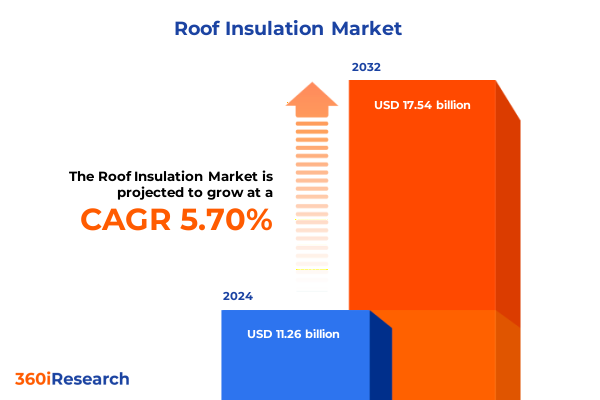

The Roof Insulation Market size was estimated at USD 11.89 billion in 2025 and expected to reach USD 12.52 billion in 2026, at a CAGR of 5.71% to reach USD 17.54 billion by 2032.

Unveiling the Imperative Role of Roof Insulation Solutions in Driving Sustainable Energy Efficiency and Extending Structural Longevity in Modern Construction

Roof insulation serves as a fundamental component in modern building design by acting as a critical barrier against heat transfer ultimately optimizing energy consumption and enhancing occupant comfort. In an era defined by escalating energy costs and stringent regulatory requirements for green construction, the choice of insulation materials and installation practices has evolved from a secondary consideration into a core strategic priority for architects builders and facility managers. Beyond thermal performance, advanced roof insulation solutions now contribute to moisture control noise reduction and structural longevity thereby safeguarding asset value and operational efficiency over decades.

This executive summary offers a succinct yet comprehensive introduction to the evolving roof insulation landscape by mapping out its key technological innovations market shifts and regulatory influences. It outlines the purpose and scope of the full report by highlighting relevant segmentation frameworks regional dynamics competitive benchmarks and actionable insights geared toward decision makers. By laying out the report’s analytical approach and main focus areas this introduction sets the stage for a deep dive into transformative trends and strategic imperatives that define where the industry stands today and where it is headed tomorrow

Exploring Groundbreaking Technological Innovations and Sustainability Imperatives Reshaping the Roof Insulation Landscape for Next Generation Building Practices

The roof insulation sector is undergoing a wave of transformative shifts driven by heightened sustainability mandates coupled with rapid technological innovation. Eco friendly materials such as bio based cellulose and mineral wool derived from recycled content are ascending in prominence as specifiers seek to reduce embodied carbon and align with net zero objectives. At the same time advanced synthetic options including vacuum insulated panels and aerogel enhanced composites are gaining traction in high performance applications that demand unparalleled thermal resistance without sacrificing structural footprint.

Concurrently digital tools are reshaping how stakeholders evaluate and monitor insulation performance. Thermal imaging drones and infrared scanning systems now enable precise identification of air leakage and thermal bridging long before installation is complete. IoT enabled sensors integrated within roofing assemblies provide continuous data on moisture levels and temperature gradients empowering facility management teams to enact preventive maintenance and optimize energy management in real time. Moreover, the convergence of green roof technology with advanced insulation solutions has unlocked a dual value proposition by promoting stormwater management while further insulating the building envelope.

In tandem with material and digital breakthroughs, a broader shift toward circular economy principles and end of life recyclability is redefining product design and supply chain partnerships. Manufacturers are forging take back programs to reclaim aged insulation boards and channel them into new production cycles. Regulatory frameworks in key markets are increasingly mandating lifecycle assessments and cradle to cradle certifications thereby accelerating adoption of closed loop strategies. Together these intersecting forces are creating a new paradigm for roof insulation that blurs traditional boundaries between product performance, environmental stewardship and data driven building management.

Assessing the Multi Faceted Economic and Supply Chain Consequences of United States Tariff Measures on Roof Insulation Products in 2025

The imposition of new tariff measures on imported roof insulation products in early 2025 has generated significant ramifications across the United States supply chain and pricing structures. These duties, which target a range of foam board and spray foam variants sourced from key manufacturing hubs overseas, were introduced to protect domestic producers and encourage expanded local production capacity. As a result, importers have faced elevated landed costs and longer procurement cycles, compelling many stakeholders to reassess their sourcing strategies and material specifications.

