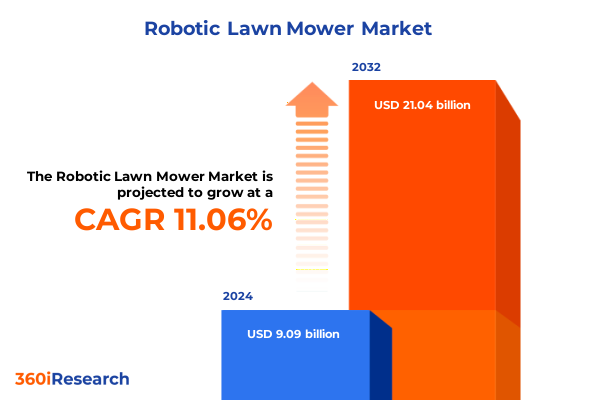

The Robotic Lawn Mower Market size was estimated at USD 10.04 billion in 2025 and expected to reach USD 11.09 billion in 2026, at a CAGR of 11.15% to reach USD 21.04 billion by 2032.

Setting the Stage for the Robotic Lawn Mower Revolution by Examining Market Dynamics, Technological Progress, and Emerging Growth Drivers

The robotic lawn mower segment is transforming residential and commercial landscaping practices by marrying automation technology with user-focused convenience. Increasingly sophisticated algorithms now enable machines to navigate complex terrains, learn landscape boundaries, and adjust cutting patterns in real time. Meanwhile, demographic shifts favoring aging populations and time-poor homeowners are accelerating adoption as consumers seek hands-free alternatives to conventional mowing. Against this backdrop, landscaping professionals and large-scale service providers are also exploring fleets of automated mowers to reduce labor intensity and drive operational consistency.

In this context, decision-makers require a clear understanding of the forces shaping this nascent field. Technological breakthroughs in sensor systems, AI-powered navigation and battery chemistry are converging to expand performance and reliability. At the same time, sustainability commitments are steering innovation toward zero-emission designs and resource-efficient operation. This report lays the foundation for strategic planning by examining these broad dynamics and highlighting how stakeholders can harness emerging trends to capture new value.

Unveiling the Transformative Shifts Redefining Robotic Lawn Mower Landscapes Through AI Integration, Sustainable Energy and Smart Connectivity

The robotic lawn mower industry is experiencing transformative shifts driven by breakthroughs in artificial intelligence, energy management and connectivity ecosystems. Autonomous navigation systems now leverage deep learning models to optimize route planning and obstacle avoidance, ushering in a new era of precision landscaping. On the energy front, advancements in battery technologies have driven substantial gains in runtime and charging efficiency, while early pilot programs for solar-integrated charging stations promise further reductions in operational costs and environmental footprint.

Connectivity has become a cornerstone of differentiation, as manufacturers integrate Internet of Things platforms to enable remote monitoring, firmware updates and predictive maintenance alerts. In parallel, partnerships between mower OEMs and smart-home providers are paving the way for integrated lawn-care scheduling, voice-activated commands and data-driven consumption insights. Together, these shifts are redefining user expectations and compelling established and emerging players to reimagine both product design and service delivery models.

Assessing the Cumulative Impact of 2025 United States Tariffs on Robotic Lawn Mower Supply Chains, Cost Structures and Strategic Sourcing Decisions

In 2025, the United States enacted revised tariff schedules targeting a range of imported robotic lawn mowers and related components, reshaping global supply chain strategies. Heightened duties on products manufactured in key overseas hubs have increased landed costs, prompting many suppliers to reevaluate sourcing models. As import expenses rose, original equipment manufacturers initiated dialogues with assembly partners in duty-free or preferential-trade zones, accelerating nearshoring efforts in North America.

These tariff pressures have also influenced channel dynamics, as distributors and retail chains negotiate pricing structures to offset margin compression. Some end users are beginning to absorb incremental costs, while others seek value from bundled service offerings that smooth out upfront capital expenditures. Moreover, component suppliers are collaborating with domestic assemblers to minimize customs exposures, leading to deeper alliances within local manufacturing ecosystems. Ultimately, the cumulative effect of these tariffs is catalyzing a diversification of manufacturing footprints and driving strategic investment in regional logistical resilience.

Decoding Segmentation Insights That Reveal Demand Patterns in Type, Power Sources, Lawn Sizes, Blade Variants, Voltage Levels, Channels and End Users

Through the lens of type segmentation, fully automatic robotic mowers command mainstream adoption thanks to their hands-free operation, while remote-controlled models maintain a niche among enthusiasts who desire manual override capabilities. Power source analysis highlights the dominance of battery-powered designs, where lead-acid chemistry remains cost-competitive but lithium-ion platforms are accelerating growth with superior energy density. Hybrid units that combine internal combustion engines with electric motors are capturing attention for extended runtimes, and early-stage solar-powered systems are being piloted for sustainable recharging.

