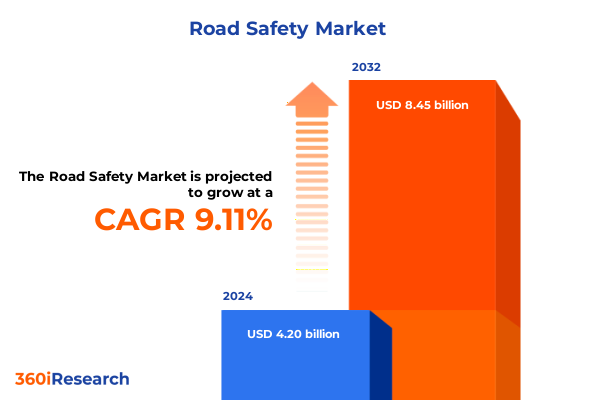

The Road Safety Market size was estimated at USD 4.56 billion in 2025 and expected to reach USD 4.96 billion in 2026, at a CAGR of 9.19% to reach USD 8.45 billion by 2032.

Shaping a Safer Tomorrow Through Collaborative Innovation, Policy Evolution, and Technological Integration to Address Dynamic Road Safety Challenges

Road safety has ascended to the forefront of public and private sector agendas as the convergence of rapid urbanization, increasing vehicle ownership, and evolving mobility patterns has escalated the complexity of ensuring safe roadways. Advances in sensor technologies, telematics, and data analytics are enabling a new era of proactive risk mitigation and real-time response, creating an inflection point for stakeholders across the transportation ecosystem. Simultaneously, shifting regulatory landscapes and heightened consumer expectations are catalyzing cross-sector collaboration, driving a holistic approach to prevention, management, and enforcement.

As governments and industry participants pursue zero-vision goals, the spotlight on integrated safety solutions has never been sharper. From smart intersections to predictive analytics platforms, the imperative to harmonize infrastructure upgrades with in-vehicle innovations is reshaping investment priorities and strategic roadmaps. In parallel, the maturation of artificial intelligence, edge computing, and connected ecosystems is unlocking novel capabilities for incident detection, emergency response coordination, and behavioral insights. As this executive summary unfolds, readers will gain clarity on the transformative forces redefining road safety, dissect the impact of recent trade policies, and examine actionable intelligence for navigating an increasingly dynamic global market.

Harnessing Digital Transformation, Artificial Intelligence, and Data-Driven Infrastructure to Revolutionize Traffic Management and Elevate Road Safety Standards

The road safety landscape is experiencing a profound metamorphosis driven by digital transformation and the accelerated adoption of intelligent systems. Artificial intelligence algorithms are now capable of processing vast volumes of camera and sensor data to anticipate hazards and orchestrate preventive interventions before an incident unfolds. Concurrently, edge computing architectures are decentralizing intelligence, enabling low-latency responses that are critical for split-second collision avoidance maneuvers. These technological underpinnings are further bolstered by next-generation connectivity standards, which are fostering vehicle-to-everything communication and unlocking situational awareness across diverse mobility corridors.

Moreover, the integration of infrastructure monitoring devices-such as embedded road surface sensors and dynamic traffic cameras-has ushered in a new paradigm of system-wide visibility. This granular insight into road conditions and traffic flows not only enhances real-time incident detection but also informs predictive maintenance strategies that prolong asset life cycles. At the same time, regulatory bodies are codifying data-sharing frameworks and establishing performance benchmarks for emergency response protocols. As a result, industry stakeholders are coalescing around interoperable platforms and standardized APIs, setting the foundation for scalable, citywide safety deployments that transcend traditional jurisdictional boundaries.

Assessing the Far-Reaching Consequences of New 2025 United States Trade Tariffs on Road Safety Technology Supply Chains and Industry Economics

The implementation of new United States tariffs in 2025 has introduced both headwinds and strategic inflection points for the road safety technology ecosystem. By imposing additional duties on imported semiconductors, advanced sensors, and specialized electronic components crucial for driver assistance and collision avoidance systems, these measures have elevated cost structures for manufacturers and system integrators. Consequently, original equipment manufacturers and technology providers have recalibrated their supply chain strategies, prioritizing localized sourcing partnerships and accelerated development of domestic production capacities to mitigate exposure to import levies.

