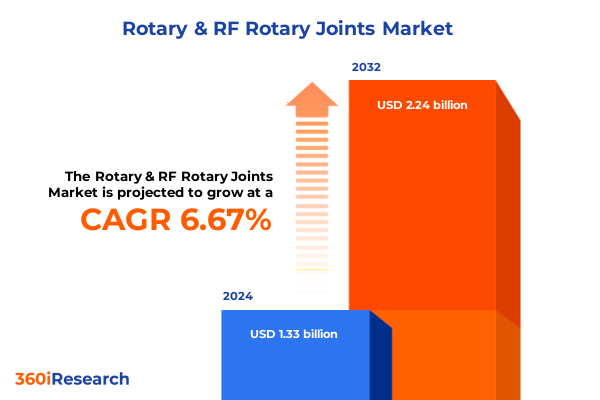

The Rotary & RF Rotary Joints Market size was estimated at USD 1.41 billion in 2025 and expected to reach USD 1.49 billion in 2026, at a CAGR of 6.83% to reach USD 2.24 billion by 2032.

Unveiling the Critical Role of Rotary and RF Rotary Joints in Accelerating Industrial Automation Renewable Energy and High-Stress Applications

The demand for rotary and RF rotary joints is growing across industries as automation and digitalization reshape operational paradigms. In renewable energy, wind turbines rely on robust slip ring systems to transmit power and data from rotating blades to stationary nacelles, ensuring continuous energy generation and advanced condition monitoring. Simultaneously, the expansion of collaborative robotics and precision machinery underscores the necessity for compact, high-performance rotary interfaces that maintain signal integrity and minimize maintenance requirements. Moreover, aerospace and defense applications demand rotary joints engineered to endure extreme environments-from high-altitude conditions to maritime exposure-driving innovation in materials and design.

Amid these dynamics, fiber optic rotary joints are emerging as critical enablers of high-frequency data transmission, particularly in sectors requiring real-time analytics and remote diagnostics. Hybrid slip rings, which combine electrical and optical pathways, are gaining prominence for their ability to support simultaneous power and data flow within space-constrained assemblies. As industries converge on the imperatives of reliability, efficiency, and environmental resilience, rotary and RF rotary joints are positioned at the heart of next-generation electromechanical solutions.

Embracing Contactless Innovations and Smart Connectivity to Redefine Rotary Joint Performance and Reliability Across Sectors

The rotary interface landscape is undergoing transformative shifts driven by breakthroughs in contactless and wireless technologies. Traditional brush-based systems are being complemented-and in some cases replaced-by brushless designs that leverage capacitive and inductive coupling to eliminate friction, reduce wear, and extend service intervals. These contactless solutions deliver cleaner signal transmission and maintenance-free operation, making them particularly appealing for remote installations and sterile environments. Moreover, advancements in miniaturization are enabling rotary joints with slimmer profiles and multi-channel capabilities, facilitating integration into compact robotics and medical devices where space constraints previously limited functionality.

In parallel, the convergence of IIoT and smart manufacturing has given rise to intelligent rotary interfaces equipped with embedded sensors and connectivity. These smart slip rings provide real-time performance data and predictive maintenance alerts, empowering operators to preempt downtime and optimize asset utilization. This integration of sensing and analytics fosters a data-driven ecosystem in which rotary components actively contribute to operational transparency and efficiency gains.

Navigating Cumulative Tariff Pressures and Supply Chain Disruptions to Build Resilience in Rotary Joint Procurement Strategies

The United States’ 2025 tariff revisions have added layers of complexity for manufacturers and OEMs relying on imported rotary joint components. Existing Section 301 measures impose duties ranging from 7.5% to 25% on electrical parts sourced from China, while Section 232 steel and aluminum levies further elevate costs for bearing rings and structural housings. These layered tariffs amplify acquisition expenses and disrupt established procurement strategies, prompting end users to explore regional suppliers and alternative materials to mitigate price pressures.

Consequently, many stakeholders are diversifying supply chains, leveraging duty drawback programs in Mexico and Canada, and evaluating nearshoring opportunities. Some are redesigning products to reduce high-strength steel intensity or substituting alloys that incur lower tariff classifications. While short-term stockpiling offers temporary relief, sustainable resilience requires agile sourcing policies, comprehensive scenario planning, and transparent supplier collaboration to ensure continuity despite evolving trade landscapes.