Consequently, contractors and distributors are grappling with a dual challenge of containing project budgets while preserving performance standards. The higher cost base for certain insulation products has spurred end users to explore alternative technologies such as glass wool and advanced cellulose alternatives that fall outside the tariff scope. Meanwhile, manufacturers operating within the tariff zone have expedited investments in capacity expansions at domestic facilities in the Southeast and Midwest, seeking to capture displaced import volumes and mitigate supply disruptions.

Strategic responses have emerged rapidly. Some organizations have established hybrid sourcing models that blend tariff impacted foam boards with untaxed composite panels to balance cost and R-value performance. Others have pursued nearshoring initiatives by partnering with North American production sites under preferential trade agreements. These adaptive strategies underscore the broader imperative for agility in supply chain management, as ongoing policy shifts may continue to recalibrate cost structures and competitive positioning throughout the roof insulation market.

Deciphering Critical Market Segmentation Dimensions Spanning Technology Material Type End Use Distribution Channel and Application Perspectives

A nuanced understanding of market segmentation is pivotal for stakeholders aiming to target the right opportunities and optimize product development priorities. Based on Technology the market is studied across Blanket Insulation, Foam Board, Loose Fill Insulation, and Spray Foam; within Blanket Insulation Batts and Rolls segment commands attention for retrofit applications, while Foam Board subdivided into Expanded Polystyrene Board, Extruded Polystyrene Board, and Polyisocyanurate Board highlights diverging performance profiles tailored to new construction. Spray Foam’s bifurcation into Closed Cell and Open Cell varieties underscores the trade off between conductivity values and expansion properties critical to seamless sealing.

Equally, based on Material Type the analysis spans Cellulose, Expanded Polystyrene, Extruded Polystyrene, Fiberglass, Mineral Wool, and Spray Foam, with the latter further detailed by Closed Cell and Open Cell to bring greater granularity to product R-value and application considerations. This lens reveals shifting preferences toward sustainable fiber based solutions and next generation polymeric foams that deliver both high thermal resistance and minimal environmental footprint. From an End Use perspective the market is categorized across Commercial, Industrial, and Residential: within Commercial the Education, Healthcare, and Retail sub segments illustrate varying requirements for acoustic control, fire resistance, and lifecycle cost management while the Industrial focus on Data Centers and Manufacturing underscores critical uptime and thermal regulation demands; the Residential split between Multi Family and Single Family highlights divergent adoption rates tied to building code stringency and consumer sustainability awareness.

Delving into Distribution Channel, the study examines Direct Sales, Distributors Wholesalers, Online Channels, and Retailers to evaluate how procurement preferences are evolving in an omnichannel era where e commerce platforms and value added distribution models both play pivotal roles. Lastly, based on Application the distinction between New Construction and Retrofit sheds light on divergent specification cycles, installation challenges, and retrofit incentive programs that drive demand differently across project types. Together these segmentation insights equip market participants with a strategic roadmap for prioritizing investments and engagement models aligned to specific end use cases and customer journeys.

This comprehensive research report categorizes the Roof Insulation market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Technology

- Material Type

- End Use

- Distribution Channel

- Application

Uncovering Divergent Regional Dynamics and Market Drivers Influencing Roof Insulation Adoption Across Americas Europe Middle East Africa and Asia Pacific

Regional dynamics exert a profound influence on roof insulation adoption patterns and technology preferences. In the Americas widespread policy incentives for energy efficiency upgrades in both residential and commercial buildings have catalyzed demand for high performance solutions. Federal and state level rebates tied to decarbonization roadmaps, combined with voluntary green building certifications, are steering procurement toward insulation products that meet or exceed updated thermal transmittance criteria. Construction firms in North America, grappling with pronounced labor shortages and rising labor costs, are also prioritizing prefabricated insulation systems that accelerate installation timelines and mitigate on site variability.

Meanwhile, Europe Middle East & Africa presents a mosaic of regulatory stringency and market maturity. In Western Europe rigorous energy performance standards backed by the European Union’s Renovation Wave initiative have elevated the importance of advanced materials such as vacuum insulated panels and phase change material integrated roof assemblies. Gulf region countries, facing extreme thermal loads, continue to emphasize polyisocyanurate foam boards for their superior R values, though recent sustainability mandates are encouraging a shift toward bio based and recyclable alternatives. In Sub Saharan Africa growing urbanization is creating nascent opportunities for economical loose fill and blanket options that can be deployed rapidly across expanding residential zones.

