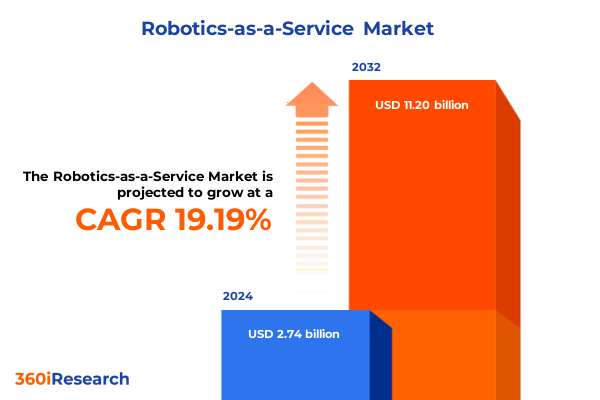

The Robotics-as-a-Service Market size was estimated at USD 3.26 billion in 2025 and expected to reach USD 3.83 billion in 2026, at a CAGR of 19.24% to reach USD 11.20 billion by 2032.

Unveiling the Extraordinary Growth and Strategic Importance of Robotics-as-a-Service in Continuously Evolving Industry Transformations

The rise of Robotics-as-a-Service marks a paradigm shift in how organizations adopt automation to drive efficiency, agility, and innovation. By transforming traditional capital-intensive investments into flexible, subscription-based models, businesses can deploy robotic solutions rapidly without the barrier of large upfront costs. This approach democratizes access to advanced automation, enabling even small and mid-sized enterprises to harness emerging technologies such as AI-driven vision systems, cloud-based orchestration platforms, and autonomous navigation technologies.

As operational complexity grows across industries, the service-based delivery of robotics offers a compelling proposition: scalability on demand. Firms can ramp up capacity to meet seasonal peaks and scale back during lean periods, aligning robotic deployments with real-time business needs. Moreover, continuous updates and maintenance services embedded within the subscription ensure that robotics fleets remain at the cutting edge of performance and reliability. These dynamics collectively underscore why Robotics-as-a-Service is reshaping the competitive landscape, driving faster time to value and fostering a more inclusive innovation ecosystem.

How Robotics-as-a-Service Is Redefining Operational Efficiency Through Service-Based Automation Models and Flexible Deployment

Across industrial and commercial domains, a profound transformation is underway as organizations pivot from ownership to service-based automation frameworks. This shift mitigates lifecycle risks and obsolescence concerns inherent in one-time capital purchases, while unlocking new revenue streams for providers through recurring service contracts. By integrating machine learning algorithms, predictive analytics, and remote diagnostic capabilities, Robotics-as-a-Service platforms now deliver autonomous problem resolution and adaptive performance tuning, elevating operational uptime and throughput.

In parallel, cloud connectivity and digital twins have emerged as foundational enablers of orchestration at scale. Operators gain holistic visibility into fleet operations, leveraging aggregated data to optimize workflows and forecast maintenance needs. Collaborative robots have advanced beyond static production lines, working safely alongside humans in dynamic environments to enhance precision and accelerate throughput. Collectively, these technological and commercial advances are driving a transformative leap, enabling organizations to reimagine workflows and unlock productivity gains that were previously unattainable.

Assessing the Far-Reaching Consequences of 2025 US Tariff Measures on Robotics-as-a-Service Supply Chains and Cost Structures

In 2025, the United States implemented a series of tariff adjustments targeting imported components critical to robotics systems, including precision sensors, high-grade motors, and semiconductor assemblies. These measures, enacted under existing trade frameworks, introduced incremental duties on key parts sourced predominantly from certain international suppliers. The cumulative effect elevated the landed cost of robotics hardware, prompting service providers to reassess their supply chain strategies and contract structures.

Rather than passing the entire cost increase to end users, many providers responded by optimizing their warehouse inventories, streamlining component sourcing through diversified vendor portfolios, and accelerating nearshoring initiatives. These strategic adjustments have softened the impact of tariffs on subscription pricing and preserved the value proposition of Robotics-as-a-Service. Additionally, the need to mitigate trade policy risks has spurred closer collaboration between manufacturers and service integrators, resulting in joint development agreements that emphasize modular, interchangeable architectures resilient to future tariff fluctuations.

