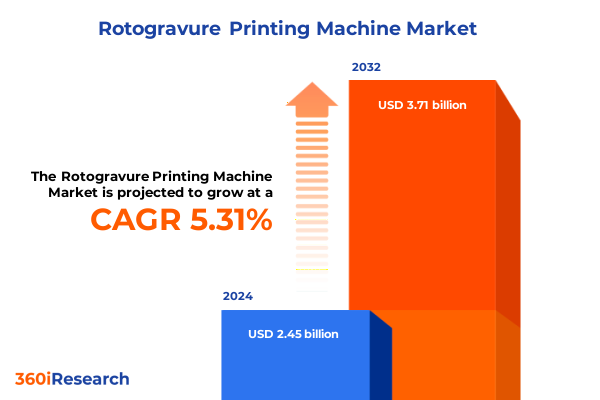

The Rotogravure Printing Machine Market size was estimated at USD 2.56 billion in 2025 and expected to reach USD 2.68 billion in 2026, at a CAGR of 5.43% to reach USD 3.71 billion by 2032.

Embarking on an Exploration of the Rotogravure Printing Machine Industry That Illuminates Its Evolutionary Drivers and Current Market Dynamics Perspective

To begin, a foundational understanding of the rotogravure printing machine industry requires tracing its lineage from early industrial engravings to today’s high-speed, digitally integrated presses. Historically prized for its ability to deliver rich, consistent image quality at scale, the gravure process has evolved through successive waves of technological innovation, each enhancing throughput, precision, and substrate versatility. This research unpacks the critical junctures-such as the shift from manual gravure cylinders to computer-aided engraving, and the transition from solvent-based inks toward more sustainable alternatives-illuminating how these milestones have collectively shaped current capabilities.

In addition, the modern landscape demands a nuanced view of how emergent drivers like sustainability mandates, digital workflow integration, and customer expectations for shorter production runs compel equipment manufacturers and end users alike to rethink conventional gravure applications. Our analysis delves into the multifaceted pressures influencing capital investment decisions, from regulatory incentives for low-VOC inks to the ROI calculus of incorporating inline quality inspection systems.

Furthermore, this introduction sets the stage for a comprehensive exploration of market dynamics, guiding stakeholders through an executive summary that highlights transformative shifts, tariff-driven cost realignments, segmentation intelligence, regional growth patterns, and actionable recommendations. By contextualizing these topics within both historical trajectories and present-day imperatives, readers gain a strategic vantage point for navigating the evolving rotogravure printing machine ecosystem.

Uncovering the Pivotal Shifts Reshaping Rotogravure Printing Technology Adoption, Market Structure, and Value Chain Transformation

Amid intensifying competition and rising sustainability expectations, the rotogravure printing machine market has experienced several pivotal inflection points in recent years. A primary catalyst has been the widespread adoption of digital design workflows, which seamlessly integrate with gravure cylinder preparation, reducing lead times and minimizing errors. This digital infusion not only accelerates job setup but also supports variable data printing, enabling converters to address increasingly personalized packaging and decorative needs. Consequently, equipment OEMs are investing heavily in software and automation partnerships to maintain relevance in a marketplace that prizes agility.

Simultaneously, environmental considerations have prompted a shift away from traditional solvent-based ink formulations toward UV curing and water-based alternatives. Such transitions are underpinned by both regulatory frameworks targeting VOC emissions and a growing corporate responsibility ethos among brand owners. To accommodate these reformulations, machine manufacturers have reengineered press architectures to withstand different ink chemistries and designed versatile drying units-ranging from UV LED arrays to conventional mercury lamps-thereby expanding the technology’s application scope.

Moreover, the integration of Industry 4.0 principles has transformed maintenance protocols and production monitoring. Smart sensors embedded throughout the press line enable real-time diagnostics and predictive maintenance, significantly reducing unscheduled downtime. As a result, forward-looking stakeholders view digital twin simulations and IoT-driven feedback loops as essential components for achieving optimal throughput and minimizing quality deviations. Collectively, these transformative shifts underscore a broader market movement toward convergence-where mechanical excellence, digital sophistication, and environmental stewardship intersect to define the future of rotogravure printing machines.

Analyzing the Ripple Effects of 2025 United States Tariff Policies on Supply Chains, Production Costs, and Competitive Positioning in Rotogravure Printing

In 2025, new tariffs imposed by the United States government on imported gravure printing machinery and associated components have introduced significant challenges for both OEMs and end users. By elevating duty rates on mechanical assemblies, spare parts, and certain high-precision components, these measures have incrementally increased landed costs for imported equipment. As a result, converters have faced a recalibration of capital expenditure plans, prompting some to accelerate scheduled purchases before tariff escalations while others have deferred upgrades to mitigate near-term financial impact.

