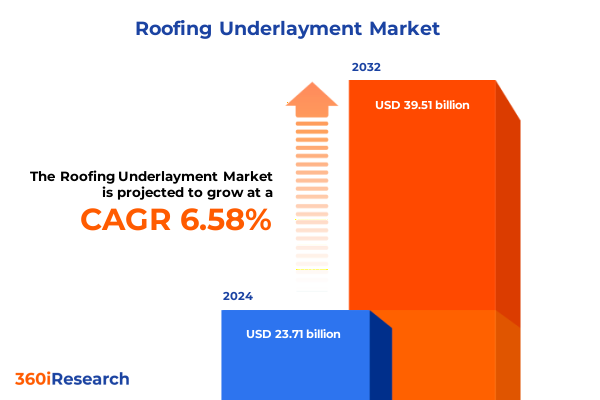

The Roofing Underlayment Market size was estimated at USD 25.20 billion in 2025 and expected to reach USD 26.80 billion in 2026, at a CAGR of 6.63% to reach USD 39.51 billion by 2032.

Essential Foundations of Modern Roofing Underlayment Illuminating Durability Efficiency and Structural Integrity Across Contemporary Construction Projects

The evolution of roofing underlayment has been pivotal in advancing the durability and performance of modern building envelopes, serving as the critical line of defense against moisture infiltration and structural deterioration. By creating a resilient barrier between the roof deck and primary covering materials, underlayment safeguards insulation, prevents water damage, and extends the service life of entire roofing systems. As contemporary architecture increasingly demands both aesthetic appeal and operational efficiency, the role of high-quality underlayment has never been more central to achieving holistic building performance.

Over the decades, the roofing underlayment segment transitioned from traditional asphalt saturated felt to more sophisticated composites, reflecting innovations in polymer chemistry and engineered textiles. This progression has unlocked enhanced tear resistance, improved weatherability, and optimized installation workflows for roofing contractors. Moreover, the rise of synthetic and rubberized asphalt solutions has introduced self-adhered and torch-applied options that cater to diverse climatic conditions and project specifications.

With extreme weather events becoming more frequent and stringent building codes taking effect across many jurisdictions, the selection of underlayment is now influenced by parameters such as fire resistance, water resistance, and long-term waterproof performance. As a result, stakeholders ranging from architects to facility managers are prioritizing advanced underlayment technologies that balance cost-efficiency with uncompromising protection against environmental stressors.

Emerging Technological Materials and Regulatory Dynamics Reshaping the Roofing Underlayment Market with Greater Performance and Compliance Pressures

Recent years have witnessed transformative shifts within the roofing underlayment landscape driven by material science breakthroughs and evolving regulatory frameworks. Synthetic formulations leveraging multi-layer and single-layer membranes now offer enhanced tensile strength and superior moisture management compared to legacy felt products. Concurrently, the emergence of rubberized asphalt systems-available in both self-adhered and torch-applied formats-has introduced a new benchmark for elasticity and self-sealing properties around fasteners and protrusions, addressing chronic leak points that challenge older installations.

Meanwhile, tightening environmental regulations have accelerated the adoption of underlayment solutions formulated with recycled feedstocks and solvent-free adhesives, aligning industry practices with broader sustainability targets. In parallel, digital tools such as roofing inspection drones and IoT-enabled moisture sensors are enabling real-time performance monitoring of installed underlayment, extending warranties and reducing maintenance costs. These innovations collectively underscore a shift toward materials that not only meet or exceed code requirements, but also integrate seamlessly with smart building ecosystems.

Moreover, the intersection of modular construction methods and prefabricated roof assemblies is reshaping the installation paradigm. By standardizing underlayment components for offsite assembly, stakeholders can streamline supply chains and reduce on-site labor demands. As a result, the roofing underlayment market is experiencing an accelerated push toward high-performance, sustainable, and data-driven solutions that support industry leaders in meeting tomorrow’s construction challenges today.

Comprehensive Analysis of 2025 United States Tariff Adjustments Unveiling Strategic Consequences for Roofing Underlayment Supply Chains and Pricing Dynamics

The United States’ imposition of new tariff adjustments in early 2025 has exerted a notable influence on roofing underlayment supply chains and pricing structures. By raising duties on several imported underlayment materials, including selected synthetic membranes and rubberized asphalt products, these measures have driven procurement teams to reassess sourcing strategies and contractual commitments with overseas suppliers. Consequently, many manufacturers have explored near-shoring and domestic production partnerships to mitigate cost escalations and ensure continuity of supply for critical infrastructure projects.

