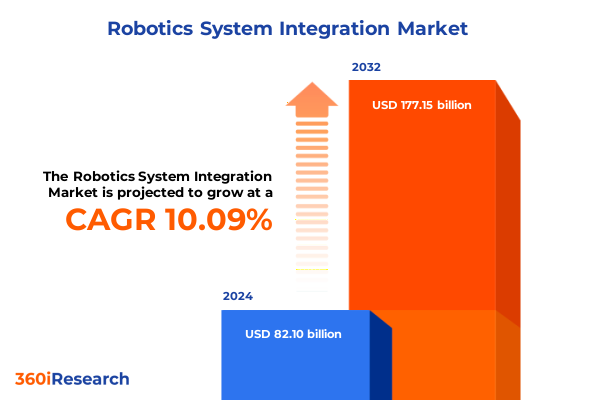

The Robotics System Integration Market size was estimated at USD 89.89 billion in 2025 and expected to reach USD 98.52 billion in 2026, at a CAGR of 10.17% to reach USD 177.15 billion by 2032.

Revolutionizing Industry with Integrated Robotics Solutions Embracing Intelligent Automation to Enhance Operational Agility and Precision in Manufacturing

The realm of robotics system integration has emerged as a cornerstone for companies striving to enhance operational resilience and drive sustainable competitive advantage. As enterprises grapple with the complexities of modern manufacturing and service delivery, integrating advanced robotic systems offers a pathway to unprecedented efficiency gains and precision outcomes. By unifying hardware, software, and control mechanisms into cohesive solutions, system integrators enable seamless automation that responds dynamically to shifting production demands and quality requirements.

Moreover, this integration extends far beyond isolated robotic deployments. It encompasses end-to-end workflows that harmonize material handling, inspection, and human–machine collaboration across factory floors and service environments alike. Leading organizations recognize that successful system integration not only reduces manual intervention but also fosters data-rich ecosystems. These ecosystems underpin real-time decision-making, predictive maintenance, and continuous process optimization, ultimately contributing to higher throughput, reduced downtime, and enhanced return on technology investments.

In this executive summary, we introduce critical insights into the transformative forces shaping the system integration landscape. We explore how technological innovations, regulatory shifts, and regional dynamics converge to create new opportunities and challenges. Through a detailed examination of segmentation criteria, tariff impacts, and actionable strategies, our analysis equips decision-makers with the clarity and direction needed to navigate this evolving domain and propel their automation journeys forward.

Transformative Shifts Driven by AI, IoT Connectivity, and Collaborative Robotics Reshaping the System Integration Landscape for Future Operations

The robotics system integration landscape is undergoing transformative shifts propelled by the convergence of artificial intelligence, ubiquitous connectivity, and advanced sensor technologies. Processes that once demanded rigid configurations are now evolving into adaptive architectures capable of self-optimization. These shifts manifest in the proliferation of collaborative robots that seamlessly work alongside human operators, leveraging machine learning algorithms to refine task execution and safety protocols in real time.

Additionally, the rise of the industrial Internet of Things has catalyzed a new paradigm in which integrated systems generate continuous streams of operational data. This data, when harnessed through edge computing and cloud analytics, yields predictive insights that preempt equipment failures and balance workloads dynamically. Consequently, manufacturers can shift from reactive maintenance schedules to condition-based strategies, reducing unplanned downtime and extending the life cycles of critical assets.

Furthermore, software platforms that support modular integration frameworks have democratized access to advanced automation. By standardizing communication protocols and offering low-code programming interfaces, these platforms accelerate deployment timelines and lower barriers for small to midsized enterprises. In turn, this democratization spurs increased cross-industry adoption, as businesses in sectors ranging from healthcare to electronics embrace tailored integration blueprints to meet their unique application requirements.

Assessing the Cumulative Impact of United States Tariffs in 2025 on Robotics System Integration Supply Chains, Cost Structures, and Competitive Strategies

The imposition of additional tariffs by the United States in 2025 has imparted a multifaceted impact on the robotics system integration sector, influencing supply chain configurations, procurement strategies, and total cost structures. Integrators dependent on imported components have encountered elevated input costs, prompting many to reassess vendor partnerships and negotiate more favorable terms to mitigate margin compression. Some stakeholders have initiated reshoring pilots to establish local assembly hubs, thereby reducing exposure to international trade fluctuations and improving delivery lead times.

