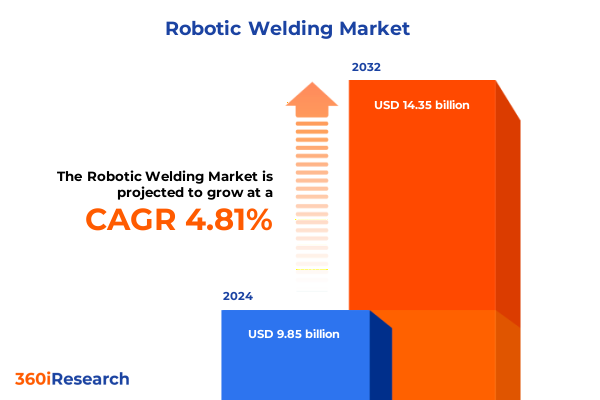

The Robotic Welding Market size was estimated at USD 10.32 billion in 2025 and expected to reach USD 10.82 billion in 2026, at a CAGR of 4.81% to reach USD 14.35 billion by 2032.

Introducing the Evolution and Current Landscape of Robotic Welding Technologies Revolutionizing Precision and Productivity in Manufacturing

Over the past decade, the manufacturing landscape has shifted in fundamental ways, driven by relentless pressure for efficiency, quality, and flexibility. Robotic welding has emerged at the forefront of this transformation, marrying mechanical precision with advanced control systems to deliver superior consistency and throughput. As industrial operations grapple with the challenges of labor shortages and increasing safety requirements, welding automation offers a compelling solution. Integrating robotics into welding operations not only mitigates human exposure to high-temperature environments and fume generation but also unlocks new levels of repeatability. Moreover, the advancements in sensor integration and machine learning algorithms have enabled real-time process monitoring, ensuring that each weld meets stringent quality standards. Consequently, organizations across sectors such as automotive, aerospace, and heavy fabrication are accelerating their adoption of robotic welding to maintain a competitive edge. Through this executive summary, readers will gain a concise yet comprehensive introduction to the current state of robotic welding, its core benefits, and the key drivers fueling its adoption in modern manufacturing settings.

Examining the Transformative Shifts Reshaping Robotic Welding Adoption Driven by Innovation, Labor Dynamics, and Industry 4.0 Integration

In recent years, a confluence of technological breakthroughs and evolving market forces has reshaped the robotic welding arena. Industry 4.0 philosophy has permeated factory floors, prompting the integration of IoT-enabled sensors, digital twins, and advanced analytics for predictive maintenance. This integration has minimized unplanned downtime and optimized throughput by signaling wear or misalignment before failures occur. Concurrently, the emergence of collaborative robots has lowered the entry barrier for smaller and medium-sized enterprises, offering safety-rated solutions that operate alongside human workers without traditional guarding. Labor dynamics have also played a pivotal role, with skilled welder shortages prompting companies to seek automated systems that can swiftly be retrained for new part geometries. At the same time, sustainability mandates and energy efficiency goals have elevated the appeal of processes such as laser welding, which delivers lower heat input and reduced spatter relative to conventional arc methods. These transformative shifts underscore a broader trend: robotic welding is no longer a niche capability but has become a strategic imperative for manufacturers striving to enhance resilience, agility, and innovation.

Assessing the Far-Reaching Impacts of 2025 United States Tariffs on Robotic Welding Supply Chains, Costs, and Competitive Positioning

The landscape of robotic welding in the United States has been notably influenced by tariff measures enacted in 2025, which targeted a range of imported automation equipment and consumables. By imposing levies on imported robot arms, power supplies, and welding wire sourced from key trading partners, these policy changes have elevated input costs for many end users. Manufacturers confronted increased capital expenditure, compelling procurement teams to reassess supplier strategies and pursue alternative sourcing domestically or from tariff-exempt regions. In certain instances, the higher landed cost of equipment has prompted a reevaluation of total cost of ownership, with companies opting to extend the service life of existing installations through comprehensive maintenance and upgrade programs. Moreover, the uncertainty surrounding potential tariff escalations has underscored the need for supply chain diversification, leading organizations to forge stronger relationships with local integrators and parts suppliers. As a result, the 2025 tariff initiatives have acted as a catalyst for reshaping procurement practices, encouraging a shift toward modular, scalable welding cells that can adapt rapidly to policy fluctuations and market demand.

