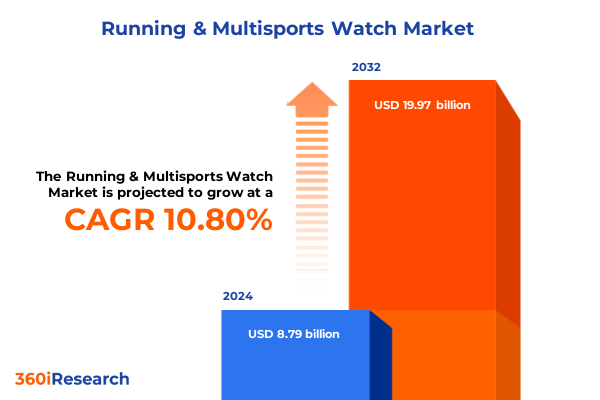

The Running & Multisports Watch Market size was estimated at USD 9.73 billion in 2025 and expected to reach USD 10.78 billion in 2026, at a CAGR of 10.81% to reach USD 19.97 billion by 2032.

Overview of the running and multisports wearable sector’s evolution from basic activity trackers to sophisticated data-driven performance platforms

The global running and multisports wearable sector has witnessed unprecedented evolution over the past decade, driven by rapid advancements in sensor technology, user-centric software platforms, and seamless connectivity. Initially conceived as simple pedometers, modern wearables now integrate a multitude of performance metrics, enabling athletes and casual users alike to monitor heart rate variability, GPS tracking, and even biometric stress indicators in real time. As a result, stakeholders across the value chain-from component suppliers to health-focused application developers-are recognizing the sector’s potential to redefine how individuals approach fitness, wellness, and overall performance enhancement.

Moreover, the convergence of data analytics and artificial intelligence has introduced new dimensions of personalization and insight generation. Algorithms now process vast troves of user-generated data to provide predictive analytics, customized training regimens, and nutrition guidance, elevating the user experience beyond basic activity tracking. Such developments have not only fueled consumer adoption but have also created strategic imperatives for brands seeking differentiation in a rapidly saturating marketplace. With end users demanding more intuitive interfaces and actionable insights, companies are compelled to innovate or risk obsolescence.

Furthermore, the COVID-19 pandemic accelerated consumer emphasis on at-home fitness solutions, further solidifying demand for advanced running and multisports wearables. As traditional gym closures and social distancing measures became widespread, users turned to wearable devices for guided workouts and community-driven challenges. This momentum has persisted into 2025, shaping market dynamics and prompting industry leaders to recalibrate their product roadmaps. This introduction lays the groundwork for a comprehensive exploration of the transformative shifts, regulatory impacts, and strategic imperatives defining the current competitive landscape.

How cutting-edge sensor integration, advanced connectivity, and platform partnerships are redefining wearable performance monitoring

The wearables landscape has undergone a profound transformation as emerging technologies have reshaped both product capabilities and consumer expectations. Notably, the integration of multi-frequency GPS and barometric altimeters has enabled precise distance and elevation tracking, essential for trail runners and triathletes seeking granular performance metrics. Coupled with improvements in optical heart rate sensors and electrocardiogram modules, these enhancements have elevated device accuracy to clinical-grade levels, fostering greater trust among professional and amateur athletes alike.

Meanwhile, the proliferation of low-power wireless protocols such as Bluetooth Low Energy and eSIM-enabled cellular connectivity has unlocked unprecedented freedom for users. Gone are the days when athletes needed to carry smartphones; today’s wearables can stream live performance data, receive notifications, and even facilitate emergency calls independently. This shift toward untethered experiences has broadened the appeal of multisport watches for endurance events, open-water swims, and ultra-distance cycling competitions, enhancing safety and convenience for participants.

