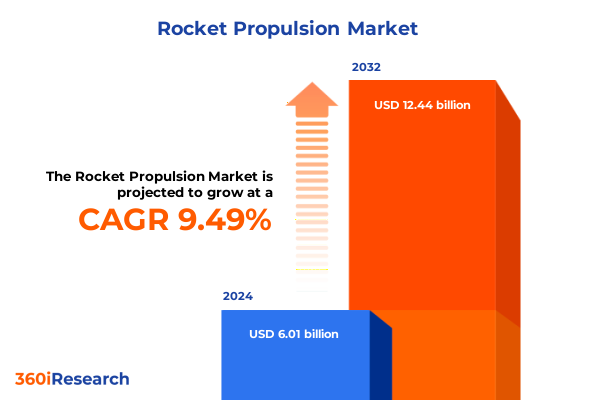

The Rocket Propulsion Market size was estimated at USD 6.59 billion in 2025 and expected to reach USD 7.13 billion in 2026, at a CAGR of 9.49% to reach USD 12.44 billion by 2032.

Understanding the Transformative Evolution and Strategic Importance of Modern Rocket Propulsion Systems in the Dynamic Aerospace Arena

The modern era of rocket propulsion is defined by a convergence of technological innovation, evolving market forces, and strategic imperatives that make propulsion systems the linchpin of national security, commercial competitiveness, and scientific discovery. From the continual drive to reduce cost per kilogram to orbit through reusability to the burgeoning demand for greener propellants, propulsion design and manufacturing are transforming at an unprecedented pace. As public and private stakeholders continue to invest heavily in launch capabilities, understanding the complexities of propulsion architectures, supply chains, and emerging regulations has become more critical than ever.

This executive summary offers a distilled perspective on the strategic forces shaping the propulsion landscape, providing decision-makers with a clear lens through which to evaluate opportunities and risks. It contextualizes the interplay between government policy, private-sector innovation, and global market dynamics. By synthesizing key trends in technology, regulatory changes, and competitive positioning, this introduction lays the groundwork for deeper analysis in subsequent sections.

Revolutionary Drivers and Technological Breakthroughs Reshaping the Global Rocket Propulsion Ecosystem for Tomorrow’s Missions

The propulsion arena is experiencing paradigm shifts driven by breakthroughs in material science, manufacturing methods, and digital integration. Additive manufacturing has revolutionized the fabrication of complex combustion chambers and injector systems, enabling cost-effective prototyping and rapid iteration. Simultaneously, the advent of high-performance alloys and composite materials has unlocked new thermal and structural capabilities, allowing engines to operate at higher pressures and temperatures, which translates directly to improved thrust and efficiency.

Beyond materials and manufacturing, the rise of methane and other “green” propellants is reshaping development roadmaps for both first-stage and upper-stage propulsion. Methalox engines, exemplified by next-generation designs, offer a compelling balance of performance, storability, and reduced environmental impact. Complementing this trend, the integration of digital twins and advanced simulation tools is streamlining engine development cycles by predicting performance outcomes and failure modes before physical testing. As these technologies mature, the propulsion ecosystem is poised to deliver unprecedented levels of reliability and affordability for a wide array of missions.

Assessing the Far-Reaching and Ongoing Consequences of Recent United States Tariff Policies on Rocket Propulsion Supply Chains

A renewed focus on national security has prompted the U.S. Commerce Department to initiate an investigation under Section 232 into imports of commercial aircraft, jet engines, and related parts, which currently face a 10% duty. If the probe results in elevated tariffs, manufacturers dependent on foreign suppliers may experience further cost pressures as they navigate input price increases and potential production delays.

Major propulsion system suppliers have already signaled significant financial impacts from the current tariff regime. One leading aerospace and defense conglomerate reported that doubling the U.S. tariff on aluminum and steel to 50% inflicted a $125 million cost burden in the first half of the year and projects a cumulative $500 million hit to its bottom line in 2025 alone. Combined with similar measures affecting critical components sourced from China, industry leaders anticipate a total trade-related expense exceeding $1 billion, compelling them to implement tariff mitigation strategies and adjust pricing structures.

Geopolitical developments have also reshaped the propulsion supply chain. Sanctions imposed after the 2022 invasion of Ukraine halted imports of Russian-built RD-180 engines, which were once the backbone of certain U.S. launch vehicles. With the phase-out of these engines, domestic manufacturers accelerated the development of new liquid propulsion architectures, such as methane-fueled staged-combustion designs, to replace legacy systems and eliminate reliance on sanctioned suppliers.

