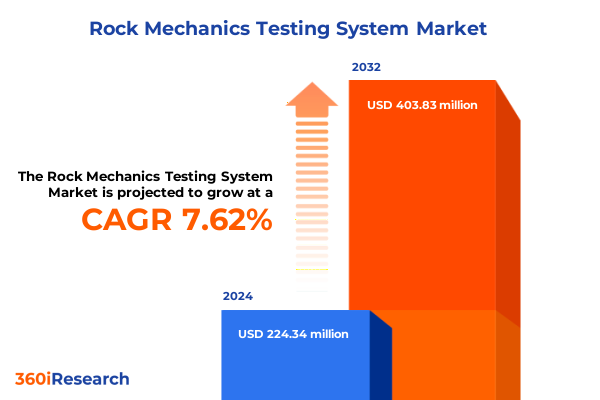

The Rock Mechanics Testing System Market size was estimated at USD 236.12 million in 2025 and expected to reach USD 255.36 million in 2026, at a CAGR of 7.96% to reach USD 403.83 million by 2032.

Emerging Dynamics and Foundational Overview of the Rock Mechanics Testing System Market Shaping Future Infrastructure and Resource Extraction

The rock mechanics testing system market is undergoing a critical juncture characterized by rapid technological evolution and expanding applications across infrastructure, energy, and environmental sectors. This introduction establishes the foundational context by highlighting the drivers of market growth, including surging infrastructure investments, heightened focus on sustainable resource development, and stringent regulatory requirements for geotechnical safety. By mapping the key forces reshaping demand, this section sets the stage for deeper analysis of how emerging dynamics will influence stakeholders from manufacturers to end users.

Throughout this overview, attention centers on the interplay between innovation and regulation. Advanced testing methodologies are increasingly indispensable as project complexities intensify, requiring rigorous evaluation of rock behavior under diverse stress conditions. Simultaneously, government standards and international best practices mandate enhanced accuracy, reliability, and traceability in testing outputs. The convergence of these trends underpins a market environment that values precision and adaptability, laying the groundwork for competitive differentiation and strategic collaboration.

Unprecedented Technological Innovations and Operational Paradigm Shifts Redefining the Landscape of Rock Mechanics Testing Systems Worldwide

In recent years, transformative shifts have redefined the operational landscape of rock mechanics testing systems. Foremost among these is the integration of automation and digital platforms, which have streamlined workflows, reduced human error, and accelerated data processing cycles. Automated triaxial and direct shear testing systems now leverage robotic sample handling and real-time analytics, enabling high-throughput studies without compromising on precision. As a result, laboratories and field-testing units can optimize resource allocation and respond more swiftly to project demands.

Complementing digitalization, the adoption of advanced sensor technologies and machine learning algorithms has elevated predictive capabilities in failure analysis and stability assessment. These innovations facilitate proactive decision making by correlating large datasets with geomechanical models to forecast performance under extreme conditions. In parallel, collaborative cloud platforms promote knowledge sharing, allowing cross-regional teams to harmonize methodologies and benchmark results. Collectively, these paradigm shifts have not only improved testing accuracy but also reduced the time-to-insight, empowering stakeholders to manage risk more effectively and capitalize on emerging opportunities.

Assessing the Cumulative Impact of United States Trade Tariffs Implemented in 2025 on Rock Mechanics Testing Equipment Supply Chains and Costs

The United States government’s implementation of new tariffs in early 2025 has exerted significant cumulative effects on the rock mechanics testing equipment ecosystem. With levies targeting key components and instrument assemblies sourced from major manufacturing hubs in Asia, supply chains have encountered increased lead times and elevated procurement costs. These disruptions have prompted original equipment manufacturers and end users alike to reevaluate sourcing strategies, consider alternative suppliers, and absorb additional overhead pressures.

In response, several market participants have accelerated efforts to localize critical manufacturing processes and strengthen domestic partnerships. By investing in regional assembly facilities and qualifying new component vendors within North America, companies aim to mitigate tariff-induced cost escalations and enhance resilience. Nevertheless, the transitional phase poses challenges: capital expenditures for facility expansion, certification of newly qualified suppliers, and alignment with existing quality protocols. As a result, procurement cycles have lengthened, and project budgets are under renewed scrutiny, underscoring the urgency for adaptable supply chain frameworks capable of buffering against policy volatility.

Deep-Dive into Multidimensional Segmentation Insights Illuminating Diverse Test Types, Applications, End Users, Technologies, and Mobility Preferences

Insight into market segmentation reveals nuanced demand patterns that reflect evolving project requirements and technological preferences. When viewed through the lens of test types, consolidation, direct shear, permeability, triaxial, and uniaxial evaluations form the core of laboratory and field analyses. Within this domain, triaxial assessments bifurcate into automated solutions that deliver high-throughput data and conventional systems prized for established methodology, enabling both rapid iteration and deep validation.

