equipment fabricators to streamline component availability and reduce lead times. Although tariffs initially introduced headwinds, the cumulative effect has been a gradual reinforcement of regional resilience and a renewed emphasis on cost transparency and supply chain agility across the value chain.

Looking ahead, the industry’s ability to adapt through strategic sourcing, contractual flexibility, and integrated service offerings will determine how effectively it navigates the evolving tariff environment, ultimately shaping competitive positioning and long-term growth trajectories.

Unveiling How Equipment, Application, and Service Tiering Drives Specialized Rigless Intervention Outcomes

A nuanced understanding of the rigless intervention market emerges when dissecting performance across equipment offerings, application focus, and service categories. Specialists deploying coiled tubing systems find these tools well-suited for high-pressure acidizing and complex fracturing acidizing campaigns that demand continuous conveyance. Conversely, slickline interventions excel in cost-effective scale removal operations, leveraging mechanical scale removal or acid-based treatment approaches. In deeper or deviated wells, snubbing solutions provide the necessary well control for perforation tasks, whether executed through shaped charge perforation or gun perforation methods.

Parallel to equipment distinctions, the selection of application type drives service innovation. High-pressure fracturing and multistage fracturing approaches have gained traction in unconventional shale reservoirs, while matrix acidizing remains crucial for porosity enhancement in mature fields. Sand control interventions now blend gravel packing with chemical consolidation techniques to optimize sand management. Additionally, the sector has seen the advancement of chelation-based treatments complementing acid-based methods for complex scale removal scenarios.

Beyond equipment and application differentiation, service types shape market engagement. Completion enhancement services focus on boosting production efficiency post-drilling, whereas wellbore cleanout operations prioritize debris removal and flow assurance. Maintaining well integrity through corrosion monitoring and mechanical integrity assessments underpins the long-term viability of interventions. This segmentation framework offers stakeholders clarity on where innovation and investment are most impactful.

This comprehensive research report categorizes the Rigless Intervention Services market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Service Type

- By Deployment Mode

- By Service Duration

- Application Type

Exploring Regional Nuances Across the Americas, EMEA, and Asia-Pacific That Shape Rigless Service Adoption

Regional dynamics reveal distinct growth drivers and challenges across the Americas, Europe, Middle East & Africa, and Asia-Pacific geographies. In the Americas, a resurgence in onshore shale activity underpins demand for agile well stimulation services, with operators favoring interventions that minimize downtime and logistical footprint. Environmental regulations in Canada have spurred the uptake of electric intervention fleets, reinforcing sustainability aspirations.

In Europe, Middle East & Africa, deepwater and ultra-deepwater fields in the North Sea and West Africa have elevated the demand for robust subsea intervention technologies. Regional joint ventures and local content regulations have fostered partnerships between international service providers and national oil companies, accelerating technology transfer and skill development. Meanwhile, the transition to greener energy models in Europe has encouraged multi-service packages that integrate carbon intensity monitoring with traditional intervention tasks.

Asia-Pacific markets exhibit growing appetite for rigless techniques in mature fields across Australia and China, alongside expanding unconventional plays in Southeast Asia. Regulatory frameworks favoring local manufacturing have incentivized service providers to establish regional fabrication hubs. As a result, the Asia-Pacific region is emerging as a testbed for next-generation digital interventions, combining real-time analytics with automated tool deployment platforms to address challenging reservoir conditions efficiently.

This comprehensive research report examines key regions that drive the evolution of the Rigless Intervention Services market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Analyzing How Industry Leaders and Innovators Are Crafting Differentiated Service Ecosystems to Stay Ahead

Leading service providers have intensified efforts to distinguish their offerings through strategic partnerships, proprietary technologies, and service integration models. Major players have invested in digital twins of intervention tools, enabling predictive maintenance and virtual commissioning that reduce unplanned downtime. Collaborative alliances with equipment manufacturers have expedited the development of hybrid-electric intervention rigs designed for remote and offshore applications, enhancing both environmental performance and operational uptime.

Competitive differentiation now hinges on the ability to deliver end-to-end service packages that combine mechanical interventions with real-time diagnostic insights. Several top-tier companies have introduced subscription-based maintenance programs, bundling completion enhancement, well integrity assessment, and remote monitoring under unified contracts. These integrated models not only provide predictable service spend but also foster closer client relationships through shared performance metrics and continuous improvement loops.

Moreover, new entrants and mid-sized specialists are carving out niches in advanced sand control solutions and complex scale removal treatments, leveraging chemical consolidation expertise and chelation-based methodologies. Their focus on targeted applications and agile service deployment is driving innovation and compelling established providers to enhance their modular offerings.

This comprehensive research report delivers an in-depth overview of the principal market players in the Rigless Intervention Services market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- ABL Group ASA

- Aker Solutions ASA

- Altus Intervention AS

- Archer Limited

- Baker Hughes Company

- BJ Energy Solutions

- China Oilfield Services Limited

- Expro Group Holdings N.V.

