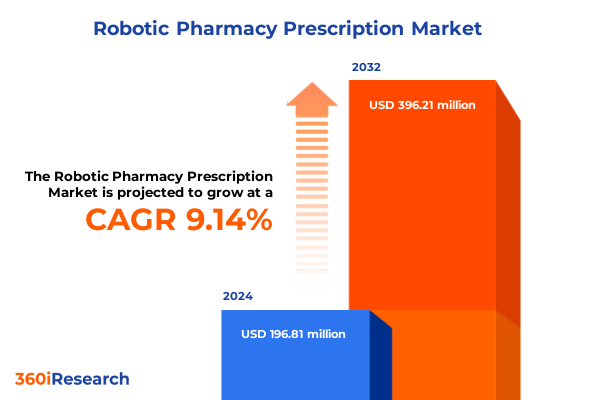

The Robotic Pharmacy Prescription Market size was estimated at USD 214.16 million in 2025 and expected to reach USD 237.65 million in 2026, at a CAGR of 9.18% to reach USD 396.21 million by 2032.

Pioneering the Future of Pharmacy Automation with Advanced Robotic Prescription Solutions Driving Operational Excellence and Patient Safety

The adoption of robotic pharmacy prescription solutions represents a seismic shift in the way medications are prepared and dispensed, offering unprecedented gains in efficiency, accuracy, and patient safety. Historically, manual compounding and dispensing have been fraught with potential for human error, leading to dosage mistakes, contamination risks, and extended preparation times. With the integration of advanced robotics, processes that once required multiple staff members and extensive training can now be streamlined into automated workflows. This transformation not only accelerates prescription turnaround but also enhances traceability through real-time data capture and analytics. As healthcare facilities across the continuum strive to optimize outcomes, robotic platforms have emerged as a critical enabler of operational excellence and regulatory compliance.

Against this backdrop, this executive summary distills the core insights from a comprehensive market research initiative that examines the evolving landscape of prescription automation. The analysis delves into technological drivers, policy developments, and strategic imperatives shaping the robotic pharmacy sector. By synthesizing qualitative assessments and secondary research, the study provides decision-makers with a clear lens on emerging opportunities, potential challenges, and actionable strategies to harness the power of robotics in pharmacy practice.

Emerging Technological Breakthroughs and Operational Innovations Reshaping the Landscape of Robotic Pharmacy Prescription Systems and Services

Innovation cycles in pharmaceutical technology are accelerating at an unprecedented pace, with breakthroughs in artificial intelligence, machine learning, and sensor integration redefining the capabilities of robotic prescription systems. Recent developments have introduced self-learning algorithms that optimize compounding parameters based on historical usage patterns, enabling systems to predict demand more accurately and reduce waste. Concurrently, enhancements in modular hardware architectures allow rapid reconfiguration of robotic arms and dispensing modules, facilitating seamless integration with existing pharmacy management platforms. These advances have spurred a wave of partnerships between automation vendors and software developers, resulting in end-to-end solutions that bridge the gap between order management and distribution.

Moreover, the convergence of robotics with the Internet of Things has unlocked remote monitoring and predictive maintenance functionalities. Pharmacy managers can now track equipment performance, receive automated alerts for component degradation, and schedule service interventions before disruptions occur. Such capabilities not only reduce downtime but also extend the useful life of high-value assets. As healthcare providers navigate staffing shortages and heightened scrutiny over medication safety, these transformative shifts underscore the strategic importance of adopting next-generation robotic prescription platforms.

Assessing the Comprehensive Effects of the 2025 United States Tariff Adjustments on the Robotic Pharmacy Prescription Equipment Value Chain and Supply Dynamics

In 2025, the United States implemented targeted tariff adjustments on imported automation and pharmaceutical machinery components, reflecting broader efforts to incentivize domestic manufacturing and safeguard supply chain resilience. These duties have influenced procurement decisions for robotic compounding and dispensing equipment, prompting stakeholders to reassess cost structures and vendor strategies. For some healthcare providers, the incremental tariff rates have translated into higher capital expenditures, motivating operators to explore leasing arrangements or refurbished systems as cost-effective alternatives. At the same time, domestic equipment assemblers have seized the opportunity to deepen their value proposition by offering bundled maintenance and training packages that mitigate the initial investment burden.

Despite the immediate cost headwinds, market participants have leveraged tariff-driven incentives to localize component sourcing and assembly processes. By forming joint ventures with regional electronics and robotics firms, suppliers have reduced their exposure to import duties while fostering innovation ecosystems within the United States. Over time, these shifts are expected to yield downstream benefits, including shortened lead times, enhanced after-sales support capabilities, and greater alignment with federal procurement guidelines. Healthcare organizations that proactively adapt to the revised tariff environment are poised to secure preferential access to new funding programs aimed at modernizing pharmacy infrastructure.