Moreover, the increased duties have accelerated the adoption of alternative sourcing models. Organizations are diversifying supplier portfolios to include regional manufacturers and leveraging free trade agreements to access tariff exemptions. These strategic adjustments, while initially requiring investment in qualification processes and quality assurance protocols, have contributed to more resilient procurement networks that can better withstand future policy shifts.

In parallel, integrators are incorporating tariff considerations into project financial models from the outset, ensuring that potential cost escalations are transparently communicated to clients. This proactive stance has reinforced trust in collaborative planning and fostered stronger alignment between integrator and end-user objectives. Collectively, these adaptive responses underscore a broader industry pivot toward agility and strategic foresight in the face of evolving trade dynamics.

Unveiling Key Segmentation Insights Across Robot Types, Service Offerings, Deployment Models, Application Domains, and End-User Verticals in System Integration

A nuanced examination of market segmentation reveals distinct patterns in demand and service requirements across multiple dimensions. When assessing robot types, articulated arms dominate high-precision applications, while Cartesian configurations deliver linear motion solutions for assembly and material handling. Collaborative robots have emerged as a versatile class that bridges the gap between high-speed production and safe human interaction. In parallel, SCARA robots continue to excel in tasks requiring rapid, planar movements. On the service side, system integrators provide end-to-end support that spans installation and commissioning activities, followed by programming and system configuration. Ongoing maintenance and upgrade services then ensure operational continuity, whereas design and engineering consultancy shapes bespoke solutions. Comprehensive training and support programs further equip operations teams to leverage integrated systems effectively.

The choice between cloud-based and on-premise deployment models significantly influences integration strategies and total cost of ownership considerations. Cloud platforms offer scalable analytics and remote monitoring capabilities, which support distributed manufacturing environments and centralized data governance. Conversely, on-premise implementations appeal to sectors with stringent data security or latency requirements, enabling localized control and deterministic performance.

Integration applications vary across core functions, from automated inspection that relies on machine vision to complex welding and soldering processes demanding precise motion control. Material handling solutions encompass palletizing, conveyor interfacing, and robotic pick-and-place operations that optimize throughput. Inspection and testing frameworks leverage force sensors and laser measurement systems to uphold stringent quality standards. Finally, end-user industries ranging from aerospace and defense to agriculture and healthcare drive tailored integration roadmaps, each influenced by unique regulatory environments, customization needs, and operational benchmarks.

This comprehensive research report categorizes the Robotics System Integration market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Robot Type

- Service Type

- Deployment

- Application

- End-Users

Analyzing Critical Regional Dynamics Impacting Robotics System Integration Adoption Patterns and Growth Drivers in the Americas, EMEA, and Asia-Pacific Markets

Regional dynamics play a pivotal role in shaping the trajectory of robotics system integration adoption, as market maturity and regulatory frameworks differ markedly across geographies. Within the Americas, the interplay of nearshoring trends and robust digital infrastructure has fueled investments in advanced automation solutions. High-value manufacturing hubs in North America increasingly integrate robotic systems to address labor shortages and accelerate product innovation cycles. Latin American markets are gradually embracing low-cost automation models that cater to agroindustrial and automotive sectors.

In Europe, Middle East, and Africa, regulatory emphasis on sustainability and circular economy practices has driven integrators to design systems optimized for energy efficiency and material reuse. Collaborative frameworks between government bodies and industry consortia in Western Europe support large-scale pilot projects that validate next-generation integration methodologies. Meanwhile, Middle Eastern countries leverage automation to diversify economic portfolios beyond hydrocarbons, prompting investments in smart logistics and infrastructure automation. African markets, though nascent, show growing interest in robotics integration for agriculture and light manufacturing, facilitated by public–private partnerships focusing on skills development.

Across Asia-Pacific, a heterogeneous landscape manifests in highly advanced markets such as Japan and South Korea, where the integration of robotics with 5G networks and edge AI has set new benchmarks for smart factories. In contrast, Southeast Asian nations adopt modular integration packages tailored for cost-sensitive operations in electronics and textiles. China continues to expand its domestic system integration capabilities, supported by government initiatives that incentivize technology localization and export-oriented automation deployments.

