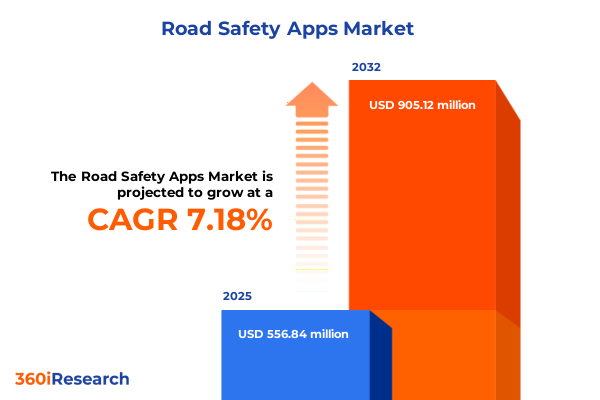

The Road Safety Apps Market size was estimated at USD 556.84 million in 2025 and expected to reach USD 597.40 million in 2026, at a CAGR of 7.18% to reach USD 905.12 million by 2032.

Unveiling the Transformative Evolution of Road Safety Applications From Early GPS Geofencing Tools to AI-Enabled Real-Time Collision Prevention and Behavioral Monitoring

Road traffic incidents remain a pressing global challenge, claiming approximately 1.19 million lives each year and leaving many more with serious injuries. The Global status report on road safety 2023 highlights that, despite a 5 percent reduction in fatalities since 2010, over half of these losses involve vulnerable road users such as pedestrians, cyclists, and motorcyclists, underscoring an urgent need for innovative measures that can accelerate further progress

The proliferation of smartphones has fundamentally reshaped mobility behaviors. In the United States, over nine in ten adults now own a smartphone, creating a ubiquitous platform through which safety-focused applications can deliver real-time alerts, navigational guidance, and behavioral feedback directly to drivers and road users

Simultaneously, the integration of advanced sensor technologies into vehicles and mobile devices has expanded the potential of road safety applications. Forward collision prevention systems alone can reduce crash rates by nearly 29 percent, while lane keeping assistance features have demonstrated up to a 19 percent decrease in lane-departure incidents. Such capabilities highlight the transformative power of sensor-driven, app-based safety solutions in mitigating on-road risks

Examining Pivotal Transformative Trends Shaping Road Safety App Innovations Amidst Rapid Digitalization, AI Integration, and Strengthening Regulatory Standards

The road safety applications market is undergoing a profound transformation driven by advances in artificial intelligence and machine learning. Next-generation ADAS features, such as Mobileye’s Surround ADAS™ platform, leverage AI-powered SoCs and OTA software updates to deliver modular, future-proof safety functions at scale. This shift has enabled automakers and tech firms to co-create solutions that continuously learn from real-world data and adapt to evolving regulatory and environmental conditions

Enhanced connectivity through embedded telematics and 5G networks is also reshaping user expectations. In North America, three out of four cars sold in 2023 came equipped with embedded telematics systems, while subscription-based and cloud-native telematics services have emerged as mainstream offerings. Regulatory mandates, such as the EU’s eCall initiative requiring automatic emergency calling in new vehicles, have further accelerated telematics adoption and set a global precedent for safety integration

Moreover, a growing emphasis on regulatory compliance and data security has encouraged stakeholders to adopt interoperable, standards-based architectures. Partnerships between OEMs, Tier 1 suppliers, and software providers are now commonplace, enabling rapid deployment of sensor-fusion platforms and data analytics capabilities that collectively enhance situational awareness, predictive maintenance, and driver behavior monitoring.

Assessing the Cumulative Impacts of 2025 United States Tariff Policies on Road Safety App Hardware Costs, Global Supply Chains, and Market Accessibility

In 2025, emerging tariff policies in the United States are poised to reshape the economics of road safety hardware. Proposed semiconductor tariffs of up to 25 percent on foreign-fabricated wafers have the potential to elevate component costs significantly. Given the growing semiconductor content in modern vehicles and telematics modules, this measure threatens to increase the baseline expense of sensor-driven safety systems, driving OEMs to reconsider sourcing strategies and cost structures

Simultaneously, the automotive sector faces a broader 25 percent tariff on certain imported vehicle components, with direct implications for telematics devices, driver monitoring cameras, and connectivity modules. Industry analyses suggest that such import duties could raise consumer prices on affected vehicle segments by 10 to 15 percent, while disrupting supply chains that rely on globalized manufacturing of critical electronics

In response, manufacturers and technology firms are increasingly exploring localization of chip production, near-shoring of assembly operations, and strategic stockpiling of semiconductors and sensors. These tactics aim to mitigate short-term cost pressures and preserve market accessibility, but may also introduce transitional inefficiencies and inventory volatility that reshape the competitive landscape over the coming years.