Integrating Product Excellence Material Science and Distribution Strategies to Address Diverse Application Demands and Drive Segment-Specific Growth

When evaluated by product type, traditional electrical slip rings continue to anchor established applications, yet fiber optic rotary joints are carving out critical niches in high-speed data environments such as aerospace telemetry and offshore wind monitoring. Hybrid slip rings that integrate optical pathways are gaining traction for their dual-function capability, while RF rotary joints fulfill specialized roles in radar and communication arrays. Rotary transformers further broaden the portfolio, enabling high-voltage AC power transfer in demanding industrial settings. Moreover, the shift from brush-based to brushless technology underscores a market pivot toward maintenance-free, long-life solutions that align with smart factory imperatives and stringent hygiene requirements. Contact material choices deeply influence performance: copper remains the workhorse for power transmission in cost-sensitive automation, silver alloys provide superior arc resistivity and corrosion resistance for harsh environments, and precious metals like gold ensure ultra-low contact resistance where signal fidelity is paramount. Across applications-from aerospace defense to medical imaging, robotics, and packaging machinery-manufacturers are tailoring distribution strategies to customer preferences, blending direct sales for critical partners, distributor networks for regional coverage, and online channels to expedite aftermarket support.

This comprehensive research report categorizes the Rotary & RF Rotary Joints market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Product Type

- Technology

- Contact Material

- Application

- Distribution Channel

Highlighting Regional Dynamics from Aerospace Leadership and Medical Precision in the Americas to Europe’s Offshore Wind Surge and Asia-Pacific’s Rapid Industrial Expansion

In the Americas, the United States leads with pronounced demand in aerospace, defense, and industrial automation. Defense modernization programs and advancements in satellite and radar systems drive the need for high-reliability RF rotary joints, while the burgeoning robotics sector seeks compact, multi-channel slip rings for collaborative automation. Medical imaging facilities also rely on precision rotary assemblies in MRI and CT scanners, reinforcing a broad base of mission-critical applications.

Europe, Middle East & Africa benefit from aggressive renewable energy targets and extensive offshore wind projects. Nations such as the United Kingdom, Germany, and Denmark are deploying next-generation wind farms that demand durable contactless slip rings capable of enduring corrosive marine conditions. Concurrently, Europe’s automotive and packaging industries integrate miniaturized rotary interfaces into factory automation, and defense applications continue to drive RF joint innovation amid secure communications requirements.

Asia-Pacific remains the fastest-growing region, anchored by China’s ambitious wind capacity expansions and India’s industrial automation investments. The Asia-Pacific market features cost-competitive manufacturing hubs, robust demand for fiber optic and hybrid rotary joints, and increasing emphasis on condition-monitoring systems. Government incentives for digitization and smart infrastructure further accelerate adoption across manufacturing, energy, and telecommunications sectors.

This comprehensive research report examines key regions that drive the evolution of the Rotary & RF Rotary Joints market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Examining Leadership Strategies and Technological Differentiation Among Major Manufacturers to Uncover Competitive Advantage and Innovation Pathways

Global slip ring leadership is distributed across specialized and diversified players. Moog has expanded its footprint through strategic acquisitions, integrating advanced composites and hybrid data platforms to enhance performance in aerospace and medical markets. Schleifring Group excels in tailored contactless and brush-based solutions, capitalizing on modular designs to serve offshore wind and defense clients. Mercotac’s brushless, liquid-metal technology delivers near-zero noise and maintenance-free operation, a distinct advantage in high-precision test equipment and space applications. Conductix-Wampfler focuses on integrated energy and data transmission systems, supporting large-scale industrial installations. Emerging innovators such as Stemmann-Technik and NSD Corporation emphasize custom configurations and rapid prototyping, catering to niche requirements in robotics and automation. Across the board, leading companies are investing in IoT-enabled rotary interfaces, forging partnerships to deliver turnkey solutions that marry hardware excellence with digital services.

This comprehensive research report delivers an in-depth overview of the principal market players in the Rotary & RF Rotary Joints market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- BGB Innovation Ltd

- CIRCOR International, Inc.

- Cobham France SAS

- Columbus McKinnon Corporation

- Curtiss-Wright Corporation

- Deublin Company

- Dynamic Sealing Technologies, Inc.

- GAT Gesellschaft für Antriebstechnik mbH

- Hangzhou Grand Technology Co., Ltd.

