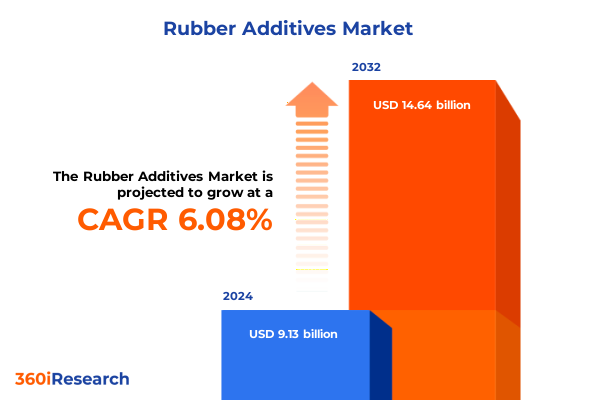

The Rubber Additives Market size was estimated at USD 9.68 billion in 2025 and expected to reach USD 10.28 billion in 2026, at a CAGR of 7.08% to reach USD 15.64 billion by 2032.

Innovative Developments and Strategic Relevance of Rubber Additives in Modern Industrial and Consumer Applications Fueling Performance Across Diverse Sectors

Rubber additives play a pivotal role in enhancing the performance, durability, and safety of rubber-based materials across diverse industries. From automotive sealing and tire applications to consumer goods and industrial hoses, these chemical compounds impart critical functionalities such as improved tensile strength, resistance to heat and aging, and optimized processing characteristics. The growing complexity of end-use requirements continues to drive innovation in additive technologies, compelling manufacturers to develop advanced solutions that meet stringent regulatory standards while delivering exceptional performance.

In addition to traditional performance enhancements, contemporary market dynamics emphasize sustainability and environmental stewardship. Manufacturers increasingly prioritize bio-based and non-toxic formulations to comply with tightening global regulations and to satisfy rising consumer demand for eco-friendly products. As a result, the industry has witnessed a surge in research investments focused on producing renewable and low-emission additives without compromising functional properties. This evolving landscape underscores the strategic importance of staying ahead of technological trends and regulatory shifts in order to capitalize on emerging opportunities within the rubber additives arena.

Emerging Technological Breakthroughs and Sustainability Imperatives Redefining the Competitive Landscape of Rubber Additives Industry

The rubber additives industry is experiencing transformative shifts driven by technological advancements and heightened sustainability imperatives. Nanotechnology integration, for instance, has unlocked new possibilities for reinforcing rubber matrices at the molecular level, thereby enhancing mechanical properties and extending service life. Innovations in nano-silica, graphene-based additives, and functionalized nanoparticles promise to accelerate the next wave of performance improvements, allowing manufacturers to deliver lighter, stronger, and more durable elastomeric products.

Simultaneously, a global push toward circular economy principles has spurred the development of recyclable and bio-derived additive solutions. They not only reduce dependency on fossil-based feedstocks but also facilitate end-of-life material recovery. In parallel, digitalization of R&D processes-leveraging computational chemistry, artificial intelligence, and high-throughput screening-has shortened development cycles and improved formulation precision. Together, these technological and ecological imperatives are redefining competitive dynamics, prompting industry players to invest heavily in innovation pipelines and strategic collaborations to secure long-term value creation.

Assessing the Multidimensional Impact of United States Tariff Policies on Rubber Additives Supply Chains and Profitability Dynamics

In 2025, a cumulative framework of U.S. tariffs on imported rubber additives and precursor chemicals has materialized into a significant catalyst for supply chain realignment. Initial Section 301 measures imposed on certain polymer stabilizers and curing agents sourced from key Asian markets have been augmented by targeted duties on carbon black and specialty zinc oxides. These layered tariff structures have elevated landed costs, compelling manufacturers to reevaluate sourcing strategies and pass through incremental expenses to downstream processors.

As a consequence, procurement teams have accelerated supplier diversification efforts, exploring emerging markets in Southeast Asia and Latin America while incentivizing domestic production investments. This trend has been reinforced by federal incentives aimed at reshoring critical chemical manufacturing capabilities, thereby reducing exposure to trade policy volatility. Additionally, some end users have begun reformulating additive packages to substitute higher-duty components with locally produced alternatives, driving innovation in formulation engineering. Overall, these cumulative tariff measures have spurred an industry-wide pivot toward geographic resilience, cost optimization, and localized supply chain architectures.

