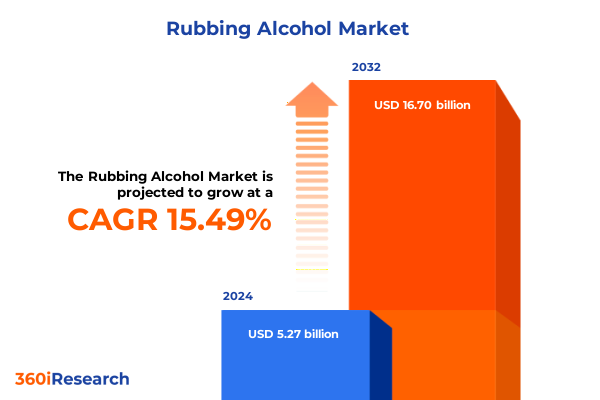

The Rubbing Alcohol Market size was estimated at USD 6.05 billion in 2025 and expected to reach USD 6.95 billion in 2026, at a CAGR of 15.59% to reach USD 16.70 billion by 2032.

Discover the Essential Foundations of the Rubbing Alcohol Market and Its Critical Role in Hygiene Healthcare and Industrial Applications Shaping Today’s Landscape

The global rubbing alcohol market has evolved into a critical component of modern healthcare, consumer hygiene, and industrial maintenance. Traditionally valued for its rapid antimicrobial properties and versatility, rubbing alcohol has become an indispensable household staple and an essential resource within clinics and hospitals. Its multifaceted applications span cosmetic uses, disinfection protocols, and cleaning regimens, offering a cost-effective solution across myriad environments. In parallel, increasing public awareness of hygiene practices and ongoing innovations in formulation have further cemented rubbing alcohol’s market relevance, driving both consumption volumes and product diversification.

This executive summary distills key market insights, from transformational shifts and regulatory developments to segmentation analysis and competitive dynamics. By drawing on comprehensive research methodologies, this report aims to equip decision-makers with a clear understanding of current challenges, growth drivers, and strategic opportunities within the rubbing alcohol industry. The insights presented herein are designed to inform investment decisions, product development roadmaps, and go-to-market strategies, ultimately supporting stakeholders in navigating the evolving landscape with confidence.

Explore the Convergence of Health Crises Digital Distribution and Sustainability Innovations Reshaping the Rubbing Alcohol Industry

Recent years have witnessed profound shifts reshaping the rubbing alcohol ecosystem. Demand surges prompted by global health crises catalyzed unprecedented expansion in household and medical segments, while supply chains adapted rapidly to meet urgent needs. Concurrently, formulation innovations have introduced diverse delivery formats such as gels, wipes, and aerosols, catering to consumer convenience and industrial ease of use. Digital transformation within distribution channels has further accelerated market accessibility, with e-commerce platforms emerging as dominant avenues for retail purchase.

The convergence of heightened regulatory standards and sustainability imperatives has also influenced product development strategies. Manufacturers are prioritizing greener packaging solutions and non-toxic, skin-friendly formulations to align with evolving consumer expectations. In tandem, advancements in production technology have enhanced purity levels, increased yield efficiencies, and reduced carbon footprints. Together, these transformative forces are steering the rubbing alcohol market toward a more resilient, consumer-centric, and environmentally responsible future.

Analyze the Ripple Effects of 2025 Tariff Hikes on Raw Material Sourcing Cost Structures and Supply Chain Resilience

In 2025, a series of cumulative tariff adjustments in the United States imposed additional duties on key raw materials and finished products within the rubbing alcohol supply chain. Ethanol and isopropyl alcohol imports experienced escalated tariff rates, leading to elevated procurement costs for domestic producers. As manufacturers grappled with these increased overheads, pricing pressure cascaded through distribution networks, affecting both consumer and industrial segments. The resultant margin compression prompted strategic sourcing reevaluations and spurred interest in alternative feedstock and domestic raw material production.

Meanwhile, downstream distributors and retailers navigated the impact of higher landed costs by optimizing inventory management and renegotiating supplier agreements. Some stakeholders accelerated vertical integration efforts to mitigate tariff exposure, while others explored tariff engineering strategies such as reclassification of blend percentages. Although these adaptations alleviated short-term cost burdens, the long-term implications underscore the importance of regulatory monitoring and agile supply chain structures to sustain competitive advantage within the tightened tariff landscape.

