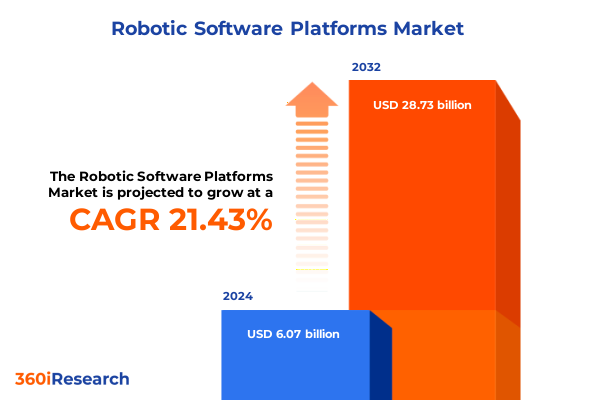

The Robotic Software Platforms Market size was estimated at USD 7.30 billion in 2025 and expected to reach USD 8.79 billion in 2026, at a CAGR of 21.60% to reach USD 28.73 billion by 2032.

Discover the Strategic Imperative Behind Robotic Software Platforms Shaping Operational Excellence and Competitive Advantage in Today's Enterprises

Robotic software platforms have become the linchpin of modern automation strategies, enabling organizations to orchestrate complex processes with unprecedented precision and efficiency. In today’s rapidly evolving landscape, enterprises across industries recognize that hardware alone no longer suffices to unlock the full potential of robotics; instead, sophisticated software ecosystems drive real-time decision-making, facilitate seamless integration with enterprise resource planning systems, and empower machines to learn and adapt to dynamic environments. This convergence of robotics and intelligent software is reshaping the competitive frontier, requiring business leaders to elevate their strategic priorities and investment frameworks.

At its core, the proliferation of robotic software solutions reflects a broader digital transformation imperative. Manufacturers seeking to enhance throughput and minimize downtime, healthcare providers aiming to improve procedural accuracy, and logistics firms striving to optimize supply chain agility all converge on a singular insight: software defines the robot. Consequently, a robust platform that unifies machine vision, motion control, simulation, and analytics is no longer a differentiator but a necessity. As such, organizations must cultivate a deep understanding of platform capabilities, ecosystem interoperability, and deployment nuances to ensure that automation initiatives deliver sustained value over time.

Furthermore, as the robotics domain matures, the software landscape itself is experiencing its own evolution-from monolithic applications to modular architectures, from rigid control logic to adaptive algorithms imbued with artificial intelligence, and from on-premise deployments to hybrid cloud–edge models. These shifts are driving a strategic dialogue among C-suite executives and technology teams alike, compelling them to reimagine traditional operating models, skill frameworks, and partnership dynamics. In this context, the executive summary that follows provides a comprehensive lens on the transformative trends and market forces at play, equipping decision-makers with a clear roadmap for navigating the complexities of robotic software platforms.

Exploring the Revolutionary Technological and Operational Transformations Driving the Next Wave of Robotic Software Platform Evolution

The landscape of robotic software platforms is undergoing a profound metamorphosis, driven by breakthroughs in artificial intelligence and the convergence of cloud, edge, and on-device computing. For instance, machine learning algorithms increasingly enable robots to interpret unstructured environments, recognize patterns in real time, and autonomously refine their performance. Concurrently, the rise of digital twins and high-fidelity simulators is transforming how developers validate complex behaviors and accelerate time-to-market. These capabilities are fueling a new wave of applications, ranging from autonomous material handling in warehouses to precision surgery in healthcare settings.

Equally significant is the shift toward open standards and interoperable frameworks, which are dismantling traditional silos and fostering vibrant developer communities around robotic operating systems. As organizations adopt middleware solutions that abstract hardware heterogeneity, they benefit from economies of scale in software development and reduced vendor lock-in. At the same time, an unwavering emphasis on cybersecurity has emerged, with platform providers embedding advanced encryption, anomaly detection, and secure update mechanisms to protect robotics ecosystems from evolving threats.