In-Depth Exploration of End Use Polymer Type Application and Form Segmentation Revealing Critical Insights into Market Drivers

A granular segmentation analysis reveals distinct demand drivers across multiple dimensions. Within the end use domain, automotive requirements dominate through specialized rubber parts, high-performance hoses and belting, critical seals and gaskets, and advanced tire formulations. Construction-related applications leverage additives to enhance flooring systems, roofing membranes, insulation products, and sealing technologies. Consumer goods, from household items to sporting equipment, rely on tailored additive packages to deliver tactile comfort, durability, and safety. Healthcare applications, though smaller in volume, impose rigorous purity and biocompatibility standards, spurring development of ultra-clean antioxidant and antiozonant chemistries. Industrial usage encompasses heavy-duty hoses, industrial sealing solutions, and other equipment parts demanding thermal stability and abrasion resistance.

Polymer-specific segmentation further illuminates market dynamics. Chloroprene rubber and EPDM variants require unique curing accelerators and activators to achieve resistance to heat and ozone, while natural rubber grades-RSS, SVR, and TSR-depend heavily on peroxide-based and sulfur donor vulcanizing agents. Nitrile formulations exhibit strong affinity for specialty antidegradants, and SBR types, including emulsion and solution grades, benefit from targeted plasticizer and flame retardant combinations. Integrating these insights with type-based segmentation-covering accelerators such as guanidines, sulfenamides, and thiazoles; activators like stearic acid and zinc oxide; as well as fillers, flame retardants, antistatic agents, and vulcanizing systems-enables manufacturers to fine-tune offerings based on specific polymer matrices.

This comprehensive research report categorizes the Rubber Additives market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Type

- Polymer

- Form

- Application

Comprehensive Regional Analysis Highlighting Unique Demand Patterns and Regulatory Landscapes Across Americas EMEA and Asia-Pacific Territories

Regional dynamics shape distinct priorities and growth trajectories across the Americas, EMEA, and Asia-Pacific. In the Americas, mature markets emphasize stringent regulatory compliance and cost containment, driving demand for high-performance and multi-functional additive systems that can reduce overall compound complexity. Domestic production incentives and rising labor costs have led to nearshoring of key chemical processes, which fosters stronger collaboration between additive suppliers and major OEMs in automotive and construction sectors.

Europe, the Middle East, and Africa collectively focus on regulatory harmonization, sustainable sourcing, and circular economy integration. EMEA producers and end users increasingly adopt low-VOC, bio-derived, and recyclable additive solutions, aligning with European Union directives and regional ESG targets. Meanwhile, Asia-Pacific remains the fastest-growing region, fueled by rapid industrialization in China and India alongside expanding automotive manufacturing capabilities. This region not only presents robust demand for conventional rubber additives but also serves as a hub for cost-competitive production, exporting specialty grades to global markets while investing in local R&D for next-generation materials.

This comprehensive research report examines key regions that drive the evolution of the Rubber Additives market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Strategic Profiles of Leading Enterprises Shaping Innovation Trajectories and Collaborations in the Competitive Sphere of Rubber Additives

Leading enterprises have distinguished themselves through strategic investments in advanced manufacturing, robust R&D platforms, and close partnerships with downstream integrators. For example, global specialty chemical firms continue to enhance their additive portfolios through acquisitions of regional compounders, enabling seamless integration of formulation expertise and supply chain agility. Several innovators have introduced patented bio-based antioxidant and antiozonant chemistries, securing first-mover advantages in sustainable product lines. Meanwhile, custom service providers differentiate by offering technical support, on-site compounding trials, and digital formulation tools that accelerate time-to-market for OEMs.

Collaboration between additive suppliers and equipment manufacturers is another hallmark of industry leadership. Strategic joint ventures focused on co-developing tailor-made curing and reinforcement packages are gaining traction, particularly in high-growth segments such as electric vehicle sealing systems and advanced tire engineering. These partnerships not only mitigate development risk but also foster co-innovation models that align product roadmaps with evolving end-user specifications. Collectively, the strategic profiles of these market leaders underscore the importance of integrated capabilities, market responsiveness, and continuous innovation.

This comprehensive research report delivers an in-depth overview of the principal market players in the Rubber Additives market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- Arkema S.A.

