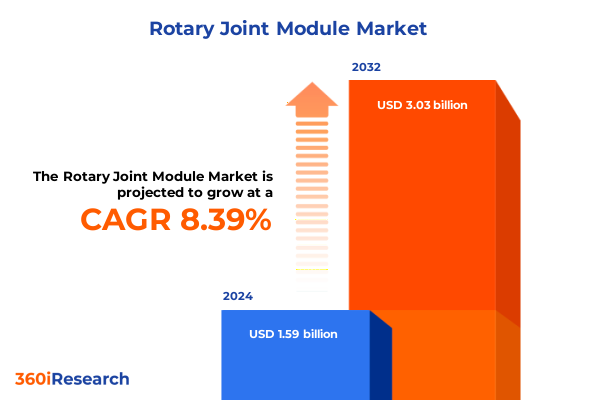

The Rotary Joint Module Market size was estimated at USD 1.70 billion in 2025 and expected to reach USD 1.86 billion in 2026, at a CAGR of 8.56% to reach USD 3.03 billion by 2032.

Revealing the Foundational Importance of Rotary Joint Modules and Their Pivotal Role in Enabling Advanced Industrial Applications

Rotary joint modules serve as the critical interface enabling the transfer of power, signals, and fluids between stationary and rotating structures. These engineered components underpin the functionality of wind turbines, automated manufacturing cells, medical imaging systems, and aerospace control mechanisms. Their precision design ensures uninterrupted data transmission and fluid flow, thereby sustaining performance in high-speed or high-stress environments.

The maturation of rotary joint technology has paralleled advancements in fiber optics, digital communications, and miniaturized electromechanical systems. Consequently, modern iterations deliver enhanced bandwidth capacity, lower electrical noise, and superior durability under extreme temperatures or corrosive settings. In turn, manufacturers across defense, energy, and industrial sectors can architect systems that maintain peak efficiency while meeting stringent reliability benchmarks.

As industries embrace automation and digital monitoring frameworks, the role of rotary joint modules has expanded beyond point-to-point connections. These components now integrate diagnostic sensors, predictive maintenance protocols, and modular designs that reduce downtime and simplify retrofits. Such innovations are redefining expectations for uptime, data integrity, and lifecycle costs across applications.

Unveiling the Key Technological and Market Drivers Redefining Rotary Joint Module Performance and Design

Over the past decade, the convergence of smart manufacturing and digital control platforms has instigated profound shifts in rotary joint module requirements. What once sufficed for basic power rotation now demands seamless integration of high-speed data interfaces, low-latency communication channels, and remote monitoring capabilities. This evolution has propelled providers to invest in fiber optic solutions and high-density multi-channel architectures to accommodate burgeoning data demands.

Simultaneously, industry trajectories toward electrification and renewable energy generation have elevated the significance of fluid and power transmission modules. Rotary unions engineered for precision gas and liquid transfer within wind turbine nacelles or solar tracking systems are now expected to endure harsher environmental loads and extended maintenance intervals. As a result, suppliers are focusing on corrosion-resistant materials and advanced sealing techniques.

In parallel, the proliferation of collaborative and autonomous robotics has created a surge in demand for compact rotary modules capable of supporting simultaneous power and signal rotation. Modular configurations designed for rapid installation and in-field servicing are gaining traction, revealing a clear trend toward scalable, plug-and-play designs that can adapt to evolving production footprints.

Analyzing the Cumulative Impact of Evolving U.S. Tariff Policies on Rotary Joint Module Supply Chains and Cost Structures

In 2025, cumulative U.S. tariffs imposed under Section 301 and Section 232 have continued to reshape procurement strategies for rotary joint modules and their subcomponents. Duties on steel and aluminum remain in effect, elevating base material costs for slip rings and housing enclosures. Concurrently, targeted levies on certain electronic and fiber optic imports from key suppliers have amplified component expenses, compelling manufacturers to reassess their global sourcing networks.

Consequently, many system integrators have shifted orders toward domestic fabricators or allied nations offering favorable trade terms. Nearshoring efforts have intensified, enabling tighter control over quality standards while mitigating tariff exposure. Nonetheless, the transition has introduced new complexities, including strained capacity at regional production facilities and the need for accelerated supplier qualification processes.

Despite these headwinds, some industry players have leveraged tariff credits and exemption programs to alleviate cost inflation. By proactively engaging with trade compliance experts, organizations can navigate evolving duty schedules and optimize landed costs. As the trade landscape continues to evolve, maintaining a dynamic procurement strategy proves essential for sustaining competitive pricing and ensuring uninterrupted supply of critical rotary joint modules.