Examining lawn area reveals that small properties up to 0.2 acres benefit from compact, user-friendly models, whereas medium-sized parcels between 0.2 and 0.5 acres require more robust navigation and battery capacity. Large lawns stretching from 0.5 to 1 acre demand industrial-grade performance and fleet management tools. Blade type considerations show mulching systems gaining preference for soil health, while rotary blades address high-growth scenarios and reel blades provide precision cuts for premium applications. Voltage tiers segment entry-level units up to 20 volts from mid-range 20V to 30V models and high-power platforms above 30 volts.

Sales channel analysis underscores the enduring role of offline distribution through dealers, distributors and retail outlets offering hands-on demonstration, even as online direct-to-consumer portals and third-party marketplaces expand reach and convenience. End-user segmentation distinguishes residential customers valuing ease of use and low upkeep from commercial clients in golf courses, parks, recreation areas and sports facilities that require high durability, tailored maintenance contracts and centralized fleet oversight.

This comprehensive research report categorizes the Robotic Lawn Mower market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Type

- Power Source

- Lawn Area

- Blade Type

- Voltage

- Sales Channel

- End User

Exploring Regional Insights Highlighting Unique Growth Engines, Regulatory Environments and Consumer Preferences Across Americas, EMEA and Asia Pacific

Across the Americas, strong homeowner affinity for automated solutions, supportive incentive programs and a mature retail infrastructure have driven robust uptake of robotic lawn mowers. Distributors in North America are partnering with landscapers to integrate automated fleets into service offerings, while Canadian demand is buoyed by a growing focus on green technology adoption. Latin American markets, though nascent, are demonstrating early interest, particularly in high-end residential communities.

In Europe, Middle East and Africa, stringent emissions regulations in the European Union are accelerating the phase-out of gas-powered alternatives, creating a tailwind for electric and autonomous mowing solutions. Demand in the Middle East is concentrated in luxury resort and urban regeneration projects, where water conservation and labor optimization are high priorities. Meanwhile, Africa’s emerging economies are starting to explore robotic options for municipal and high-security installations.

The Asia-Pacific region presents diverse trajectories: Japan’s advanced robotics sector is leading consumer and commercial pilots, while Australia’s vast land parcels are driving demand for high-capacity battery architectures. China’s industrial landscape is evolving from local OEM focus toward export readiness, and emerging Southeast Asian economies are building regulatory frameworks to encourage innovative landscaping technologies. Together, these regional insights illuminate a patchwork of adoption drivers shaped by regulatory, climatic and economic variables.

This comprehensive research report examines key regions that drive the evolution of the Robotic Lawn Mower market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Profiling Key Industry Players Shaping the Robotic Lawn Mower Market Through Innovation, Strategic Partnerships and Competitive Differentiation

Industry incumbents are actively defining the competitive contours of the robotic lawn mower ecosystem by leveraging core competencies in robotics, battery technology and distribution networks. One prominent leader has distinguished itself through fleet management platforms that sync dozens of units via a centralized dashboard, enabling real-time performance tracking and maintenance scheduling. Another major competitor is deploying advanced blade modules and mulching innovations designed to improve soil health and aesthetics, appealing to premium landscaping services.

Established power tool conglomerates are integrating their broad retail reach with in-store demo programs and bundled maintenance plans, creating frictionless purchase experiences. Simultaneously, specialized newcomers are carving niches around software-driven user interfaces and subscription-based service models. Tier-two players from adjacent markets, such as handheld outdoor equipment, are forging strategic partnerships with battery and sensor suppliers to accelerate time to market. Collectively, these competitive moves underscore a market in flux, where technological leadership and ecosystem orchestration are critical to sustaining differentiation.

This comprehensive research report delivers an in-depth overview of the principal market players in the Robotic Lawn Mower market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- AL-KO SE

- Ambrogio Robot

- Deere & Company

- EcoFlow Technology Inc.

- ECOVACS

- Honda Motor Co., Ltd.

- Husqvarna Group

- Hyundai Corporation

- LG Electronics Inc.

- Ma.Ri.Na. Systems s.r.l.

- Positec Tool Corporation

- Robert Bosch GmbH

- RoboMow

- Stiga Group by Castelgarden SpA

- Stihl Holding AG & Co. KG

- STIHL Incorporated.

- SUMEC Hardware & Tools Co., Ltd.

- The Toro Company

- The Worx Company

- Wiper S.r.l.