- Halliburton Company

- Helix Energy Solutions Group, Inc.

- Hunting PLC

- National Oilwell Varco, Inc.

- Oceaneering International, Inc.

- Odfjell Technology Ltd.

- Petrofac Limited

- Sapura Energy Berhad

- Schlumberger Limited

- Trican Well Service Ltd.

- Weatherford International plc

- Welltec A/S

Practical Roadmap for Providers to Leverage Technology, Data Integration, and Supply Chain Agility for Growth

To thrive in the evolving rigless intervention domain, industry leaders must adopt an agile strategy that aligns technology, supply chain, and commercial models. First, investing in modular and electrified intervention units will be crucial to meet tightening environmental regulations and reduce operational emissions. By partnering with specialized manufacturers, providers can accelerate deployment cycles and optimize total cost of ownership.

Equally important is the integration of advanced analytics into service delivery. Operators should pilot digital twin and machine learning applications to forecast tool performance, preemptively address failure modes, and customize treatment protocols. Collaborative data-sharing agreements between service companies and operators can unlock new productivity gains and enhance round-trip economics.

Finally, embracing strategic procurement practices will mitigate tariff-driven cost fluctuations. Establishing agile supply networks that blend local content with global expertise will preserve margin stability. Additionally, offering outcome-based contracts that tie pricing to production uplift and asset integrity will differentiate providers in competitive tenders and strengthen long-term client partnerships.

Detailing the Multi-Method Research Framework That Validates Insights on Rigless Intervention Dynamics

This analysis is underpinned by a rigorous research methodology combining primary interviews, secondary data mining, and qualitative validation. Industry practitioners, including operations managers, technical specialists, and procurement leaders, were consulted through structured interviews to capture insights on technology adoption, tariff responses, and regional dynamics. Complementing these discussions, secondary sources comprised peer-reviewed journals, technical white papers, and verified corporate disclosures to ensure factual accuracy.

Data from regulatory filings and trade associations provided a comprehensive view of policy developments and market access conditions. Each data point was triangulated across multiple sources to verify consistency and mitigate bias. Analytical frameworks, such as PESTEL and Porter’s Five Forces, were applied to contextualize macroeconomic and competitive influences. Throughout the research process, quality control measures-peer review, cross-functional team workshops, and iterative feedback loops-ensured methodological integrity and alignment with stakeholder expectations.

This structured approach guarantees that the findings and recommendations in this report are robust, actionable, and reflective of current industry realities.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Rigless Intervention Services market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Rigless Intervention Services Market, by Service Type

- Rigless Intervention Services Market, by By Deployment Mode

- Rigless Intervention Services Market, by By Service Duration

- Rigless Intervention Services Market, by Application Type

- Rigless Intervention Services Market, by Region

- Rigless Intervention Services Market, by Group

- Rigless Intervention Services Market, by Country

- United States Rigless Intervention Services Market

- China Rigless Intervention Services Market

- Competitive Landscape

- List of Figures [Total: 16]

- List of Tables [Total: 1749 ]

Summarizing the Strategic Imperatives and Market Forces Shaping the Future of Rigless Intervention Services

Rigless intervention services are at a pivotal juncture, driven by technological innovation, environmental imperatives, and shifting trade policies. As the industry transitions from traditional rig-based operations toward more agile, cost-effective solutions, stakeholders must remain vigilant to navigate emerging challenges and capitalize on growth opportunities.

This report has illuminated the critical trends reshaping the landscape-from automation and digital integration to tariff-induced supply chain recalibrations. By understanding segmentation nuances, regional dynamics, and competitive strategies, decision-makers can formulate targeted approaches that enhance operational efficiency and sustainability.

Looking forward, the convergence of electrification, real-time analytics, and collaborative contracting models will define market leadership. Organizations that proactively invest in technology, foster flexible supplier ecosystems, and align commercial terms with client outcomes will solidify their position as innovation catalysts. Rigless intervention is no longer a operational adjunct; it represents a transformative service pillar poised to unlock new value wells across the global energy sector.

Connect with Ketan Rohom to Secure Actionable Rigless Intervention Services Insights and Elevate Your Strategic Decision Making

Engaging with this market research report will empower you to make informed decisions and gain a competitive edge in the rapidly evolving rigless intervention services sector. To access this comprehensive analysis and unlock tailored insights, reach out to Ketan Rohom, Associate Director, Sales & Marketing at 360iResearch. Ketan will guide you through the report’s depth and breadth, ensuring you receive the data-driven strategies needed to navigate challenges, capitalize on emerging trends, and enhance your operational success. Seize this opportunity to transform your understanding into action and secure your organization’s leadership in the industry.

- How big is the Rigless Intervention Services Market?

- What is the Rigless Intervention Services Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?