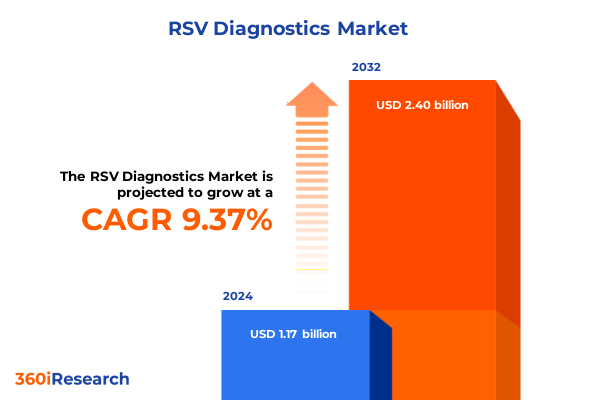

The RSV Diagnostics Market size was estimated at USD 1.26 billion in 2025 and expected to reach USD 1.36 billion in 2026, at a CAGR of 9.64% to reach USD 2.40 billion by 2032.

Understanding the Evolving Landscape of RSV Diagnostics Amidst Shifting Epidemiological Patterns and Technological Innovations

With the resurgence of respiratory syncytial virus infections underscoring the critical need for timely and accurate detection, stakeholders across the healthcare spectrum are compelled to reevaluate existing diagnostic approaches. Recent epidemiological shifts, spurred by waning immunity in post-pandemic populations and novel viral strains, have magnified the urgency for robust testing infrastructure. Parallel to these clinical challenges, technological advances have accelerated the introduction of next-generation molecular assays and compact point-of-care platforms. As healthcare systems grapple with balancing rapid turnaround times against sensitivity thresholds, the market for respiratory syncytial virus diagnostics has entered a phase of unprecedented evolution.

Against this backdrop, this executive summary synthesizes the key drivers, barriers, and opportunities defining the current environment. By examining transformative shifts in testing modalities, quantifying the impact of recent trade policies, and dissecting critical market segments, it provides a strategic lens for decision-makers seeking to align product development, manufacturing, and distribution with emerging demands. Seamlessly integrating insights on regional dynamics and competitive positioning, this introduction lays a foundation for stakeholders to navigate complexity and capitalize on growth trajectories in RSV diagnostics.

Emerging Diagnostic Modalities and Healthcare Delivery Models Are Reshaping How RSV Is Detected and Managed in Clinical Practice

The diagnostic landscape for RSV has undergone a metamorphosis fueled by converging trends in technology and care delivery. First, the proliferation of molecular assays, driven by real-time polymerase chain reaction enhancements and isothermal amplification techniques, has elevated sensitivity benchmarks while shortening analysis cycles. Concurrently, innovations in chemiluminescence immunoassays and immunofluorescence detection have refined antigen-based testing at central laboratories, delivering scalable solutions for high-throughput screening. These breakthroughs have, in turn, galvanized investment in microfluidic and lateral flow assay platforms, empowering clinicians with rapid, on-site decision support.

Moreover, healthcare delivery models have adapted to pandemic-era lessons, with home care and telehealth services expanding the point-of-care testing footprint. Diagnostics manufacturers are responding by optimizing sample collection kits and portable analyzers that integrate seamlessly with digital health ecosystems. As a result, traditional diagnostic laboratories are augmenting their services with remote testing capabilities, while academic institutes and clinics collaborate on pilot programs to validate next-generation platforms. Collectively, these shifts are recalibrating stakeholder expectations around accuracy, cost efficiency, and patient-centered care pathways.

Assessing the Compounding Effects of Recent US Tariff Policies on Supply Chain Dynamics and Cost Structures Across the RSV Diagnostics Value Chain

In 2025, the US government’s recalibration of tariff schedules has created ripple effects throughout the RSV diagnostics supply chain. Heightened duties on imported reagents and key instrumentation components, such as nucleic acid amplification enzymes and microfluidic cartridges, have elevated input costs for test kit manufacturers. Consequently, many suppliers have adapted by diversifying sourcing strategies, forging alliances with domestic enzymology firms and buffer producers to mitigate exposure to cross-border levies.

These cost pressures have prompted contract manufacturers and original equipment vendors to revisit their pricing frameworks, leading some to implement tiered margins for academic institutes and public health laboratories. In parallel, distributors have recalibrated inventory management protocols, shifting from lean, just-in-time models toward buffer stock strategies to insulate against tariff-induced volatility. Although end users, including hospitals and diagnostic labs, have expressed concerns over potential test price inflation, proactive collaboration between stakeholders has facilitated volume-based discounts and co-investment in local reagent production. Ultimately, these adaptations underscore the market’s resilience and the strategic importance of supply chain agility in an environment of evolving trade policy.

