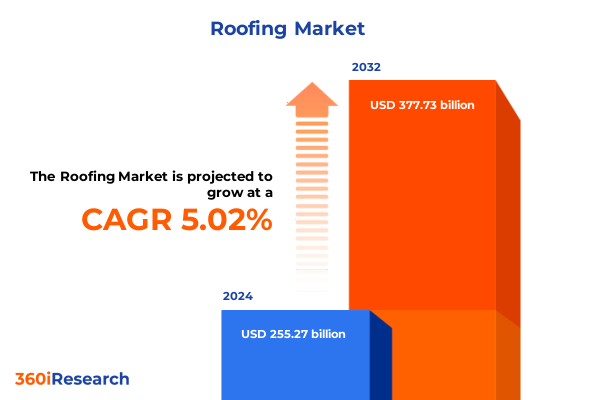

The Roofing Market size was estimated at USD 268.37 billion in 2025 and expected to reach USD 280.97 billion in 2026, at a CAGR of 5.00% to reach USD 377.73 billion by 2032.

A concise orientation to the structural forces reshaping sourcing choices, contractor economics, and product pathways across the roofing value chain

The roofing sector sits at the intersection of several powerful forces - shifting trade policy, tightening labor markets, accelerating climate impacts, and rapid product innovation - all of which are converging to change how manufacturers, distributors, and contractors make decisions. In this environment, strategic clarity depends less on single-point assumptions and more on understanding structural drivers that alter sourcing choices, margin pressure points, contractor capacity, and the lifecycle economics of roof systems. The purpose of this executive summary is to synthesize those drivers and present the practical implications that leaders must absorb now in order to preserve competitiveness and capture durable value.

To that end, this analysis emphasizes the operational levers available to industry participants: supply chain reconfiguration, product and installation productivity, channel rebalancing, and targeted go-to-market differentiation. The narrative that follows connects macro policy movements with day‑to‑day realities on job sites and in procurement desks, highlighting where risk consolidates and where opportunity emerges. By starting with an integrated view of commercial, industrial, and residential roofing dynamics, the aim is to equip executives and functional leaders with a concise framework for near-term action and medium-term resilience planning.

How concurrent policy shifts, accelerating rooftop technologies, and escalating climate-driven repair cycles are remaking sourcing and product decisions

The roofing landscape is being reconstituted by transformative shifts across policy, technology, and climate risk that are durable rather than cyclical. On the policy front, recent changes in U.S. trade posture have raised the stakes for material sourcing decisions, prompting buyers and manufacturers to reevaluate supplier footprints and inventory strategies. These trade-policy moves sit alongside an intensifying domestic conversation about industrial policy and reshoring incentives, which collectively encourage capital investment in local mills and component manufacturing. As a consequence, procurement teams are working to blend nearshoring, diversified global sourcing, and longer-term supplier commitments to lower exposure to abrupt tariff shocks.

Technological and product innovation is also accelerating. Integration of rooftop solar and low-profile, contractor-friendly photovoltaic shingles is moving from early adoption to practical mainstream options in targeted geographies, changing the calculus for replacement versus retrofit decisions. Concurrently, product-system innovation in metal roofing and advanced underlayments is elevating the performance expectations for durability, thermal control, and ease of installation. Climate and weather exposures are compounding demand-side dynamics: more frequent severe storms and an evolving risk profile for hail, wind, and wildfire drive urgent repair cycles and force insurers, owners, and contractors to weigh durability against upfront cost. Taken together, these transformative shifts require vertically aware strategies that align product development, channel execution, and risk management for an era of heightened policy and environmental uncertainty.