In addition, higher input costs have prompted industry leaders to reassess procurement frameworks and scale back nonessential R&D overhauls, redirecting capital toward incremental innovation that can be realized within compressed timelines and budgets. At the same time, the tariffs have created an impetus for cross-border joint ventures and licensing agreements aimed at sharing fabrication resources and co-developing next-generation semiconductors optimized for road safety applications. The resulting reconfiguration of global value chains underscores the importance of agility and resilience, compelling stakeholders to diversify supplier networks, invest in in-house capabilities, and embrace collaborative innovation models that can endure fluctuating trade regimes and geopolitical flux.

Uncovering Critical Segmentation Dynamics Across Technology, Application, End User Profiles, and Transportation Modes That Define the Evolving Road Safety Technology Market

A nuanced exploration of market segmentation dynamics reveals the complex interplay between technological innovation, application demand, end user adoption patterns, and transportation mode specificity. Within the technology dimension, advanced driver assistance systems dominate the landscape through a spectrum of adaptive cruise control, autonomous emergency braking, blind spot detection, lane departure warning, and parking assistance functions, while connected vehicle technology expands its reach via vehicle-to-everything, vehicle-to-infrastructure, and vehicle-to-vehicle communication protocols. Infrastructure monitoring solutions contribute valuable context through a trifecta of road surface sensors, traffic cameras, and weather monitoring systems, augmenting predictive analytics and maintenance planning. Likewise, intelligent transportation systems leverage emergency response systems, incident detection algorithms, and traffic management software to orchestrate citywide safety ecosystems, and speed enforcement systems encompass average speed check networks, fixed speed cameras, and mobile speed enforcement platforms to uphold compliance.

Transitioning to the application segmentation, collision prevention remains the cornerstone, integrating intersection collision warning, lane change assistance, pedestrian safety alerts, and rear collision warning capabilities. Post-collision services complement this proactive stance by delivering accident reporting solutions, emergency medical assistance coordination, and roadside assistance dispatch. Traffic flow optimization leverages adaptive traffic control algorithms and signal timing optimization to alleviate congestion and minimize risk exposure, while traffic law enforcement employs red light violation detection, speed control systems, and stop sign violation monitoring to strengthen regulatory adherence. As for end user segments, automotive OEMs and commercial fleet operators are spearheading large-scale deployments, government agencies are institutionalizing public safety initiatives, individual consumers are embracing aftermarket enhancements, and insurance companies are underwriting performance-based risk reduction programs.

In the realm of transportation modes, the automotive sector encompasses commercial vehicles, passenger vehicles, and two-wheelers, delivering the bulk of volume-driven investments, while commercial and general aviation use cases focus on runway incursion prevention and in-flight monitoring. Complementing these are commercial and recreational marine applications targeting smart port operations and vessel collision avoidance, and freight rail and passenger rail networks increasingly integrating automated track inspection and real-time hazard detection capabilities. Together, these segmentation insights illuminate critical pockets of opportunity and underscore the imperative for tailored strategies that align innovation roadmaps with specific functional and operational requirements.

This comprehensive research report categorizes the Road Safety market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Product Type

- Technology Use

- Application

- End User

Illuminating Regional Divergences and Growth Opportunities in Americas, Europe Middle East & Africa, and Asia-Pacific Road Safety Technology Adoption

Regional nuances are shaping divergent road safety trajectories, with stakeholders adapting strategies to local regulatory frameworks, infrastructure maturity levels, and mobility challenges. In the Americas, public–private collaborations have accelerated the rollout of connected vehicle pilots and smart roadway initiatives, underpinned by robust funding mechanisms for infrastructure upgrades and telematics adoption. Stricter enforcement regimes and incentive programs for adoption of advanced driver assistance features are driving momentum, while data sharing partnerships between municipal authorities and insurance providers are generating new models for performance-based underwriting.

Over in Europe, Middle East & Africa, the focus on harmonized safety standards is fostering transnational compatibility of vehicle-to-infrastructure deployments. Pan-European research consortia are piloting cross-border corridor projects that integrate weather-adaptive traffic management and automated emergency routing, while regulatory bodies in the Gulf Cooperation Council and African Union are issuing guidelines to accelerate telematics integration in commercial fleets. Investment in low-latency communication infrastructure and edge-based analytics hubs is deepening system interoperability across metropolitan and intercity networks.