Another pivotal trend lies in the democratization of robotics through collaborative human-robot interactions. Vision processing software, intuitive programming environments, and natural language interfaces are lowering the barriers to entry, enabling non-specialists to deploy sophisticated robotic systems without extensive coding expertise. As a result, cobots and autonomous mobile robots are gaining traction in sectors as diverse as retail, agriculture, and energy, challenging preconceptions about the scope and scale of automation. These transformative shifts collectively underscore the critical need for organizations to stay abreast of emerging platform capabilities, partner networks, and best practices to maintain a competitive edge.

Unpacking the Comprehensive Effects of United States Trade Tariffs Implemented in 2025 on Robotic Software Platform Supply Chains and Innovation

The implementation of new United States tariffs in 2025 has introduced a complex dynamic to the robotic software platform market, impacting both upstream component procurement and downstream innovation cycles. By targeting a range of imported hardware elements-from precision sensors to specialized microprocessors-the tariffs have raised the overall cost of robot assembly, which in turn exerts pressure on software providers to justify higher licensing fees or service charges. As many platform developers rely on close partnerships with hardware manufacturers, any cost escalation in the hardware supply chain inevitably reverberates across software pricing models.

In response, several platform vendors have accelerated their efforts to diversify supplier bases, seeking alternative sources in markets not subject to elevated duties. This strategic pivot often involves re-evaluating manufacturing footprints, qualifying new subcontractors, and adjusting quality control protocols to maintain stringent performance standards. Moreover, the uncertainty surrounding tariff schedules has prompted many organizations to engage in tariff exclusion petitions or lobby for policy clarifications, illustrating how trade policy can catalyze advocacy and reshape vendor-government ecosystems.

Beyond cost implications, the cumulative effect of tariffs is prompting a reevaluation of research and development investments. With constrained budgets, platform providers may prioritize feature roadmaps that optimize existing codebases rather than pursue blue-sky innovations. Meanwhile, end users face the challenge of reconciling the need for cutting-edge software capabilities with budgetary constraints, potentially delaying upgrade cycles or limiting pilot deployments. At the same time, the reshoring of component production in response to trade pressures could enhance supply chain resilience and shorten lead times, offering a silver lining amid the broader disruptions.

Ultimately, the 2025 tariff regime underscores the intricate interdependencies between trade policy, supply chain strategy, and software innovation. Organizations that proactively adapt their procurement strategies, engage in collaborative risk-sharing with platform partners, and remain agile in their deployment approaches will be best positioned to navigate this shifting terrain without sacrificing long-term growth objectives.

Revealing Crucial Market Segmentation Insights Across Software Types Robot Types Deployment Models Organization Sizes and Industry Verticals

Insight into the robotic software market becomes clearer when examining how each dimension of segmentation dictates platform requirements and adoption strategies. From a software perspective, solutions that incorporate artificial intelligence capabilities are winning favor among organizations seeking predictive maintenance and adaptive control, while middleware offerings streamline interoperability between disparate control frameworks. Likewise, specialized modules such as motion control libraries, robotic operating systems, high-fidelity simulators, and advanced vision processing suites cater to distinct project life-cycle phases, underscoring the importance of modular, extensible platforms that can evolve alongside enterprise needs.

Turning to robot typology, autonomous mobile robots excel in dynamic environments where navigation algorithms and obstacle avoidance are paramount, whereas collaborative robots thrive on galvanizing human-robot teamwork through intuitive safety features and user-friendly programming interfaces. Humanoid robots, still nascent in their commercial deployment, demand sophisticated behavior orchestration engines and ethical governance frameworks. Industrial robots remain the backbone of high-volume manufacturing operations, necessitating rock-solid real-time control stacks, while specialized robots tailored for niche use cases-such as underwater inspection or pharmaceutical dispensing-require bespoke software approaches that integrate domain-specific compliance protocols.

