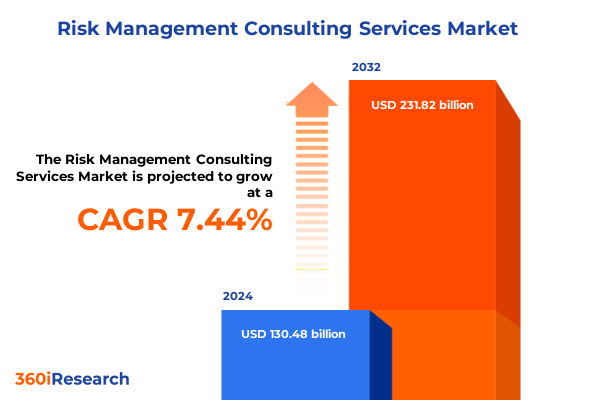

The Risk Management Consulting Services Market size was estimated at USD 139.78 billion in 2025 and expected to reach USD 149.91 billion in 2026, at a CAGR of 7.49% to reach USD 231.82 billion by 2032.

Navigating the Evolving Risk Management Consulting Landscape Amid Rapid Digital Transformation, Heightened Regulatory Demands, and Escalating Geopolitical Uncertainties

The risk management consulting sector is confronting an era defined by rapid digital transformation, intensifying regulatory scrutiny, and unprecedented geopolitical volatility. Organizations must assimilate emerging technologies, adapt to evolving compliance frameworks, and navigate volatile trade policies simultaneously. This confluence of pressures is reshaping priorities for risk leaders, placing a premium on agility and foresight as enterprises recalibrate their risk appetites and strategies to mitigate unpredictable disruptions

Against this backdrop, digital innovation is revolutionizing traditional consulting approaches. Advanced analytics, cloud-based platforms, and AI-driven predictive models are empowering consultants to deliver real-time risk insights and scenario planning at scale. As a result, firms are transitioning from static assessments to dynamic risk intelligence, enabling clients to anticipate threats and respond proactively. This evolution is catalyzing partnerships between risk advisors and technology providers, fostering integrated solutions that bridge strategy and execution

Moreover, the rapid expansion of interdependent third-party networks and the surge in stakeholder demands for robust ESG performance are compelling risk consultants to broaden their focus. Firms are embedding continuous monitoring, supply chain resilience, and sustainability metrics into their offerings to address complex, multidimensional risks. Cultivating a risk-aware organization through culture enhancement and targeted training is now a critical component of comprehensive risk engagements, uniting human capital and technological assets for holistic enterprise resilience.

Identifying the Transformative Shifts Reshaping Risk Management Consulting Through Integrated Cybersecurity, ESG Emphasis, and Advanced Third-Party Controls

The integration of cybersecurity and operational risk management has emerged as a defining trend, as digital infrastructure becomes inseparable from core business processes. Organizations are dismantling silos to implement unified risk platforms that provide end-to-end visibility and streamline incident response protocols. This holistic approach not only enhances threat detection but also fosters cross-functional collaboration, ensuring that cyber resilience is embedded at every level of the enterprise

Climate risk and ESG considerations are transitioning from peripheral reporting requirements to central pillars of enterprise risk frameworks. Forward-looking companies are leveraging climate scenario analysis and ESG risk metrics to inform strategic investments, secure stakeholder trust, and meet rigorous disclosure mandates. By integrating sustainability into risk modeling, organizations can identify vulnerabilities related to resource scarcity, regulatory shifts, and reputational exposure, transforming ESG compliance into a driver of competitive differentiation

Dynamic third-party risk management has gained prominence as supply chains and digital ecosystems grow more complex. The adoption of real-time monitoring and AI-powered due diligence tools enables companies to detect vendor vulnerabilities and compliance deviations instantaneously. This shift towards continuous assessment elevates the role of risk consultants, who now guide clients in building resilient supplier networks and establishing collaborative governance platforms that align internal and external risk practices seamlessly

Finally, adaptive governance and a strong risk culture are essential as organizations confront accelerating change. Agile risk management frameworks that incorporate scenario planning, stress testing, and iterative policy adjustments are enabling enterprises to pivot quickly in response to emerging threats. Building a pervasive risk mindset across all organizational layers ensures that decisions are informed by risk intelligence, fostering a proactive stance and empowering stakeholders to act decisively.

