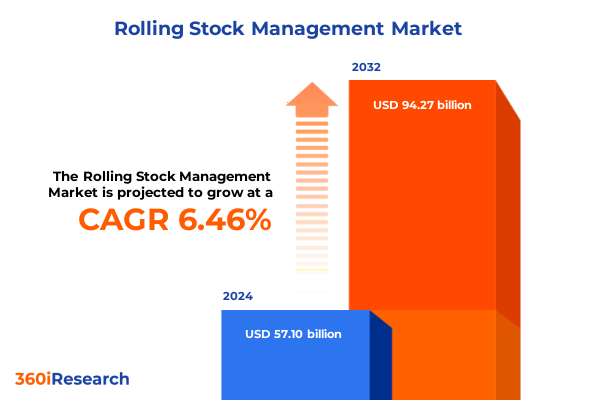

The Rolling Stock Management Market size was estimated at USD 60.73 billion in 2025 and expected to reach USD 63.88 billion in 2026, at a CAGR of 6.48% to reach USD 94.27 billion by 2032.

Unveiling the Strategic Importance of Rolling Stock Management for Sustainable Operations Efficiency and Reliability in Modern Rail Networks

Rolling stock management encompasses the planning, procurement, maintenance, and retirement of rail vehicles that form the backbone of freight and passenger transportation networks. As rail operators strive to maximize asset utilization, ensure safety, and contend with rising service expectations, efficient rolling stock strategies have never been more critical. Beyond mere upkeep, contemporary management practices integrate lifecycle cost analysis, sustainability metrics, and digital performance tracking to optimize reliability and meet evolving regulatory standards. With global rail traffic volumes surging and infrastructure modernization on the agenda in key markets, the strategic importance of a cohesive rolling stock framework resonates across both public and private stakeholders.

The discipline extends far beyond mechanical inspections and depot scheduling; it embraces advanced asset health monitoring, predictive analytics, and data-driven decision frameworks. Leveraging real-time telemetry, operators can minimize unplanned downtime and extend the service life of critical components, driving significant operational savings. Furthermore, as environmental mandates push for reduced emissions and energy consumption, integrated rolling stock policies ensure that propulsion systems-from traditional diesel to hybrid and electric platforms-are deployed, maintained, and phased out in alignment with broader decarbonization goals. By establishing a robust rolling stock management ecosystem, organizations can deliver resilient service, lower total cost of ownership, and improved passenger and freight satisfaction in an increasingly competitive landscape.

How Digital Innovation, Sustainability Mandates, and Cyber Resilience Are Revolutionizing Rolling Stock Management Practices

The landscape of rolling stock management has undergone a profound transformation as digital and sustainable technologies converge to reshape maintenance, operations, and customer engagement. Internet of Things sensors on bogies, braking systems, HVAC units, and propulsion modules now collect high-velocity data streams, enabling remote diagnostics that pinpoint anomalies before they escalate into failures. Artificial intelligence algorithms fuse this telemetry with historical performance records to forecast potential faults, prioritize maintenance tasks, and schedule interventions with surgical precision. This shift from time-based to condition-based maintenance reduces unscheduled outages, optimizes spare parts inventory, and enhances overall fleet availability.

Simultaneously, the industry’s pursuit of greener operations has accelerated the adoption of electric motors, hybrid powertrains, and regenerative braking technology. These advances not only lower fuel consumption and carbon emissions but also introduce new maintenance paradigms that require specialized diagnostic tools and training. Operators are pairing digital twins-virtual replicas of physical assets-with real-time sensor inputs to simulate wear patterns and stress responses, allowing for proactive refurbishment and design refinements. As cybersecurity threats loom larger alongside connectivity gains, network resilience now underpins every rolling stock strategy, with end-to-end encryption and intrusion detection integrated into onboard control systems. Together, these transformative shifts are redefining the principles of reliability, safety, and efficiency across global rail networks.

