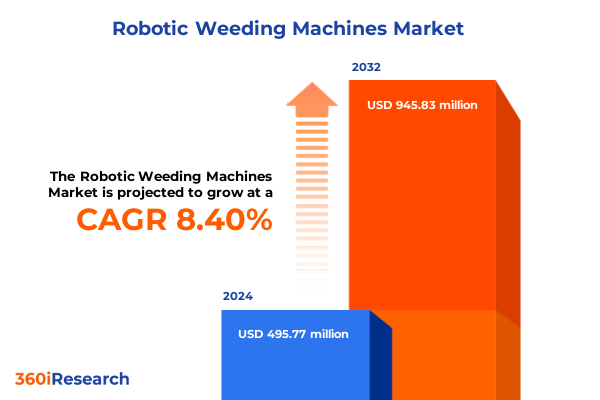

The Robotic Weeding Machines Market size was estimated at USD 535.34 million in 2025 and expected to reach USD 578.70 million in 2026, at a CAGR of 8.47% to reach USD 945.83 million by 2032.

Unveiling the New Era of Smart Weed Control through Innovative Robotic Machines Driving Sustainable Agriculture and Operational Precision

The integration of robotic weeding machines is redefining the intersection of technology and agriculture, marking a significant shift toward precision and sustainability. These machines leverage advanced algorithms and sensors to distinguish between crops and weeds, reducing chemical usage and fostering healthier soils. As farmers face escalating labor shortages and tightening environmental regulations, robotic weeders offer an efficient solution that aligns with modern demands for eco-friendly practices. Moreover, this technology empowers operators of all experience levels by automating repetitive tasks, thus driving consistency in field operations while mitigating reliance on manual labor.

Consequently, the market for robotic weeding systems has emerged as a focal point for innovation across both large-scale commercial farms and specialized crop producers. Recent deployments demonstrate that these autonomous units not only reduce herbicide applications but also enhance yield quality by minimizing inadvertent crop damage. In turn, this encourages a broader adoption among stakeholders seeking to balance productivity with sustainability imperatives, underscoring the transformative potential of this agricultural paradigm shift.

Revolutionary Advances in AI, Electrification, and Connectivity Redefining Robotic Weeding Technologies and Farming Efficiency

Breakthroughs in artificial intelligence, electrification, and connectivity are collectively generating a watershed moment for robotic weeding technologies. Advanced computer vision algorithms now accurately differentiate crop species from undesirable plants with greater than 95 percent precision, enabling targeted interventions and minimizing soil disruption. Simultaneously, improvements in battery density and modular design have produced fully electric platforms that operate longer and require less maintenance than their combustion-engine predecessors. These electric weeders, once constrained by limited runtimes, now achieve field-worthy durations through optimized energy management systems and smart scheduling protocols.

Moreover, the integration of Internet of Things (IoT) capabilities has elevated these machines from standalone devices to networked assets. Real-time performance monitoring, remote parameter adjustments, and predictive maintenance scheduling are now standard features, transforming service agreements and leasing models into outcome-driven solutions. By enabling operators to analyze usage metrics and optimize deployment strategies, connectivity not only maximizes uptime but also fosters a data-driven culture in agricultural operations. Collectively, these technological advances are recalibrating expectations and setting a new benchmark for autonomous weeding systems.

Assessing the Aggregate Effects of 2025 United States Tariff Policies on Supply Chains and Cost Structures for Robotic Weeding Systems

The introduction of a 10 percent global tariff on all imports, effective April 5, 2025, followed by reciprocal tariffs ranging from 11 percent to 50 percent across 57 trading partners as of April 9, 2025, has reshaped cost structures in automation equipment supply chains. Machinery manufacturers must now account for these ad valorem duties on non-U.S. content-even when the initial assembly occurs domestically-leading to increased capital expenditures and recalibrated procurement strategies. This sweeping policy, announced under the April Executive Order, imposes additional tariffs on countries deemed to practice nonreciprocal trade, compelling stakeholders to reassess their sourcing footprints.