Decoding the Diverse Market Segments within RSV Diagnostics by Test Type Product Technology Platform End User Sample Type Distribution Channel and Age Group

A nuanced understanding of market segmentation illuminates critical pathways for targeted innovation and market entry. By test type, immunoassays continue to command attention through subtypes such as chemiluminescence immunoassay, enzyme-linked immunosorbent assay, and immunofluorescence assay, each offering distinct benefits in throughput and automation. Molecular tests, underpinned by isothermal amplification, next-generation sequencing, and real-time polymerase chain reaction, deliver unparalleled analytical sensitivity. Concurrently, rapid tests leveraging lateral flow assay and microfluidic assay technologies address urgent needs for decentralized, same-visit diagnostics.

From a product perspective, instruments-namely analyzers and PCR machines-form the backbone of laboratory infrastructure, while kits tailored for saliva or swab collection facilitate user-friendly sampling. Reagents, including optimized buffers and enzymes, drive assay performance and consistency. Technology platforms such as ELISA, immunofluorescence, and PCR bridge these products to diverse end users-spanning academic institutes, clinics, diagnostic laboratories, home care settings, and hospital laboratories-each with distinct operational requirements. Sample type considerations, encompassing blood, nasopharyngeal swab, and saliva matrices, further dictate assay design and regulatory pathways. Distribution channels bifurcate into offline and online streams, enabling stakeholders to balance reach and service quality, while age group segmentation of adult, geriatric, and pediatric patients informs product packaging, labeling, and user training strategies. Together, these interwoven dimensions guide strategic prioritization and resource allocation for market participants.

This comprehensive research report categorizes the RSV Diagnostics market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Product

- Test Type

- Technology Platform

- Sample Type

- Age Group

- End User

- Distribution Channel

Regional Nuances in RSV Diagnostic Adoption Highlight Divergent Trends across Americas Europe Middle East Africa and Asia Pacific Markets

Regional dynamics continue to shape investment priorities and adoption curves within the RSV diagnostics market. In the Americas, established reimbursement frameworks and high public health spending underpin widespread deployment of laboratory-based PCR and immunoassay systems. Government-supported surveillance initiatives further incentivize partnerships between diagnostic vendors and public health agencies, reinforcing focus on rapid test rollouts in community clinics and home care contexts.

Across Europe, the Middle East, and Africa, heterogeneous healthcare infrastructures present both challenges and opportunities. Western European markets drive demand for cutting-edge molecular platforms, whereas emerging regions in the Middle East and Africa gravitate toward cost-effective rapid tests and portable analyzers. Regulatory harmonization efforts within the European Union contrast with more fragmented pathways elsewhere, compelling suppliers to tailor market entry strategies accordingly.

In Asia-Pacific, large-scale screening programs in countries such as China, Japan, and Australia stimulate demand across all test categories, particularly in molecular diagnostics. At the same time, nascent markets in Southeast Asia and South Asia rely heavily on lower-complexity immunoassays and lateral flow devices to address gaps in laboratory capacity. These regional nuances highlight the importance of localized product development, strategic partnerships, and distribution network optimization.

This comprehensive research report examines key regions that drive the evolution of the RSV Diagnostics market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Competitive Strategies and Portfolio Diversification Tactics Deployed by Leading Players to Sustain Growth in the RSV Diagnostics Market

Leading diagnostic companies are leveraging diverse growth levers to consolidate their market positions. Key players have invested in expanding their molecular testing portfolios through strategic acquisitions of niche technology firms specializing in isothermal amplification and next-generation sequencing. Simultaneously, conglomerates with broad immunoassay capabilities have intensified R&D to enhance sensitivity and reduce cross-reactivity, differentiating their platforms in clinical laboratories and hospital networks.

Partnerships between reagent suppliers and instrument manufacturers are forging integrated solutions that simplify procurement and service agreements for large health systems. Additionally, several firms have launched digital health initiatives that integrate test results with telemedicine platforms, delivering seamless patient management pathways. In the realm of rapid tests, manufacturers are optimizing microfluidic designs to achieve laboratory-grade performance in decentralized settings, further expanding their addressable market. Collectively, these strategies reflect a competitive environment where agility, collaboration, and technological diversification determine long-term value creation.

