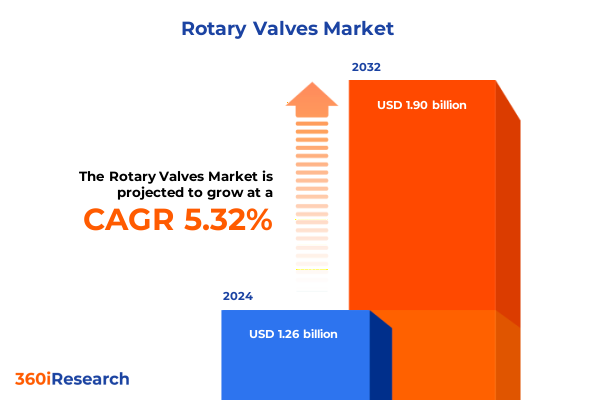

The Rotary Valves Market size was estimated at USD 1.26 billion in 2024 and expected to reach USD 1.32 billion in 2025, at a CAGR of 5.32% to reach USD 1.90 billion by 2032.

Groundbreaking Introduction to Rotary Valves and Their Indispensable Role in Modern Industrial Processes and Global Supply Chains

Rotary valves play a pivotal role in facilitating precise flow control, metering, and bulk material handling across a broad spectrum of industrial processes. By enabling accurate modulation of pressure and flow in pneumatic conveying systems and process pipelines, they contribute substantially to operational efficiency and system reliability. Their rugged construction and versatility make them indispensable in environments ranging from cement and chemical processing to food and beverage manufacturing, where consistent material throughput is critical.

As industries confront increasing demands for process optimization and downtime reduction, rotary valves have evolved in design and functionality. Advancements in materials science, sealing technologies, and actuator integration have expanded their application envelope, enabling performance under extreme pressures, temperatures, and abrasive conditions. These innovations underscore the strategic importance of understanding the rotary valve landscape as enterprises seek to enhance productivity, ensure compliance with stringent regulatory frameworks, and achieve sustainable operational practices.

Transformative Technological and Operational Shifts Reshaping the Rotary Valves Landscape and Powering Industry 4.0 Advancements

The rotary valves market is undergoing a profound transformation driven by the convergence of Industry 4.0 principles and sustainability objectives. Smart valve systems now incorporate Internet of Things sensors, enabling real‐time monitoring of temperature, pressure differentials, and positional data, which fuels advanced analytics and predictive maintenance algorithms; this integration has been shown to reduce unplanned downtime by up to a third and offers unprecedented visibility into process health. Meanwhile, wireless connectivity protocols such as LoRaWAN and 5G are facilitating remote diagnostics in hazardous or distributed plant environments, simplifying retrofits and lowering installation costs.

Sustainability and energy efficiency have also emerged as powerful catalysts, prompting manufacturers to develop low-power electric actuators and eco-friendly materials such as recycled alloys and biodegradable polymers. These innovations not only align with evolving environmental regulations but also enhance the total lifecycle value of valve assets by reducing energy consumption and facilitating end-of-life recycling. As a result, pipeline operators, chemical plants, and water treatment facilities are increasingly adopting these next-generation rotary valves to meet both performance targets and corporate responsibility commitments.

Assessing the Far-Reaching Cumulative Impact of Section 232 Tariffs on Rotary Valves and Supply Chains in the United States in 2025

In 2025, cumulative Section 232 tariffs on imported steel and aluminum have significantly increased input costs for rotary valve manufacturers and end-users alike. The initial February proclamation reinstated a 25% steel tariff and elevated aluminum duties to 25%, ending exemptions and applying a uniform levy across major trade partners, which tightened global supply chains and constrained material availability. Just months later, a June proclamation doubled these rates to 50%, with only limited carve-outs for the United Kingdom, further amplifying cost pressures and compelling firms to re-evaluate sourcing strategies.

These escalating tariff burdens have triggered a shift toward domestic production and nearshoring, as manufacturers seek to mitigate cross-border duties and inventory risk. Although some companies have responded by stockpiling key components ahead of rate increases, many are negotiating alternative supply agreements and exploring material substitutions to preserve margin integrity. At the same time, these market dynamics have accelerated consolidation among suppliers, as scale becomes a critical advantage in absorbing and distributing the cost impacts of higher duties.

Comprehensive Segmentation Insights Revealing How Types, Actuation Methods, End-Use Industries, Pressure Ratings and More Shape Market Opportunities

Analyzing the market through the lens of valve type reveals distinct performance and application trends across ball, butterfly, and plug variants. While ball valves continue to dominate tolerance-sensitive applications due to their tight shut-off capabilities and durability in high-pressure environments, butterfly valves are increasingly favored for large-diameter pipelines where lightweight construction and quick operation enhance system agility. Plug valves, valued for their simplistic design and low maintenance profile, have found renewed interest in sectors requiring abrasive handling resilience.