Examining the Cumulative Impact of 2025 United States Tariff Policies on Corporate Supply Chains, Inflationary Pressures, and Consulting Demand Dynamics

In early April 2025, the United States implemented sweeping tariff measures, including a universal 10% levy on all imports and country-specific reciprocal tariffs reaching up to 125% for certain trading partners. This unprecedented escalation has infused substantial uncertainty into global supply chains and trade relationships. Companies are now recalibrating their sourcing strategies, evaluating alternative suppliers, and investing in scenario planning to maintain operational continuity amidst shifting cost structures

These tariff adjustments have begun to filter through to consumer prices, with studies indicating a gradual rise in goods inflation during the first quarter of 2025. As importers pass on added costs, the broader economy is experiencing pressure on profit margins and consumer purchasing power. The Federal Reserve has signaled a cautious stance on interest rate reductions, citing tariff-induced inflationary risks as a key factor in its monetary policy deliberations

Corporate clients are responding to these macroeconomic headwinds by adopting more conservative spending patterns. CFOs across major industries are pausing discretionary capital investments and revising hiring projections, while executives are directing resources toward risk assessment and contingency planning. This shift in behavior underscores the critical role of risk management consultants in helping organizations navigate volatility and maintain strategic agility

Conversely, the tariff environment has catalyzed a surge in demand for specialized consulting services. Firms such as McKinsey & Company, Boston Consulting Group, PwC, and KPMG have reported significant upticks in client inquiries related to supply chain optimization, regulatory compliance, and cost mitigation strategies. The need for expert guidance on tariff exclusions, trade remedy applications, and alternative logistics solutions is driving robust engagement growth across the consulting sector

Uncovering Key Segmentation Insights by Type, Service Offering, Delivery Model, Industry Verticals, and Client Size to Map Market Complexity

The market is examined comprehensively by type, revealing how distinct risk domains such as compliance and regulatory risk, cybersecurity and IT risk, financial risk management, operational risk management, strategic and reputational risk, and third-party risk management each command specialized service offerings. By analyzing these discrete risk categories, advisors can tailor frameworks that align with client-specific risk profiles and regulatory environments.

Service offerings are segmented to encompass crisis and disaster recovery planning, policy and framework development, risk assessment and audit, risk monitoring and analytics, and training and risk culture development. This classification demonstrates the importance of delivering end-to-end risk solutions that range from strategic blueprinting to continuous performance monitoring and organizational enablement.

Service delivery models are distinguished between on-site consulting and remote consulting, reflecting how evolving client preferences and technological capabilities influence engagement modalities. The flexibility to deploy expertise both in-person and virtually ensures that risk advisory services remain accessible, scalable, and cost-effective across diverse organizational contexts.

Industry vertical analysis segments the market across banking and financial services, energy and utilities, government and public sector, healthcare and life sciences, IT and telecom, manufacturing, and retail and consumer goods. Notably, banking and financial services is further disaggregated into asset management, banking, and insurance, while healthcare and life sciences includes hospitals and healthcare providers, medical device companies, and pharmaceutical manufacturers. Such granular vertical insights underpin targeted solution design and sector-specific risk benchmarking.

Client size serves as an additional segmentation dimension, dividing organizations into large enterprises and small and medium enterprises. This distinction acknowledges that resource availability, risk tolerance, and governance structures vary markedly by organizational scale, necessitating differentiated advisory approaches to optimize value and drive sustainable risk resilience.

This comprehensive research report categorizes the Risk Management Consulting Services market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Type

- Service Delivery Model

- Service Offering

- Industry Vertical

- Client Size

Unearthing Key Regional Insights Across the Americas, Europe Middle East Africa, and Asia Pacific to Highlight Divergent Risk Management Needs

In the Americas, regulatory harmonization efforts combined with strong private sector innovation foster a dynamic risk consulting environment. North American enterprises are investing heavily in digital risk platforms and cyber resilience, while Latin American markets exhibit growing demand for compliance advisory as governments strengthen anti-corruption and data protection statutes. Across both regions, firms are prioritizing solutions that integrate analytics, AI, and cloud-based resilience tools to address unique geopolitical and economic challenges.