Deployment models form another critical axis, as cloud-native platforms unlock centralized orchestration and fleet management capabilities, enabling continuous updates and seamless cross-site analytics. In contrast, on-premise implementations appeal to organizations with stringent latency, data sovereignty, or cybersecurity requirements, highlighting the need for lightweight edge agents and secure VPN tunneling solutions. Moreover, large enterprises often demand enterprise resource planning and customer relationship management integrations, along with rigorous vendor support SLAs, whereas small and medium enterprises prioritize ease of configuration, simplified licensing schemes, and pay-as-you-go pricing structures.

Finally, the vertical landscape reveals nuanced application patterns. Aerospace and defense entities typically require MIL-STD compliant software and robust audit trails, agriculture innovators leverage machine vision and AI models for crop monitoring, and automotive manufacturers focus on high-precision calibration routines. Utilities and energy firms deploy predictive analytics for remote asset inspections, healthcare providers emphasize real-time feedback loops for minimally invasive procedures, and retail organizations harness autonomous solutions to streamline order fulfillment and inventory management. By aligning platform strategies with these segmentation vectors, decision-makers can tailor their investments to deliver maximum operational impact.

This comprehensive research report categorizes the Robotic Software Platforms market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Software Type

- Robot Type

- Deployment Type

- Organization Size

- Vertical

Illuminating Strategic Regional Differences and Growth Dynamics Impacting Robotic Software Platforms Across the Americas EMEA and Asia-Pacific

Regional dynamics play a pivotal role in shaping how robotic software platforms are adopted, scaled, and governed across different markets. In the Americas, a robust manufacturing base paired with aggressive logistics optimization initiatives has created fertile ground for cloud-native orchestration tools and AI-driven analytics. North American enterprises, in particular, prioritize seamless integration with existing enterprise IT infrastructures, leveraging hybrid cloud models to balance performance with cost-efficiency. Furthermore, favorable government incentives for reshoring critical technologies are catalyzing localized development centers, strengthening the North American supply chain ecosystem.

Across Europe, the Middle East, and Africa, regulatory frameworks and industrial heritage converge to influence platform adoption. European automotive and aerospace hubs demand strict compliance with functional safety standards, driving investment in certified software modules and traceable development processes. Concurrently, intergovernmental collaborations within the European Union are fostering cross-border pilot programs in sectors such as pharmaceutical manufacturing and food processing. In the Middle East and Africa, emerging smart city projects and renewable energy deployments are fueling exploratory use cases for autonomous inspections, adaptive control systems, and remote monitoring solutions.

The Asia-Pacific region stands out for its rapid embrace of digital transformation and government-backed automation roadmaps. Leading economies such as Japan and South Korea push the frontier of humanoid robotics and smart factory deployments, while China’s ambitious industrial policy and expansive R&D funding are accelerating homegrown platform innovation. Meanwhile, Southeast Asian nations are emerging as important centers for pilot projects in agriculture automation and warehouse logistics, leveraging lower labor costs and robust telecommunication infrastructures. Together, these regional nuances underscore the importance of tailored market entry strategies and ecosystem partnerships to address localized regulatory, cultural, and technological requirements.

This comprehensive research report examines key regions that drive the evolution of the Robotic Software Platforms market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Examining the Leading Players Driving Innovation Competition and Strategic Partnerships in the Robotic Software Platform Ecosystem

The competitive landscape of robotic software platforms is characterized by a blend of established industrial automation titans and innovative software disruptors, each vying to define the next generation of intelligent robotics. Leading industrial automation integrators have leveraged decades of control-system expertise to expand their software portfolios, creating comprehensive solutions that span motion control, data analytics, and digital twin modeling. At the same time, cloud hyperscale providers have introduced robotics-as-a-service offerings, embedding advanced AI tools and managed orchestration services to lower implementation barriers for enterprise clients.

Complementing these market incumbents, agile startups are making their mark by focusing on niche applications and rapid innovation cycles. Leveraging open-source foundations, these emerging players iterate on vision processing frameworks and simulation environments, enabling developers to test and deploy new robot behaviors in compressed timelines. Strategic partnerships between startups and system integrators further accelerate go-to-market strategies, combining domain expertise with scalable infrastructure.