Analyzing the Broad Supply Chain Disruptions Driven by Expanded U.S. Steel and Aluminum Tariffs Impacting Rolling Stock Components

Early in 2025, U.S. policy reforms expanded Section 232 tariffs to cover all steel and aluminum imports at a 25% rate and eliminated country-specific exemptions for nations including Canada, the European Union, and Mexico, effective March 12. This shift ended the previous regime of voluntary export restraints and general approved exclusions, subjecting derivative steel and aluminum products to the same duties as primary metals. While the intent was to bolster domestic metal producers, the immediate effect rippled across the rolling stock supply chain.

Component manufacturers reliant on foreign steel and aluminum faced sharp cost increases, compelling many to reassess sourcing strategies or pass expenses downstream. Disc brake and regenerative brake producers reported higher raw material bills, while suppliers of diesel engines, electric motors, and structural alloys experienced extended lead times as customs authorities adjusted to new product classifications and documentation requirements. The introduction of tariffs on aluminum extrusions and fabricated steel assemblies disrupted just-in-time inventory models, prompting rail operators to increase on-hand safety stocks and revise maintenance schedules to mitigate the risk of part shortages.

In parallel, uncertain tariff carve-outs for derivative articles forced cross-border facilities to reconfigure supply chain footprints, with U.S. Customs and Border Protection issuing new guidelines for documenting “melted and poured” or “smelted and cast” origin claims. These regulatory changes have elevated administrative burdens, required enhanced customs expertise, and underscored the need for agile procurement policies. As a result, rolling stock stakeholders are increasingly prioritizing tariff impact analysis and regionalized sourcing solutions to protect operational continuity.

Extracting Critical Insights from Component, Technology, Application, and End User Segmentation to Guide Rolling Stock Strategy

Deep insights emerge when examining the market across multiple dimensions of segmentation that shape rolling stock management solutions. Component-level specialization reveals distinct maintenance requirements and performance metrics: bogie and HVAC units demand rigorous thermal and vibration monitoring, while control systems hinge on software integrity checks and cybersecurity protocols. Within braking solutions, disc brakes offer proven mechanical reliability whereas regenerative brakes integrate electrical energy recovery, influencing both maintenance intervals and energy efficiency calculations. Propulsion systems likewise diverge, with diesel engines balancing power density and fuel availability, electric motors prioritizing lifecycle cost reductions, and hybrid platforms offering transitional flexibility.

Technological segmentation highlights the ascendancy of advanced digital tools. AI analytics frameworks extract actionable insights from terabytes of operational data, unlocking predictive maintenance routines that preempt costly failures. Condition monitoring architectures deploy multisensor suites across all core subsystems, enabling real-time health assessments. Predictive maintenance algorithms schedule interventions based on calculated remaining useful life, while remote diagnostics and telematics platforms empower depot engineers to troubleshoot faults from centralized operations centers, reducing labor costs and turnaround times.

Application-focused segmentation differentiates solutions for freight and passenger domains. The freight market subdivides into sectors such as automotive, bulk commodities, containerized goods, and refrigerated cargo, each presenting unique asset utilization profiles and environmental challenges. Passenger transport encompasses high-speed rail, intercity services, and urban transit networks, where reliability, comfort, and punctuality are paramount. End-user segmentation further contextualizes these dynamics: government operators often adhere to stringent service level agreements and mandate indigenous sourcing, leasing firms pursue fleet uptime optimization to maximize asset ROI, and private operators prioritize cost-effective maintenance models aligned with contract requirements.

This comprehensive research report categorizes the Rolling Stock Management market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Component

- Technology

- Application

- End User

Comparing Regional Rolling Stock Management Dynamics and Investment Patterns across Americas, EMEA, and Asia-Pacific Markets

Regionally, opportunities and challenges in rolling stock management vary significantly across the Americas, Europe Middle East and Africa, and Asia-Pacific corridors. In the Americas, robust freight demand and government investments in sustainable transportation accelerate the adoption of predictive maintenance and telematics solutions, especially in North America where private railroads lead digital innovation. Meanwhile, Latin American networks prioritize capacity expansion to support raw material exports, driving demand for modular bogies and lightweight train architectures.