Illuminating Critical Market Segments Driving Adoption Across Diverse End Users and Offerings Within Robotics-as-a-Service

The Robotics-as-a-Service market caters to an expansive array of end users, where agricultural operations rely on autonomous machines for precision seeding and harvesting, defense agencies deploy unmanned platforms for surveillance and logistics, and healthcare facilities integrate service robots for disinfection and patient assistance. Within logistics and warehousing, last mile delivery solutions encompass both ground-based autonomous vehicles and aerial drones, while warehouse automation leverages advanced storage and retrieval systems alongside conveyor networks to streamline throughput. Manufacturing environments embrace discrete and process-oriented workflows, with automotive assembly and semiconductor fabrication benefiting from robotic precision, and food, beverage, and pharmaceutical producers capitalizing on consistent, hygienic handling.

On the technology front, the diversity of robot types underscores the breadth of service offerings. Autonomous mobile platforms navigate complex facilities with either laser-guided or vision-guided systems, collaborative robots accommodate varying payload classes to assist human workers, and industrial robots span articulated, Cartesian, and SCARA designs optimized for high-speed, repetitive tasks. In parallel, professional and personal service robots augment front-line roles in hospitality, maintenance, and consumer engagement, reflecting the model’s cross-industry flexibility.

Functionally, applications range from routine cleaning and sanitation to advanced inspection, testing, and material handling, with depalletizing and palletizing functions handled seamlessly by intelligent machines. Order fulfillment benefits from case packing and precision picking, while surgery assistance robots deliver steady, minimally invasive procedures. Underlying this ecosystem, service models such as analytics, hardware-as-a-service, software-as-a-service, support and maintenance, and training deliver end-to-end solutions. Deployment choices span cloud-based orchestration, hybrid configurations, and on-premises control, all underpinned by flexible business frameworks including leasing, outcome-based engagement, pay-per-use metering, and subscription plans tailored to hourly or task-specific needs.

This comprehensive research report categorizes the Robotics-as-a-Service market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Robot Type

- Service Model

- Deployment Model

- Business Model

- End User

- Application

Discovering Regional Drivers and Barriers Shaping Robotics-as-a-Service Adoption Across Global Markets and Infrastructure

Regional dynamics profoundly shape the trajectory of Robotics-as-a-Service adoption across the globe. In the Americas, advanced logistics networks and robust manufacturing bases underpin widespread acceptance of service-based automation. Providers in North America closely align with leading e-commerce and automotive clusters, offering integrated solutions that address labor shortages and stringent operational benchmarks. Meanwhile, Latin American markets demonstrate a growing appetite for entry-level service models, particularly within agriculture and warehousing sectors seeking cost-effective automation pathways.

In Europe, the Middle East, and Africa, regulatory frameworks and sustainability imperatives influence deployment strategies. European Union directives on digitalization and green manufacturing encourage collaborative projects that integrate robotics with renewable energy systems. In the Middle East, infrastructure investments and smart city initiatives fuel demand for intelligent mobility and facility management robots, while African markets gradually embrace warehouse automation to enhance supply chain resilience.

Asia-Pacific stands at the forefront of service-based robotics innovation, driven by ambitious government programs in Japan, South Korea, and China that prioritize next-generation manufacturing and autonomous logistics. High urban density and aging workforces accelerate deployments of healthcare assistance robots and last mile delivery drones in metropolitan centers. Collectively, these regional drives and barriers underscore the necessity for providers to tailor service portfolios to local regulations, workforce profiles, and infrastructural landscapes.

This comprehensive research report examines key regions that drive the evolution of the Robotics-as-a-Service market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Profiling Leading Innovators and Emerging Challengers Transforming the Robotics-as-a-Service Market Through Strategic Initiatives

Leading automation incumbents are evolving their portfolios to integrate subscription-based offerings, while technology entrants and specialized startups bring agile, niche solutions to market. Established robotics manufacturers have expanded their service divisions, leveraging deep expertise in hardware design and global support networks to deliver end-to-end automation as a recurring service. Concurrently, cloud-native software providers are forging partnerships with hardware integrators to offer unified control platforms, enabling real-time monitoring and performance optimization across heterogeneous fleets.

Innovative challengers focus on targeted use cases-drone-enabled delivery, surgical robotics, and autonomous mobile robots with advanced perception systems-to carve out high-value segments. These players often adopt modular, open-source architectures, collaborating with research institutions to accelerate feature development and validation. Strategic alliances between service providers, academic labs, and component suppliers enhance the pace of innovation, culminating in rapid proof-of-concept cycles and scalable deployments. Collectively, this ecosystem of established leaders and disruptive newcomers drives continuous value creation for end users.

This comprehensive research report delivers an in-depth overview of the principal market players in the Robotics-as-a-Service market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- Aethon Inc.

- Amazon Robotics

- Boston Dynamics Inc.

- Clearpath Robotics Inc.

- Covariant AI Inc.

- Fanuc Corporation

- Gideon Brothers Ltd.