Exploring application areas underscores diversity: civil engineering initiatives span foundation design, slope stability analysis, and tunneling projects, each necessitating distinct testing protocols. Environmental studies require permeability testing to assess contaminant migration, while mining operations segment into coal, metal, and nonmetal extraction, driving demand for customized rock characterization. In oil and gas exploration, drilling support and reservoir characterization hinge on precise mechanical data to optimize well design and production strategies.

A further breakdown by end users reveals adoption across academic and research institutes pursuing fundamental geomechanical insights, construction companies seeking risk mitigation, engineering consultants delivering project feasibility studies, and government agencies enforcing regulatory compliance. Mining and oil and gas companies equally rely on these systems to ensure safe extraction and operational efficiency.

Technological segmentation spotlights the ascent of automated systems underpinned by robotic integration and software-enabled platforms, contrasted with manual systems that appeal where flexibility and cost containment are priorities. Mobility considerations differentiate fixed laboratory setups from portable systems, with battery-operated units expanding field capabilities where power infrastructure is limited and sampling conditions are unpredictable.

This comprehensive research report categorizes the Rock Mechanics Testing System market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Test Type

- Application

- End User

- Technology

- Mobility

Strategic Regional Perspectives Highlighting Market Trajectories, Growth Drivers, and Challenges Across Americas, EMEA, and Asia-Pacific Territories

Regional analysis highlights distinctive drivers shaping market trajectories across the Americas, Europe, Middle East & Africa, and Asia-Pacific. In the Americas, robust infrastructure development and the resurgence of oil and gas exploration underpin demand for both fixed and portable testing solutions. Regulatory frameworks in the United States and Canada emphasize stringent safety margins, fueling investment in high-precision automated systems to streamline compliance and expedite project approvals.

In Europe, Middle East & Africa, a dual focus on renewable energy integration and mining heritage propels market dynamics. Tunnel construction for metro expansion and hydroelectric projects in Europe demand sophisticated consolidation and shear testing, while mining operations in South Africa and the Middle East prioritize deep rock characterization for metal and nonmetal extraction. Emerging economies within the region are also investing in portable systems to support remote geological surveys and environmental assessments.

Across the Asia-Pacific, rapid urbanization in China, India, and Southeast Asia is a primary growth catalyst. Major civil infrastructure initiatives, such as high-speed rail networks and urban tunneling, drive persistent demand for reliable rock mechanics evaluation. Concurrently, mining expansions in Australia and resource-rich Southeast Asian nations sustain requirements for comprehensive testing across diverse geological formations. Local manufacturers in the region are increasingly adopting automated and hybrid systems to meet OEM standards at competitive price points.

This comprehensive research report examines key regions that drive the evolution of the Rock Mechanics Testing System market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Competitive Intelligence Unveiling Key Player Strategies, Innovative Offerings, and Collaborative Initiatives Driving the Rock Mechanics Testing System Market

Competitive analysis reveals that leading entities in the rock mechanics testing system market are advancing through a mix of product innovation, strategic alliances, and service differentiation. Several established instrumentation providers have introduced modular automation packages that integrate seamlessly with legacy equipment, thereby reducing barriers for laboratories seeking digital transformation. These platforms often include remote monitoring capabilities that enable predictive maintenance and reduce system downtime.

Partnerships between equipment manufacturers and software developers are gaining traction, with collaborative initiatives focusing on developing cloud-based repositories of test data. Such ecosystems facilitate benchmarking and comparative analysis across projects and geographies. In addition, select market players have entered joint ventures to co-develop region-specific solutions, tailoring product portfolios to comply with local standards and customer preferences.

Service-oriented models are another competitive frontier. Some providers now offer subscription-based access to testing platforms, allowing academic and small enterprise users to leverage high-end automation without significant capital investment. Similarly, extended warranty and calibration packages are bundled with core systems to ensure long-term performance and regulatory compliance. Through these multifaceted approaches, companies are solidifying their market position and creating entry barriers for new competitors.

This comprehensive research report delivers an in-depth overview of the principal market players in the Rock Mechanics Testing System market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- Aimil Ltd.

- CONTROLS S.r.l.

- Cooper Research Technology

- ELE International Limited

- GCTS – Geotechnical Consulting & Testing Systems, LLC

- Geocomp Corporation

- Geocomp Corporation

- Geotechnical Instruments Ltd.