Furthermore, specialized industrial components critical to robotic weeding-such as microcontrollers, machine vision sensors, and edge-computing modules-have experienced compounded duty rates. For example, tariffs on high-tech imports initially at 25 percent have been raised to 50 percent for certain semiconductor products, directly inflating the bill of materials for next-generation machines. As a result, developers and OEMs are evaluating a mix of nearshoring strategies, inventory buffering, and supplier diversification to mitigate supply chain volatility. These measures are imperative to maintain price competitiveness and preserve planned rollout timelines in a tariff-intensive environment.

In-Depth Exploration of Component, Type, Operation, Sales, Application, and End-Use Segments Fueling Robotic Weeding Market Dynamics

The component architecture of robotic weeding machines-encompassing blade mechanisms, chassis structures, control units, propulsion systems, robotic arms, and suction systems-plays a pivotal role in defining performance benchmarks and maintenance requirements. Innovations within these elements have led to modular platforms that facilitate rapid swapping of key units, thereby reducing downtime and streamlining service interventions.

When examining machine classifications, distinctions between electric weeders, mechanical weeders, and thermal weeders inform deployment strategies and operational footprints. While thermal solutions excel in chemical-free weed eradication through targeted heat applications, mechanical weeders leverage precision-engineered actuators to physically remove unwanted plants. Electric variants, by contrast, deliver enhanced energy efficiency and quieter operation, making them suitable for sensitive environments.

Operational modes range from fully autonomous systems capable of on-the-fly navigation to semi-autonomous units requiring periodic human oversight. This dichotomy influences user training programs and field-level decision-making, as some growers prioritize complete autonomy while others seek collaborative control frameworks.

Regarding distribution, direct sales channels provide premium service packages and integration support, whereas distributors and retailers enable broader access through localized networks. Leasing agreements, on the other hand, unlock asset-as-a-service models that reduce initial capital outlays and shift the commercial focus toward output-based pricing.

From an application standpoint, robotic weeders address demands across crop production, environmental conservation, farming operations, garden maintenance, and horticulture. Their adaptability ensures that whether in expansive row crops or curated public and private green spaces, these machines can be fine-tuned for variable weed pressures and soil conditions.

Finally, end-use contexts span agricultural farms, game parks, and public gardens, each presenting unique regulatory, aesthetic, and operational considerations. By aligning machine capabilities with distinct user requirements, vendors are able to optimize configurations that balance efficiency with ecosystem preservation.

This comprehensive research report categorizes the Robotic Weeding Machines market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Component

- Type

- Operation Type

- Sales Channel

- Application

- End-Use

Comparative Analysis of Regional Drivers and Challenges Shaping the Robotics Weeding Landscape in Americas, EMEA, and Asia-Pacific

The Americas region remains at the forefront of technological adoption in robotic weeding, driven by large-scale agribusinesses seeking to counter labor scarcity and enhance precision farming practices. North America’s advanced infrastructure and supportive regulatory frameworks have accelerated field trials and commercial rollouts, positioning it as a launchpad for disruptive platforms.

In contrast, Europe, the Middle East, and Africa (EMEA) exhibit a rich tapestry of adoption drivers and challenges. Stringent environmental directives in the European Union have catalyzed demand for chemical-free solutions, while emerging markets within the Middle East and Africa are gradually integrating robotics to boost yield resilience amid resource constraints. Investment in research consortia and cross-border collaborations further underscores EMEA’s strategic significance in product validation and standard-setting.

Meanwhile, the Asia-Pacific corridor is characterized by rapid mechanization in food production and a burgeoning middle class fueling organic produce consumption. Countries such as Japan and Australia have been early adopters of next-generation weeding machines, whereas emerging economies like India and Southeast Asia are piloting semi-autonomous systems to optimize labor allocation and reduce cultivation costs. Regional dynamics in Asia-Pacific therefore present a dual opportunity for suppliers: deploy proven solutions in mature markets and adapt cost-effective models for high-growth agricultural sectors.

