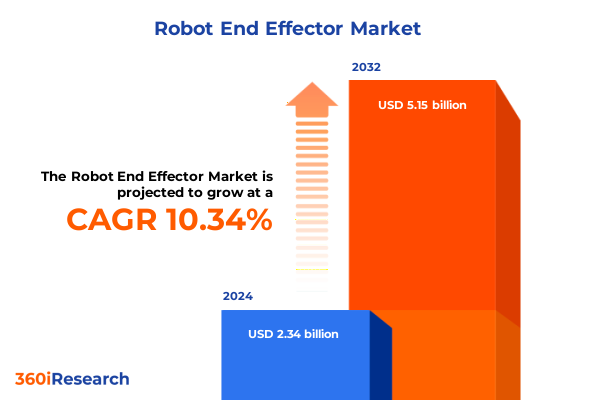

The Robot End Effector Market size was estimated at USD 3.35 billion in 2025 and expected to reach USD 3.81 billion in 2026, at a CAGR of 14.65% to reach USD 8.73 billion by 2032.

Unlocking the Critical Role of Robotic End Effectors in Driving Precision, Efficiency, and Advanced Automation Across Diverse Industrial Applications

Robotic end effectors, often called end-of-arm tooling, serve as the essential link between a robotic arm and its operational environment. These devices comprise a diverse array of tools-from mechanical grippers and suction cups to welding torches and painting nozzles-tailored to perform specific tasks with precision. In the context of industrial robotics, the end effector determines the capabilities of the entire system, enabling robots to handle, assemble, process, and inspect parts across countless manufacturing and service processes.

The global deployment of industrial robots has reached unprecedented levels, with the International Federation of Robotics reporting over 4.28 million units operating in factories worldwide as of 2023. This marks a 10 percent increase from the previous year and underscores the rapid integration of automated solutions in production settings. With annual installations exceeding half a million units for the third consecutive year, manufacturers are embracing end effectors that enhance productivity, quality, and safety.

As the market for robotic systems expands, end effectors have emerged as critical enablers of Industry 4.0 initiatives. The global market value of industrial robot installations reached a record US$16.5 billion in early 2025, driven by demand for integrated solutions that combine artificial intelligence, advanced sensing, and precise tooling. Against this backdrop, understanding the evolving landscape of end effectors is vital for decision-makers seeking to optimize automation strategies and maintain competitive advantage.

Exploring the Transformative Technological and Market Shifts Reshaping Robotic End Effector Innovations and Industry Adoption in the 2025 Landscape

The landscape of end effector technology is undergoing fundamental shifts fueled by advances in artificial intelligence, connectivity, and human-robot collaboration. Robots are becoming more perceptive, adaptive, and autonomous, allowing for end effectors that can adjust grip strength, trajectory, and force based on real-time sensor feedback. This trend toward intelligent tooling is rooted in the convergence of AI algorithms with embedded sensors, enabling robots to perform complex pick-and-place, assembly, and inspection tasks previously limited to human operators.

Another disruptive force reshaping end effector innovation is the rise of digital twins. By creating virtual replicas of tooling systems and production processes, manufacturers can simulate performance, predict failures, and optimize tool design before physical deployment. The growing integration of IoT connectivity and edge computing enhances these digital platforms, providing millisecond-level feedback loops that reduce downtime and improve throughput in high-volume operations.

Simultaneously, collaborative robots-cobots-are driving demand for specialized end effectors designed to operate safely alongside human workers. With features like force-limiting sensors and soft materials, these tools facilitate shared workspaces in assembly, packaging, and machine tending applications. The adoption of robotics-as-a-service (RaaS) models further accelerates this trend, lowering entry barriers for small and medium-sized enterprises and broadening the end effector market across new industry segments.