In addition, mergers and acquisitions remain an active strategic lever, as companies seek to shore up gaps in their software stacks or secure access to specialized talent pools. By integrating complementary technologies-such as cloud-native analytics, cybersecurity services, or edge-computing frameworks-leading vendors are building end-to-end platforms that cater to diverse industry requirements. These competitive maneuvers underscore the ongoing race to deliver differentiated value propositions that align with evolving customer priorities, whether that emphasis falls on ease of deployment, advanced machine learning capabilities, or turnkey regulatory compliance.

This comprehensive research report delivers an in-depth overview of the principal market players in the Robotic Software Platforms market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- ABB Ltd.

- Aibrain Inc.

- Amazon Web Services, Inc.

- Anduril Industries

- Boston Dynamics

- Brain Corporation

- Clearpath Robotics

- CloudMinds Technology, Inc.

- Cyberbotics Ltd.

- Dassault Systemes

- Energy Robotics

- FANUC Corporation

- FPT Software Ltd.

- International Business Machines Corporation

- iRobot Corporation

- KEBA

- Microsoft Corporation

- Neurala, Inc.

- NVIDIA Corporation

- Rockwell Automation Inc.

- Teradyne, Inc.

- Universal Robots AS

- Yaskawa Electric Corporation

Strategic Actionable Recommendations for Industry Leaders to Optimize Robotic Software Investments Accelerate Adoption and Maximize Competitive Advantage

To thrive in the rapidly evolving robotic software landscape, industry leaders should adopt a proactive, multi-faceted strategy that prioritizes both technological excellence and operational agility. First, organizations must invest in modular, microservices-based architectures that facilitate rapid feature enhancements while isolating critical subsystems for seamless upgrades. By decoupling components-such as vision algorithms, motion control kernels, and data analytics pipelines-teams can accelerate development cycles and reduce time-to-deployment.

Second, forging strategic alliances with hardware vendors and cloud providers can unlock co-innovation opportunities and ensure optimized integration across the technology stack. Such partnerships should emphasize joint roadmaps, shared engineering sprints, and aligned go-to-market initiatives to maximize ecosystem synergies. Concurrently, executives must champion a culture of continuous learning and skill development, equipping cross-functional teams with expertise in AI, cybersecurity, and systems engineering to adapt to emergent platform capabilities.

Third, leaders should adopt a hybrid deployment mindset, balancing the scalability of cloud orchestration with the resilience of edge-based processing. Careful evaluation of latency, data sovereignty, and network availability requirements will inform whether mission-critical applications reside on-premise or leverage cloud services. Furthermore, implementing robust DevSecOps pipelines that integrate automated testing, vulnerability scanning, and compliance validation will fortify platform security and streamline regulatory approvals.

Finally, decision-makers must cultivate data governance frameworks that transform operational telemetry into actionable insights. By linking robotic performance metrics with broader enterprise KPIs-such as throughput, quality yield, and total cost of ownership-organizations can justify future platform investments and identify new automation opportunities. Executing these recommendations in concert will empower industry leaders to harness the full strategic potential of robotic software platforms.

Detailing the Robust Research Methodology Including Data Collection Analysis Framework and Validation Processes Underpinning the Executive Summary

The insights presented herein are underpinned by a robust research methodology that blends qualitative and quantitative approaches to ensure rigor, relevance, and reliability. Initially, an exhaustive secondary research phase involved the analysis of industry white papers, peer-reviewed journals, regulatory filings, and original vendor documentation to map the technological landscape and identify prevailing trends. This foundational work was complemented by ongoing monitoring of trade policy developments, technical standards committees, and competitor announcements.

Subsequently, primary research activities were conducted through in-depth interviews with senior executives, robotics engineers, and solution architects across diverse sectors. These conversations yielded granular perspectives on deployment challenges, feature priorities, and strategic roadblocks. To augment qualitative insights, a series of targeted surveys and data-collection exercises captured quantitative metrics on platform adoption rates, deployment architectures, and integration complexities.