Uncovering Key Segmentation Insights Highlighting Process, Robot Type, End User, Component, Integration, and Payload Dynamics in Welding Automation

An in-depth segmentation analysis reveals the multifaceted nature of the robotic welding market, highlighting opportunities across various process types, robot architectures, end-use industries, and system configurations. In terms of welding processes, longstanding arc welding modalities such as MAG, MIG, plasma, and TIG remain prevalent for general fabrication tasks, while cutting-edge techniques like electron beam and friction stir welding are gaining traction in aerospace and high-precision applications. Laser welding has evolved beyond CO2 systems to include disk, fiber, and Nd:YAG lasers, enabling manufacturers to address part thickness variability with minimal thermal distortion. Within the robot type sphere, articulated models dominate high-payload applications, whereas collaborative, Cartesian, delta, and SCARA robots serve specialized roles in electronics assembly, small parts welding, and flexible cell layouts. End-use segmentation underscores the prime drivers in automotive assembly, aerospace fabrication, shipbuilding, and oil and gas construction, while electronics and general fabrication segments are increasingly adopting automation for quality consistency. Further granularity emerges when examining component segmentation, where hardware investments remain foundational, and services encompassing installation, maintenance and repair, and training are critical for sustaining uptime. Integration architectures likewise span integrated and standalone systems to accommodate diverse production scales, and payload classifications-from under 10 kilograms to above 100 kilograms-define the suitability of platforms across light-weight assembly to heavy structural welding.

This comprehensive research report categorizes the Robotic Welding market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Welding Process

- Robot Type

- Component

- Integration Type

- End User

Delivering Regional Insights into Robotic Welding Trends across Americas, Europe Middle East & Africa, and Asia-Pacific Manufacturing Ecosystems

The adoption and maturity of robotic welding vary significantly across global regions, shaped by local manufacturing intensity, regulatory frameworks, and technology ecosystems. In the Americas, robust automotive and aerospace sectors in North America drive sophisticated cell deployments, while Mexico’s burgeoning industrial parks favor cost-effective standard arc welding solutions. Transitioning to Europe, Middle East and Africa, stringent quality and safety regulations in Western Europe have fostered high levels of automation, particularly in Germany and the United Kingdom, where advanced laser and friction stir systems address lightweight vehicle mandates. In contrast, Middle Eastern oil and gas infrastructure projects increasingly deploy heavy-duty welding cells to meet rigorous pipeline and offshore fabrication standards. Within Asia-Pacific, expansive electronics manufacturing hubs in China, Japan, and South Korea lead in high-speed, precision welding, and emerging economies such as India are rapidly embracing automation to augment local skilled labor scarcity. Across each region, the interplay of government incentives, local supply chains, and engineering talent availability influences the pace and scale of robotic welding integration.

This comprehensive research report examines key regions that drive the evolution of the Robotic Welding market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Profiling Leading Companies Driving Innovation in Robotic Welding Including Technological Advancements, Strategic Collaborations, and Competitive Differentiation

A competitive overview of the robotic welding sphere features a blend of traditional automation giants, specialized integrators, and emerging technology providers. Leading global players have distinguished themselves through continuous innovation in robot arm design, controller software, and end-effector tooling. Strategic collaborations between robotics manufacturers and welding power source vendors have yielded tightly integrated systems that optimize arc stability and energy efficiency. Meanwhile, select integrators have carved niches by offering turnkey cells with advanced vision-guided alignment and adaptive seam tracking, meeting the exacting demands of high-mix, low-volume production. On the software front, companies that provide modular, open-architecture platforms for process programming and analytics have unlocked new value in remote monitoring and predictive maintenance. A recent pattern of mergers and acquisitions underscores a trend toward consolidation, as both incumbents and newcomers seek to combine complementary expertise in artificial intelligence, digital simulation, and cloud connectivity. Service providers offering rapid deployment, training programs, and aftermarket support have also gained prominence, as end users prioritize resilient operations and minimal downtime.

This comprehensive research report delivers an in-depth overview of the principal market players in the Robotic Welding market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- ABB Ltd

- Carl Cloos Schweisstechnik GmbH

- Comau S.p.A.

- Daihen Corporation

- FANUC Corporation

- Kawasaki Heavy Industries, Ltd.

- KUKA Aktiengesellschaft

- Mitsubishi Electric Corporation

- Nachi-Fujikoshi Corp.