- Wolf-Garten GmbH & Co. KG

- Yamabiko Corporation

- Zucchetti Centro Sistemi S.p.a.

Actionable Recommendations to Drive Competitive Advantage Through Innovation, Supply Chain Resilience, Channel Optimization and Customer Engagement

Companies seeking to outpace competitors must prioritize research and development investments in sensor fusion, machine-learning navigation and predictive diagnostics to elevate product performance and reliability. At the same time, diversifying manufacturing footprints by establishing assembly operations in low-tariff zones or nearshore locations can mitigate import duty burdens and reduce lead times. Strengthening after-sales support through digital service platforms and proactive maintenance contracts will foster customer loyalty and unlock recurring revenue streams.

Optimizing omnichannel distribution by combining experiential offline showrooms with streamlined online ordering and fulfillment can capture diverse customer preferences and expand market reach. Collaborative ventures with renewable energy providers to integrate solar-charging kiosks offer dual benefits of sustainability and operational cost reduction. Finally, developing tailored solutions for commercial segments, such as modular fleet architectures and advanced reporting tools, can open new revenue pools in golf courses, public parks and sports venues. These recommendations offer a roadmap for sustained growth and competitive advantage.

Outlining Research Methodology Incorporating Primary Interviews, Expert Surveys and Secondary Data Analysis for Comprehensive Robotic Lawn Mower Insights

This analysis draws upon in-depth interviews with senior executives, product managers and distribution partners across North America, Europe and Asia-Pacific. Expert surveys were conducted to capture emerging technology adoption rates, procurement criteria and service model preferences, ensuring a balanced mix of qualitative and quantitative insight. Secondary research included review of patent filings, regulatory publications and trade association reports to validate product innovations and compliance trends.

Data triangulation was employed by cross-referencing primary findings with third-party logistics data and component pricing indexes. All data points underwent rigorous validation through consensus workshops with industry specialists, providing a peer-reviewed framework that underpins the report’s conclusions. This comprehensive methodology ensures that stakeholders can trust the analysis as a strategic touchstone for decision-making in a rapidly evolving robotic lawn mower landscape.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Robotic Lawn Mower market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Robotic Lawn Mower Market, by Type

- Robotic Lawn Mower Market, by Power Source

- Robotic Lawn Mower Market, by Lawn Area

- Robotic Lawn Mower Market, by Blade Type

- Robotic Lawn Mower Market, by Voltage

- Robotic Lawn Mower Market, by Sales Channel

- Robotic Lawn Mower Market, by End User

- Robotic Lawn Mower Market, by Region

- Robotic Lawn Mower Market, by Group

- Robotic Lawn Mower Market, by Country

- United States Robotic Lawn Mower Market

- China Robotic Lawn Mower Market

- Competitive Landscape

- List of Figures [Total: 19]

- List of Tables [Total: 1908 ]

Drawing Conclusions on Market Readiness, Strategic Imperatives and Future Outlook for Stakeholders Navigating the Robotic Lawn Mower Industry

As automation permeates landscaping, robotic lawn mowers emerge as a cornerstone of next-generation outdoor maintenance. Strategic emphasis on AI-driven navigation, energy efficiency and connectivity will delineate winners from laggards in the years ahead. At the same time, the ability to adapt supply chains in the face of regulatory shifts, such as recent tariff implementations, will determine cost competitiveness and market access.

Key imperatives for stakeholders include achieving technological differentiation through continuous innovation, fortifying manufacturing agility and crafting seamless customer experiences across channels. By aligning product roadmaps with regional regulatory drivers and end-user requirements, companies can secure market relevance and operational resilience. Ultimately, the confluence of sustainability imperatives and consumer demand for hands-free convenience positions the robotic lawn mower market for sustained momentum.

Engage with Ketan Rohom to Acquire Comprehensive Robotic Lawn Mower Market Report and Gain Strategic Insights for Business Growth and Innovation

To delve deeper into the nuances of the robotic lawn mower landscape and secure a competitive edge, reach out directly to Ketan Rohom, Associate Director of Sales & Marketing at 360iResearch. His expertise in translating complex market intelligence into actionable growth strategies ensures that your organization gains unparalleled visibility into emerging opportunities and potential disruption points. Partnering with Ketan will equip your team with the rigorously researched insights and strategic foresight needed to guide product development, optimize go-to-market tactics, and foster resilience in a rapidly evolving industry. Engage with Ketan to obtain the full report and position your business at the forefront of innovation and operational excellence in the dynamic robotic lawn mower sector.

- How big is the Robotic Lawn Mower Market?

- What is the Robotic Lawn Mower Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?