Unveiling Deep Segmentation Perspectives to Illuminate Propellant, Engine, Thrust, and Application Dynamics Across the Propulsion Spectrum

Examining the market through the lens of propellant types uncovers how mission requirements and performance criteria drive the choice between hybrid, liquid, and solid formulations. Within hybrid segments, hydroxyl-terminated polybutadiene and paraffin-based mixtures deliver varying thrust profiles and burn stability that align with specific launch parameters. Liquid propellants, whether cryogenic, hypergolic, or kerosene-based, offer trade-offs in storage complexity, ignition reliability, and performance, influencing their selection for core stages or upper stages. Solid formulations, characterized by HTPB or PBAN binders, continue to be favored for military applications and certain booster configurations due to their storability and simplicity.

Transitioning to engine configurations, the market differentiates between hybrid, liquid, and solid propulsion systems, each further refined by cycle architecture or motor construction. Liquid engines leveraging expander, gas-generator, pressure-fed, or staged-combustion cycles exhibit distinct manufacturing and operational considerations that affect cost, reliability, and thrust-to-weight ratios. In the solid domain, cast and filament-wound motor designs balance production throughput against performance consistency. Layered atop these technical distinctions, thrust class segmentation into high, medium, and low thrust categories directly maps to application profiles, from heavy lift launchers through versatile orbital transfer vehicles to precise low-thrust maneuvering units. Application segmentation further deepens insight by aligning propulsion solutions with defense needs-spanning strategic and tactical missile systems-commercial and government launch vehicles, and research platforms dedicated to scientific payloads and technology demonstration missions.

This comprehensive research report categorizes the Rocket Propulsion market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Propellant Type

- Engine Type

- Thrust Class

- Application

Examining Distinct Regional Trends and Strategic Opportunities Within the Americas, EMEA, and Asia-Pacific Rocket Propulsion Markets

Regional dynamics play a defining role in how propulsion technologies are developed, adopted, and commercialized. In the Americas, the United States leads with a robust ecosystem supported by heavy investment in reusable launch systems, aggressive government procurement budgets, and a thriving private sector that includes established prime contractors and rapidly scaling new entrants. This region also benefits from integrated supply chains spanning raw material production to advanced manufacturing, with Mexico and Canada serving as key partners for components and subassemblies.

Europe, the Middle East, and Africa present a tapestry of collaborative ventures and national flagship programs. The European Space Agency and industrial consortia continue to refine next-generation engines for heavy and medium-lift launchers, while the United Kingdom, France, and Germany invest in sustainable propellant research and digital manufacturing integration. Meanwhile, emerging hubs in the Middle East pursue indigenous capability through strategic partnerships, and Africa is beginning to cultivate local expertise in satellite launch adapters and smaller solid motor systems.

Asia-Pacific demonstrates the fastest growth trajectory, propelled by a blend of state-sponsored initiatives and a growing cadre of private launch companies. China’s multi-orbit launch cadence has accelerated demand for diverse propulsion solutions, including green propellant initiatives. India’s propulsion programs, backed by ISRO, emphasize cost economies and mission reliability, with parallel development of semi-cryogenic engines. Japan and South Korea are doubling down on liquid and solid motor innovation, while Australia’s nascent sector focuses on small-satellite launchers and in-country manufacturing of composite motor cases.

This comprehensive research report examines key regions that drive the evolution of the Rocket Propulsion market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Highlighting Leading Innovators and Strategic Collaborators Driving Competitive Advantage and Growth in Rocket Propulsion

A handful of industry leaders and agile challengers are defining the competitive architecture of the propulsion sector. One prominent innovator has pushed the frontier with a full-flow staged-combustion methane engine that supports rapid reusability and high performance, setting new benchmarks for cost efficiency. Another major conglomerate continues to modernize legacy cryogenic and hypergolic engines, integrating advanced cooling channels and additive-manufactured injectors to extend mission life and streamline production.

Emerging players are also making strategic inroads. A trans-Pacific startup is developing a medium-thrust liquid engine optimized for small launch vehicles, leveraging electric pump-fed cycles for mass reduction. In the solid propulsion domain, modular motor providers are targeting defense prime contractors with rapid-turnaround manufacturing and binder chemistries that reduce smoke signature. These and other actors, including state-backed engine developers in Europe and Asia, are forging partnerships and joint ventures to accelerate technology transfer and secure long-term supply chain resilience.

This comprehensive research report delivers an in-depth overview of the principal market players in the Rocket Propulsion market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- Aerojet Rocketdyne Holdings, Inc.

- ArianeGroup SAS

- Astra Space, Inc.

- Avio S.p.A.

- Blue Origin, LLC

- Firefly Aerospace, Inc.

- Isar Aerospace Technologies GmbH

- Lockheed Martin Corporation

- Mitsubishi Heavy Industries, Ltd.

- Northrop Grumman Corporation

- Relativity Space, Inc.

- Rocket Factory Augsburg AG

- Rocket Lab USA, Inc.

- Sierra Space Corporation

- Skyroot Aerospace Pvt. Ltd.

