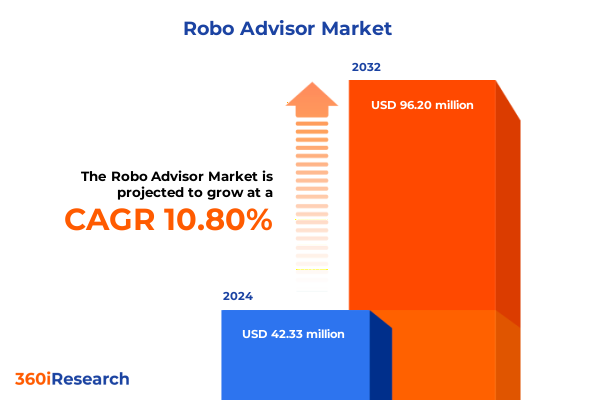

The Robo Advisor Market size was estimated at USD 46.57 million in 2025 and expected to reach USD 58.11 million in 2026, at a CAGR of 10.91% to reach USD 96.19 million by 2032.

Pioneering the Future of Automated Wealth Management: Unveiling the Transformative Power and Critical Trends Shaping Robo Advisor Solutions

The financial world is undergoing a profound transformation as digital-first solutions redefine traditional wealth management paradigms. Automated advisory platforms, commonly known as robo advisors, are leveraging advanced algorithms and real-time data analytics to deliver highly personalized investment strategies at scale. This evolution is not just a shift in technology but a fundamental change in how individuals and institutions approach financial planning and portfolio management.

In recent years, the democratization of sophisticated investment tools through intuitive digital interfaces has bridged gaps between professional asset managers and end users seeking efficient, cost-effective solutions. Enhanced by machine learning and artificial intelligence, robo advisors continuously refine their methodologies by assimilating vast datasets, from macroeconomic indicators to individual behavioral metrics. Consequently, clients benefit from dynamic portfolio rebalancing and strategic asset allocation that were once the exclusive domain of high-net-worth individuals.

As market dynamics accelerate, financial institutions face the dual challenge of integrating robo advisory offerings while maintaining regulatory compliance and fostering client trust. This introduction sets the stage for an in-depth exploration of the forces reshaping the robo advisor landscape, illuminating both the transformative potential and the strategic imperatives that will determine success in this rapidly evolving sector.

Evolving Dynamics in Digital Advisory: How AI, Personalization Expectations, and Regulatory Shifts Are Redefining the Robo Advisor Ecosystem

The emergence of advanced analytics and artificial intelligence has fueled a profound shift in client expectations, driving demand for tailored advice that adapts in real time to changing market conditions. Gone are the days when static models could address the diverse risk-return objectives of a new generation of investors. Instead, the landscape is now characterized by dynamic algorithms capable of processing alternative data sources, sentiment analysis, and real-time economic signals to generate actionable insights.

Simultaneously, evolving regulations across major financial jurisdictions are mandating higher standards for transparency, data protection, and fiduciary responsibility. Regulatory bodies are increasingly scrutinizing algorithmic decision-making, imposing new requirements for explainability and auditability. Moreover, the convergence of open banking initiatives and API interoperability is enabling seamless integration between traditional institutions and innovative fintech firms, fostering a more competitive ecosystem.

As a result, firms must adapt by embedding robust risk management frameworks, strengthening cybersecurity protocols, and cultivating partnerships that accelerate technology adoption. These transformative shifts underscore the imperative for financial institutions to rethink their operating models and strategic priorities in order to capitalize on the next generation of automated wealth management solutions.

Assessing the Compounding Effects of 2025 US Tariffs on Robo Advisor Infrastructure Costs, Cloud Services, and Operational Viability

The imposition of reciprocal tariffs on technology imports in 2025 has significantly elevated the cost structure for data center infrastructure, which underpins the cloud environments foundational to robo advisory services. President Trump’s tariffs introduced duties as high as 34% on equipment from China, 32% on imports from Taiwan, and 25% on hardware from South Korea, combined with a baseline 10% tariff on most other technology shipments, driving hardware expenditures upwards and straining operational budgets for digital platforms.

Even with targeted exemptions for critical AI components such as GPUs and high-performance computing servers, essential materials for data center construction-ranging from cooling systems to structural steel-remain subject to steep tariffs. These increased duties have created supply chain bottlenecks and delayed the roll-out of new facilities, compelling service providers to reevaluate sourcing strategies and consider alternative manufacturing hubs in Southeast Asia and Mexico.

Consequently, robo advisors, which are heavily reliant on scalable cloud architectures for real-time portfolio rebalancing and data analytics, are experiencing elevated operational costs. Several leading cloud providers have already signaled delays in capacity expansion and modest price adjustments, trends that ultimately risk being passed through to end-clients in the form of higher advisory fees or diminished services. Microsoft’s scaling back of certain data center projects exemplifies how tariff-driven uncertainties are reverberating across the digital wealth management ecosystem.