Unraveling the Multifaceted Segmentation of Rotary Joint Modules Spanning Types, Industries, Applications, and Distribution Channels

Market participants categorize rotary joint modules according to component design and functional requirements. When viewed through the type lens, offerings range from fiber optic rotary joints that facilitate high-bandwidth data links to mercury-wetted slip rings known for low electrical noise, as well as rotary unions specialized for fluid conveyance and conventional metallic slip rings designed for power transfer. Each variant addresses distinct operational challenges, whether optimizing signal fidelity, minimizing maintenance, or balancing cost considerations.

Adoption patterns diverge significantly by end use industry, where automotive assembly lines demand high-speed data rotation, medical imaging systems require ultra-precise signal integrity, and aerospace platforms insist on ruggedized performance under extreme g-loads. In oil, gas, and chemical environments, modular solutions incorporating advanced sealing and corrosion-resistant alloys are paramount, while packaging lines and renewable energy installations favor compact, low-friction designs to minimize wear during continuous cycles. Meanwhile, robotics applications prioritize integrated multi-channel capabilities to support simultaneous power, data, and fluid pathways in collaborative workcells.

Functional applications further refine module specifications. For data transmission, ethernet ports must coexist seamlessly with serial communication and video signal channels. Fluid transfer units are engineered to handle both gas and liquid media with strict pressure tolerances. In power transmission, alternating current and direct current feedthroughs require distinct insulation and contact materials. Mounting preferences, whether bearing, flange, or single- versus dual-disc configurations, influence mechanical coupling and ease of installation, while choices in contact materials-copper for cost efficiency, gold or silver for superior conductivity, and fiber optic composites for immunity to electromagnetic interference-directly shape performance. Channel density options range from single-path interfaces to multi-channel and high-density versions, each reflecting trade-offs between size and throughput. Sales channels likewise vary, encompassing direct engagements, third-party distribution partnerships, and online platforms that cater to diverse procurement preferences.

This comprehensive research report categorizes the Rotary Joint Module market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Type

- Mounting

- Contact Material

- Number Of Channels

- End Use Industry

- Application

- Sales Channel

Examining Regional Adoption Patterns and Innovation Drivers Across Americas, EMEA, and Asia-Pacific Markets

Regional dynamics exert a pronounced influence on rotary joint module innovation and deployment strategies. In the Americas, the robust presence of automotive OEMs and oil and gas operators drives demand for high-speed data and fluid transfer solutions, prompting manufacturers to emphasize corrosion resistance and lifespan extension. Proximity to varied end users also accelerates collaborative R&D initiatives and customer-centric customization programs.

Across Europe, the Middle East, and Africa, aerospace and renewable energy sectors have emerged as dominant adopters of advanced rotary modules. Here, stringent regulatory frameworks for safety and emissions foster the uptake of lightweight, high-efficiency designs, often developed in partnership with leading research institutions. Furthermore, government incentives for clean energy projects bolster investments in specialized rotary unions for wind and solar tracking assemblies.

In the Asia-Pacific region, rapid expansion of electronics manufacturing, robotics integration, and autonomous machinery underpins sustained growth in both fiber optic rotary joints and multi-channel slip rings. Local production hubs benefit from cost-competitive labor and materials, while cross-border collaboration within regional trade blocs facilitates streamlined supply chains. As a result, Asia-Pacific serves as both a significant consumption market and an export base for rotary joint innovations.

This comprehensive research report examines key regions that drive the evolution of the Rotary Joint Module market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Revealing Competitive Strategies and Technological Innovations Among Leading Rotary Joint Module Manufacturers

Within the competitive landscape, a core group of technology leaders shapes product roadmaps and service offerings. Established motion control specialists leverage decades of expertise to deliver modular, scalable solutions that satisfy rigorous industry standards. Meanwhile, emerging firms with niche fiber optic capabilities challenge incumbents by providing ultra-miniature, high-bandwidth rotary assemblies tailored for next-generation telecom and defense programs.

Strategic collaborations have become commonplace, with alignments between component innovators and system integrators expediting time to market for complex assemblies. Certain manufacturers distribute through exclusive networks, ensuring premium support and tailored engineering services, whereas others employ broad channel strategies to capture diverse end-user segments. Several regional players focus on high-volume, cost-effective designs for rapidly growing markets, demonstrating that scale and localization can be as competitive as advanced feature differentiation.

Investment patterns also reveal a bifurcation between firms prioritizing material science breakthroughs-such as novel composite contact interfaces-and those concentrating on digital augmentation, integrating condition-monitoring sensors and cloud-based analytics into their module suites. This duality underscores an industry that prizes both mechanical performance and data-driven lifecycle management solutions.

This comprehensive research report delivers an in-depth overview of the principal market players in the Rotary Joint Module market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- ABB Ltd.

- Columbus McKinnon Corporation

- Conductix-Wampfler GmbH

- Deublin Company

- Eagle Industry Co., Ltd.

- Eltra GmbH

- Kadant Inc.

- LTN Servotechnik GmbH

- Moog Inc.