This comprehensive research report examines key regions that drive the evolution of the Robotics System Integration market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Examining Strategic Approaches and Innovation Drivers of Leading Robotics System Integration Companies and Their Competitive Differentiation in the Ecosystem

A survey of leading system integrators highlights diverse strategic approaches to maintaining competitive advantage through technology leadership and service excellence. Certain integrators emphasize proprietary software ecosystems that streamline cross-platform interoperability, bundling analytics dashboards and predictive maintenance modules into integrated service contracts. Others differentiate through vertical specialization, assembling solution portfolios tailored for niches such as medical device assembly or high-speed e-commerce fulfillment centers.

Several innovative companies have established global partner networks, aligning with hardware OEMs and cloud providers to co-develop turnkey offerings. These alliances enable rapid response to emerging requirements, such as integrating vision-guided robotics with additive manufacturing for hybrid production lines. Additionally, key players are investing heavily in research and development centers that simulate end-to-end automation scenarios, providing clients with immersive proof-of-concept demonstrations before full-scale rollout.

Service differentiation also extends to deep expertise in cyber-physical security, as integrators deploy advanced firewalls, encryption layers, and anomaly detection systems to safeguard IoT-connected assets. By offering bundled cybersecurity assessments and compliance audits, these firms help clients navigate complex regulatory landscapes while ensuring uninterrupted production. Collectively, these strategies underscore a broader industry shift toward holistic solution platforms and collaborative innovation models that address the evolving demands of smart manufacturing and service automation.

This comprehensive research report delivers an in-depth overview of the principal market players in the Robotics System Integration market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- 4D Systems, LLC

- ABB Ltd.

- Accenture PLC

- Acieta, LLC

- Acme Manufacturing

- Adaptec Solutions LLC

- Advent Design Corporation

- Amtec Solutions Group

- ATC Automation by TASI Group

- Bastian Solutions, LLC by Toyota Advanced Logistics

- Concept Systems Inc.

- Delkor Systems, Inc.

- Dixon Automatic Tool, Inc.

- Edgewater Automation LLC

- enVista, LLC

- Fanuc Corporation

- FH Automation

- Geku Automation by HAHN Group

- Hitachi, Ltd.

- Honeywell International Inc.

- Hy-Tek LLC

- Infosys Limited

- Invio Automation

- Jabil Inc.

- JH Robotics, Inc.

- Kadence Automation & Robotic Systems

- Kawasaki Heavy Industries, Ltd.

- Keller Technology Corporation

- MESH Automation, Inc.

- Midwest Engineered Systems, Inc.

- Mujin Co., Ltd.

- Oracle Corporation

- RNA Automation Ltd

- Robotic Automation

- Siemens AG

- SP Automation & Robotics

- TW Automation

- Wipro Pari Pvt Ltd

- YASKAWA Electric Corporation

Actionable Recommendations for Industry Leaders to Accelerate Adoption of Next-Generation Robotics System Integration While Strengthening Supply Chain Resilience

Industry leaders seeking to capitalize on the momentum of robotics system integration should prioritize investments in interoperable architectures that facilitate rapid deployment of new modules and functionalities. Embracing standardized communication protocols not only accelerates integration timelines but also reduces long-term maintenance complexity. In addition, organizations should cultivate partnerships with cloud and edge computing providers to harness scalable analytics capabilities, thereby enabling continuous process optimization and remote system diagnostics.

Simultaneously, developing robust in-house training programs is essential to bridge the skills gap and foster a workforce adept at overseeing hybrid human–robot ecosystems. Upskilling initiatives that focus on programming, system troubleshooting, and data analytics will empower operations teams to manage integrated environments autonomously and safely. Furthermore, as global trade dynamics evolve, companies should build diversified supplier networks that balance cost efficiencies with tariff risk mitigation strategies.

Finally, forward-looking integrators and end-users alike should engage in cross-industry consortia and standards bodies to co-create regulatory frameworks and best practices. By actively participating in pilot projects and contributing to open protocol development, stakeholders can shape the interoperability landscape, drive down implementation costs, and accelerate the adoption curve for next-generation automation solutions.