In response to enhanced import levies, distributors and contractors have observed a compression in profit margins, prompting pass-through cost mechanisms that have elevated end-user pricing in some regions. Simultaneously, this environment has catalyzed investment in local manufacturing capabilities, as stakeholders seek to offset dependency on tariff-impacted imports. Such investments range from expanding polymer extrusion lines to diversifying material blends that utilize domestically sourced components.

Furthermore, the tariff landscape has heightened the importance of supply-chain resilience. Industry participants are implementing advanced forecasting tools and dynamic pricing agreements to absorb volatility. At the same time, regulatory bodies are engaging with private sector partners to streamline customs processes and minimize administrative delays. Taken together, these developments emphasize the strategic need for roofing underlayment stakeholders to navigate tariff headwinds through operational agility and proactive risk management.

In-Depth Segmentation of Roofing Underlayment Market Illuminating Diverse Material Types Forms Applications and Distribution Pathways Driving Adoption

An in-depth review of market segmentation illustrates how material innovation, product type, and form factors are jointly shaping roofing underlayment selection criteria. On the material front, traditional asphalt saturated felt remains a cost-effective choice for basic applications, while fibre cement underlayment continues to gain traction in projects demanding superior fire performance. Non-bitumen synthetic membranes, which are categorized into multi-layer and single-layer variants, are increasingly preferred for their light weight, high tensile strength, and UV resistance, particularly in climates with significant thermal fluctuations. Meanwhile, rubberized asphalt solutions, offered in self-adhered and torch-applied configurations, deliver unparalleled waterproofing and self-sealing around roof penetrations.

Differentiation by type further refines market dynamics, as fire-resistant formulations address code compliance in high-risk zones, water-resistant underlayment meets standard moisture control requirements, and fully waterproof options provide an additional safeguard for low-slope and complex roofing geometries. The choice between panels and sheet forms also influences installation speed and waste reduction, with rigid panels offering dimensional stability and sheets facilitating coverage of irregular substrates.

Installation methodology is another critical axis, where adhesive-based systems reduce mechanical penetrations, mechanically attached underlayment appeals to cost-sensitive contractors, and nail-on variants continue to serve traditional build-up roof assembly practices. Application preferences split into new construction, which demands long-term performance warranties, and repair and renovation, where ease of retrofit and compatibility with existing membranes is paramount. Distribution channels span offline networks of specialty distributors and direct sales, as well as online platforms that provide digital configurators and expedited delivery. Finally, end-use segmentation across commercial, industrial, and residential sectors underscores divergent performance expectations and lifecycle considerations, with each vertical demanding tailored underlayment solutions to balance budgetary constraints with risk mitigation.

This comprehensive research report categorizes the Roofing Underlayment market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Material

- Type

- Form

- Installation Method

- Application

- Distribution Channel

- End Use

Global Regional Dynamics Illuminating Growth Drivers and Challenges Across Americas EMEA and Asia Pacific Roofing Underlayment Markets

The Americas region leads the roofing underlayment transformation with robust adoption of synthetic and rubberized asphalt products, driven by stringent North American building codes and a heightened focus on resilience against hurricanes and wildfires. In the United States and Canada, increasing investments in infrastructure and residential redevelopment are spurring demand for underlayment solutions that combine rapid installation with exceptional durability. Simultaneously, Latin America is witnessing growing interest in cost-effective felt alternatives, though logistical challenges in remote areas continue to favor distributors with integrated supply-chain capabilities.

Across Europe, Middle East & Africa, varying climatic and regulatory landscapes are shaping underlayment preferences. In Europe, strict EU directives on energy efficiency and fire safety have elevated fibre cement and fire-resistant synthetic membranes to prominence, while green building certifications are driving the incorporation of recycled materials. The Middle East’s high-temperature environments are accelerating the use of UV-stable and waterproof systems, and Africa’s emerging markets are balancing affordability with reliability, leading to hybrid adoption of felt and synthetic underlayment in commercial and industrial projects.

Asia-Pacific represents the fastest-growing region, where rapid urbanization and infrastructure modernization in China, India, and Southeast Asia are fueling multi-layer synthetic membrane deployment. Moreover, government initiatives promoting disaster-resilient construction in typhoon- and earthquake-prone zones are encouraging the uptake of torch-applied rubberized asphalt systems. Japan and Australia continue to lead in specialty underlayment innovations, leveraging advanced polymers to meet high standards of seismic and cyclonic protection.