- NSK Ltd.

- Parker Hannifin Corporation

- RIX CORPORATION

- SKF AB

Advancing Rotary Joint Module Competitiveness Through Strategic Collaboration, Modular Design, and Sustainability Enablement

To navigate the evolving demands of rotary joint applications, industry leaders should prioritize collaborative development programs that integrate fiber optic and electromechanical expertise. By fostering cross-functional teams, organizations can accelerate proof-of-concept cycles and align emerging capabilities with end-user requirements. Moreover, diversifying supplier networks through nearshoring or regional partnerships will strengthen resilience against tariff fluctuations and geopolitical uncertainties.

Investing in modular platform architectures will enable rapid configuration adjustments, reducing lead times and lowering inventory costs. Similarly, embedding predictive maintenance sensors and real-time diagnostics into rotary modules will deliver tangible value through reduced downtime and extended service intervals. Emphasizing compatibility with standardized communication protocols and mounting interfaces will further streamline integration across varied equipment portfolios.

Lastly, enhancing sustainability credentials-whether through recyclable materials, energy-efficient operation, or reduced lubricant usage-can differentiate offerings in markets where environmental compliance and corporate responsibility carry increasing weight. By aligning product roadmaps with global sustainability frameworks, companies can unlock new procurement channels and strengthen stakeholder trust.

Detailing a Robust Multi-Method Research Framework Integrating Primary Interviews, Secondary Analysis, and Quality Assurance Protocols

This analysis is founded on a structured research approach combining both primary and secondary information sources. Primary insights were gathered through in-depth interviews with design engineers, procurement managers, and supply chain executives across key industries, ensuring firsthand perspectives on performance requirements and market challenges. Complementing this, rigorous surveys of OEMs and distributors provided quantitative validation of adoption trends and procurement cycles.

Secondary research encompassed technical whitepapers, industry association publications, and patent filings to track technological advancements and patent activity. Trade compliance documents and government trade statistics informed the assessment of tariff impacts, while scholarly articles on materials science and tribology supported evaluation of contact material innovations. Data triangulation techniques were employed throughout to corroborate findings and resolve discrepancies.

Quality assurance measures included peer reviews by domain experts and cross-verification against publicly disclosed financial reports where relevant. This multi-layered methodology ensures that conclusions reflect both current realities and emerging trajectories within the rotary joint module ecosystem.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Rotary Joint Module market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Rotary Joint Module Market, by Type

- Rotary Joint Module Market, by Mounting

- Rotary Joint Module Market, by Contact Material

- Rotary Joint Module Market, by Number Of Channels

- Rotary Joint Module Market, by End Use Industry

- Rotary Joint Module Market, by Application

- Rotary Joint Module Market, by Sales Channel

- Rotary Joint Module Market, by Region

- Rotary Joint Module Market, by Group

- Rotary Joint Module Market, by Country

- United States Rotary Joint Module Market

- China Rotary Joint Module Market

- Competitive Landscape

- List of Figures [Total: 19]

- List of Tables [Total: 1908 ]

Concluding Insights on Strategic Imperatives and Evolving Dynamics in the Rotary Joint Module Ecosystem

The intricate interplay of technological innovation, regional specialization, and trade policy underscores the pivotal role of rotary joint modules in modern industrial ecosystems. As demands for high-speed data transfer, reliable fluid conveyance, and efficient power rotation intensify, component providers that harness advanced materials, modular architectures, and integrated diagnostics will secure leadership positions.

Regional market dynamics reveal that proximity to key end users, regulatory landscapes, and supply chain structures fundamentally shape adoption strategies. Concurrently, evolving tariff regimes necessitate agile procurement approaches and strategic sourcing to balance cost management with performance imperatives. Competitive differentiation will hinge on delivering tailored solutions that align with both operational needs and sustainability goals.

Ultimately, stakeholders equipped with comprehensive insights into segmentation nuances, regional trends, and company strategies will be best positioned to capitalize on opportunities and mitigate risks. The continued evolution of rotary joint modules promises to drive efficiencies across a spectrum of applications, heralding a new era of connectivity in rotating systems.

Secure Comprehensive Rotary Joint Module Intelligence Through a Personalized Consultation with Our Associate Director of Sales & Marketing

To explore comprehensive insights and strategic intelligence on rotary joint modules, readers are encouraged to engage directly with Ketan Rohom, Associate Director of Sales & Marketing, who can provide detailed guidance on report benefits, tailored data access, and subscription options. By initiating a conversation, stakeholders will unlock executive briefings, sample data extracts, and a customized overview aligned with organizational priorities. Secure your competitive advantage through this specialized consultation and purchase the full market research report to inform critical decisions on technology adoption, supply chain resilience, and long-term innovation roadmaps.

- How big is the Rotary Joint Module Market?

- What is the Rotary Joint Module Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?