Actuation methods further diversify functionality, with electric actuation gaining traction in automated facilities seeking precise control and integration with digital control systems. Pneumatic and hydraulic actuators remain prevalent for rapid cycling and remote operation, particularly in hazardous settings where intrinsic safety is paramount. Manual actuation continues to serve niche maintenance and emergency-shutdown roles, balancing cost-effectiveness with basic reliability. The end-use segmentation stretches from chemical processing, where corrosion-resistant designs are critical, to food and beverage and pharmaceutical sectors that demand hygienic construction. Concurrently, pressure ratings from low to high define suitability for water treatment to oil and gas pipelines, while connection types such as flanged, socket weld, threaded, and welded outline installation flexibility. Finally, size categories up to two inches through above six inches guide applications from intricate process control to bulk material handling in cement and mining operations.

This comprehensive research report categorizes the Rotary Valves market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Product Type

- Valve Type

- Material

- Category

- Operation Mode

- Pressure Rating

- Size

- Application

- End Use Industry

- Sales Channel

Strategic Regional Insights Illuminating Market Drivers and Opportunities Across the Americas, EMEA and Asia-Pacific for Rotary Valves

Regional dynamics underscore divergent growth drivers across the Americas, EMEA, and Asia-Pacific territories. In the Americas, infrastructure modernization projects and shale-gas investments have stimulated demand for high-pressure rotary valves, while economic incentives for onshore manufacturing have bolstered domestic supply chains. North American manufacturers are capitalizing on nearshoring trends, leveraging regulatory stability and proximity to key end-use industries.

Europe, the Middle East, and Africa present a complex mosaic of electrification goals, petrochemical expansions, and water infrastructure upgrades. The EU’s commitment to circular economy principles has elevated requirements for energy-efficient valves and recycled materials, whereas Middle Eastern investments in downstream hydrocarbon processing have driven uptake of advanced metallurgical designs. In Africa, budding mining operations are prompting selective valve deployments to manage abrasive slurries and high-viscosity materials. Meanwhile, the Asia-Pacific region leads in unit volumes, fueled by rapid industrialization in China and India, sprawling chemical parks, and accelerating renewable energy installations that demand specialized valve solutions, particularly in hydrogen and carbon capture applications.

This comprehensive research report examines key regions that drive the evolution of the Rotary Valves market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Key Company Insights Unveiling How Leading Manufacturers Are Innovating, Collaborating, and Competing in the Rotary Valve Market

Leading rotary valve manufacturers are differentiating through aggressive R&D investments, strategic alliances, and targeted acquisitions. Emerson Electric has expanded its smart valve portfolio with embedded predictive-analytics capabilities, enhancing integration with control platforms across oil and gas installations. Flowserve has forged collaboration agreements with digital twin software providers to simulate valve performance and reduce commissioning times across petrochemical and power generation projects.

Velan has realigned its global footprint by divesting non-core assets and investing in clean-energy valve solutions, including cryogenic designs for hydrogen storage applications, reflecting the energy transition imperative. Metso’s emphasis on modular rotary systems underscores its commitment to customizable solutions for bulk solids handling in cement, mining, and biomass sectors. These concerted moves by key players underscore the competitive landscape’s shift toward technology-led differentiation and value-chain optimization.

This comprehensive research report delivers an in-depth overview of the principal market players in the Rotary Valves market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- ACS Valves Inc.

- Alfa Laval AB

- ANDRITZ AG

- Armstrong International, Inc.

- Azbil Corporation

- Belimo Group

- Bush & Wilton, Ltd.

- Christian Bürkert GmbH & Co. KG

- CIRCOR INTERNATIONAL, INC.

- Coperion GmbH by Hillenbrand, Inc.

- DMN‑Westinghouse

- Donaldson Company, Inc.

- Dynamic Air Inc.

- Emerson Electric Co.

- Flowserve Corporation

- GEA Group Aktiengesellschaft

- Gericke AG

- Honeywell International Inc.

- IMI plc

- Jaudt Dosiertechnik Maschinenfabrik GmbH

- Johnson Controls International plc

- Kice Industries, Inc.

- KITZ Corporation

- KSB Limited

- Magnum Systems, Inc.

- Meyer Industrial

- Neway Valve (Suzhou) Co., Ltd

- Parker-Hannifin Corporation

- Pearson-Arnold Technologies, Inc. LLC

- Qlar Europe GmbH

- Rotolok Valves, Inc.