In addition, the convergence of fitness wearables with broader health platforms has given rise to ecosystems that extend beyond standalone devices. Partnerships between watch manufacturers and wellness app developers now enable seamless data synchronization, feeding into comprehensive health dashboards that inform medical consultations and corporate wellness initiatives. These collaborative models demonstrate how strategic alliances can drive market expansion by offering users integrated solutions that encompass training, recovery, and long-term health monitoring.

Evaluating the effects of 2025 US import tariffs on supply chain strategies, manufacturing realignments, and product portfolio optimizations

The introduction of new United States tariffs in early 2025 has had a cascading impact on import-dependent segments of the running and multisports watch industry. Component costs for semiconductor sensors, heart rate modules, and GPS chips-largely sourced from Asia-experienced an immediate uptick, compelling manufacturers to reassess global supply chain configurations. Although some cost pressures have been mitigated through strategic partnerships with regional suppliers, others have been absorbed into higher retail pricing, potentially dampening consumer demand among price-sensitive segments.

Moreover, the layered tariff structure has incentivized some brands to relocate assembly operations closer to end markets. Latin American manufacturing hubs have emerged as viable alternatives, offering preferential trade agreements that offset tariff liabilities. While this strategic realignment has shortened lead times and improved inventory flexibility, it has also introduced complexities related to quality control and regulatory compliance across diverse jurisdictions. As a result, companies must balance the benefits of tariff avoidance against the challenges of maintaining consistent product standards.

In tandem with supply chain adjustments, the tariff-induced cost fluctuations have accelerated product line rationalizations. Firms are streamlining their portfolios to focus on high-margin premium and professional-grade devices, where consumers are more amenable to paying a premium for advanced features and brand prestige. Conversely, entry-level running and multisports watches are being optimized for regional production or localized sourcing to maintain affordability. Overall, the cumulative impact of these tariffs underscores the importance of agile manufacturing strategies and diversified sourcing frameworks in navigating evolving trade landscapes.

Drawing strategic inferences from product variety, distribution pathways, user profiles, and connectivity preferences across the wearable ecosystem

Insights derived from the analysis of product, sales channel, end user, and connectivity segments highlight distinct patterns of consumer behavior and operational focus. When examining product types, adventure-focused multisport watches leverage ruggedized designs and extended battery life to cater to outdoor enthusiasts, while swimming watches prioritize waterproofing standards and swim stroke analytics for aquatic training. Running watches, differentiated by GPS-only and GPS plus heart rate monitoring variants, speak to the precision needs of professional athletes and the cost-conscious preferences of recreational runners.

Turning to sales channels, offline retail environments continue to serve as trusted touchpoints for experiential purchase journeys, providing hands-on demonstrations and in-person consultations. However, direct-to-consumer online platforms are gaining traction by offering customization options, firmware updates, and subscription-based training content. Meanwhile, marketplace ecosystems aggregate diverse brands, enabling price comparison and promotional bundling, thereby appealing to budget-conscious shoppers seeking value-driven propositions.

In assessing end-user segments, professional athletes demand enterprise-grade data analytics, customizable performance metrics, and seamless integration with coaching software. Fitness enthusiasts, both casual and serious, prioritize intuitive interfaces, social sharing features, and gamified challenges to stay motivated, whereas amateur users seek simplified guidance, basic activity tracking, and affordable entry points. Connectivity preferences further distinguish user groups: Bluetooth remains the baseline for smartphone tethering, Wi-Fi supports bulk data uploads and firmware updates, and cellular options-ranging from embedded SIM to traditional cards-empower untethered tracking and emergency services, particularly for remote outdoor activities.

This comprehensive research report categorizes the Running & Multisports Watch market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Product Type

- Sales Channel

- End User

- Connectivity

Uncovering the diverse regional dynamics influencing consumer preferences, regulatory drivers, and retail channels across global territories

Geographic disparities in consumer adoption, regulatory frameworks, and retail infrastructures shape the regional narrative for running and multisports wearables. In the Americas, robust e-commerce penetration and a mature fitness culture drive strong demand for premium devices that offer comprehensive health monitoring and social connectivity functions. Meanwhile, Latin American markets are witnessing steady growth in entry-level wearables as rising disposable incomes and local assembly initiatives improve affordability.