Deriving Strategic Segmentation Insights Across Advanced Driver Assistance, Telematics, Driver Monitoring, Fleet Management, Insurance Telematics, and Navigation Safety

A holistic segmentation framework facilitates targeted strategies for distinct technology clusters within the road safety ecosystem. Advanced Driver Assistance, Telematics & Tracking, Driver Monitoring, Fleet Management, Insurance Telematics, Navigation Safety, and Crash Detection & Emergency Response each represent unique value pools, characterized by differentiated hardware requirements, regulatory drivers, and integration pathways.

Within Advanced Driver Assistance, applications such as Adaptive Cruise Control-spanning Full-Speed Range and Stop-And-Go variants-coexist with Blind Spot Detection, Collision Warning Systems (forward and rear), and Lane Departure Warning features like Lane Change Assist and Lane Keeping Assist. This diversity underscores a tiered approach to collision mitigation and automated support, in which real-time sensor fusion and predictive analytics deliver incremental safety gains on the road

In the Telematics & Tracking domain, performance monitoring modules-covering engine health and fuel efficiency-complement theft recovery and vehicle tracking solutions. These telematics capabilities enhance operational visibility and enable proactive maintenance regimes that contribute to overall driver and fleet safety.

Driver Monitoring technologies incorporating alcohol detection, distracted driving alerts, and fatigue detection-via eye-closure monitoring and steering pattern analysis-prioritize the human element of safety. Parallel segments in Fleet Management and Insurance Telematics focus on compliance monitoring, route planning, pay-as-you-drive models, risk profiling, and usage-based insurance variants that leverage behavior-based and mileage-based underwriting.

Navigation Safety applications, featuring hazard notifications for accident sites and road conditions, route optimization, and speed-limit alerts, further augment situational awareness. Finally, Crash Detection & Emergency Response systems tie together automatic crash notifications, emergency dispatch integration, and SOS functionalities to reduce response times and accelerate post-impact care.

This comprehensive research report categorizes the Road Safety Apps market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Advanced Driver Assistance

- Telematics & Tracking

- Driver Monitoring

- Fleet Management

- Insurance Telematics

- Navigation Safety

- Crash Detection & Emergency Response

Uncovering Critical Regional Dynamics Influencing Road Safety App Adoption, Regulatory Support, and Market Expansion Across Americas, EMEA, and Asia-Pacific Markets

The Americas lead in consumer-grade road safety app adoption, fueled by high smartphone penetration, widespread 5G rollout, and supportive regulatory guidance from agencies such as the National Highway Traffic Safety Administration. The U.S. market, in particular, benefits from a robust aftermarket ecosystem and a proactive stance on telematics privacy and data security, which collectively drive user trust and sustained engagement

In Europe, Middle East & Africa, stringent safety standards and pan-regional mandates like the European Union’s eCall requirement have established a high baseline for ADAS and telematics integration. Euro NCAP rating incentives and local infrastructure investments in smart road networks further amplify demand for advanced collision avoidance and connected mobility solutions

Asia-Pacific markets exhibit rapid urbanization and significant public investment in smart city initiatives, particularly in China, Japan, and South Korea. Favorable government policies, coupled with strong telematics attach rates that account for over half of the global market share, have positioned the region as a hotbed for innovation and scale in road safety technologies

This comprehensive research report examines key regions that drive the evolution of the Road Safety Apps market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Highlighting Major Companies Driving Innovation and Competitive Dynamics in the Road Safety Apps Landscape Through Strategic Collaborations and Technology Partnerships

Major industry players are forging strategic alliances to accelerate the rollout of next-generation safety solutions. Mobileye’s collaboration with Volkswagen Group and Valeo to integrate surround-sensing ADAS in high-volume MQB platform vehicles exemplifies this trend. By streamlining hardware and software procurement and leveraging Mobileye’s proven EyeQ technology, these partnerships aim to democratize advanced crash prevention features for mass-market applications

In the mobility services arena, Lyft’s agreement with Mobileye to deploy robotaxis in Dallas by 2026 demonstrates how safety-centric sensor platforms are migrating from passenger vehicles to autonomous ride-hail fleets. This initiative, underpinned by Marubeni’s financing and third-party fleet operations, underscores the convergence of app-based safety monitoring and fully automated driving solutions

NVIDIA has emerged as a pivotal partner for automakers seeking to embed AI-driven safety and in-cabin monitoring capabilities. Collaborations with major OEMs such as Toyota, Continental, and Aurora to develop DRIVE AGX-powered platforms illustrate the vital role of accelerated compute and unified software stacks in delivering functionally safe L2+ and L3 ADAS features across diverse vehicle lineups

This comprehensive research report delivers an in-depth overview of the principal market players in the Road Safety Apps market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- Azuga, Inc.