- SAMSON AG

- Schneider Electric SE

- Siemens Aktiengesellschaft

- Swedish Exergy AB

- TBMA Europe BV

- Valmet Corporation

- VDL Groep B.V

- Velan Inc.

- Vidmar, Inc. by Stanley Black & Decker, Inc.

- Vortex Global

- WAMGROUP S.p.A.

- Young Industries, Inc.

Actionable Strategic Recommendations for Industry Leaders to Enhance Competitiveness, Drive Innovation, and Mitigate Market Disruptions

Industry leaders should prioritize the integration of advanced sensor networks and cloud-based analytics to unlock predictive maintenance and real-time performance optimization. By embracing interoperable digital architectures, companies can minimize unplanned downtime and extend asset lifecycles, yielding measurable improvements in operational expenditure. Cultivating partnerships with IIoT platform providers and cybersecurity specialists will ensure secure data exchange and compliance with evolving data-protection standards.

To mitigate tariff-induced cost escalation, organizations are advised to diversify supplier bases, pursue dual-sourcing strategies, and evaluate the feasibility of domestic or near-border manufacturing hubs. Concurrently, enhancing material innovation through collaborative R&D can identify alternative alloys and composites that deliver comparable mechanical performance at lower duty classifications. Lastly, embedding sustainability considerations into product roadmaps will not only meet regulatory requirements but also align with customer demand for green solutions, positioning companies for long-term competitive advantage.

Rigorous Research Methodology Underpinning the Analysis Through Comprehensive Data Collection, Validation and Triangulation Techniques

This analysis is founded on a rigorous methodology combining in-depth primary interviews with valve OEM executives, end-user procurement specialists, and industry consultants. These qualitative insights were triangulated against a comprehensive review of company literature, regulatory filings, and authoritative trade association reports. Secondary data sources were cross-verified for consistency and augmented with real-time tariff and supply chain announcements from official government proclamations and leading news agencies.

Quantitative assessments leveraged historical shipment records, import-export datasets, and patent filings to identify technology adoption curves and geographic distribution trends. All data underwent meticulous validation through expert panel reviews, ensuring the robustness of conclusions and recommendations. This multi-method approach guarantees that the findings reflect both the current state of the rotary valve market and emerging trajectories informed by macroeconomic and regulatory developments.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Rotary Valves market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Rotary Valves Market, by Product Type

- Rotary Valves Market, by Valve Type

- Rotary Valves Market, by Material

- Rotary Valves Market, by Category

- Rotary Valves Market, by Operation Mode

- Rotary Valves Market, by Pressure Rating

- Rotary Valves Market, by Size

- Rotary Valves Market, by Application

- Rotary Valves Market, by End Use Industry

- Rotary Valves Market, by Sales Channel

- Rotary Valves Market, by Region

- Rotary Valves Market, by Group

- Rotary Valves Market, by Country

- United States Rotary Valves Market

- China Rotary Valves Market

- Competitive Landscape

- List of Figures [Total: 22]

- List of Tables [Total: 2862 ]

Conclusive Executive Summary Synthesizing Core Findings on Market Dynamics, Challenges, and Strategic Imperatives for Rotary Valves

In conclusion, the rotary valve market stands at the intersection of digital transformation, sustainability imperatives, and geopolitical reshuffles. Technological advancements in smart sensors, AI-driven analytics, and energy-efficient actuation are redefining performance benchmarks, while escalating tariffs are reshaping supply chain strategies and cost structures. Segmentation analysis highlights the nuanced interplay of valve type, actuation mode, end-use sector, pressure requirements, connection styles, and size categories in steering application-specific growth.

Regional insights reveal that localized growth drivers and regulatory landscapes require tailored go-to-market strategies, and leading companies are already repositioning through innovation partnerships and strategic divestitures. The recommended actionable measures-spanning digital integration, supply chain diversification, material innovation, and sustainability alignment-provide a roadmap for stakeholders to navigate market complexities and seize opportunities. Together, these findings offer a holistic executive summary of the critical forces shaping the future of rotary valves.

Connect with Ketan Rohom to Secure the Definitive Rotary Valve Market Research Report That Empowers Strategic Decision-Making

Don’t miss the opportunity to leverage this exhaustive analysis and gain a competitive edge in the dynamic rotary valve market by securing your copy of the full report today. Engage directly with Ketan Rohom, Associate Director of Sales & Marketing, to discuss tailored research solutions and ensure your organization is equipped with the actionable insights needed to navigate evolving industry trends. Act now to capitalize on early access benefits, customized data packages, and expert guidance designed to inform strategic planning and investment decisions.

- How big is the Rotary Valves Market?

- What is the Rotary Valves Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?