Europe, Middle East, and Africa markets present diverse regulatory landscapes influenced by the EU’s stringent directives and the rapid digitalization initiatives emerging across the Gulf and sub-Saharan Africa. Compliance services in the EMEA region are focusing on multi-jurisdictional governance frameworks, ESG integration, and operational continuity planning. Consultants are aligning their offerings with regional sustainability mandates and geopolitical risk assessments to help clients navigate the interplay of policy shifts and market opportunities.

Asia-Pacific is characterized by robust growth in risk awareness driven by accelerated digitization and regulatory modernization. Leading economies in the region are adopting comprehensive cybersecurity mandates and data sovereignty regulations, prompting enterprises to seek advanced risk monitoring and privacy compliance solutions. In emerging APAC markets, risk advisory demand is escalating as organizations pursue cross-border expansion and supply chain diversification in response to ongoing trade tensions and infrastructure development initiatives.

This comprehensive research report examines key regions that drive the evolution of the Risk Management Consulting Services market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Analyzing Leading Risk Management Consulting Companies Highlighting Differentiated Capabilities, Strategic Partnerships, and Market Positioning

The competitive landscape is defined by global professional services firms and specialized consultancies each cultivating distinct value propositions. Leading players such as Accenture and Deloitte leverage integrated technology platforms and deep industry expertise to deliver end-to-end risk transformation programs. Their comprehensive digital ecosystems allow clients to consolidate risk functions, enhance predictive analytics, and streamline compliance workflows.

Tier-one accounting and advisory firms including PwC, EY, and KPMG emphasize regulatory advisory and financial risk management, supported by robust audit capabilities and global networks. These firms are investing in advanced data analytics and automated compliance solutions to elevate service efficiency and ensure adherence to evolving statutory requirements.

Strategic consultancies like McKinsey & Company and Boston Consulting Group focus on high-impact strategic and reputational risk engagements, combining scenario-based stress testing with executive advisory. Their expertise in organizational strategy and performance transformation positions them to guide C-suite decision-making on enterprise-wide risk governance.

Boutique firms such as SIB Consulting and specialized third-party risk advisors differentiate through niche expertise and agile delivery models. These consultancies excel in rapid deployment, customized risk assessments, and hands-on training services, catering to clients seeking tailored solutions in sectors like manufacturing, healthcare, and technology.

This comprehensive research report delivers an in-depth overview of the principal market players in the Risk Management Consulting Services market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- Deloitte Touche Tohmatsu Limited

- PricewaterhouseCoopers International Limited (PwC)

- KPMG International Limited

- Ernst & Young Global Limited

- Accenture PLC

- International Business Machines Corporation

- McKinsey & Company

- Boston Consulting Group

- Actualize Consulting

- Allianz Group

- Alvarez & Marsal Holdings, LLC

- Aon PLC

- Bain & Company, Inc.

- BearingPoint B.V.

- BlackRock, Inc.

- Brokerslink

- Capgemini SE

- Consultport GmbH

- Crisil Limited

- ECBM Insurance Brokers & Consultants

- FM Global Group

- FTI Consulting, Inc.

- Grant Thornton LLP

- Hartman Executive Advisors

- HUB International Limited

- Kroll, LLC

- Marsh & McLennan Companies, Inc.

- MedPro Group

- Mercadien Group

- Mercer (US) LLC

- NMS Consulting, Inc.

- Princeton Holdings Limited

- Protiviti Inc.

- Risk Management Consulting LLC

- SC&H Group, Inc.

- Willis Towers Watson Public Limited Company

Providing Actionable Recommendations for Industry Leaders to Strengthen Risk Frameworks, Enhance Resilience, and Drive Sustainable Growth

Industry leaders should establish integrated risk governance frameworks that unite cybersecurity, operational, financial, and ESG risk domains under a single oversight mechanism. By aligning cross-functional teams and leveraging unified risk platforms, organizations can break down silos and accelerate threat detection and response.

Organizations are advised to embed climate risk and ESG considerations into their core risk assessments and strategic planning. Utilizing scenario analysis and stakeholder engagement tools, enterprises can quantify environmental impacts, meet disclosure mandates, and transform sustainability compliance into a source of competitive advantage.