In-Depth Segmentation Analysis Revealing Key Dynamics Across User Settings Product Types Components Automation Levels and Distribution Channels

A nuanced examination of market segmentation reveals how different use cases, product offerings, and supply structures converge to shape adoption trajectories. Within clinical environments, smaller benchtop compounding systems have gained traction for point-of-care medication preparation, whereas larger hospital pharmacies prioritize mobile robotics capable of high-throughput IV compounding. Long term care facilities have been steadily implementing decentralized dispensing units to improve medication management in residential settings, and retail pharmacies are integrating centralized robotic dispensing systems to streamline customer service and loyalty programs. Vendors that understand the unique requirements of each end user category are better positioned to tailor their value propositions.

Further granularity emerges when analyzing product architecture. The IV compounding segment is bifurcated between benchtop and mobile systems, each optimized for specific workflow footprints and flexibility needs. Robotic dispensing systems contrast centralized installations that feed multiple dispensing stations from a single hub against decentralized kiosks that sit directly within pharmacy counters. Component-level insights underscore the critical balance between hardware reliability, software intelligence, and service support. Within the services domain, consulting, training, integration, and maintenance support represent essential pathways to ensure seamless deployment and sustained performance. Finally, the level of automation-ranging from fully automatic end-to-end workflows to semi-automatic configurations-intersects with distribution channel strategies, where aftermarket parts sales complement direct sales engagements to provide comprehensive lifecycle management.

This comprehensive research report categorizes the Robotic Pharmacy Prescription market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Product

- Component

- Automation Level

- End User

- Distribution Channel

Comparative Regional Examination Highlighting Market Drivers Restraints and Opportunities across the Americas Europe Middle East Africa and Asia Pacific

Regionally, the Americas have emerged as a lead market thanks to a robust healthcare infrastructure, favorable reimbursement policies, and early adoption of pharmacy automation. Within this region, the United States stands at the forefront, driven by both government incentives and competitive pressures to enhance operational efficiency. Canada’s public healthcare system has also begun allocating budgets toward robotics to address pharmacist shortages and safety mandates. Shifting focus to Europe, Middle East, and Africa, stringent regulatory frameworks in Western European countries have accelerated the uptake of standardized robotic platforms, while emerging economies in Eastern Europe, the Gulf Cooperation Council, and African markets are exploring pilot deployments to modernize medication distribution.

In the Asia-Pacific region, dynamic growth is fueled by expanding private healthcare networks and rising demand for high-margin specialty compounds. Japan leads the way with strong domestic robotics expertise and a clear regulatory pathway for automated prescription technologies. Meanwhile, China’s large hospital networks are piloting integrated compounding and dispensing lines to meet volume requirements, and India’s franchised pharmacy chains are experimenting with modular robotic kits to differentiate their service offerings. Across all regions, the interplay between regulatory standards, labor market dynamics, and investment climates informs the pace and scale of robotic pharmacy prescription adoption.

This comprehensive research report examines key regions that drive the evolution of the Robotic Pharmacy Prescription market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Profiles of Leading Industry Players Showcasing Strategic Initiatives Technological Portfolios and Competitive Positioning in Robotic Pharmacy Automation

The competitive landscape features a blend of established automation conglomerates, specialized medical robotics firms, and software-centric innovators. Leading global suppliers have been augmenting their portfolios through strategic acquisitions, securing advanced visualization tools and AI capabilities to enhance system intelligence. Meanwhile, boutique robotics developers are carving out niches by focusing on highly flexible compounding platforms or turnkey dispensing units designed for specific pharmacy layouts. Strategic partnerships between automation vendors and pharmaceutical software providers have also surfaced, enabling seamless integration with electronic health record systems and inventory management platforms.

Service excellence has become a pivotal differentiator, as companies with extensive training and maintenance networks can guarantee uptime and compliance adherence. Some market leaders are adopting subscription-based models that bundle hardware, software updates, and ongoing support into unified agreements, reducing the complexity of multivendor engagements. Additionally, joint research initiatives with academic institutions and clinical sites are accelerating the validation of new compounding protocols, reinforcing supplier credibility and fostering deeper customer relationships. As competition intensifies, vendors that excel at aligning technology roadmaps with evolving pharmacy practice requirements are gaining measurable advantages.

This comprehensive research report delivers an in-depth overview of the principal market players in the Robotic Pharmacy Prescription market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- Accu-Chart Plus Healthcare Systems, Inc.

- ARxIUM Inc.

- Baxter International Inc.

- Becton, Dickinson and Company

- Capsa Solutions LLC

- Cardinal Health, Inc.

- Cencora, Inc.

- Gebr. Willach GmbH

- Innovation Associates, Inc.