- Huber & Suhner AG

- IMI plc

- Jiangsu Tengxuan Technology Co., Ltd.

- Johnson-Fluiten S.r.l.

- Kadant Inc.

- MacArtney A/S

- Meggitt PLC

- Mercury Systems, Inc.

- Mersen SA

- Moflon Technology Co., Limited

- Moog Inc.

- National Oilwell Varco

- Parker-Hannifin Corporation

- Pasternack Enterprises, Inc.

- RIX Corporation

- Rotary Systems, Inc.

- Rotoflux S.r.l.

- Spectrum Control, Inc.

- SPINNER GmbH

- SRS-Industrievertretungen GmbH

Prioritizing Contactless Innovation Supply Chain Diversification and IoT Integration to Maintain Competitiveness and Foster Sustainable Growth

Industry leaders should prioritize the incorporation of brushless and contactless designs to reduce maintenance overhead and enhance service life, particularly in remote or harsh environments. Strengthening supplier diversification-through duty-free zones and near-shore partnerships-can offset tariff volatility and ensure material flow continuity. Consolidating digital capabilities, such as embedded sensing and predictive analytics, will differentiate offerings and fortify aftermarket revenue streams. Collaborative R&D alliances can accelerate the adoption of advanced materials like composites and specialty alloys that meet evolving performance and sustainability standards. Finally, aligning product portfolios with IIoT and Industry 4.0 initiatives will position companies at the forefront of smart manufacturing, enabling seamless integration of rotary joints within interconnected system architectures.

Applying a Rigorous Mix of Primary Interviews Secondary Data and Quantitative Triangulation to Illuminate Market Drivers and Validate Strategic Insights

This analysis leverages a multi-phased research framework combining primary and secondary methods. Primary insights were garnered through interviews with industry executives, technical specialists, and procurement leaders, ensuring nuanced perspectives on operational challenges and innovation drivers. Secondary data sources encompass peer-reviewed journals, patent databases, and regulatory filings, providing a robust context for material science advances and trade policy shifts. Quantitative validation employed data triangulation among supplier shipment records, customs statistics, and market intelligence platforms. Scenario analysis and sensitivity testing evaluated tariff impacts under varying policy assumptions. Conclusions are derived through iterative expert review and consensus, ensuring both strategic relevance and empirical accuracy.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Rotary & RF Rotary Joints market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Rotary & RF Rotary Joints Market, by Product Type

- Rotary & RF Rotary Joints Market, by Technology

- Rotary & RF Rotary Joints Market, by Contact Material

- Rotary & RF Rotary Joints Market, by Application

- Rotary & RF Rotary Joints Market, by Distribution Channel

- Rotary & RF Rotary Joints Market, by Region

- Rotary & RF Rotary Joints Market, by Group

- Rotary & RF Rotary Joints Market, by Country

- United States Rotary & RF Rotary Joints Market

- China Rotary & RF Rotary Joints Market

- Competitive Landscape

- List of Figures [Total: 17]

- List of Tables [Total: 954 ]

Synthesizing Technical Innovation Geopolitical Resilience and Digital Connectivity as the Cornerstones of Future Rotary Joint Leadership

The rotary and RF rotary joint sector stands at a crossroads of material innovation, digital transformation, and geopolitical complexity. As demand surges from renewable energy, advanced manufacturing, and critical infrastructure, the imperative for reliable, high-performance rotary interfaces intensifies. Embracing brushless contactless technologies and integrating smart connectivity will be pivotal in unlocking new application frontiers and operational efficiencies. Meanwhile, agility in supply chain design and proactive tariff mitigation strategies will underpin cost competitiveness and continuity. The future will favor those who meld engineering excellence with digital acumen, forging next-generation solutions that drive productivity, sustainability, and resilience across global industries.

Take the Next Step with Expert Guidance from Our Sales & Marketing Leader to Secure Your Market Intelligence and Drive Business Growth

Don’t let uncertainty slow your strategic decisions. Reach out to Ketan Rohom, Associate Director of Sales & Marketing, to secure comprehensive insights and take decisive steps forward. His expertise and personalized guidance will help you navigate the complexities of the rotary and RF rotary joint market. Invest in clarity, protect your competitive edge, and drive your organization toward sustained success. Contact Ketan Rohom today and transform insights into action.

- How big is the Rotary & RF Rotary Joints Market?

- What is the Rotary & RF Rotary Joints Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?