Unlocking Strategic Segment Differentiation: In-Depth Insights Across Service Models, User Profiles, and Deployment Architectures Driving Robo Advisor Adoption

Across service models, fully automated platforms have demonstrated remarkable scalability and cost efficiency by leveraging pure algorithmic decision-making and minimal human intervention. These solutions excel in delivering standardized, rule-based portfolios to a broad client base, enabling rapid client onboarding and automated rebalancing cycles. In contrast, hybrid models combine algorithmic processing with periodic human oversight, offering a tailored advisory experience that addresses complex financial planning needs and fosters deeper client relationships.

When considering end users, individual investors are drawn to intuitive robo platforms that prioritize ease of use, transparent fee structures, and personalized goal-setting features. These digital natives value seamless mobile experiences and automated tax-loss harvesting as integral components of their investment journey. Conversely, institutional investors deploy robo advisor frameworks to optimize operational efficiency, integrate custom risk overlays, and streamline large-scale portfolio management, often embedding robo-driven tools within broader enterprise systems.

On the deployment front, cloud-based architectures empower rapid feature roll-outs, elastic scalability, and reduced capital outlay, while on-premise environments provide financial institutions with enhanced control over data governance, security postures, and regulatory compliance. In practice, many firms adopt a hybrid infrastructure strategy that balances the flexibility of cloud services for client-facing applications with the stability of on-premise systems for sensitive back-office operations.

This comprehensive research report categorizes the Robo Advisor market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Service Type

- End User

- Deployment Mode

Exploring Regional Variations: How Geographic Market Drivers Shape Robo Advisor Adoption and Innovation Across Global Financial Hubs

In the Americas, digital advisory platforms have matured rapidly, driven by a confluence of tech innovation hubs and progressive regulatory frameworks that catalyze fintech collaboration. The ubiquity of cloud infrastructure and widespread financial literacy initiatives have bolstered consumer confidence in algorithmic advice, encouraging legacy financial firms to integrate or acquire robo advisor capabilities. Meanwhile, North American robo advisors are experimenting with advanced AI-driven features such as natural language interfaces and hyper-personalization to capture a growing market of digitally savvy investors.

Across Europe, the Middle East, and Africa, regulatory bodies have emphasized investor protection and data privacy, leading to a careful but steady adoption of automated advisory services. In key financial centers, collaborations between traditional banks and fintech startups have become prevalent, allowing institutions to comply with stringent data localization requirements while offering innovative, cost-effective digital advice. Regional investors in these markets often prioritize robust compliance frameworks and tailored investment strategies that account for local ESG considerations.

In Asia-Pacific, rapid smartphone penetration and a burgeoning middle class have created fertile ground for robo advisor growth. Many providers are innovating around gamified interfaces and social investing features to engage younger demographics. At the same time, regulatory sandboxes in markets such as Singapore and Australia have accelerated pilot programs, enabling robo advisors to refine their algorithms and scaling models in a controlled yet forward-looking environment.

This comprehensive research report examines key regions that drive the evolution of the Robo Advisor market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Decoding Competitive Leadership: Critical Insights into How Leading Fintech Firms and Traditional Financial Institutions Are Shaping the Robo Advisor Market

Leading pure-play fintech firms have leveraged nimble development cycles and deep focus on user experience to capture substantial market interest. By rapidly incorporating AI-driven analytics and offering low-fee structures, these companies have disrupted traditional advisory channels, compelling established financial institutions to innovate or partner with fintech entrants. Many of these digital-first players have also demonstrated agility in iterating product features based on real-time client feedback.

Conversely, incumbent asset managers and wealth management arms of global banking institutions have capitalized on their established client bases, extensive regulatory expertise, and strong brand reputations to launch or acquire robo advisor offerings. These players enhance credibility by integrating human advisory services alongside automated platforms, leveraging existing distribution networks and cross-selling capabilities to accelerate adoption. Strategic partnerships between traditional banks and technology providers have further amplified product reach, combining deep industry knowledge with technological prowess.

Across both segments, a common theme remains the relentless pursuit of differentiation through advanced analytics, seamless mobile experiences, and integrated financial planning tools. As competition intensifies, maintaining a balance between innovation speed and regulatory compliance will be critical for any organization seeking to lead the robo advisory market.

This comprehensive research report delivers an in-depth overview of the principal market players in the Robo Advisor market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- Acorns Grow Incorporated

- Ally Financial Inc.

- Axos Financial, Inc.

- Betterment Holdings, Inc.

- Capital One

- Charles Schwab Corporation

- E*TRADE by Morgan Stanley

- Ellevest, Inc.

- Fincite GmbH

- FMR LLC

- Ginmon Vermogensverwaltung GmbH

- M1 Holdings Inc.