This comprehensive research report examines key regions that drive the evolution of the Robotic Weeding Machines market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Profiling Leading Innovators Shaping Robotic Weeding Machine Evolution through Cutting-Edge Technology, Strategic Partnerships, and Market Expansion

Carbon Robotics has set a new standard with its LaserWeeder G2, an AI-powered platform that employs convolutional neural networks to target undesirable plants with precision lasers. The result is a significant reduction in herbicide applications, enhancing environmental stewardship and operational safety. Simultaneously, John Deere’s See & Spray technology integrates machine learning to administer herbicides only where needed, blending legacy agricultural equipment with digital intelligence to streamline chemical usage and mitigate drift.

Emerging innovators such as Greenfield in Kansas and Aigen Robotics in North Dakota are commercializing autonomous, battery-powered robots aimed at environmentally conscious farmers. Greenfield’s field trials cover thousands of acres, demonstrating a scalable service model supported by strategic investments, while Aigen’s solar-powered units offer extended runtime for remote operations, reducing reliance on external energy grids.

European specialist Naïo Technologies continues to innovate with its Ted vineyard robot, which combines mechanical weeding with real-time crop health diagnostics through integrated sensors. Having secured industry accolades for its Oz all-electric weeder, Naïo’s fleet now supports multi-task workflows in viticulture, pruning and weeding in a single pass, thereby streamlining labor requirements and enhancing yield quality.

In the precision vegetable sector, FarmWise’s Vulcan weeder has proven its efficacy in intra-row applications, achieving notable reductions in labor and cultivator passes. Despite scaling challenges, the company’s recent restructuring and ongoing Series A funding aim to expand service coverage and introduce platform enhancements that improve throughput and reduce per-acre costs.

Meanwhile, FarmDroid’s integrated seeding-and-weeding model leverages GPS-guided precision to eliminate weeds immediately post-planting, addressing early growth competition. Their global fleet’s performance metrics illustrate high utilization rates and consistent results across diverse crops, reinforcing the viability of synchronized planting and weeding operations.

Lastly, Ecorobotix’s micro-spraying technology deploys ultra-lightweight platforms that reduce herbicide use by up to 90 percent, exemplifying how precision applications can marry sustainability with cost efficiencies. Their modular architectures facilitate swift adjustments for varied crop profiles and service offerings, underscoring the value of adaptable design in meeting evolving agricultural needs.

This comprehensive research report delivers an in-depth overview of the principal market players in the Robotic Weeding Machines market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- Adigo AS

- AGCO Corporation

- Autonomous Solutions, Inc.

- Carbon Autonomous Robotic Systems, Inc.

- CARRE SAS

- Dahlia Robotics GmbH

- Ecorobotix SA

- Energreen S.p.A.

- F. Poulsen Engineering ApS

- FarmDroid ApS

- FarmWise Labs, Inc.

- Forlinx Embedded Technology Co., Ltd.

- Garford Farm Machinery Ltd.

- John Deere Group

- Kubota Corporation

- LEMKEN GmbH & Co. KG

- Naïo Technologies SAS

- Odd.Bot B.V.

- PeK Automotive d.o.o.

- Robert Bosch GmbH

- Rowbot Systems LLC

- SeedSpider Inc.

- Small Robot Company

- SwarmFarm Robotics

- Tertill Corporation

- VitiBot

Actionable Strategic Roadmap Offering Proven Measures to Navigate Market Complexity and Optimize Investment in Robotic Weeding Solutions

Industry leaders should prioritize modular platform development to accelerate feature roll-out and simplify maintenance cycles. By designing interchangeable components-for example, swap-in seeders, cultivators, and weeder heads-vendors can reduce total cost of ownership and offer tailored configurations for diverse crop profiles. This approach not only enhances service flexibility but also fosters stronger aftermarket revenue streams.

Moreover, forging strategic alliances with agronomic service providers and technology firms can expand distribution networks and reinforce credibility among farmers. Collaborative agreements-ranging from co-development of AI algorithms to joint pilot programs-unlock cross-sector expertise, thereby de-risking adoption for end users and catalyzing faster market penetration. As an integral next step, companies must engage in ecosystem building, inviting input from growers, researchers, and policymakers to co-create value propositions.