Unveil Critical Segmentation Insights Across Application Form Type Channel Packaging and End User Profiles Influencing Market Dynamics

Segmenting the rubbing alcohol market by application reveals distinct growth patterns across cosmetic, household, industrial, and medical end uses. Cosmetic formulations benefit from consumer demand for antiseptic skincare solutions, while household usage for cleaning and disinfection continues to capitalize on heightened hygiene awareness. Industrial applications leverage high purity grades for equipment degreasing and solvent cleansing, and medical demand remains robust within clinics and hospitals. When assessing product form, liquid solutions maintain leadership due to versatility, but gels and wipes have risen sharply in convenience-driven channels.

Differentiating by type, ethanol-based products hold strong market positioning for their rapid evaporation and lower odor, whereas isopropyl alcohol variants offer deeper protein denaturation critical for clinical sterilization. Distribution through online retail channels such as e-commerce marketplaces and manufacturer websites has expanded consumer reach, complementing traditional pharmacy storefronts and supermarket availability. Turning to packaging, aerosol cans and bottles-particularly high-density polyethylene and PET bottles-dominate, although flexible pouches and single- or multi-dose sachets are gaining ground in on-the-go and travel segments. Finally, end users split among individual consumers, industrial enterprises, and medical facilities, with clinics and hospitals continuing to drive the highest volume consumption.

This comprehensive research report categorizes the Rubbing Alcohol market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Type

- Form

- Packaging

- Application

- Channel

- End User

Examine Geographical Contrasts in Demand Drivers Regulatory Trends and Production Capacities Shaping Regional Market Performance

Geographically, the Americas region remains a powerhouse for rubbing alcohol demand, driven by robust healthcare infrastructure in the United States and Canada, and expanding industrial and household consumption across Latin American economies. Regulatory alignment toward stringent hygiene standards has further entrenched consumption patterns, while localized production investments strengthen supply networks. In Europe Middle East and Africa, diverse regulatory frameworks and varying consumer preferences generate a heterogeneous market; Western Europe’s focus on eco-friendly packaging contrasts with emerging markets in the Middle East prioritizing price competitiveness and basic disinfection needs.

Asia-Pacific stands out as the fastest-growing region, fueled by rising industrial activities, expanding medical tourism, and growing consumer health consciousness. China and India lead in manufacturing capacities, leveraging cost-effective feedstock and large-scale production facilities. Southeast Asian markets exhibit increasing upticks in household cleaning and personal care adoption, while Australia and Japan demand premium high-purity grades for clinical use. Across all regions, cross-border trade complexities and shifting import-export policies underscore the need for geographically diversified strategies to ensure uninterrupted supply and market penetration.

This comprehensive research report examines key regions that drive the evolution of the Rubbing Alcohol market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Discover How Industry Leaders Are Leveraging Integration Innovation and Collaborative Alliances to Strengthen Market Positions and Drive Growth

Leading participants in the rubbing alcohol market have adopted multifaceted strategies to secure growth and resilience. Major chemical producers integrate backward into ethanol and isopropyl feedstock production to safeguard supply and control costs. Consumer goods conglomerates emphasize branded gel and wipe offerings, leveraging marketing channels to drive premiumization and convenience. Specialty packaging firms introduce innovative formats such as recyclable PET bottles and pouches to address sustainability concerns. Additionally, contract manufacturers and private-label producers capitalize on scale efficiencies to serve both established retailers and niche online platforms.

Strategic partnerships and acquisitions have further consolidated market positions, enabling portfolio diversification and expanded distribution reach. Research alliances with academic institutions and technology startups facilitate novel disinfection technologies and advanced formulation research. Service providers focusing on regulatory compliance and quality assurance offer end-to-end solutions to navigate complex regional standards. Collectively, these dynamic competitive maneuvers underscore an industry in continual evolution, driven by cost optimization imperatives and burgeoning demand across consumer, industrial, and medical segments.

This comprehensive research report delivers an in-depth overview of the principal market players in the Rubbing Alcohol market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- Atul Limited

- Avantor, Inc.

- BASF SE

- Clariant AG

- Denoir Technology Corporation

- Dow Inc.

- Eastman Chemical Company

- Exxon Mobil Corporation

- GOJO Industries, Inc.

- Honeywell International Inc.

- Hydrite Chemical Co.

- INEOS Group Holdings S.A.

- JXTG Nippon Oil & Energy Corporation

- LG Chem Ltd.

- LyondellBasell Industries N.V.

- Mitsui & Co., Ltd.

- Oxea GmbH

- Royal Dutch Shell plc

- Sasol Ltd.