Analyzing the Cumulative Impact of 2025 U.S. Tariffs on Global Robotic End Effector Supply Chains, Component Costs, and Strategic Sourcing Responses

In early 2025, U.S. trade policy once again placed tariffs on a broad range of imports from China and other trading partners, directly affecting the cost structure of critical robotics components such as sensors, actuators, and control boards. These measures, implemented under Section 301 and related statutes, imposed duty rates as high as 34 percent on certain parts, including rare earth magnets and semiconductors used in end effector systems. As a result, manufacturers faced substantially increased landed costs that were often passed along to end users in the form of higher automation equipment prices.

The ripple effects of tariff-driven cost increases have extended beyond pricing, triggering strategic supply chain reconfigurations. Robotics companies have accelerated “China + 1” diversification strategies, directing procurement toward Southeast Asia, India, and Mexico. Some firms have begun reshoring subassembly operations to the United States or Canada to mitigate duties and shorten lead times. While these shifts improve resilience, they require upfront capital investments in new tooling lines and skilled labor, delaying near-term deployment of advanced end effectors.

Moreover, small and medium-sized enterprises-traditionally more price-sensitive-have been particularly impacted by diminished access to competitively priced end effectors. Industries such as packaging, food processing, and general components manufacturing have reported project delays or cancellations due to strained capital budgets. Even large OEMs are recalibrating rollout schedules to absorb tariff-related cost inflation while maintaining the long-term automation roadmap.

Despite these challenges, the tariff environment has catalyzed domestic innovation. Incentive programs, such as the CHIPS and Science Act, have increased funding for local semiconductor and sensor production, indirectly supporting advanced end effector development. Industry observers note that, over time, reduced reliance on single-source suppliers and enhanced domestic capacity could yield more robust, integrated end effector offerings with lower geopolitical risk.

Deriving Key Market Insights from End Effector Segmentation by Type, Actuation, Industry Application, and Automation Level for Strategic Positioning

End effector solutions can be dissected by tool type, revealing distinct applications and performance criteria. Mechanical and electric grippers remain the backbone of material handling, processing objects ranging from precision electronics to automotive parts. Suction cups, leveraging vacuum-based gripping, have become indispensable in high-speed packaging and e-commerce fulfillment centers due to their ability to handle flat surfaces with gentle contact. Welding torches, painting tools, cutting implements, and magnetic grippers each deliver specialized process capabilities, reflecting an industry imperative for modular end-of-arm tooling that can be rapidly swapped to accommodate diverse tasks.

Actuation mechanisms underpin tool responsiveness and force control. Electric systems dominate in applications requiring precise motion, further categorized into brushless DC motors prized for continuous high-speed operation, servo motors offering closed-loop torque control, and stepper motors valued for accurate microstepping and positional repeatability. Hydraulic actuators support heavy payloads and high force densities, while pneumatic units excel in rapid cycling and cost-effective simplicity for low-precision tasks. The selection among these technologies balances speed, force, precision, and cost, influencing solution design from cobot-grade soft grippers to heavy-duty welding heads.

The applications landscape spans multiple industries that demand distinct tooling characteristics. Automotive assembly lines apply end effectors for high-speed welding, painting, and parts transfer, while electronics manufacturing emphasizes cleanroom-compatible grippers for delicate component placement. The food and beverage, pharmaceutical, and packaging sectors require hygienic tooling with minimal fragmentation risk. Logistics and warehousing leverage mixed-tooling solutions to handle varied parcel geometries, whereas metal and machinery fabrication call for precision cutting and welding heads capable of enduring high temperatures and abrasive environments.

Automation maturity defines the complexity of end effector integration. Fully automatic systems, often found in high-volume automotive plants, utilize robotic work cells with tool changers and automated changeover sequences. Semi-automatic setups blend manual part loading with robotic processing, optimizing labor allocation. Manual end effector applications persist in low-volume or highly customized production runs. Collaborative robots require tooling engineered for safe human interaction, differentiated into heavy, medium, and light payload variants that accommodate tasks from palletizing to delicate assembly with intrinsic force-limiting features.