- KUKA Aktiengesellschaft

- McKesson Corporation

- MedAvail Technologies Inc.

- Omnicell, Inc.

- Parata Systems, Inc.

- RxSafe, LLC

- ScriptPro LLC

- Swisslog AG

- Talyst Systems, LLC

- TOSHO Inc.

- Yuyama Co., Ltd.

Actionable Strategic Recommendations Empowering Industry Leaders to Capitalize on Emerging Trends and Mitigate Risks in Robotic Pharmacy Prescription Markets

To capitalize on the evolving market dynamics, industry leaders should prioritize building flexible solution architectures that accommodate both current workflows and future innovations. It is essential to establish collaborative ecosystems with software integrators and data analytics providers to deliver holistic offerings that extend beyond hardware functionality. Emphasizing modular design principles will enable incremental upgrades and localized customization, addressing diverse regulatory and operational contexts.

Furthermore, organizations should explore creative financing mechanisms, such as outcome-based contracting and managed services, to lower entry barriers and align value delivery with patient safety metrics. Investing in workforce upskilling through dedicated training academies will not only accelerate adoption but also engender trust among pharmacy staff. Finally, proactive engagement with policy makers to shape supportive reimbursement pathways and standards for robotic prescription will ensure a favorable environment for sustained growth.

Rigorous Research Methodology Ensuring Robust Insights through Structured Data Collection Validation and Multistage Analytical Frameworks

This study combines a rigorous multi-stage research methodology to ensure comprehensive and reliable insights. Initially, secondary research was conducted using reputable industry publications, patent databases, regulatory filings, and white papers to develop an initial framework. Following this, primary interviews were held with key stakeholders, including hospital pharmacy directors, automation engineers, and regulatory experts, providing qualitative depth and validation of emerging themes.

Quantitative data was triangulated through vendor financial disclosures, equipment shipment records, and technology adoption surveys to corroborate findings and identify market trajectories. In addition, a bottom-up analysis was employed to verify segmentation dynamics, leveraging historical deployment data and pricing models. Supplementary workshops with clinical pharmacists and automation vendors further refined the interpretation of technical and operational requirements. Throughout the process, cross-functional reviews ensured alignment with industry best practices and minimized potential biases.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Robotic Pharmacy Prescription market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Robotic Pharmacy Prescription Market, by Product

- Robotic Pharmacy Prescription Market, by Component

- Robotic Pharmacy Prescription Market, by Automation Level

- Robotic Pharmacy Prescription Market, by End User

- Robotic Pharmacy Prescription Market, by Distribution Channel

- Robotic Pharmacy Prescription Market, by Region

- Robotic Pharmacy Prescription Market, by Group

- Robotic Pharmacy Prescription Market, by Country

- United States Robotic Pharmacy Prescription Market

- China Robotic Pharmacy Prescription Market

- Competitive Landscape

- List of Figures [Total: 17]

- List of Tables [Total: 1431 ]

Conclusive Insights Summarizing Critical Findings and Strategic Implications for Stakeholders in the Robotic Pharmacy Prescription Ecosystem

The synthesis of technological innovations, policy shifts, and market dynamics underscores a clear trajectory toward broader adoption of robotic pharmacy prescription solutions. Stakeholders that embrace modular automation architectures, coupled with data-driven service models, will be best positioned to achieve efficiency gains and elevate patient safety standards. The realignment of supply chains in response to tariff adjustments, alongside strategic local partnerships, indicates a maturation of the ecosystem and a move toward in-country value creation.

As the landscape continues to evolve, continuous collaboration among vendors, healthcare providers, and regulators will be paramount. Ensuring interoperability with electronic health systems, maintaining robust training programs, and advocating for adaptive reimbursement frameworks will collectively shape the next phase of growth. Ultimately, the convergence of innovation and execution excellence will define the leaders in the robotic pharmacy prescription market.

Immediate Next Steps Contact Information for Procuring Detailed Market Research and Engaging with an Expert Associate Director for Tailored Solutions

To unlock the full potential of your organization’s pharmacy automation strategy, reach out today to Ketan Rohom, Associate Director of Sales & Marketing, who offers expert guidance tailored to your unique operational needs and procurement priorities. Ketan brings deep industry expertise in navigating complex technology portfolios and vendor landscapes to help you identify the optimal combination of products, services, and support structures. Engaging with this research will not only provide you with comprehensive data but also strategic insights to accelerate implementation timelines, ensure regulatory compliance, and enhance return on investment. Don’t let emerging market dynamics leave you behind; initiate a conversation with Ketan Rohom to secure your competitive edge in the rapidly evolving world of robotic pharmacy prescription solutions

- How big is the Robotic Pharmacy Prescription Market?

- What is the Robotic Pharmacy Prescription Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?