An actionable assessment of the 2025 tariff expansions on steel and aluminum and the practical sourcing and risk-management responses shaping manufacturer and distributor behavior

The recent expansion and enforcement of tariffs on steel and aluminum have introduced a new and immediate layer of input-cost risk for segments of the roofing supply chain that rely on metal components and derivative steel-intensive products. Policy proclamations issued in 2025 expanded the scope and application of Section 232 duties and in certain cases eliminated prior exemptions, affecting downstream articles and derivative products in addition to primary alloys. These changes have immediate implications for metal roofing panels, fasteners, flashing, and specialty components that include steel or aluminum content, and they have prompted many firms to revisit sourcing, pricing, and contract language with distributors and large end customers. The administration’s moves, and subsequent legal scrutiny of expanded tariff authority, make the short-term policy environment more volatile and the medium-term regulatory trajectory less certain, compounding the commercial need for scenario-based procurement planning.

In practice, manufacturers and distributors are pursuing a mix of tactical and structural responses. Tactically, many buyers are accelerating inventory purchases where storage economics permit and negotiating indexed contracts that pass or share tariff risk. Structurally, there is renewed interest in domestic production and assembly to capture “melted and poured” or “smelted and cast” exemptions, and in qualifying alternate materials with similar performance attributes to reduce commodity exposure. Legal challenges and ongoing administrative reviews mean that tariff exposure should be treated as a scenario risk - actionable but fluid - and resilience planning should prioritize flexibility in supplier qualification, SKU rationalization, and supply‑chain visibility tools to react quickly to further policy adjustments.

Insights into how layered segmentation across product, material, roof type, distribution, installation method, and application concentrates risk and opportunity across the value chain

Segmentation drives where margin pressure and opportunity will concentrate across the roofing value chain. When the market is viewed by product type-covering fasteners and accessories, insulation, roofing systems, and roofing underlayment-each category exhibits different sensitivity to raw‑material tariffs, installation labor intensity, and inventory turnover. Fasteners and accessories are particularly exposed to steel and specialty-metal inputs and often move faster through inventories, while insulation and underlayment decisions are tightly coupled to code changes and thermal-performance expectations. Roofing systems themselves aggregate those inputs and reflect the combined effects of material costs, warranty exposure, and contractor installation economics.

Material type is another organizing axis: asphalt shingles, clay and concrete tiles, and metal roofing each have distinct supplier structures, logistics footprints, and life‑cycle maintenance patterns. Asphalt shingle supply lines are concentrated and highly responsive to petrochemical pricing and manufacturing capacity near large distribution centers, while clay and concrete tiles require different import patterns and heavier freight considerations. Metal roofing’s exposure to steel and aluminum policy shifts creates concentrated upstream risk that also affects derivative product pricing and the substitution dynamics between metal and other materials. Roof type splits-flat roof versus sloped roof-drive specification and installer skill needs, influencing product choice and warranty design. Distribution channel segmentation shapes where value is captured: direct sales, distributors and wholesalers, and e-commerce platforms each demand different commercial models; manufacturer websites and broader marketplaces are expanding reach but require tighter logistics, SKU clarity, and digital sales enablement. Installation type-new construction versus renovation and replacement-determines cadence, price elasticity, and contractor business models, while application-level segmentation across commercial, industrial, and residential customers requires tailored propositions. Within commercial markets, hospitality, office, and retail customers stress different performance attributes and procurement cycles. Industrial buyers in manufacturing and warehousing prioritize durability and uptime, and residential demand divides between multi‑family and single‑family homeowners with divergent financing channels and upgrade drivers. These layered segmentation lenses must be applied simultaneously to reveal where investments in product design, channel economics, and contractor enablement will deliver the greatest returns.

This comprehensive research report categorizes the Roofing market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Product Type

- Material Type

- Roof Type

- Distribution Channel

- Installation Type

- Application

How Americas, EMEA, and Asia-Pacific regional policy, climate, and distribution dynamics are redirecting sourcing, fulfillment, and product design priorities

Regional dynamics will continue to reshape sourcing, channel strategy, and product prioritization. In the Americas, U.S. policy changes, rebuilding activity after storm events, and the professional distribution networks of large retailers and national distributors create a market where domestic sourcing and pro-focused digital tools matter. North American demand drivers include retrofit cycles, insurance claims activity after severe weather, and the continued emphasis by large pro-distributors to improve digital fulfillment and job‑site delivery capabilities. These forces favor manufacturers and distributors that can combine regional inventory presence with rapid fulfillment and contractor support.