Across Asia-Pacific robust urban growth and industrial expansion are driving a spike in both new construction and retrofit projects. Countries such as China and India have intensified building code enforcement, resulting in broader uptake of closed cell spray foam systems for their moisture sealing and insulation dual benefits. Southeast Asian markets, balancing cost sensitivity with environmental goals, are exploring hybrid insulation solutions that combine local mineral wool variants with imported foam boards. This regional tapestry underscores the importance of customizing product portfolios and go to market strategies to accommodate diverse climatic challenges and regulatory landscapes.

This comprehensive research report examines key regions that drive the evolution of the Roof Insulation market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Highlighting Leading Industry Players and Innovative Strategic Alliances Driving Competitive Advantage in the Roof Insulation Market Landscape

The competitive arena within roof insulation is marked by the presence of both global conglomerates and agile specialized firms, each vying to differentiate through technology leadership and partnership ecosystems. Leading players have doubled down on research collaborations with material science institutes to advance bio based formulations and high R value composites, while others have concentrated on scaling manufacturing footprints closer to key demand centers. Strategic alliances with roofing contractors and energy service companies have emerged as a vital pathway for installers to bundle insulation upgrades with broader envelope remediation offerings.

Moreover, a number of companies have pursued targeted mergers and acquisitions to broaden their product portfolios and accelerate time to market. Acquisitions of niche aerogel technology developers and recycled fiber insulation startups underscore the industry’s focus on sustainable innovation. Meanwhile, joint ventures structured around circular economy principles have materialized, enabling partners to share responsibility for product take back and recycling programs-an essential differentiator in markets with stringent end of life regulations.

Service oriented differentiation plays a complementary role, as manufacturers increasingly integrate digital support platforms alongside their product offerings. Remote monitoring services, warranty management dashboards, and installation training modules are becoming standard components in the value proposition. These combined efforts to fortify collaborative networks, enrich product ecosystems and deliver end to end service solutions are setting the competitive tempo for companies aiming to capture the most lucrative segments of the expanding roof insulation landscape.

This comprehensive research report delivers an in-depth overview of the principal market players in the Roof Insulation market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- Armacell International S.A.

- Atlas Roofing Corporation

- BASF SE

- Beijing New Building Material (Group) Co., Ltd.

- Carlisle Companies Incorporated

- CertainTeed Corporation

- Dow Chemical Company

- Firestone Building Products Company, LLC

- Fletcher Building Limited

- GAF Materials Corporation

- Huntsman International LLC

- Johns Manville Corporation

- Kingspan Group PLC

- Knauf Insulation GmbH

- Lapolla Industries, Inc.

- Owens Corning

- Rockwool International A/S

- Saint-Gobain S.A.

- Soprema Group

- URSA Insulation, S.A.

Empowering Industry Leaders with Strategic Recommendations to Enhance Operational Efficiency Innovation and Sustainable Growth Trajectories

Leaders in the roof insulation space should prioritize investment in next generation material research to secure first mover advantage in high performance and sustainable segments. This entails forging partnerships with academic institutions focused on advanced polymer chemistry and bio derived insulation media. By channeling R&D resources toward low carbon manufacturing processes and recyclable end use systems organizations can align with tightening environmental regulations and brand expectations for circularity. Engaging in open innovation challenges with startups and accelerator programs can further accelerate commercial scale up of breakthrough formulations.

Simultaneously, industry participants must embrace digital transformation across the supply chain. Deploying sensor enabled monitoring at manufacturing sites can improve yield consistency and reduce waste. On the distribution front, integrating e commerce platforms with predictive analytics allows distributors and contractors to anticipate demand fluctuations and optimize inventory levels. Internally, leveraging data from thermal performance testing and field deployments can inform iterative product improvements and targeted marketing strategies. This data centric approach builds a feedback loop that drives continuous enhancement of both product and service offerings.

Finally, operational excellence and regulatory advocacy remain foundational. Strengthening collaboration with trade associations and code writing bodies ensures that emerging innovations are incorporated into building standards in a timely manner. Concurrently, streamlining certification processes and investing in installer training programs elevates overall market acceptance of new insulation technologies. By balancing bold investments in innovation with disciplined execution of compliance and performance validation, industry leaders can navigate evolving challenges and capture the most compelling opportunities across diverse end use sectors.