- Panasonic Holdings Corporation

- Yaskawa Electric Corporation

Formulating Actionable Recommendations for Industry Leaders to Capitalize on Robotic Welding Advancements and Navigate Market Disruptions Effectively

To navigate the evolving robotic welding landscape and maintain a competitive advantage, industry leaders should take several strategic actions. First, investing in collaborative robots and flexible cell architectures can enable rapid reconfiguration for new product introductions, addressing shifting market demands with minimal capital drag. Simultaneously, diversifying supply chains by incorporating regional integrators and local component suppliers can hedge against policy-driven cost volatility and shorten lead times. Embracing open-platform software ecosystems will facilitate seamless integration of predictive analytics and digital twin simulations, empowering teams to detect issues before they escalate and optimize processes in real time. Leadership in sustainable manufacturing requires an assessment of energy consumption across welding modalities, promoting low-heat-input techniques and regenerative power systems to align with corporate decarbonization goals. Additionally, fostering partnerships with academic institutions and vocational training centers will develop the welding-automation workforce of the future, ensuring in-house expertise in programming, maintenance, and quality assurance. Finally, proactive engagement with policymakers and industry consortia can shape favorable regulatory frameworks, safeguarding investments and promoting standards that drive interoperability.

Detailing Rigorous Research Methodology Combining Primary Interviews, Secondary Analysis, and Data Triangulation for Comprehensive Market Intelligence

This research employs a rigorous methodology designed to deliver reliable, comprehensive insights into the robotic welding market. Primary research comprised in-depth interviews with senior executives at robotics manufacturers, welding integrators, and end-user organizations, providing qualitative perspectives on adoption drivers and operational challenges. Simultaneously, a broad secondary analysis was conducted, reviewing peer-reviewed journals, patent filings, regulatory documents, and technical white papers to corroborate emerging technology trends and regional policy impacts. Data triangulation techniques ensured that quantitative findings align with real-world experiences, leveraging cross-verification between top-down projections and bottom-up supplier revenue data. The study also integrates case studies highlighting deployment best practices and lessons learned across diverse industry verticals. Finally, an expert advisory panel validated the analytical framework, ensuring objectivity and mitigating bias. This multi-method approach underpins the credibility of the report’s insights, equipping stakeholders with actionable intelligence for strategic decision-making.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Robotic Welding market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Robotic Welding Market, by Welding Process

- Robotic Welding Market, by Robot Type

- Robotic Welding Market, by Component

- Robotic Welding Market, by Integration Type

- Robotic Welding Market, by End User

- Robotic Welding Market, by Region

- Robotic Welding Market, by Group

- Robotic Welding Market, by Country

- United States Robotic Welding Market

- China Robotic Welding Market

- Competitive Landscape

- List of Figures [Total: 17]

- List of Tables [Total: 1590 ]

Concluding Strategic Imperatives and Future Directions Emphasizing the Critical Role of Robotic Welding in Advancing Manufacturing Excellence

Robotic welding stands at a critical juncture, poised to accelerate the evolution of manufacturing processes worldwide. Technological advancements in sensor fusion, artificial intelligence, and lightweight materials are expanding the horizons of what automated welding can achieve, from intricate aerospace assemblies to high-volume automotive production. At the same time, external pressures such as trade policy shifts, labor availability, and sustainability mandates underscore the need for resilient, agile strategies. By examining segmentation dynamics, regional nuances, and competitive landscapes, this study illuminates the pathways to optimized welding operations. Industry leaders equipped with these insights can make informed investments, foster innovation partnerships, and build robust supply networks that withstand market volatility. Ultimately, embracing robotic welding as a core pillar of modern manufacturing will yield enhanced quality, throughput, and safety, securing long-term value in increasingly competitive global markets.

Engage with Associate Director of Sales & Marketing to Secure Comprehensive Robotic Welding Market Insights and Propel Strategic Decision-Making

To gain a complete understanding of market dynamics, competitive landscapes, and emerging opportunities in robotic welding, decision-makers are encouraged to secure the comprehensive market research report. By partnering with Ketan Rohom, Associate Director, Sales & Marketing, readers will receive personalized guidance and tailored insights that translate into strategic actions. Reach out to Ketan Rohom to discuss subscription options and access the full suite of data-driven analysis designed to propel your business forward in the rapidly evolving world of welding automation.

- How big is the Robotic Welding Market?

- What is the Robotic Welding Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?