Across Europe, the Middle East and Africa, tightening energy codes and variable import regimes influence material mix and product specifications. The EMEA region’s diversity in climate and regulatory regimes means that performance attributes such as thermal resistance, fire resiliency, and lifecycle embodied carbon matter differently in each sub‑market. This heterogeneity encourages modular product platforms that can be adapted for local standards while preserving manufacturing efficiencies.

In Asia‑Pacific, the supply base for many materials remains concentrated, and trade policies, freight dynamics, and manufacturing capacity continue to influence global lead times and cost baselines. At the same time, accelerating urbanization and large‑scale industrial projects in several APAC markets are supporting demand for commercial and industrial roofing systems. For global manufacturers and traders, the region represents both a critical source of components and a heterogeneous set of end markets that require differentiated channel approaches.

This comprehensive research report examines key regions that drive the evolution of the Roofing market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

How leading manufacturers and distributors are rebalancing integration, innovation, and digital fulfillment to protect margins and accelerate premium system adoption

Major manufacturers, distributors, and specialist system providers are responding to the convergent pressures of policy and demand with a mix of capability investments. Leading roof-system suppliers are accelerating product innovation around integrated energy options, low-profile solar, and contractor-friendly metal systems while emphasizing localized manufacturing footprints to insulate margins from tariff shocks. Distributor networks are consolidating fulfillment and digital capabilities to serve professional contractors with enhanced job‑site delivery, staging, and integrated procurement tools, and there is elevated interest from both strategic and financial buyers in companies that offer recurring maintenance contracts or embedded sustainability features.

Across the supplier landscape, some firms are prioritizing vertical integration-bringing assembly or certain component manufacturing closer to key end markets-to capture margin and qualify products under domestic-content exemptions where policy permits. Other firms are investing in product simplification and installation productivity to reduce dependence on scarce skilled labor. Meanwhile, innovators on the roofing-energy nexus are moving from demonstrator projects to production lines, offering options that bridge aesthetic expectations with energy generation. These competitive responses reflect a bifurcated set of priorities: protect core commodity-exposed product lines through supply‑chain and sourcing changes, and expand higher‑value system offerings that command premium positioning with contractors and owners.

This comprehensive research report delivers an in-depth overview of the principal market players in the Roofing market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- Atlas Roofing Corporation

- BASF SE

- Boral Limited

- Braas Monier Building Group S.A.

- Carlisle Companies Incorporated

- Classic Metal Roofing Systems LLC

- Decra Roofing Systems, Inc.

- Duro-Last Roofing, Inc.

- Eagle Roofing Products

- Firestone Building Products Company, LLC

- Future Roof, Inc.

- GAF Materials Corporation

- Gerard Roofing Technologies

- Henry Company LLC

- IKO Industries Ltd.

- Johns Manville Corporation

- Ludowici Roof Tile, Inc.

- Malarkey Roofing Products

- Met-Tile, Inc.

- Owens Corning

- Petersen Aluminum Corporation

- Sika AG

- TAMKO Building Products LLC

A pragmatic set of priority actions industry leaders can deploy now to harden sourcing, boost installation productivity, and monetize higher-value roof systems

Industry leaders must pursue a short list of actionable moves that strengthen resilience and create competitive separation. First, adopt flexible sourcing playbooks that include dual‑sourcing for critical metal components, strategic domestic qualification for key SKUs, and forward procurement triggers tied to tariff windows. This approach reduces single‑point exposure and preserves the option to pivot if policy or freight conditions change. Second, invest in installation productivity through standardized kits, pre‑assembly, and installer training programs that reduce on‑roof labor hours and warranty leakage; in the current labor environment, productivity improvements are as impactful as incremental material savings.