To address supply chain vulnerabilities, companies should implement continuous third-party monitoring and AI-driven due diligence processes. This proactive stance reduces blind spots and enables timely mitigation of vendor-related risks, enhancing overall resilience in complex global ecosystems.

Cultivating a robust risk culture is essential; firms must invest in targeted training programs and risk-awareness campaigns that empower employees to identify and escalate emerging threats. Embedding risk competencies across all organizational layers fosters informed decision-making and reinforces accountability.

Finally, enterprises should adopt agile risk management methodologies, incorporating iterative stress testing, real-time analytics, and flexible policy frameworks. This adaptive approach allows organizations to pivot swiftly in response to regulatory changes, market disruptions, and technological advancements.

Outlining a Comprehensive Research Methodology Combining Primary Interviews, Secondary Data Validation, and Rigorous Analytical Frameworks

This research combined extensive secondary data analysis with in-depth primary interviews to ensure a comprehensive understanding of the risk management consulting landscape. Industry publications, regulatory filings, and company reports were systematically reviewed to identify prevailing trends and benchmark service offerings.

A series of structured interviews was conducted with senior risk executives, compliance officers, and consulting partners to capture frontline insights on evolving client needs and market dynamics. These qualitative inputs were triangulated with quantitative survey data to validate key findings and ensure methodological rigor.

The analytical framework incorporated segmentation by risk type, service offering, delivery model, industry vertical, and client size to map the market’s complexity. Cross-regional comparison techniques were applied to highlight geographic variations and emerging opportunities.

Data integrity was maintained through a multi-tier verification process, including peer reviews and expert consultations. Advanced analytical tools and scenario modeling were employed to synthesize insights and develop actionable recommendations tailored to decision-makers.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Risk Management Consulting Services market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Risk Management Consulting Services Market, by Type

- Risk Management Consulting Services Market, by Service Delivery Model

- Risk Management Consulting Services Market, by Service Offering

- Risk Management Consulting Services Market, by Industry Vertical

- Risk Management Consulting Services Market, by Client Size

- Risk Management Consulting Services Market, by Region

- Risk Management Consulting Services Market, by Group

- Risk Management Consulting Services Market, by Country

- United States Risk Management Consulting Services Market

- China Risk Management Consulting Services Market

- Competitive Landscape

- List of Figures [Total: 17]

- List of Tables [Total: 1272 ]

Synthesizing Executive Insights to Conclude on Strategic Imperatives for Risk Management Consulting in an Unpredictable Business Environment

As organizations navigate an increasingly complex risk environment, aligning strategic imperatives with dynamic capabilities is paramount. The convergence of digital innovation, regulatory evolution, and geopolitical shifts demands an integrated, forward-looking approach to risk management.

The insights presented underscore the necessity of holistic frameworks that encompass cybersecurity, ESG, third-party, and operational risks. By adopting adaptive governance structures and fostering a pervasive risk culture, enterprises can anticipate disruptions and capitalize on emerging opportunities.

Ultimately, the effectiveness of risk management consulting hinges on the ability to transform data-driven intelligence into strategic action. Partnering with consultancies that offer both technological acumen and industry-specific expertise will be critical for organizations seeking to build resilient, sustainable, and future-ready enterprises.

Seize Strategic Advantages Today Contact Associate Director Ketan Rohom to Secure Your Comprehensive Risk Management Consulting Market Research Report

Take the next step toward unparalleled risk management expertise by securing your copy of the comprehensive market research report today. Engage directly with Ketan Rohom, Associate Director of Sales & Marketing, to explore tailored insights and discover how your organization can thrive amidst evolving risk landscapes. Reach out to schedule a personalized briefing and gain early access to detailed strategies, executive analyses, and actionable data that will empower your decision-making and drive competitive advantage.

Don’t miss this opportunity to align with leading industry intelligence and leverage proven methodologies to fortify your risk frameworks. Contact Ketan Rohom now to initiate your journey toward informed, resilient, and forward-thinking risk management solutions.

- How big is the Risk Management Consulting Services Market?

- What is the Risk Management Consulting Services Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?