This comprehensive research report examines key regions that drive the evolution of the Roofing Underlayment market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Strategic Profiles of Leading Roofing Underlayment Manufacturers Highlighting Innovations Competitive Positioning and Collaborative Ventures Shaping the Industry

Several manufacturers have emerged as pivotal forces within the roofing underlayment sector, each leveraging distinct capabilities to drive market evolution. One leading global entity is renowned for pioneering multi-layer synthetic membranes that integrate advanced polymer coatings, reinforcing tear resistance and UV stability for long-roof lifespans. This organization’s commitment to continuous product innovation is reflected in its strategic partnerships with research institutes and its investment in state-of-the-art extrusion lines.

Another dominant player has built its market presence on proprietary rubberized asphalt formulations, offering both self-adhered and torch-applied systems that excel in waterproof performance. This company’s vertically integrated model encompasses raw-material procurement through to finished-product distribution, enabling flexible pricing structures and just-in-time delivery solutions for key commercial clients. Its recent collaboration with a leading logistics provider has reduced regional lead times and strengthened service levels across multiple continents.

A third contender, with deep roots in fibre cement technology, has carved a niche in fire-resistant underlayment solutions, capitalizing on stringent regulatory environments in Europe and North America. Through targeted acquisitions and joint ventures, this enterprise has expanded its geographic footprint and diversified its product portfolio to include hybrid membranes that combine cementitious layers with premium synthetic backings. Across these and other frontrunners, investment in digital sales channels and customer-centric technical support services is redefining competitive positioning, ensuring that manufacturers remain agile in meeting bespoke project demands.

This comprehensive research report delivers an in-depth overview of the principal market players in the Roofing Underlayment market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- 3M Company

- Alpha Pro Tech, Ltd.

- Atlas Roofing Corporation

- BASF SE

- Benjamin Obdyke Incorporated

- Bostik SA by Arkema Group

- Carlisle Companies Incorporated

- CertainTeed by Saint-Gobain Group

- Dove Technology Ltd.

- DuPont de Numerous, Inc.

- Duro-Last, Inc.

- Epilay Inc.

- Firestone Building Products Company, LLC

- GAF Materials LLC

- Gardner-Gibson Company by ICP Group

- GCP Applied Technologies Inc.

- GCP Applied Technologies Inc.

- H.B. Fuller Company

- Henkel AG & Co. KGaA

- Holcim Ltd

- Huntsman International LLC

- IKO Industries Ltd.

- Intertape Polymer Group Inc.

- Johns Manville

- Johns Manville Corporation

- Keene Building Products, Inc.

- Lexsuco Corporation by Fransyl Group

- MAPEI S.p.A.

- MFM Building Products Corp.

- OMG Building Products LLC

- Owens Corning

- Paramelt RMC B.V. by TER Group

- POLYGLASS S.p.A by Mapei S.p.A.

- PrimeSource Building Products, Inc.

- RPM International Inc.

- Sika AG

- Soprema SA

- TAMKO Building Products LLC

- United Asphalt Company by FM Conway Ltd

Proactive Strategic Recommendations for Industry Leaders to Enhance Product Performance Streamline Supply Chains and Drive Sustainable Market Growth

Industry leaders should prioritize accelerated development of high-performance underlayment by allocating greater resources to R&D collaborations with academic and industrial partners. By focusing on next-generation polymers and bio-based additives, companies can differentiate offerings in increasingly sustainability-driven procurement processes. Concurrently, strengthening domestic production capabilities will mitigate tariff volatility and reduce dependence on cross-border logistics, ensuring supply-chain resilience in the face of evolving trade policies.

Contractors and distributors must embrace digital platforms for real-time order tracking, product configuration, and technical troubleshooting, which collectively enhance customer experience and drive repeat business. Implementing integrated ERP systems can harmonize inventory management and streamline forecasting, enabling faster response to demand spikes and regional project surges. Furthermore, forging strategic alliances with installation training providers will bolster contractor proficiency, minimize on-site errors, and support premium warranty programs that elevate brand reputation.