Meanwhile, Asia-Pacific markets are witnessing a surge in demand for modular safety platforms tailored to high-density urban environments and emerging mobility models. Rapid urbanization has catalyzed public sector initiatives to deploy widespread camera networks, road surface sensors, and AI-driven incident detection tools. Government-led smart city frameworks in the region are incentivizing local OEMs and technology startups to co-create localized solutions, while cross-sector alliances are optimizing supply chains to bolster component accessibility and reduce deployment cycles.

This comprehensive research report examines key regions that drive the evolution of the Road Safety market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Identifying Strategic Moves and Competitive Positioning of Leading Global Corporations Driving Innovation in Road Safety Technology Solutions

Leading corporations in the road safety technology arena are executing multifaceted strategies that combine organic innovation with targeted partnerships to secure competitive advantages. Established global tier-one suppliers are expanding their portfolios through acquisitions of specialized sensor firms and software platforms, integrating advanced perception and machine learning capabilities directly into embedded vehicle architectures. They are also forging alliances with urban infrastructure operators to pilot smart intersection trials and dynamic traffic control systems, thereby extending their influence beyond the confines of passenger cabins.

In parallel, automotive OEMs are internalizing safety technology development, establishing dedicated business units tasked with creating cohesive ecosystems that span in-vehicle features, cloud-based analytics, and roadside device networks. This vertically integrated approach is complemented by collaborations with telecom providers to harness fifth-generation connectivity for low-latency data exchange, enabling real-time hazard warnings and coordinated emergency responses. Meanwhile, emerging technology disruptors are carving out niche positions by offering modular, retrofit-friendly solutions that retrofit existing vehicle and infrastructure assets, democratizing access to advanced safety functionalities without requiring full fleet renewal.

Across the spectrum, efforts to standardize data protocols and secure interoperability are driving consortium-led frameworks, with leading participants investing in open-source software toolkits and cross-certification programs. Financial services firms and insurance underwriters are also entering the ecosystem, leveraging telematics and usage-based insurance models to encourage safer driving behaviors. This confluence of strategic investments, collaborative pilots, and regulatory engagement is charting a course toward an integrated, end-to-end road safety value chain.

This comprehensive research report delivers an in-depth overview of the principal market players in the Road Safety market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- 3M Company

- AllGoVision Technologies Pvt. Ltd.

- Avery Dennison Corporation

- Brady Corporation

- Cisco Systems, Inc.

- Clearview Intelligence Ltd.

- Cubic Corporation

- Cubic Corporation

- Dahua Technology Co., Ltd.

- Digi International Inc.

- FLIR Systems, Inc. by Teledyne Technologies

- FRED Engineering Ltd.

- Gregory Industries Inc.

- Highway Safety Products, Inc.

- Hikvision Digital Technology Co., Ltd.

- IDEMIA

- International Business Machines Corporation

- Iteris, Inc.

- Jaybro Group LLC

- Jenoptik AG

- Kapsch TrafficCom AG

- Lindsay Corporation

- Microsoft Corporation

- Pexco LLC

- Schneider Electric SE

- Sensys Gatso Group AB

- Siemens Mobility GmbH

- Swarco AG

- TagMaster AB

- TEG Safety Inc.

- Thales Group

- Trelleborg AB

- Trinity Industries, Inc.

- Vectus India Pvt. Ltd.

- VITRONIC GmbH

Outlining Actionable Strategies for Industry Visionaries to Accelerate Road Safety Advancements, Forge Strategic Partnerships, and Navigate Regulatory Complexities

Industry leaders seeking to capitalize on the road safety transformation must prioritize robust partnerships that bridge the gap between automotive, infrastructure, and digital technology domains. It is essential to invest in scalable connected vehicle platforms that can seamlessly integrate with diverse sensor networks and leverage artificial intelligence for predictive hazard detection. To that end, establishing co-development agreements with chipset manufacturers and software providers will accelerate time to market and optimize system performance under stringent latency requirements.