- InVia Robotics Inc.

- iRobot Corporation

- KUKA AG

- Locus Robotics Corp.

- Mujin Inc.

- Ocado Group

- Osaro Inc.

- Rapyuta Robotics Co. Ltd.

- RightHand Robotics Inc.

- RoboCV LLC

- Skycatch Inc.

- Soft Robotics Inc.

- Teradyne Inc.

- Vecna Robotics Inc.

- Yaskawa Electric Corporation

- Zebra Technologies

Strategic Imperatives for Industry Leaders to Capitalize on Robotics-as-a-Service Opportunities in a Rapidly Evolving Landscape

To seize the full potential of Robotics-as-a-Service, industry leaders should prioritize cross-functional collaboration between engineering, operations, and commercial teams. Establishing co-innovation labs enables rapid prototyping and co-development of customized solutions that address specific customer pain points. In parallel, investing in robust data analytics and AI capabilities will unlock predictive maintenance and dynamic workflow optimization, enhancing service quality and customer retention.

Furthermore, cultivating a global partner ecosystem expands geographical reach and facilitates localization of service offerings. Providers must also embrace flexible commercial frameworks, balancing guaranteed outcomes with pay-per-use structures to align incentives and share risk with customers. Equally important is building comprehensive training and support programs that accelerate user adoption and minimize operational disruption. By implementing these strategic imperatives, organizations can establish resilient, scalable service portfolios that drive sustained growth and industry leadership.

Comprehensive Research Approach Combining Primary Expert Interviews and Rigorous Secondary Data Analysis for Market Insights

This research integrates primary insights from in-depth interviews with senior executives, operations managers, and technical specialists spanning end-user industries, system integrators, and technology providers. Complementing these qualitative inputs, secondary data sources include patent filings, industry white papers, regulatory filings, and reputable trade publications. Rigorous data validation protocols ensure consistency across disparate datasets, with careful triangulation to resolve any discrepancies.

Quantitative analysis employs scenario-based frameworks and sensitivity testing to evaluate the impact of key drivers such as tariff changes, technological advancements, and regional regulatory shifts. The segmentation approach categorizes the market across end users, robot types, applications, service and deployment models, and business frameworks. Throughout the study, methodological transparency is maintained by documenting assumptions, data sources, and analytical processes, guaranteeing replicability and credibility of findings.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Robotics-as-a-Service market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Robotics-as-a-Service Market, by Robot Type

- Robotics-as-a-Service Market, by Service Model

- Robotics-as-a-Service Market, by Deployment Model

- Robotics-as-a-Service Market, by Business Model

- Robotics-as-a-Service Market, by End User

- Robotics-as-a-Service Market, by Application

- Robotics-as-a-Service Market, by Region

- Robotics-as-a-Service Market, by Group

- Robotics-as-a-Service Market, by Country

- United States Robotics-as-a-Service Market

- China Robotics-as-a-Service Market

- Competitive Landscape

- List of Figures [Total: 18]

- List of Tables [Total: 3657 ]

Concluding Strategic Perspectives on the Future Trajectory and Transformational Potential of Robotics-as-a-Service Solutions

The shift toward service-centric automation heralds a new era of operational excellence and strategic flexibility, as businesses redefine investment models and collaborate with technology partners to unlock continuous innovation. Through resilient supply chain strategies and regionally tailored service offerings, the Robotics-as-a-Service ecosystem will continue to expand its footprint across diverse verticals, from agriculture to healthcare.

As tariff landscapes evolve and competitive dynamics intensify, providers who blend technical prowess with customer-centric service models stand poised to lead the market. The insights presented herein equip decision-makers with a deep understanding of segmentation nuances, regional drivers, and strategic imperatives necessary to navigate this transformative journey effectively. Embracing the RaaS paradigm promises not only enhanced productivity and cost efficiency but also the agility to capitalize on emerging opportunities in a rapidly digitizing world.

Contact Ketan Rohom to Secure Your Comprehensive Robotics-as-a-Service Market Research Report Tailored to Your Strategic Objectives

For exclusive access to the detailed insights and strategic analysis of the Robotics-as-a-Service market, we invite you to connect with Ketan Rohom, Associate Director, Sales & Marketing, who will guide you through our comprehensive report offerings. Whether you require tailored data deep dives, bespoke consulting sessions, or enterprise licensing agreements, his expertise ensures you receive the precise intelligence you need to drive informed decisions. Reach out today to secure your copy of the full market research report and embark on a path toward leveraging service-based robotics for sustained competitive advantage.

- How big is the Robotics-as-a-Service Market?

- What is the Robotics-as-a-Service Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?