- Merrill Guided Investing by Bank of America Corporation

- MFM Investment Ltd.

- Mphasis

- Profile Software S.A.

- Qraft Technologies Inc.

- QuietGrowth Pty. Ltd.

- Scalable Capital GmbH

- SigFig Wealth Management, LLC

- Social Finance, Inc.

- The Vanguard Group Inc.

- Wealthfront Inc.

- Wells Fargo Clearing Services, LLC

- Zacks Advantage

Charting the Path Forward: Strategic Imperatives and Actionable Recommendations for Financial Institutions to Excel in the Evolving Robo Advisor Arena

Financial institutions must prioritize investment in advanced data analytics and machine learning capabilities to drive deeper client personalization and predictive portfolio optimization. By harnessing alternative data sources, including behavioral and sentiment indicators, providers can refine risk-assessment models and enhance client trust through more accurate, transparent recommendations.

At the same time, strengthening cybersecurity protocols and data governance frameworks remains essential to protect sensitive investor information and comply with evolving regulatory requirements. Firms should continuously evaluate potential vulnerabilities, conduct third-party audits, and implement encryption standards that span data at rest and in transit. Establishing clear incident response plans will further mitigate reputational risk.

To foster sustainable growth, organizations should integrate environmental, social, and governance criteria directly into automated investment algorithms. This not only meets rising investor demand for responsible investing but also positions providers as forward-thinking market leaders. Developing flexible API architectures and pursuing strategic partnerships with fintech innovators can accelerate time to market for new features, while hybrid advisory models will ensure that complex client needs are met through a combination of automated efficiency and human expertise.

Comprehensive Research Methodology Unveiled: Balancing Qualitative Insights and Quantitative Rigor to Illuminate the Robo Advisor Landscape

Our analysis employed a rigorous research framework that combined primary and secondary methodologies to ensure comprehensive coverage of the robo advisor sector. Primary research included in-depth interviews with senior executives at leading wealth management firms and specialized fintech providers, complemented by structured surveys targeting both retail and institutional end users to capture evolving preferences and pain points.

Secondary research encompassed a detailed review of regulatory filings, industry white papers, academic journals, and thematic reports from reputable financial publications. We also analyzed company financial disclosures and investor presentations to map strategic initiatives and product roadmaps. Data triangulation was applied throughout to validate findings and enhance reliability.

A structured segmentation framework guided our approach, examining service types, end-user profiles, and deployment modes across key regions. Statistical techniques were used to identify correlation trends and forecast potential strategic inflection points. Finally, all insights were peer-reviewed by a panel of market analysts and subject matter experts to ensure balanced perspectives and actionable intelligence.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Robo Advisor market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Robo Advisor Market, by Service Type

- Robo Advisor Market, by End User

- Robo Advisor Market, by Deployment Mode

- Robo Advisor Market, by Region

- Robo Advisor Market, by Group

- Robo Advisor Market, by Country

- United States Robo Advisor Market

- China Robo Advisor Market

- Competitive Landscape

- List of Figures [Total: 15]

- List of Tables [Total: 636 ]

Synthesizing Insights and Forecasting Next Phases: How Robo Advisors Are Poised to Transform Wealth Management Through Innovation and Inclusive Design

The rapid advancement of AI and data analytics is poised to redefine the future of wealth management, enabling unprecedented levels of personalization, scalability, and cost efficiency. As robo advisors continue to evolve, interoperability with traditional banking systems and integration of ethical investing standards will become critical differentiators across competitive landscapes.

To capitalize on emerging opportunities, firms must navigate regulatory complexities while maintaining the agility to innovate. Hybrid advisory models, which seamlessly blend automated algorithms with human expertise, are likely to gain traction among both retail and institutional clients seeking nuanced financial guidance.

Looking ahead, the most successful market participants will be those that align cutting-edge technologies with transparent governance practices, deliver exceptional user experiences, and continually adapt to shifting investor demands. By synthesizing these strategic imperatives, organizations can position themselves at the forefront of the automated wealth management revolution, driving sustained growth and customer loyalty.

Secure Your Competitive Edge Today by Connecting with Ketan Rohom to Acquire the Definitive Robo Advisor Market Research Report

Engaging proactively with our Associate Director for Sales & Marketing will equip you with unprecedented insights and tailored guidance to stay ahead of industry evolution. By partnering directly with Ketan Rohom, you will receive not only the comprehensive market research report but also personalized support to contextualize findings for your strategic priorities.

Don’t miss this opportunity to transform your strategic approach around robo advisor adoption. Connect with Ketan Rohom today to discuss your specific needs, explore customized offerings, and secure your access to the definitive analysis that will drive your next wave of growth in automated wealth management.

- How big is the Robo Advisor Market?

- What is the Robo Advisor Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?