Detailing Rigorous Research Frameworks Data Collection Techniques and Analytical Approaches Underpinning Comprehensive Roof Insulation Insights

The research methodology underpinning this market analysis is grounded in a blend of primary and secondary data collection techniques designed to ensure depth and reliability. Primary insights were obtained through structured interviews with key stakeholders including roofing contractors, material suppliers, regulatory officials, and energy service companies across major regions. These conversations yielded qualitative perspectives on evolving procurement drivers, performance expectations, and product adoption barriers.

Secondary research encompassed a systematic review of publicly available technical standards, policy documents, industry white papers, and patent filings to map emerging material innovations and regulatory shifts. Trade association publications and specialized trade magazines provided supplemental context on installation best practices and evolving supply chain dynamics. Data points were cross referenced with market participant disclosures and commercial property retrofit databases to validate anecdotal inputs and align narratives around adoption trends.

Analytical rigor was reinforced through a multi stage validation process. Initial draft findings were circulated to a panel of industry experts for review and feedback, ensuring that interpretations accurately reflected market realities. Data integrity checks and consistency analyses were performed to confirm coherence across segmentation, regional profiles, and competitive assessments. Throughout the research, adherence to methodological best practices in qualitative market analysis ensured that the resulting insights are both actionable and grounded in real world dynamics.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Roof Insulation market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Roof Insulation Market, by Technology

- Roof Insulation Market, by Material Type

- Roof Insulation Market, by End Use

- Roof Insulation Market, by Distribution Channel

- Roof Insulation Market, by Application

- Roof Insulation Market, by Region

- Roof Insulation Market, by Group

- Roof Insulation Market, by Country

- United States Roof Insulation Market

- China Roof Insulation Market

- Competitive Landscape

- List of Figures [Total: 17]

- List of Tables [Total: 2226 ]

Synthesizing Key Takeaways and Strategic Imperatives to Navigate Emerging Opportunities and Challenges in the Roof Insulation Industry

By synthesizing the multitude of trends spanning advanced materials, digitalization, policy shifts, and competitive dynamics, this executive summary crystallizes the strategic imperatives for stakeholders in the roof insulation domain. Key takeaways emphasize the urgency of integrating sustainability principles throughout product lifecycles, the value of digital monitoring platforms in optimizing performance, and the criticality of agile sourcing strategies amid evolving tariff environments. These insights collectively point to a market in transition-one where innovation and adaptability will determine winners and laggards.

As market forces continue to reshape the landscape, organizations that align R&D, supply chain optimization, and regulatory engagement into a cohesive strategy will be best positioned to capture emerging opportunities. Whether targeting high growth retrofit segments in mature markets or scaling new construction opportunities in urbanizing regions, a balanced portfolio approach informed by segmentation nuances is essential. Furthermore, fostering collaborative ecosystems spanning material developers, installers, and policy bodies will accelerate adoption cycles and reduce barriers to market entry.

Ultimately, the road ahead for roof insulation promises both complex challenges and transformative potential. Stakeholders who embrace a data driven, sustainability centric mindset will unlock pathways to unparalleled energy savings structural resilience and environmental impact reductions. This conclusion underscores the imperative to translate analytic insights into concrete actions, setting the stage for ongoing innovation and market leadership in the rapidly evolving built environment.

Take Action Today to Unlock Exclusive Strategic Insights and Direct Consultation Opportunities with Ketan Rohom Associate Director Sales Marketing

To embark on a journey toward unlocking the full potential of roof insulation innovation and strategy, reach out today to arrange a personalized consultation with Ketan Rohom Associate Director Sales & Marketing He will guide you through the unique insights and comprehensive findings available only within this market research report Engaging directly with him ensures you receive tailored answers to your organization’s specific challenges and gain clarity on how best to leverage key trends from disruptive material technologies to evolving regulatory landscapes Don’t miss the opportunity to secure a competitive edge with actionable intelligence crafted to drive energy efficiency enhance sustainability and maximize structural performance Contact Ketan Rohom now to request your copy of the full report and discover how to translate strategic research into real world results

- How big is the Roof Insulation Market?

- What is the Roof Insulation Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?