- Saudi Basic Industries Corporation

- Shell plc

- Thermo Fisher Scientific Inc.

- Tokuyama Corporation

- Vi‑Jon Laboratories, LLC

- Zhejiang Sanmei Chemical Industry Co., Ltd.

Unlock Strategic Pathways Through Sustainable Innovation Diversified Sourcing and Agile Distribution to Capture Emerging Market Opportunities

To thrive in the rapidly evolving rubbing alcohol market, industry leaders should adopt a multi-pronged approach. First, investing in sustainable production processes and eco-conscious packaging will resonate with increasingly environmentally aware consumers and comply with tightening regulations. Second, diversifying raw material sourcing through strategic alliances or vertical integration can buffer against tariff volatility and supply disruptions. Third, developing a balanced product portfolio that spans liquid, gel, and wipe formats will capture both professional and consumer segments seeking convenience and efficacy.

Furthermore, expanding digital distribution channels and leveraging data-driven consumer insights can enhance market penetration and personalize marketing efforts. Engaging in joint research initiatives to innovate advanced antiseptic formulations or green solvent alternatives will differentiate offerings and foster long-term customer loyalty. Finally, monitoring regional regulatory shifts and building flexible logistics networks will provide the agility necessary to navigate import-export constraints, ensuring consistent supply across key markets.

Leverage Robust Multidimensional Research Approaches Combining Primary Interviews Secondary Data and Expert Validation for Reliable Insights

This report’s findings are underpinned by a rigorous research methodology combining primary interviews with industry executives, regulatory bodies, and key distributors, alongside secondary research of trade publications, technical journals, and government datasets. Quantitative data validation draws on customs records, industry association statistics, and corporate financial disclosures to ensure accuracy. Qualitative insights are refined through expert panel discussions and stakeholder workshops, providing real-world context to evolving market dynamics.

The segmentation framework encompasses application, form, type, channel, packaging, and end user dimensions, enabling granular analysis of demand drivers and competitive positioning. Regional assessments integrate country-level regulatory audits, tariffs examination, and supply chain mapping. Company profiling leverages both desk research and in-depth interviews to capture strategic initiatives and innovation pipelines. Throughout, a multi-layered triangulation process verifies data consistency, ensuring the report delivers reliable and actionable intelligence for decision makers.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Rubbing Alcohol market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Rubbing Alcohol Market, by Type

- Rubbing Alcohol Market, by Form

- Rubbing Alcohol Market, by Packaging

- Rubbing Alcohol Market, by Application

- Rubbing Alcohol Market, by Channel

- Rubbing Alcohol Market, by End User

- Rubbing Alcohol Market, by Region

- Rubbing Alcohol Market, by Group

- Rubbing Alcohol Market, by Country

- United States Rubbing Alcohol Market

- China Rubbing Alcohol Market

- Competitive Landscape

- List of Figures [Total: 18]

- List of Tables [Total: 2067 ]

Synthesize Core Trends Innovations and Strategic Imperatives Defining the Future Trajectory of the Rubbing Alcohol Industry

In summary, the rubbing alcohol market stands at a strategic inflection point, shaped by recent public health imperatives, regulatory evolutions, and consumer preference shifts toward sustainability and convenience. The interplay of tariff impacts and supply chain adaptations has underscored the need for agility and strategic foresight within the industry. Differentiated product offerings and innovative packaging formats are unlocking new usage occasions, while regional market characteristics present both challenges and opportunities for global stakeholders.

As the market matures, success will hinge on companies’ ability to integrate vertically, forge collaborative innovation partnerships, and harness digital channels to engage end users effectively. By aligning operational excellence with emerging trends in green chemistry and consumer-centric convenience, industry participants can secure resilient growth pathways. The insights contained in this report furnish a comprehensive blueprint for navigating the complex landscape ahead and capitalizing on the promising prospects within the rubbing alcohol industry.

Secure Immediate Access to In-Depth Market Intelligence on Rubbing Alcohol to Accelerate Your Competitive Advantage and Growth Trajectory

Engaging with this comprehensive and authoritative report on the global rubbing alcohol market will empower your strategic planning and decision making. By securing access, you will gain immediate insights into market dynamics, emerging trends, and competitive positioning that can elevate your organization’s growth trajectory. Ketan Rohom, Associate Director of Sales & Marketing, is ready to guide you through tailored report packages and value-added consulting services. Take the next step toward informed action and sustained success by connecting with Ketan to purchase this indispensable research resource.

- How big is the Rubbing Alcohol Market?

- What is the Rubbing Alcohol Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?