In the Europe Middle East and Africa region, high-speed passenger corridors and urban transit systems create stringent reliability requirements. Operators in Western Europe capitalize on established digital twin programs to simulate maintenance scenarios, while emerging markets in the Middle East invest in turnkey solutions to rapidly scale network capabilities. Africa’s expanding rail corridors emphasize cost-effective condition monitoring and hybrid propulsion retrofits to bridge electrification gaps.

Asia-Pacific remains the fastest-growing epicenter for rail modernization. Massive fleet expansions in China and India are accompanied by ambitious high-speed rail projects, propelling demand for integrated AI analytics, cloud-based fleet management, and advanced braking systems. Japan’s legacy networks continue to refine control system automation and cybersecurity measures. Across Southeast Asia and Australia, public-private partnerships drive rollouts of telematics-driven maintenance platforms to support intercity and urban transit growth.

This comprehensive research report examines key regions that drive the evolution of the Rolling Stock Management market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Surveying the Competitive Landscape: How Leading Manufacturers and Technology Firms Are Innovating Rolling Stock Management Offerings

Leading rolling stock management solution providers are differentiating through integrated digital platforms, strategic partnerships, and modular service offerings. Alstom has combined its train manufacturing expertise with IoT-enabled monitoring suites, offering operators end-to-end condition monitoring solutions that integrate seamlessly with existing fleet control systems. Siemens leverages its rail electrification and digital business arm to deliver cloud-native analytics and cybersecurity-enhanced remote diagnostics, reinforcing its position in high-speed and urban transit segments. CRRC, as a global rolling stock manufacturer, focuses on proprietary predictive maintenance frameworks underpinned by edge-AI processors embedded in traction units and bogies.

GE Transportation, now part of Wabtec, has prioritized hybrid propulsion upgrades and regenerative brake retrofits, pairing its locomotive platforms with telematics services to optimize fuel savings and maintenance scheduling. Hitachi Rail integrates digital twin technology for lifecycle management, enabling virtual testing of braking systems and HVAC modules before physical deployment. ABB’s traction business emphasizes component-level diagnostics and remote firmware management for motor converters, while Bombardier’s legacy digital services group offers turnkey maintenance planning and data analytics consulting. New entrants and specialized software firms complement these incumbents by providing niche solutions such as real-time anomaly detection, mobile inspection applications, and AI-driven asset performance modelling.

This comprehensive research report delivers an in-depth overview of the principal market players in the Rolling Stock Management market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- ABB Ltd.

- Alstom SA

- Alstom Transport

- Amsted Rail Company Inc.

- Bombardier Inc.

- CRRC Corporation Limited

- Greenbrier Companies Inc.

- Hitachi Ltd.

- Hyundai Rotem Company

- Kawasaki Heavy Industries Ltd.

- Knorr-Bremse AG

- Mitsubishi Electric Corporation

- Nippon Sharyo Ltd.

- Progress Rail Services Corporation

- Siemens AG

- Siemens Mobility GmbH

- Stadler Rail AG

- Thales Group

- Toshiba Corporation

- Trinity Industries Inc.

- Vossloh AG

- Wabtec Corporation

- Wabtec Corporation

Essential Strategic Actions for Rail Operators and Technology Partners to Future-Proof Rolling Stock Operations and Mitigate Supply Chain Risks

Industry leaders can capitalize on emerging trends and mitigate macroeconomic risks by adopting several strategic initiatives. First, embedding predictive maintenance systems across the fleet reduces unplanned downtime and extends component lifecycle, directly lowering maintenance budgets. By integrating AI-based anomaly detection with automated parts procurement platforms, organizations can synchronize supply chain performance with maintenance schedules and minimize inventory carrying costs. Second, diversification of supply sources, including nearshoring critical steel and aluminum components or securing advanced material alternatives, helps to insulate procurement teams from tariff volatility and shipping disruptions.