Furthermore, supply chain reconfiguration has emerged as a common strategic response. Many European and Asian machinery suppliers have explored shifting assembly operations closer to the U.S. market or partnering with local contract manufacturers to qualify for domestic origin exemptions. Although such maneuvers entail initial investment and logistical complexity, they offer a pathway to sidestep punitive duties over the long term. Concurrently, raw material suppliers-particularly those providing specialty inks and cylinder substrates-have encountered ripple effects from these tariffs, as cost increases for end users cascade upstream, influencing negotiation dynamics across the value chain.

At the same time, domestic equipment producers have leveraged the tariff environment to strengthen their competitive positioning. By emphasizing localized service networks, accelerated lead times, and bespoke fabrication capabilities, U.S.-based OEMs have captured incremental market share from incumbent foreign manufacturers. However, this shift has also intensified price competition and incentivized all industry participants to refine their value propositions, whether through extended warranty offerings, enhanced training services, or flexible financing programs. Ultimately, the cumulative impact of U.S. tariffs in 2025 has prompted a strategic reassessment of sourcing strategies, manufacturing footprints, and partnership models across the rotogravure ecosystem.

Deep Diving into Market Breakdowns by Ink Type Technology, Operational Format, End Use Applications, and Industry Verticals Driving Rotogravure Growth

A nuanced understanding of the rotogravure printing machine market emerges from examining critical segmentation dimensions that collectively define technology adoption patterns, operational modalities, and end-use applications. First, by ink type, the industry has witnessed a pronounced pivot toward ultraviolet curing solutions and water-based formulations, driven largely by stringent environmental regulations and brand owner sustainability targets. Within the UV category, the advent of UV LED systems has started to eclipse legacy mercury lamps due to their energy efficiency, reduced heat output, and longer service life. In parallel, solvent-based gravure presses continue to serve traditional applications, although their growth rate has moderated in favor of cleaner alternatives.

Beyond ink chemistries, the market delineates itself along the lines of press format. Sheet-fed rotogravure machines, prized for their precision and ability to accommodate thicker substrates, maintain relevance among high-definition decorative printing and specialized packaging producers. Conversely, web-fed configurations dominate high-volume label and flexible packaging production, where continuous rolls facilitate rapid changeovers and inline finishing options. This dichotomy underscores how operational scale and substrate requirements inform capital equipment choices.

End-use segmentation further layers complexity onto the market landscape. Decorative printing applications, including gift wrapping and wallpaper production, leverage rotogravure’s superior color consistency for premium offerings. Labels span a wide array of formats-from adhesive food labels to pharmaceutical tagging-reflecting the machine’s versatility. In packaging, corrugated board, flexible films, and folding carton producers each rely on gravure’s capacity for fine detailing and robust ink laydown. Finally, the publications segment-encompassing books, magazines, and newspapers-continues to retreat in some regions while maintaining niche growth in emerging markets.

From an industry vertical perspective, automotive and electronics sectors utilize rotogravure machines for specialized graphic laminations and decorative panels, whereas the food and beverage industry demands equipment compatible with beverage labels, confectionery wraps, and dairy product packaging. In pharmaceuticals, tablet packaging and vial labeling adhere to exacting quality standards, prompting investment in machines equipped with advanced inspection and registration controls. The interplay of these segmentation criteria shapes customer priorities and supplier roadmaps, illustrating the market’s multifaceted character.

This comprehensive research report categorizes the Rotogravure Printing Machine market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Ink Type

- Type

- Application

- End User Industry

Examining the Regional Trajectories and Adoption Patterns across the Americas, EMEA, and Asia Pacific in the Rotogravure Machine Market

Geographic considerations play an integral role in shaping rotogravure printing machine demand and competitive dynamics. In the Americas, the United States leads adoption, fueled by a robust packaging sector and stringent environmental regulations that have hastened the transition to UV and water-based ink systems. Canada and Latin American markets, while smaller in scale, exhibit pockets of rapid growth particularly in specialty packaging and labeling applications for food and beverage. The degree of capital investment and availability of local service infrastructure further influence regional purchasing cycles.

Across Europe, Middle East, and Africa, established markets such as Germany, Italy, and the United Kingdom continue to drive innovation through high-precision equipment and tailored service models. Regulatory frameworks in the European Union have strongly incentivized low-emission printing solutions, positioning EMEA as a testing ground for next-generation gravure technologies. In contrast, Middle Eastern and African markets balance the need for cost-effective solutions with rising demand for premium packaging in consumer goods, creating a dual-speed environment that challenges suppliers to offer both affordable entry-level machines and state-of-the-art presses.