This comprehensive research report categorizes the Robot End Effector market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Type

- Automation Level

- Actuation Type

- Degrees Of Freedom

- End User Industry

Unearthing Regional Dynamics Driving Robotic End Effector Adoption Trends Across the Americas, Europe Middle East Africa, and Asia Pacific Markets

The Americas region, led by the United States, has anchored end effector adoption within automotive, aerospace, and food processing industries. The robust presence of major OEMs and system integrators, coupled with government incentives for domestic manufacturing, has sustained demand for advanced tooling solutions despite tariff headwinds. Collaborative robot deployments have accelerated in North American distribution centers, driving uptake of lightweight electric grippers and vacuum-based handlers. Manufacturers in Canada and Mexico mirrored this trend, with automotive assembly plants in Mexico integrating end effectors designed for high throughput and low downtime.

Within Europe, the Middle East, and Africa, Germany’s Industrie 4.0 initiative remains a cornerstone for end effector innovation, fostering partnerships between tool suppliers and robotics OEMs to co-develop specialized grippers and processing heads. France, Italy, and Spain have advanced automation in pharmaceuticals and food and beverage, where hygienic end effectors and laser-based cleaning tools are in high demand. Across the EMEA region, regulatory emphasis on sustainability has encouraged the adoption of energy-efficient electric and pneumatic tooling, while the growth of small and midsize enterprises has been supported by robotics-as-a-service models that reduce upfront tooling costs.

Asia-Pacific continues to dominate global end effector installations, accounting for nearly 70 percent of new robot deployments in 2023. China, Japan, South Korea, and India lead this expansion, driven by electronics manufacturing, automotive assembly, and consumer goods production. Chinese OEMs have introduced low-cost end effectors to serve domestic SMEs, while Japanese suppliers emphasize high-precision, long-life tooling for semiconductor dicing and medical device assembly. Southeast Asia has emerged as a regional manufacturing hub, with Thailand and Vietnam adopting diverse tooling solutions to support electronics and automotive part exports. The intensity of competition in APAC has prompted local toolmakers to form strategic alliances, enhancing customization speed and service capabilities.

This comprehensive research report examines key regions that drive the evolution of the Robot End Effector market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Evaluating Leading End Effector Providers to Understand Strategic Portfolios, Innovation Pipelines, and Competitive Differentiation in Robotics Automation Supply Chains

Leading providers of end effector solutions are investing heavily in product differentiation and ecosystem partnerships. Industry stalwarts such as ABB and FANUC have expanded portfolios to include modular tool changer systems and digitally integrated grippers, enabling seamless data exchange with robot controllers. KUKA and Yaskawa Electric continue to innovate with hybrid gripper designs that blend soft robotics principles with force-sensing feedback, targeting healthcare and fragile goods handling. Newer entrants like OnRobot and Soft Robotics have carved out niches in collaborative applications, offering plug-and-play tool sets tailored for rapid deployment and minimal integration effort.

Component specialists such as Schunk, Zimmer Group, and FIPA maintain deep expertise in mechanical grippers and precision tool heads, while Weiss Robotics leverages additive manufacturing to accelerate custom end effector production. Other notable players, including Robotiq and Schmalz, focus on flexible vacuum-based systems with advanced sensor fusion for adaptive grip control. Partnerships between these suppliers and system integrators, as well as collaborative research with academic institutions, are expanding the frontiers of tooling robots with novel materials, embedded vision, and enhanced durability under demanding conditions.

This comprehensive research report delivers an in-depth overview of the principal market players in the Robot End Effector market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- ABB Ltd.

- Bastian Solutions, LLC by Toyota Industries Corporation

- Bosch Rexroth AG

- Denso Robotics Inc.

- DESTACO

- Effecto Group S.p.A.

- Epson Robots Inc.

- FANUC Corporation

- Festo Corporation

- FIPA GmbH

- Hiwin Technologies Corp.

- Intelligente Peripherien für Roboter GmbH

- Kawasaki Heavy Industries Ltd.

- KUKA AG

- Kyrus

- Millibar, Inc.

- Novanta Inc.

- Piab AB

- Robot System Products

- Rockwell Automation

- Seiko Epson Corporation

- SMC Corporation

- TECHMAN ROBOT INC.