- BASF SE

- Behn Meyer Group

- China Sunsine Chemical Holdings Limited

- Eastman Chemical Company

- Emery Oleochemicals

- Huntsman Corporation

- LANXESS AG

- Momentive Performance Materials

- NOCIL Limited

- R.T. Vanderbilt Holding Company, Inc.

- Sibur

- Sinopec Corporation

- Solvay S.A.

- Sumitomo Chemical Co., Ltd.

- Toray Industries, Inc.

- Wacker Chemie AG

- Yasho Industries

Actionable Strategic Recommendations Empowering Industry Leaders to Navigate Market Complexities and Accelerate Growth in Rubber Additives

Industry leaders should prioritize sustained investment in R&D to maintain competitive differentiation and address evolving customer requirements. By expanding capabilities in computational modeling and high-throughput formulation screening, organizations can accelerate the development of advanced additive chemistries tailored to next-generation elastomeric applications. Additionally, diversifying supply chain footprints across multiple geographies will bolster resilience against trade policy shifts and raw material price fluctuations.

Furthermore, embracing circular economy principles through the adoption of bio-based feedstocks, recyclable additives, and closed-loop recovery programs will strengthen regulatory compliance and brand reputation. Strategic alliances with polymer resin producers, OEMs, and research institutions can facilitate co-development of application-specific solutions while sharing development costs. Finally, leveraging digital platforms for end-to-end supply chain visibility and customer engagement will enhance operational efficiency and foster deeper customer relationships, laying the foundation for long-term growth.

Transparent Research Methodology Integrating Qualitative and Quantitative Techniques to Ensure Robustness and Credibility of Findings

Our research methodology integrates multiple layers of qualitative and quantitative analysis to ensure robustness and credibility. We commenced with exhaustive secondary research, reviewing scientific literature, patent databases, regulatory filings, and industry white papers to map the technological landscape and regulatory context. Following this, primary research involved structured interviews with senior executives, R&D directors, and procurement specialists across major additive manufacturers, OEMs, and compounders to validate market dynamics and capture emerging trends firsthand.

Data triangulation served as a core pillar of our approach. We cross-referenced insights gleaned from expert discussions with company disclosures, trade association statistics, and logistics data to corroborate key findings. Throughout the process, rigorous quality control measures, including consistency checks and peer reviews by domain experts, guaranteed the integrity of our analysis. This layered methodology ensures that the report’s conclusions and recommendations rest on a solid foundation of empirical evidence and industry expertise.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Rubber Additives market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Rubber Additives Market, by Type

- Rubber Additives Market, by Polymer

- Rubber Additives Market, by Form

- Rubber Additives Market, by Application

- Rubber Additives Market, by Region

- Rubber Additives Market, by Group

- Rubber Additives Market, by Country

- United States Rubber Additives Market

- China Rubber Additives Market

- Competitive Landscape

- List of Figures [Total: 16]

- List of Tables [Total: 2385 ]

Conclusive Synthesis Emphasizing Key Takeaways and Strategic Imperatives Emerging from In-Depth Rubber Additives Analysis Driving Informed Decision-Making

The comprehensive analysis underscores that rubber additives remain indispensable for driving performance enhancements and meeting complex end-use requirements across diverse sectors. Technological innovation-rooted in nanotechnology, bio-based chemistries, and digital formulation tools-continues to redefine material capabilities and open new avenues for market expansion. Meanwhile, regulatory and sustainability imperatives exert significant influence on product development priorities, compelling manufacturers to innovate responsibly and collaboratively.

Navigating the compounded impact of evolving trade policies requires strategic foresight and operational adaptability. Companies that successfully diversify supply chains, leverage advanced R&D methodologies, and forge strong partnerships will secure competitive advantages. Ultimately, a proactive approach-balancing cost optimization, sustainability commitments, and technological leadership-will be critical for capturing value in an increasingly dynamic rubber additives landscape.

Engage with Associate Director of Sales and Marketing for Personalized Insights and Secure Your Comprehensive Rubber Additives Market Research Report Today

To access tailored insights, detailed segment breakdowns, and strategic guidance that align with your organization’s goals, reach out to Associate Director of Sales and Marketing Ketan Rohom. He will provide personalized support in navigating the complexities of the rubber additives landscape, address your specific research needs, and ensure you receive the full breadth of analysis and data necessary to make informed decisions. Engage with Ketan to discuss customized licensing options, explore partnership opportunities, and secure your comprehensive market research report today

- How big is the Rubber Additives Market?

- What is the Rubber Additives Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?