- Space Exploration Technologies Corp.

- Stoke Space Technologies, Inc.

- United Launch Alliance, LLC

- Vaya Space, Inc.

- Virgin Galactic Holdings, Inc.

Empowering Industry Stakeholders with Practical Strategies and Innovative Pathways to Navigate Complex Challenges in Rocket Propulsion

Industry players should prioritize the expansion of additive manufacturing capabilities to reduce lead times on critical engine components and enable rapid design iterations. By investing in high-throughput directed energy deposition and powder-bed fusion systems, organizations can accelerate testing cycles and lower production costs, fostering a faster path to flight readiness.

Supply chain diversification is equally vital. Stakeholders must identify alternative sources of strategic alloys, rare earth metals, and composite materials to hedge against tariff volatility and geopolitical disruptions. Establishing dual-sourcing strategies and cultivating regional supplier networks will enhance resilience and minimize program delays.

To meet sustainability objectives and align with emerging regulatory frameworks, propulsion developers should accelerate the maturation of green propellant technologies. Methane, ammonia, and novel energetic liquid formulations offer pathways to reduced environmental impact and operational flexibility. Collaborative research partnerships with government labs and academic institutions can help de-risk scale-up and certification efforts.

Finally, embracing digital transformation through integrated simulation suites, digital twins, and predictive analytics will optimize design margins and maintenance planning. By leveraging real-time data from ground tests and in-flight telemetry, organizations can proactively address degradation modes, improve reliability, and maximize the return on propulsion assets.

Detailing Rigorous Research Methodology and Data Triangulation Processes Underpinning the Insights in the Rocket Propulsion Executive Summary

This analysis is built upon a multi-faceted research framework combining extensive secondary research and primary qualitative inputs. Publicly available literature, including technical papers, regulatory filings, and corporate disclosures, provided foundational context on technology trends, tariff developments, and company strategies. These insights were cross-referenced with government reports and trade association publications to establish a robust factual baseline.

To enrich the study, subject-matter experts in propulsion design, materials engineering, and aerospace policy were engaged through structured interviews and workshops. Their firsthand perspectives on emerging technologies, supply chain dynamics, and regulatory implications informed the interpretation of market shifts and technology adoption curves. Data triangulation methods were applied by synthesizing quantitative indicators, such as production volumes and launch rates, with qualitative insights to validate thematic findings.

Segmentation logic was defined to align with industry-standard classifications, ensuring consistent analysis across propellant type, engine cycle architecture, thrust class, and application domains. Regional and competitive landscapes were mapped using a combination of launch manifest reviews, patent activity tracking, and financial disclosures. This iterative approach ensured the comprehensive capture of market nuances and strategic imperatives driving the propulsion ecosystem.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Rocket Propulsion market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Rocket Propulsion Market, by Propellant Type

- Rocket Propulsion Market, by Engine Type

- Rocket Propulsion Market, by Thrust Class

- Rocket Propulsion Market, by Application

- Rocket Propulsion Market, by Region

- Rocket Propulsion Market, by Group

- Rocket Propulsion Market, by Country

- United States Rocket Propulsion Market

- China Rocket Propulsion Market

- Competitive Landscape

- List of Figures [Total: 16]

- List of Tables [Total: 2067 ]

Synthesizing Key Findings and Forward-Looking Perspectives to Reinforce Strategic Understanding of the Rocket Propulsion Ecosystem

The preceding analysis underscores how propulsion technologies are at the nexus of innovation, policy, and commercial strategy. The transition toward reusability, the rise of green propellants, and the integration of advanced manufacturing techniques are collectively redefining the performance and cost paradigms that have historically governed access to space. Concurrently, evolving tariff regimes and geopolitical considerations are reshaping supply chains and compelling stakeholders to adopt resilient sourcing and development strategies.

Through deep segmentation, regional profiling, and competitor benchmarking, this executive summary delivers a nuanced view of the propulsion landscape. Decision-makers can leverage these insights to align R&D investments, partnership strategies, and procurement plans with the most significant value drivers. As the industry continues to mature, staying abreast of these transformative forces will be essential to securing competitive advantage and mission success in the years ahead.

Connect with Ketan Rohom to Secure Comprehensive Insights and Exclusive Access to the Full Rocket Propulsion Market Research Report Today

To explore deeper insights into propulsion market dynamics and secure strategic foresight that can guide your next critical decisions, reach out to Ketan Rohom, Associate Director, Sales & Marketing. He can provide you with exclusive access to the full rocket propulsion market research report, equipping you with comprehensive analysis, actionable recommendations, and detailed segmentation data tailored to your needs. Engage today to ensure your organization is positioned at the forefront of propulsion innovation and market opportunity.

- How big is the Rocket Propulsion Market?

- What is the Rocket Propulsion Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?