- Weiss Robotics GmbH & Co. KG

- Zimmer Group

Formulating Actionable Strategies for Industry Leaders to Capitalize on Emerging End Effector Technologies, Supply Chain Resilience, and Market Diversification Initiatives

Industry leaders should prioritize co-engineering efforts with end effector manufacturers to develop application-specific tooling that aligns with production requirements. By embedding sensors and AI-driven control algorithms within grippers and process heads, companies can achieve adaptive performance and predictive maintenance capabilities that reduce unplanned downtime. Strengthening collaboration in pilot projects enables customization of tool geometry, force profiles, and material compatibility, ensuring that end effectors deliver optimal throughput and part quality under varying production conditions.

To mitigate geopolitical risks and tariff exposure, executives are advised to diversify supply chains by qualifying multiple tool suppliers across different regions, including nearshore and domestic sources. Establishing fast-changeover cells with standardized interfaces allows for seamless swapping of end effectors without extensive mechanical redesign, reducing lead times when substituting components. Furthermore, investing in digital twin simulations of end effector performance provides a low-risk environment for honing integration strategies and validating process parameters prior to on-floor implementation. Such measures foster resilience, cost control, and agility in automation roadmaps.

Detailing the Rigorous Research Methodology Employed to Ensure Data Accuracy, Cross-Verification, and Comprehensive Market Intelligence for End Effector Analysis

This analysis synthesizes insights drawn from primary interviews with robotics OEMs, system integrators, and tool suppliers, as well as secondary research across industry publications, regulatory notices, and trade data. Data triangulation ensured consistency between tariff impact case studies, global installation statistics from the International Federation of Robotics, and company-level product announcements. Methodological rigor was maintained through cross-validation of sourcing strategies and performance claims against field trials documented in peer-reviewed journals. The research framework emphasized transparency in data collection, expert review at multiple stages, and ongoing updates to reflect policy or market shifts up to June 2025.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Robot End Effector market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Robot End Effector Market, by Type

- Robot End Effector Market, by Automation Level

- Robot End Effector Market, by Actuation Type

- Robot End Effector Market, by Degrees Of Freedom

- Robot End Effector Market, by End User Industry

- Robot End Effector Market, by Region

- Robot End Effector Market, by Group

- Robot End Effector Market, by Country

- United States Robot End Effector Market

- China Robot End Effector Market

- Competitive Landscape

- List of Figures [Total: 17]

- List of Tables [Total: 1113 ]

Summarizing the Strategic Imperatives and Value Proposition of Advanced Robot End Effectors for Driving Operational Excellence in Manufacturing and Beyond

As industrial automation intensifies, end effectors have transcended their traditional role as ancillary tools to become strategic assets that determine production flexibility and cost efficiency. Companies that integrate intelligent tooling with AI-enabled controls and robust supply chain architectures will unlock new performance benchmarks in throughput and quality. Regional market nuances-from the manufacturing investments in North America to the competitive pricing models in Asia-Pacific-underscore the need for tailored end effector strategies. Ultimately, fostering collaborative partnerships across the robotics ecosystem and embracing digital simulation tools will position organizations to harness the full potential of robotic end effectors in driving operational excellence.

Engage with Ketan Rohom to Secure Your Comprehensive Robot End Effector Market Research Report and Unlock Critical Insights for Strategic Decision Making

Adopting a data-driven approach to automation requires timely access to in-depth, objective market intelligence and strategic guidance from trusted experts. Ketan Rohom, Associate Director of Sales & Marketing, is ready to help companies gain immediate clarity on critical trends shaping the global robot end effector landscape. By partnering with Ketan, you will receive customized insights into technology adoption, supply chain resilience tactics, and competitive benchmarking that are tailored to your organization’s priorities. Reach out today to explore how our comprehensive market research report can inform your next investment, mitigate risk, and uncover new growth opportunities in evolving automation markets.

- How big is the Robot End Effector Market?

- What is the Robot End Effector Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?