Data triage and analysis were performed using a structured framework that included trend mapping, cross-segmentation comparisons, and impact analysis. Findings were validated through a peer-review process involving subject-matter experts and industry advisors, ensuring that conclusions reflect real-world practices and emerging best practices. Rigorous quality checks, conflict-of-interest assessments, and ethical research guidelines governed every stage of the process, reinforcing the credibility of the insights.

Finally, the report underwent iterative revisions based on stakeholder feedback, aligning narrative flow with executive priorities and refining recommendations to address actionable business outcomes. This systematic approach provides stakeholders with a transparent, reproducible, and comprehensive view of the robotic software platform market.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Robotic Software Platforms market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Robotic Software Platforms Market, by Software Type

- Robotic Software Platforms Market, by Robot Type

- Robotic Software Platforms Market, by Deployment Type

- Robotic Software Platforms Market, by Organization Size

- Robotic Software Platforms Market, by Vertical

- Robotic Software Platforms Market, by Region

- Robotic Software Platforms Market, by Group

- Robotic Software Platforms Market, by Country

- United States Robotic Software Platforms Market

- China Robotic Software Platforms Market

- Competitive Landscape

- List of Figures [Total: 17]

- List of Tables [Total: 954 ]

Concluding Insights Highlighting the Strategic Value and Future Considerations for Robotic Software Platforms in Evolving Industrial Landscapes

In conclusion, robotic software platforms represent the nexus of automation, artificial intelligence, and enterprise transformation. By harnessing advanced simulation tools, modular control architectures, and cloud-edge hybrid deployments, organizations can unlock new levels of productivity, quality, and strategic agility. As trade policies such as the 2025 tariff regime introduce supply chain complexities and cost pressures, a calibrated blend of procurement diversification, supplier collaboration, and technology optimization becomes essential to sustaining innovation trajectories.

Segment-specific considerations-from software modality and robot category to deployment strategy and organizational scale-underscore that there is no one-size-fits-all solution. Instead, market leaders must tailor their platform roadmaps to vertical-specific regulations, regional market dynamics, and enterprise operating models. By prioritizing interoperability, cybersecurity, and data-driven performance management, decision-makers can ensure that robotic initiatives deliver measurable value and long-term resilience.

Ultimately, the path forward lies in embracing continuous evolution-iterating on software architectures, expanding collaborative ecosystems, and refining go-to-market approaches based on empirical feedback. With the right strategic compass, stakeholders can transform the promise of robotic software platforms into tangible competitive advantage, positioning their organizations at the forefront of the next industrial revolution.

Engage Directly with Ketan Rohom to Acquire Exclusive Market Research Insights and Elevate Your Robotic Software Platform Strategy Today

Engaging with Ketan Rohom opens the door to unparalleled insights and tailored guidance that can transform your approach to robotic software platforms. By securing the market research report today, decision-makers can harness comprehensive analyses of technology trends, competitive landscapes, and strategic imperatives to drive innovation within their organizations. Prospective clients will benefit from a collaborative discovery process, during which Ketan Rohom will facilitate a personalized walkthrough of the report’s key findings, discuss specific challenges, and outline a roadmap for integrating the insights into their operational and product strategies. The seamless interaction ensures that every stakeholder gains clarity on actionable next steps, whether it involves reconfiguring deployment models, refining investment priorities, or forging strategic partnerships.

Partnering with Ketan Rohom means tapping into an extensive network of industry experts and thought leaders who have contributed to the report’s research framework, reinforcing its credibility and relevance. Whether your focus centers on optimizing artificial intelligence modules, enhancing middleware integration, or scaling cloud-based robotic solutions, this tailored engagement will empower you to make informed decisions grounded in data-driven evidence. Reach out to coordinate an initial consultation and secure your competitive edge by acquiring the definitive guide to robotic software platforms.

- How big is the Robotic Software Platforms Market?

- What is the Robotic Software Platforms Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?