The Asia-Pacific region represents perhaps the most dynamic growth frontier. China and India, propelled by expanding retail and e-commerce sectors, account for a significant proportion of new machine installations, particularly in web-fed label and flexible packaging applications. Japanese and Korean manufacturers maintain strong domestic demand for high-definition decorative printing, while emerging markets in Southeast Asia explore collaborative leasing and financing models to overcome capital constraints. As infrastructure and regulatory maturity accelerate across the region, APAC stands poised to shape the next chapter of rotogravure innovation and market expansion.

This comprehensive research report examines key regions that drive the evolution of the Rotogravure Printing Machine market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Profiling Leading Manufacturers’ Strategic Initiatives, Innovation Portfolios, and Competitive Differentiators in the Global Rotogravure Equipment Sector

Leading equipment manufacturers in the rotogravure printing machine sector have adopted diverse strategic approaches to secure competitive advantage. Some have concentrated on expanding their innovation portfolios, introducing modular press designs that accommodate both conventional and UV LED curing systems. This flexibility enables customers to retrofit existing lines with minimal downtime, thereby lowering the threshold for technology upgrades.

Elsewhere, manufacturers have invested in proprietary software ecosystems, offering end-to-end solutions that integrate job preparation, color management, and production analytics. By capturing data at each stage of the printing process, these vendors provide customers with actionable insights into press performance, waste reduction, and run optimization. This data-centric approach not only underpins service contracts but also cements long-term partnerships.

A third cohort of companies has emphasized service excellence, cultivating extensive global support networks to deliver rapid response times and on-site technical expertise. These organizations leverage regional hubs and certified training centers to ensure that operators and maintenance personnel can maximize equipment uptime and output quality. In tandem, several players have forged alliances with ink and substrate suppliers to co-develop ink systems specifically calibrated for their press configurations, enhancing print fidelity and process reliability.

Although the strategic emphases vary, a unifying thread is the pursuit of sustainable growth through differentiated offerings. Whether through technological leadership, software-enabled maintenance models, or comprehensive aftermarket support, these key players continue to redefine the parameters of value in the global rotogravure printing machine market.

This comprehensive research report delivers an in-depth overview of the principal market players in the Rotogravure Printing Machine market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- Bobst Group SA

- Cerutti Group S.p.A.

- Comexi Group

- Fuji Kikai Kogyo Co Ltd

- Gidue S.p.A.

- Hsing Wei Machine Industry CO.LTD

- J M Heaford Ltd.

- Koenig & Bauer AG

- OMET S.p.A.

- UTECO Converting S.p.A.

- Windmöller & Hölscher KG

Implementing Targeted Strategic Roadmaps to Accelerate Operational Efficiency, Technological Adoption, and Sustainable Growth in Rotogravure Printing

Industry leaders seeking to capitalize on evolving market opportunities should consider a multifaceted approach to technology investment and operational refinement. First, deploying UV LED curing modules in retrofit programs can yield tangible energy savings and reduce heat-induced substrate distortion, thereby preserving print quality while lowering total cost of ownership. A phased implementation strategy allows organizations to validate performance benchmarks and leverage early wins to justify broader rollouts.

Simultaneously, integrating machine-to-enterprise data platforms will deliver real-time production visibility, enabling managers to identify bottlenecks and optimize press scheduling. By harnessing predictive maintenance algorithms, stakeholders can shift from time-based servicing to condition-based interventions, significantly reducing unplanned downtime and maintenance expenses.

To fortify supply chain resilience, companies should explore dual-sourcing arrangements for critical components and cultivate nearshore assembly partnerships, mitigating exposure to tariff fluctuations and logistics disruptions. Aligning with ink and substrate suppliers on joint development initiatives can accelerate the commercialization of eco-friendly formulations that meet evolving regulatory and brand owner requirements.

Finally, investing in operator training and cross-functional collaboration is essential for sustaining competitive advantage. Structured upskilling programs and knowledge-sharing forums foster a culture of continuous improvement, ensuring that technological enhancements translate into measurable productivity gains. By orchestrating these strategic levers in concert, industry leaders can enhance their market positioning and drive sustainable growth in the rotogravure printing machine landscape.

Detailing Research Methodology Incorporating Qualitative Interviews, Quantitative Surveys, and Data Triangulation to Ensure Comprehensive Industry Analysis

This analysis is grounded in a rigorous methodology that synthesizes qualitative and quantitative data streams to deliver a holistic view of the rotogravure printing machine market. The process commenced with an extensive review of industry publications, technical white papers, and regulatory filings to establish foundational context. Concurrently, the research team conducted structured interviews with senior executives, press operators, and ink formulators to capture firsthand perspectives on emerging challenges and investment priorities.