Comprehensive Research Methodology Detailing Data Collection, Expert Interviews, and Analytical Frameworks Underpinning Insights for Robotics System Integration

Our research methodology combines rigorous primary and secondary data collection processes to ensure comprehensive coverage and analytical depth. Initially, expert interviews were conducted with senior executives, system integration engineers, and technology providers to gather qualitative insights into emerging trends, pain points, and strategic priorities. These interviews formed the basis for a structured survey administered to a broader cohort of integrators and end-users, capturing quantitative data on service usage patterns, deployment preferences, and investment drivers.

Complementing this primary research, a systematic review of peer-reviewed journals, industry white papers, and leading technology forums provided additional context on technical advancements and regional policy developments. We triangulated insights from multiple sources to validate key findings and ensure that divergent perspectives were reconciled. Analytical frameworks such as SWOT analysis, Porter’s Five Forces, and value chain mapping were applied to dissect competitive dynamics and identify critical success factors.

Furthermore, case studies of representative integration projects were developed to illustrate best practices and lessons learned across different sectors. These case studies highlight real-world deployment scenarios, integration challenges, and performance outcomes, offering readers practical guidance on execution strategies. This multi-pronged approach ensures that our conclusions are grounded in both empirical evidence and actionable industry wisdom.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Robotics System Integration market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Robotics System Integration Market, by Robot Type

- Robotics System Integration Market, by Service Type

- Robotics System Integration Market, by Deployment

- Robotics System Integration Market, by Application

- Robotics System Integration Market, by End-Users

- Robotics System Integration Market, by Region

- Robotics System Integration Market, by Group

- Robotics System Integration Market, by Country

- United States Robotics System Integration Market

- China Robotics System Integration Market

- Competitive Landscape

- List of Figures [Total: 17]

- List of Tables [Total: 2226 ]

Concluding Perspectives Highlight the Strategic Imperatives and Emerging Opportunities Shaping the Future of Robotics System Integration Across Industries

As the robotics system integration domain continues to evolve, organizations must align strategic vision with operational capabilities to harness its transformative potential fully. The strategic imperatives identified in this analysis-ranging from modular architectures and data-driven maintenance models to diversified supply chain networks-serve as foundational pillars for sustained growth and competitive differentiation. By embracing these imperatives, businesses can navigate regulatory complexities, capitalize on technological advancements, and respond agilely to market fluctuations.

Emerging opportunities abound in the integration of AI-driven quality inspection, hybrid additive subtractive production lines, and real-time digital twin simulations that enable rapid iteration and customization. As integrators and end-users deepen their collaboration, we anticipate accelerated development of ecosystem partnerships that blend hardware expertise, software innovation, and domain-specific knowledge. Moreover, the convergence of robotics with emerging fields such as augmented reality and 5G connectivity will unlock new paradigms in remote operations and distributed manufacturing.

Ultimately, the path forward requires a balanced approach that couples visionary leadership with meticulous execution. Organizations that invest in people, processes, and technology in equal measure will be best positioned to realize the full value of robotics system integration and achieve resilient, future-ready operations.

Empower Your Business Transformation with Tailored Insights and Expert Guidance Contact Ketan Rohom Today to Access the Robotic System Integration Market Report

We invite you to take the next decisive step toward unlocking the full potential of robotics system integration within your organization. By partnering with Ketan Rohom, Associate Director of Sales & Marketing, you will gain exclusive access to an in-depth market research report that delivers comprehensive analysis, strategic insights, and actionable recommendations tailored to your business objectives.

This report is designed to serve as a strategic compass, offering detailed explorations of emerging technologies, tariff impacts, segmentation dynamics, and regional trends that will shape the future of system integration. Whether you seek to optimize supply chains, accelerate innovation, or strengthen competitive differentiation, this resource provides the data-driven guidance you need to make informed decisions with confidence.

Connect directly with Ketan Rohom today to secure your copy of the report and discuss how these findings align with your operational goals and growth strategy. Empower your leadership team with the knowledge to navigate complex market forces, mitigate risk, and capture new opportunities in the rapidly evolving landscape of robotics system integration.

- How big is the Robotics System Integration Market?

- What is the Robotics System Integration Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?