Finally, stakeholders should embed circular economy principles by introducing underlayment take-back initiatives and recycling partnerships that reclaim end-of-life materials. Such programs not only minimize environmental impact but also position organizations as sustainability leaders, appealing to major commercial developers with robust ESG mandates. By enacting these recommendations, industry participants will secure competitive advantage, foster market growth, and reinforce roofing system performance for decades to come.

Robust Research Methodology Detailing Data Sources Analytical Framework and Validation Techniques Underpinning Roofing Underlayment Market Insights

The research methodology underpinning this report integrates both primary and secondary data collection to ensure comprehensive and validated insights. Primary research involved structured interviews with a curated panel of roofing underlayment manufacturers, national and regional distributors, installation contractors, and building code officials. These interviews provided firsthand perspectives on material selection criteria, regulatory compliance requirements, and emerging technology adoption.

Secondary research encompassed an exhaustive review of industry publications, standards documentation, patent filings, and trade association reports to map the evolution of product innovations and legislative developments. Global trade databases were analyzed to identify import-export patterns, while corporate financial disclosures helped trace investment trends and manufacturing expansions. Data triangulation techniques were applied to reconcile findings across multiple sources and to strengthen the reliability of conclusions.

Quantitative analysis was executed using statistical modeling to assess relationships between tariff changes, raw-material costs, and pricing behavior. Qualitative insights were synthesized through thematic analysis of interview transcripts, enabling the identification of critical success factors and potential market entry barriers. To enhance transparency, a detailed annex outlines data sources, interviewee profiles, and the analytical framework employed, ensuring that stakeholders can fully evaluate the robustness of the research process.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Roofing Underlayment market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Roofing Underlayment Market, by Material

- Roofing Underlayment Market, by Type

- Roofing Underlayment Market, by Form

- Roofing Underlayment Market, by Installation Method

- Roofing Underlayment Market, by Application

- Roofing Underlayment Market, by Distribution Channel

- Roofing Underlayment Market, by End Use

- Roofing Underlayment Market, by Region

- Roofing Underlayment Market, by Group

- Roofing Underlayment Market, by Country

- United States Roofing Underlayment Market

- China Roofing Underlayment Market

- Competitive Landscape

- List of Figures [Total: 19]

- List of Tables [Total: 1590 ]

Comprehensive Synthesis and Forward-Looking Perspectives Highlighting the Strategic Imperatives and Evolutionary Trajectory of Roofing Underlayment Solutions

This comprehensive analysis underscores the pivotal role of roofing underlayment as an integral component of modern building systems, bridging functionality with sustainability and resilience. The convergence of advanced materials such as multi-layer synthetics and rubberized asphalt with evolving regulatory requirements has elevated performance standards across commercial, industrial, and residential sectors. Concurrently, the 2025 tariff adjustments in the United States have reshaped supply-chain strategies, prompting stakeholders to enhance domestic production and diversify sourcing arrangements.

Segmentation and regional dynamics reveal that material choice, product form, and installation method are increasingly tailored to localized climatic conditions and project specifications, while digital platforms and circular economy initiatives are redefining value-creation models. Leading manufacturers continue to invest in innovation, collaborative ventures, and integrated service offerings, positioning themselves to meet the complex demands of today’s construction landscape.

Looking ahead, the roofing underlayment market will be guided by imperatives such as sustainability, supply-chain resilience, and technological integration. Organizations that adopt proactive strategies-ranging from advanced R&D partnerships to digital transformation-will secure competitive advantage and deliver superior lifecycle performance. As the industry moves forward, a shared focus on collaboration and adaptation will be critical to unlocking the full potential of underlayment in supporting durable, efficient, and resilient built environments.

Unlock Critical Roofing Underlayment Market Intelligence and Engage Directly with Ketan Rohom to Secure Your Tailored Research Report Today

Unlock unparalleled insights into the roofing underlayment market by partnering with Ketan Rohom (Associate Director, Sales & Marketing) who can guide you through tailored report options and customization opportunities. Engage directly to discuss your unique business needs and explore value-added services such as bespoke data dashboards, interactive briefings, and ongoing market updates. Whether you seek detailed competitor intelligence or deep dives into regional dynamics, Ketan will help you secure a research package aligned with your strategic objectives. Take the next step toward informed decision-making and sustained competitive advantage by reaching out to Ketan Rohom today and ensure your organization benefits from the most comprehensive and actionable roofing underlayment market intelligence available.

- How big is the Roofing Underlayment Market?

- What is the Roofing Underlayment Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?