Complementing these qualitative insights, a series of quantitative surveys was deployed across OEMs, converters, and end users. The surveys probed purchasing criteria, technology adoption timelines, service preferences, and regional growth drivers. Responses were statistically weighted to reflect geographic and segmental representation, ensuring that the findings accurately mirror the diversity of market participants.

To validate and refine the data, a triangulation exercise compared primary research outcomes with secondary data from market intelligence databases and customs trade records. This cross-verification step was critical for calibrating tariff impact estimates, equipment installation trends, and segmentation breakdowns. In addition, peer reviews by independent industry analysts provided an extra layer of quality assurance, reinforcing the study’s credibility.

Collectively, these methodological pillars underpin an analysis that balances depth with breadth, delivering both strategic foresight and operational guidance. By adhering to these rigorous protocols, the research ensures that stakeholders receive actionable insights grounded in robust evidence.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Rotogravure Printing Machine market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Rotogravure Printing Machine Market, by Ink Type

- Rotogravure Printing Machine Market, by Type

- Rotogravure Printing Machine Market, by Application

- Rotogravure Printing Machine Market, by End User Industry

- Rotogravure Printing Machine Market, by Region

- Rotogravure Printing Machine Market, by Group

- Rotogravure Printing Machine Market, by Country

- United States Rotogravure Printing Machine Market

- China Rotogravure Printing Machine Market

- Competitive Landscape

- List of Figures [Total: 16]

- List of Tables [Total: 1749 ]

Synthesizing Core Findings and Strategic Implications to Illuminate the Future Trajectory of Rotogravure Printing Technology and Market Dynamics

In synthesizing the core findings, it is evident that the rotogravure printing machine industry stands at a crossroads defined by technological progress, sustainability imperatives, and evolving trade dynamics. The convergence of digital workflow integration, UV LED innovation, and data-driven maintenance models has amplified efficiency gains, while new environmental regulations and tariff regimes have introduced fresh complexities into procurement and supply chain strategies.

Segmentation analysis revealed that ink type selection and press format preferences are intricately linked to end-use requirements and geographic factors. Decorative printing, labels, packaging, and publications each present distinct technical challenges and commercial imperatives, underscoring the importance of customized equipment configurations and service models. Regional insights further highlighted how mature markets prioritize environmental compliance and precision engineering, whereas high-growth frontiers in Asia-Pacific emphasize cost-effective scalability and financing flexibility.

Key manufacturers have responded with differentiated value propositions, leveraging software ecosystems, modular designs, and expansive service networks to secure long-term customer loyalty. These strategic initiatives are supported by the research’s actionable recommendations, which advocate for targeted investments in UV LED retrofits, digital productivity platforms, supply chain diversification, and workforce upskilling. Taken together, the study furnishes stakeholders with a clear roadmap for navigating the interplay between innovation, regulation, and market access.

Ultimately, the future trajectory of rotogravure printing machines will be shaped by the industry’s ability to balance operational excellence with sustainability and resilience. As emerging technologies and policy environments evolve, this analysis provides the strategic foundation for informed decision-making and sustained competitive advantage.

Engage with Associate Director Ketan Rohom for Exclusive Insights and Access Tailored Rotogravure Printing Market Research to Drive Informed Decisions

We invite organizations seeking to leverage actionable market intelligence to connect with Associate Director Ketan Rohom and secure a comprehensive, customized report that addresses every critical aspect of rotogravure printing machine dynamics. Engaging with Ketan Rohom provides decision-makers with privileged access to in-depth analyses, tailored strategic recommendations, and ongoing expert support designed to accelerate technology adoption and optimize operational performance.

By reaching out, your team can gain priority briefings on emerging trends, tariff developments, and competitive moves that shape procurement, investment, and partnership decisions in the rotogravure sector. Whether your goal is to refine supply chain resilience, explore novel ink systems, or benchmark against market leaders, this direct line to expert insights will ensure your initiatives are both timely and data-driven. Beyond the standard research deliverables, the collaboration offers customized consultation sessions, periodic market updates, and scenario planning workshops to guide your long-term roadmap.

Take the next step toward market leadership by scheduling a strategic discussion with Ketan Rohom. Harness the full value of this research to inform your capital expenditures, R&D investments, and competitive positioning strategies. Reach out today to transform raw data into actionable intelligence and position your organization at the forefront of the rotogravure printing machine industry.

- How big is the Rotogravure Printing Machine Market?

- What is the Rotogravure Printing Machine Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?