Third, prioritize channel differentiation: expand direct support for high‑value contractor accounts, accelerate marketplace and manufacturer‑website capabilities for repeat small to mid‑sized projects, and align distributor inventory strategies with pro‑level fulfillment windows. Fourth, embed product resilience and energy integration in system roadmaps so that new launches can command higher lifecycle valuations and meet tightening code and insurer expectations. Finally, stress-test commercial contracts and warranty terms to transparently allocate tariff and supply‑chain risk with customers and partners. These recommendations are practical, actionable, and focused on shortening response times and protecting operating margins in a fast‑moving policy and climate environment.

Methodology summary explaining how public policy documents, industry association data, corporate disclosures, and product announcements were triangulated for operationally relevant conclusions

This analysis synthesizes primary and secondary inputs across public policy announcements, industry association reports, company disclosures, and targeted product releases. The approach combined a structured review of government proclamations and regulatory filings governing trade measures with an evaluation of industry association workforce and code analyses. Company press releases and earnings commentary were examined to identify concrete corporate responses to tariffs and distribution shifts, and product announcements were reviewed to validate technical and manufacturing movements in solar-integrated shingles and metal system designs. Finally, case examples from distribution and pro-retailer activities were used to illustrate practical channel and fulfillment responses.

Where possible, assertions were cross-checked against multiple independent sources to ensure accurate representation of policy changes, labor market signals, and product introductions. The conclusions are intended to be directional and operational - highlighting where leaders should allocate diligence and where stakeholders should prioritize contingency planning rather than producing single-point forecasts. Given the fluid policy backdrop and evolving code adoptions across jurisdictions, readers should treat the methodologies as a basis for scenario planning and further primary research tailored to specific procurement or product decisions.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Roofing market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Roofing Market, by Product Type

- Roofing Market, by Material Type

- Roofing Market, by Roof Type

- Roofing Market, by Distribution Channel

- Roofing Market, by Installation Type

- Roofing Market, by Application

- Roofing Market, by Region

- Roofing Market, by Group

- Roofing Market, by Country

- United States Roofing Market

- China Roofing Market

- Competitive Landscape

- List of Figures [Total: 18]

- List of Tables [Total: 1590 ]

A strategic synthesis highlighting the dual imperative for short-term resilience and long-term differentiation to secure durable competitive advantage

In synthesis, roofing market participants face a dual imperative: protect core business economics from near-term policy and supply shocks, and simultaneously invest in differentiated systems that capture higher value as codes, climate risk, and owner preferences evolve. Tariff-driven input cost volatility places a premium on supply‑chain flexibility and local qualification strategies, while labor constraints make installation productivity and contractor enablement central to margin protection. At the same time, product innovation in integrated energy and higher‑performance underlayments creates pathways for premium positioning that can offset commodity pressures.

Decision-makers should treat the current moment as a structural inflection: tactical responses will preserve short-term margin, but durable advantage will accrue to organizations that align sourcing resilience with product-system innovation and digital channel execution. Executives who move decisively on these fronts will be better positioned to stabilize margins, win pro accounts, and deploy capital into manufacturing and product lines that meet the next generation of code and climate requirements. The next steps are straightforward: prioritize scenario planning, accelerate installer productivity improvements, and selectively invest in systemized products that differentiate on lifecycle value rather than unit price alone.

Promptly engage the designated sales lead to obtain the comprehensive roofing market intelligence package and schedule a tailored executive briefing

For decision-makers ready to secure an evidence-based strategic edge, the market research report is the practical next step. Reach out to Ketan Rohom, Associate Director, Sales & Marketing, to request the full report, arrange a tailored briefing, or discuss custom deliverables that align with capital planning, supply chain sourcing, or product development priorities. The report’s supporting materials and executive briefing options are designed to accelerate procurement cycles, validate vendor negotiations, and inform board-level conversations about tariff exposure, resilience investments, and go-to-market tactics. Contacting the sales lead will initiate a confidential discussion to review the table of contents, available regional deep dives, and licensing options that suit procurement timelines and deployment plans.

- How big is the Roofing Market?

- What is the Roofing Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?