Third, rolling out centralized digital twins for high-value assets enables virtual commissioning, scenario testing, and workforce training, accelerating time-to-value for new equipment while reducing on-site labor dependencies. Fourth, investing in workforce upskilling programs fortifies the human element in an increasingly data-driven environment; comprehensive training in cybersecurity best practices and remote diagnostics ensures that technicians can fully leverage telematics and edge-compute platforms. Finally, forging strategic alliances with component and technology vendors fosters co-innovation, granting operators early access to advanced braking systems, propulsion upgrades, and next-generation condition monitoring services. By aligning cross-functional teams on these priority areas, leaders will cultivate more resilient, efficient, and future-proof rolling stock operations.

Detailing a Robust Mixed-Methods Research Framework Integrating Primary Interviews, Quantitative Surveys, and Data Triangulation

This report leverages a rigorous mixed-methods research approach to ensure comprehensive and actionable insights. Secondary research encompassed the review of industry publications, regulatory filings, and public trade data, including tariff proclamations, technical white papers, and regulatory directives issued through March 2025. Proprietary databases and peer-reviewed journals provided historical performance benchmarks across component categories and regional fleets.

Primary research included in-depth interviews with senior executives from rail operators, leasing firms, component manufacturers, and software providers. Structured discussions focused on deployment experiences, technology roadmaps, and tariff management strategies. Quantitative surveys captured detailed feedback on maintenance KPIs, technology adoption rates, and procurement challenges across all major world regions.

Data triangulation techniques reconciled insights from multiple sources, ensuring the validity and reliability of segmentation analyses and regional assessments. We applied qualitative coding to interview transcripts to identify emerging themes and validated these against secondary data trends. Expert panels reviewed draft findings and contributed scenario-based evaluations to refine recommendations. The result is a holistic understanding of current dynamics and the projected trajectory of rolling stock management solutions under evolving economic and regulatory conditions.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Rolling Stock Management market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Rolling Stock Management Market, by Component

- Rolling Stock Management Market, by Technology

- Rolling Stock Management Market, by Application

- Rolling Stock Management Market, by End User

- Rolling Stock Management Market, by Region

- Rolling Stock Management Market, by Group

- Rolling Stock Management Market, by Country

- United States Rolling Stock Management Market

- China Rolling Stock Management Market

- Competitive Landscape

- List of Figures [Total: 16]

- List of Tables [Total: 1431 ]

Synthesis of Key Findings Highlighting the Imperative of Digital, Operational, and Supply Chain Resilience in Rolling Stock Management

The critical role of advanced rolling stock management has never been more pronounced. As rail networks worldwide embrace digital transformation and confront shifting regulatory landscapes, operators must recalibrate their strategies to harness real-time data, leverage predictive analytics, and navigate supply chain headwinds. The widespread adoption of AI-driven condition monitoring, remote diagnostics, and digital twin constructs is setting new performance benchmarks for reliability and cost efficiency.

Simultaneously, the imposition of enhanced U.S. steel and aluminum tariffs underscores the strategic imperative of supply chain resilience and regional sourcing diversification. Segmentation insights reveal that tailored approaches-whether targeting freight container fleets with regenerative braking upgrades or deploying AI analytics in urban transit control systems-are essential to capture the full value of emerging technologies. By synthesizing regional nuances and competitive dynamics, stakeholders can chart a clear path forward, balancing immediate operational demands with long-term sustainability goals.

In sum, this report outlines a roadmap for rolling stock stakeholders to optimize asset utilization, reduce lifecycle costs, and strengthen system resilience. It presents a cohesive narrative of market forces, technological innovations, and actionable strategies designed to inform strategic decision-making in an increasingly complex rail environment.

Connect with Associate Director of Sales & Marketing Ketan Rohom to Secure the Full Rolling Stock Management Intelligence Report

To access the comprehensive analysis, in-depth segmentation breakdowns, regional assessments, and actionable strategies detailed in this report, reach out to Ketan Rohom, Associate Director of Sales & Marketing at 360iResearch. Ketan brings extensive expertise in rolling stock market dynamics and can guide you through tailored research packages, licensing options, and bespoke consulting services. Leverage his insights to secure your strategic advantage and make data-driven decisions that propel your organization forward in an increasingly competitive rail industry.

- How big is the Rolling Stock Management Market?

- What is the Rolling Stock Management Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?