- Humboldt Manufacturing Company

- Instron Industrial Products, LLC

- Mesy Geo-Mess Systeme GmbH

- MTS Systems Corporation

- Oyo Corporation

- Shimadzu Corporation

- Solexperts AG

- Tinius Olsen Testing Machine Company

- Utest Material Testing Equipment

- Wykeham Farrance

- ZwickRoell GmbH & Co. KG

- ZwickRoell Group

Strategic Recommendations Guiding Industry Leaders to Leverage Technological Advances, Streamline Operations, and Navigate Evolving Regulatory Landscapes

To successfully navigate the evolving landscape, industry leaders should prioritize strategic initiatives that harness technological innovation while fostering operational agility. First, accelerating the adoption of automated testing platforms will enhance throughput and data accuracy, enabling organizations to address complex geotechnical challenges with confidence. Leadership should invest in cross-functional teams to ensure seamless integration of robotics and software with existing laboratory workflows.

Second, diversifying sourcing strategies to include local and regional component vendors can mitigate the risks associated with trade policy fluctuations. By establishing qualified supplier networks across multiple jurisdictions, companies can maintain stable production schedules and reduce exposure to tariff-driven cost increases. Concurrently, pursuing collaborative partnerships with research institutions can spur joint development of bespoke solutions, reinforcing differentiation.

Finally, adopting service-based business models-such as equipment-as-a-service and predictive maintenance subscriptions-can unlock new revenue streams and strengthen customer loyalty. This shift from one-time sales to recurring engagements fosters deeper end-user relationships and amplifies lifetime value. Industry stakeholders who blend innovation, resilience, and service excellence will secure a sustainable competitive advantage.

Robust Methodological Framework Outlining Research Design, Data Collection Protocols, and Analytical Techniques Ensuring Rigor and Objectivity

The research methodology underpinning this analysis combines rigorous primary and secondary data gathering with systematic validation protocols. Initially, proprietary surveys and in-depth interviews were conducted with a cross-section of stakeholders, including laboratory managers, consulting engineers, equipment manufacturers, and regulatory authorities. These primary insights provided qualitative context and identified emerging trends directly from industry practitioners.

Complementing these findings, an extensive review of technical papers, government publications, and industry reports offered quantitative benchmarks and historical perspectives. All data sources were evaluated through a multi-tiered validation framework, ensuring consistency and accuracy. Analytical techniques such as trend mapping, demand-driver correlation, and scenario analysis were employed to distill key insights. This robust methodological approach ensures that the conclusions presented in this report rest on a foundation of objective, high-integrity evidence.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Rock Mechanics Testing System market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Rock Mechanics Testing System Market, by Test Type

- Rock Mechanics Testing System Market, by Application

- Rock Mechanics Testing System Market, by End User

- Rock Mechanics Testing System Market, by Technology

- Rock Mechanics Testing System Market, by Mobility

- Rock Mechanics Testing System Market, by Region

- Rock Mechanics Testing System Market, by Group

- Rock Mechanics Testing System Market, by Country

- United States Rock Mechanics Testing System Market

- China Rock Mechanics Testing System Market

- Competitive Landscape

- List of Figures [Total: 17]

- List of Tables [Total: 1749 ]

Synthesis of Critical Findings Emphasizing Core Trends, Challenges, and Opportunities Shaping the Future of Rock Mechanics Testing Systems

In conclusion, the rock mechanics testing system market is at an inflection point where technological leaps, regulatory demands, and geopolitical factors converge to shape future trajectories. Automated and digital solutions are redefining traditional testing paradigms, while new trade policies necessitate agile supply chain strategies. Segmentation analysis highlights diverse end-user requirements, from foundational engineering to resource extraction, underscoring the need for tailored offerings.

Regional perspectives reveal that sustained infrastructure investments in the Americas, renewable and mining projects in EMEA, and rapid urbanization across Asia-Pacific will continue to drive demand. Competitive dynamics emphasize the importance of innovation, strategic partnerships, and service-led models. By aligning with these core trends and deploying the actionable recommendations outlined earlier, organizations can position themselves to lead in a market that demands precision, adaptability, and foresight.

Engage with Our Associate Director to Secure Comprehensive Rock Mechanics Testing System Intelligence and Empower Strategic Decision-Making

To gain an authoritative, in-depth understanding of the rock mechanics testing system market and translate insights into strategic actions, reach out to Ketan Rohom (Associate Director, Sales & Marketing at 360iResearch). By securing the comprehensive market research report, organizations can align their investments, optimize supply chains, and stay ahead of regulatory shifts. Engage with our expert to customize the report for specific business needs, unlocking the full potential of data-driven decision making. Connect with Ketan to purchase the detailed analysis and elevate your competitive advantage.

- How big is the Rock Mechanics Testing System Market?

- What is the Rock Mechanics Testing System Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?