Simultaneously, engaging proactively with regulatory bodies to influence the evolution of data-sharing frameworks and performance standards will create a conducive environment for large-scale deployments. By collaborating on pilot programs that demonstrate measurable safety outcomes, stakeholders can build the case for broader policy incentives and funding allocations. Additionally, enterprises should channel resources into workforce upskilling initiatives to ensure technicians and data analysts possess the expertise to manage sophisticated telematics infrastructures and interpret complex behavioral insights.

Finally, fostering an ecosystem approach through consortium membership and public–private alliances will enhance resilience against supply chain disruptions and geopolitical uncertainty. By co-investing in edge computing hubs, smart city testbeds, and interoperable software layers, industry visionaries can accelerate innovation cycles, validate new use cases, and deliver quantifiable safety benefits to road users around the globe.

Detailing a Robust Mixed-Methods Research Framework Combining Primary Interviews, Secondary Data Analysis, and Multivariate Validation for Road Safety Insights

This research framework integrates a mixed-methods approach to ensure comprehensive coverage and data integrity. Initially, an extensive secondary research phase collated insights from policy white papers, technical standards, industry journals, and publicly available patent filings to establish foundational understanding. This was followed by a primary research phase, incorporating in-depth interviews with executives, product managers, and regulatory officials across multiple regions to capture firsthand perspectives on evolving priorities and deployment challenges.

Quantitative data points from proprietary databases were then harmonized through a rigorous triangulation process, cross-referencing multiple sources to validate segment definitions, technology adoption rates, and growth catalysts. Statistical models were applied to detect correlations between regional infrastructure investments and safety outcome metrics, while scenario analysis techniques provided sensitivity assessments under varying tariff, regulatory, and technology diffusion conditions. All findings were subjected to peer review by subject-matter experts to ensure methodological rigor and practical relevance.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Road Safety market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Road Safety Market, by Product Type

- Road Safety Market, by Technology Use

- Road Safety Market, by Application

- Road Safety Market, by End User

- Road Safety Market, by Region

- Road Safety Market, by Group

- Road Safety Market, by Country

- United States Road Safety Market

- China Road Safety Market

- Competitive Landscape

- List of Figures [Total: 16]

- List of Tables [Total: 1590 ]

Synthesizing Core Findings and Future Trajectories to Guide Stakeholders Toward Resilient, Data-Informed Road Safety Ecosystems

In synthesizing the core findings of this report, several cross-cutting themes emerge that point toward an interconnected roadmap for future progress. The convergence of advanced driver assistance capabilities, connected ecosystems, and intelligent infrastructure is redefining safety paradigms, while regional policy harmonization and funding commitments are accelerating deployments at scale. At the same time, the 2025 tariff landscape has underscored the strategic importance of supply chain resilience and the benefits of collaborative manufacturing strategies.

Looking forward, stakeholders that adopt an integrated approach-aligning technology innovation, regulatory advocacy, and ecosystem partnerships-will be best positioned to drive measurable reductions in road fatalities and serious injuries. As the market matures, there will be increasing emphasis on performance-based safety metrics, outcome-driven contracts, and the harmonization of protocols across vehicle classes and transportation modes. Ultimately, embracing data-informed decision-making and fostering transparency among public and private sector actors will be the keystone for building safer, more sustainable mobility networks that benefit societies worldwide.

Partner with Ketan Rohom to Leverage Cutting-Edge Road Safety Market Intelligence and Unlock Tailored Insights to Propel Strategic Decision-Making

To gain comprehensive strategic insights and stay ahead of emerging trends in road safety technology, engage directly with Ketan Rohom, Associate Director, Sales & Marketing. Ketan offers personalized consultations designed to clarify how the report’s in-depth analysis aligns with your unique business objectives, whether you represent an OEM aiming to integrate advanced driver assistance systems or a government agency seeking data-driven infrastructure solutions. By partnering with Ketan, you’ll benefit from real-time guidance on leveraging the latest market intelligence to inform product roadmaps, investment priorities, and collaborative initiatives. Secure your copy of the full market research report today and unlock the competitive edge you need to drive safer, smarter, and more sustainable mobility solutions across your organization.

- How big is the Road Safety Market?

- What is the Road Safety Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?