This comprehensive research report delivers an in-depth overview of the principal market players in the RSV Diagnostics market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- Abbott Laboratories

- Becton, Dickinson and Company

- bioMérieux SA

- Danaher Corporation

- DiaSorin S.p.A.

- Hologic Inc.

- Meridian Bioscience, Inc.

- QIAGEN N.V.

- QuidelOrtho Corporation

- Roche Diagnostics International AG

- Siemens Healthineers AG

- Thermo Fisher Scientific Inc.

Strategic Imperatives for Industry Leaders to Strengthen Supply Chains Leverage Technological Innovation and Optimize Market Penetration in RSV Diagnostics

To navigate this complex environment, industry leaders should prioritize strengthening supply chain resilience by establishing multi-sourcing agreements for critical reagents and components. Aligning procurement teams with R&D functions can accelerate the co-development of assays optimized for new sample types and point-of-care settings. In parallel, manufacturers ought to deepen engagement with regulatory bodies to streamline platform approvals and post-market surveillance, thereby expediting time to market.

Innovation partnerships with digital health providers can deliver value-added services, such as remote result interpretation and patient follow-up protocols, enhancing end-user loyalty. Sales and marketing teams should segment outreach strategies by end user-tailoring messaging for hospital laboratories versus home care providers-to maximize adoption rates. Lastly, forging alliances across regions-leveraging local distributors in high-growth Asia-Pacific markets or consortium models in emerging Middle Eastern and African territories-will optimize market penetration while mitigating geopolitical risk.

Robust Multi Tiered Research Framework Combining Qualitative Interviews Quantitative Data Analytics and Systematic Literature Review

This research applies a multi-tiered methodology to ensure rigor and relevance. It commenced with an exhaustive literature review of peer-reviewed journals, regulatory filings, and health agency publications to establish a foundational understanding of RSV diagnostics technology and epidemiology. Building on this secondary research, quantitative data was sourced from proprietary transaction databases and laboratory equipment shipment records to chart adoption trends across regions.

To validate quantitative insights, expert interviews were conducted with laboratory directors, procurement specialists, and key opinion leaders in infectious disease diagnostics. These qualitative discussions elucidated emerging needs in test performance, workflow integration, and reimbursement landscapes. Finally, iterative workshops with internal analysts synthesized findings into thematic frameworks, ensuring that the report’s segmentation and recommendations align with real-world stakeholder priorities. This structured approach balances data-driven accuracy with expert-led interpretation, delivering actionable intelligence.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our RSV Diagnostics market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- RSV Diagnostics Market, by Product

- RSV Diagnostics Market, by Test Type

- RSV Diagnostics Market, by Technology Platform

- RSV Diagnostics Market, by Sample Type

- RSV Diagnostics Market, by Age Group

- RSV Diagnostics Market, by End User

- RSV Diagnostics Market, by Distribution Channel

- RSV Diagnostics Market, by Region

- RSV Diagnostics Market, by Group

- RSV Diagnostics Market, by Country

- United States RSV Diagnostics Market

- China RSV Diagnostics Market

- Competitive Landscape

- List of Figures [Total: 19]

- List of Tables [Total: 2226 ]

Synthesis of Critical Insights Emphasizing Market Opportunities Challenges and the Path Forward for RSV Diagnostic Innovation and Adoption

The convergence of advanced molecular techniques, agile supply chain strategies, and evolving healthcare delivery models positions the RSV diagnostics market at a transformative juncture. While tariff pressures underscore the importance of localized manufacturing and multi-sourcing, segmentation insights reveal tailored pathways to meet diverse end-user requirements across laboratory, clinical, and home settings. Moreover, regional analyses highlight the need for adaptive market entry strategies that respond to disparate reimbursement systems and infrastructure capacities.

For industry stakeholders, the imperative is clear: fostering collaborative innovation, enhancing regulatory engagement, and optimizing distribution networks will be the cornerstone of growth. By integrating the strategic imperatives outlined herein, decision-makers can navigate the complexities of the post-pandemic diagnostic ecosystem and capitalize on the expanding demand for reliable, rapid RSV testing.

Engage with Ketan Rohom to Secure Comprehensive RSV Diagnostics Market Intelligence That Drives Strategic Decision Making and Growth

To explore how these insights can directly inform your strategic objectives and operational plans, reach out to Ketan Rohom, Associate Director, Sales & Marketing, whose expertise in RSV diagnostics market intelligence will ensure you access the comprehensive report for data-driven decision making that drives growth

- How big is the RSV Diagnostics Market?

- What is the RSV Diagnostics Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?