In light of evolving tariff landscapes, organizations should implement dual-sourcing strategies and nearshore manufacturing options to mitigate supply chain disruptions. Diversified supplier portfolios, combined with inventory hedging and flexible logistics contracts, can cushion the impact of fluctuating duties. Additionally, investing in local assembly capabilities can reduce exposure to external tariffs while showcasing commitment to regional markets.

Finally, scaling digital service offerings-such as performance analytics, remote diagnostics, and outcome-based contracts-can shift revenue models from hardware-centric to service-oriented. By leveraging fleet telematics and predictive maintenance algorithms, suppliers will drive deeper customer engagement, foster loyalty, and cultivate recurring revenue. Such proactive measures will position leaders to capitalize on the next wave of automation in agriculture.

Comprehensive Research Framework Combining Primary, Secondary, and Analytical Methodologies to Deliver Robust Market Intelligence on Robotic Weeding Technologies

This research synthesizes insights from primary and secondary sources to construct a holistic view of the robotic weeding market. Primary data was gathered through structured interviews with key industry stakeholders, including equipment manufacturers, service providers, and end users. These discussions provided qualitative context on adoption barriers, performance expectations, and emerging applications.

Secondary research encompassed a comprehensive review of regulatory filings, public financial disclosures, academic publications, and reputable news outlets. Data points, such as tariff announcements and technology benchmarks, were validated across multiple channels to ensure accuracy and currency. Quantitative triangulation was performed by cross-referencing trade data with company production reports and patent filings.

The analytical framework employed both top-down and bottom-up approaches. Top-down analysis assessed macroeconomic factors-such as trade policy shifts and environmental regulations-impacting market conditions. Conversely, bottom-up assessments reconstructed production capacities and deployment volumes based on individual company disclosures and operational metrics.

Finally, segmentation, regional, and competitive analyses were conducted using a combination of public domain data and proprietary expert surveys. This methodology supports robust conclusions and actionable recommendations, ensuring decision-makers have a clear roadmap for navigating technological, regulatory, and market complexities.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Robotic Weeding Machines market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Robotic Weeding Machines Market, by Component

- Robotic Weeding Machines Market, by Type

- Robotic Weeding Machines Market, by Operation Type

- Robotic Weeding Machines Market, by Sales Channel

- Robotic Weeding Machines Market, by Application

- Robotic Weeding Machines Market, by End-Use

- Robotic Weeding Machines Market, by Region

- Robotic Weeding Machines Market, by Group

- Robotic Weeding Machines Market, by Country

- United States Robotic Weeding Machines Market

- China Robotic Weeding Machines Market

- Competitive Landscape

- List of Figures [Total: 18]

- List of Tables [Total: 1113 ]

Concluding Synthesis Highlighting Critical Insights and Strategic Imperatives for the Future of Robotic Weeding in Agriculture

Robotic weeding machines are rapidly transitioning from niche innovations to core components of precision agriculture, driven by advancements in AI, energy efficiency, and system connectivity. As environmental sustainability and labor optimization become imperative, these technologies offer compelling value propositions across diverse applications and regions.

Despite headwinds from evolving tariff regimes and supply chain complexities, the resilience and adaptability of modular platforms and service-based models suggest that industry participants can successfully navigate cost pressures. Strategic partnerships and ecosystem collaboration will be essential to amplify market reach and mitigate adoption barriers.

Looking ahead, the continued convergence of hardware innovations with data-driven services is expected to unlock new revenue opportunities and deepen customer engagement. Embracing outcome-oriented contracts and digital performance analytics will distinguish market leaders from followers, shaping the future trajectory of autonomous weeding solutions in global agriculture.

Engage with Associate Director Ketan Rohom to Unlock Exclusive Robotic Weeding Market Intelligence and Accelerate Your Strategic Decision-Making

To seize strategic advantage and harness the full potential of the robotic weeding market, contact Ketan Rohom, Associate Director, Sales & Marketing at your earliest convenience. He can guide you through a personalized briefing and provide access to in-depth data, actionable insights, and tailored growth strategies. Engage now to align your organization with cutting-edge intelligence and ensure your market positioning remains ahead of emerging trends and competitive dynamics.

- How big is the Robotic Weeding Machines Market?

- What is the Robotic Weeding Machines Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?