- Cambridge Mobile Telematics

- DriveSafe Ltd.

- DriveSmart

- Fleet Complete, Inc.

- Geotab Inc.

- GreenRoad Technologies Ltd.

- HERE Global B.V.

- Life360, Inc.

- Lytx, Inc.

- MiX Telematics Ltd.

- Nauto, Inc.

- Nexar, Inc.

- OKDriver

- RoadSafe Solutions

- Road’s Eye LLC

- SafeDrive

- SafetyCulture Pty Ltd

- Sygic a.s.

- Teletrac Navman

- TomTom International B.V.

- Trimble Inc.

- TrueMotion, Inc.

- Waze

- Zendrive, Inc.

Actionable Strategic Recommendations for Industry Leaders to Leverage Emerging Technologies, Regulatory Shifts, and Evolving User Needs in Road Safety Applications

Industry leaders should prioritize the adoption of modular, AI-powered architectures that enable over-the-air updates and continuous learning. This approach not only ensures compliance with evolving safety standards but also fosters rapid iteration of new features based on real-world usage data.

Supply chain resilience must be reinforced through diversified sourcing strategies and strategic localization of critical components. By collaborating with trusted domestic partners and maintaining buffer inventories of semiconductors and sensors, companies can mitigate tariff-induced cost pressures and minimize deployment delays.

Finally, proactive engagement with regulatory bodies and standard-setting organizations will drive clearer frameworks for data privacy, cybersecurity, and functional safety. Forming cross-industry consortia and participating in pilot programs can shape policy outcomes and create a favorable environment for next-generation road safety innovations.

Elucidating the Rigorous Multi-Method Research Approach Blending Primary Interviews, Secondary Data Analysis, and Expert Validation for Road Safety App Insights

Our research methodology began with an extensive secondary data collection exercise, encompassing peer-reviewed journals, regulatory filings, industry white papers, and news releases. This foundation enabled the mapping of key market drivers, technology trends, and competitive dynamics.

Primary research involved in-depth interviews with over two dozen stakeholders spanning OEM executives, software developers, telematics providers, and regulatory experts. These conversations provided firsthand perspectives on adoption barriers, feature prioritization, and deployment roadmaps.

Finally, expert validation workshops were convened to review preliminary findings, challenge assumptions, and refine our segmentation framework. A rigorous triangulation process ensured that the final insights reflect both qualitative depth and quantitative rigor, delivering a robust foundation for strategic decision-making.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Road Safety Apps market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Road Safety Apps Market, by Advanced Driver Assistance

- Road Safety Apps Market, by Telematics & Tracking

- Road Safety Apps Market, by Driver Monitoring

- Road Safety Apps Market, by Fleet Management

- Road Safety Apps Market, by Insurance Telematics

- Road Safety Apps Market, by Navigation Safety

- Road Safety Apps Market, by Crash Detection & Emergency Response

- Road Safety Apps Market, by Region

- Road Safety Apps Market, by Group

- Road Safety Apps Market, by Country

- United States Road Safety Apps Market

- China Road Safety Apps Market

- Competitive Landscape

- List of Figures [Total: 19]

- List of Tables [Total: 2544 ]

Concluding Reflections on the Strategic Trajectory of Road Safety Apps Emphasizing Innovation Imperatives and Collaborative Opportunities for Future Growth

Road safety applications have matured from simple geofencing and basic alerts to sophisticated, AI-enabled ecosystems that integrate seamlessly with both vehicles and mobile platforms. This progression underscores the market’s capacity for continuous innovation and its responsiveness to evolving regulatory imperatives.

Tariff uncertainties and supply chain disruptions present tangible challenges to hardware-centric segments. Yet, these headwinds also catalyze strategic localization and partnership models that may enhance long-term resilience and cost efficiency.

As technology convergence accelerates, the most successful organizations will be those that blend deep domain expertise with agile development practices, foster cross-sector collaborations, and maintain an unwavering focus on user trust and safety outcomes.

Drive Informed Decisions With a Comprehensive Road Safety Apps Market Report and Contact Ketan Rohom to Unlock Exclusive Strategic Insights and Tailored Guidance

To ensure that decision-makers have the most comprehensive and actionable insights at their fingertips, reach out to Ketan Rohom, Associate Director, Sales & Marketing, to secure your copy of the full market research report. This in-depth analysis offers a strategic overview of current trends, proprietary segmentation insights, regional dynamics, and forward-looking recommendations you won’t find anywhere else.

Gain exclusive access to expert-validated data, granular competitive intelligence, and bespoke guidance tailored to your organization’s needs. Contact Ketan Rohom to explore customization options, licensing details, and priority delivery timelines. Empower your team with the clarity needed to navigate the evolving road safety apps market with confidence and precision.

- How big is the Road Safety Apps Market?

- What is the Road Safety Apps Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?