Across Europe, Middle East, and Africa, diverse regulatory regimes and economic heterogeneity create multifaceted opportunities. Western Europe emphasizes data privacy compliance and seamless interoperability with electronic health record systems, prompting manufacturers to prioritize security features. In contrast, markets in the Middle East and Africa are characterized by an appetite for cost-effective ruggedized devices, spurred by expanding outdoor sports festivals and government-backed health campaigns.

In the Asia-Pacific region, rapid urbanization and a burgeoning middle class underpin strong consumer spending on lifestyle and fitness gadgets. Markets such as China and India are not only major manufacturing hubs but also significant sources of demand for both premium and budget-friendly wearables. Additionally, partnerships with local telecom operators facilitate the rollout of cellular-enabled watches, catering to segment-specific requirements for continuous connectivity and safety in high-density urban environments.

This comprehensive research report examines key regions that drive the evolution of the Running & Multisports Watch market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Analyzing how tech titans, niche innovators, and strategic alliances are competing to lead performance wearables with differentiated R&D and partnership models

Leading players in the wearable technology arena are distinguished by their commitment to research and development, strategic partnerships, and brand positioning. Established consumer electronics brands leverage extensive distribution networks and brand equity to maintain market leadership, continuously enhancing their platforms through software updates and ecosystem integrations. At the same time, specialized sports technology firms focus on cutting-edge sensor innovation and athlete-centric design, carving out niches in endurance and triathlon segments.

Furthermore, technology startups have emerged as agile challengers, deploying modular architectures and open-API frameworks that enable seamless third-party integrations. These new entrants often attract venture capital funding to accelerate development cycles and forge alliances with fitness content providers. As competition intensifies, incumbents are responding with acquisition strategies aimed at securing emerging capabilities, such as advanced biometric analytics and personalized coaching algorithms.

Moreover, collaborations between wearable manufacturers and healthcare institutions are reshaping business models. By conducting joint clinical trials and publishing peer-reviewed outcomes, certain companies are positioning their devices as validated medical adjuncts, eligible for reimbursement under preventive health initiatives. These differentiated value propositions not only drive incremental revenue streams but also elevate the overall credibility of wearables as essential tools for both fitness performance and long-term health management.

This comprehensive research report delivers an in-depth overview of the principal market players in the Running & Multisports Watch market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- Apple Inc.

- COROS Wearables Inc.

- Fitbit LLC

- Garmin Ltd.

- Huawei Device Co., Ltd.

- Polar Electro Oy

- Samsung Electronics Co., Ltd.

- Suunto Oy

- Xiaomi Corporation

- Zepp Health Corporation

Implementing integrated strategies in manufacturing agility, software monetization, and cross-industry partnerships to secure competitive advantage

Industry leaders must adopt a multi-pronged approach to capitalize on evolving market dynamics and regulatory environments. First, enhancing supply chain resilience through multi-region sourcing and agile manufacturing will mitigate future tariff impacts and reduce lead times. This strategy entails establishing partnerships with alternative component providers and investing in scalable contract manufacturing capabilities closer to end-user markets.

Second, deepening software and services offerings will differentiate product portfolios and foster recurring revenue streams. By integrating AI-driven coaching platforms and subscription-based wellness content, companies can increase customer lifetime value and strengthen brand loyalty. In parallel, prioritizing data privacy and compliance with regional regulations will build trust among consumers and institutional clients.

Third, forging cross-industry collaborations-particularly with healthcare providers, insurance firms, and sports federations-will unlock new use cases for wearables beyond traditional fitness applications. Such partnerships can support telehealth initiatives, corporate wellness programs, and evidence-based sports science research. Finally, targeted marketing campaigns that resonate with distinct user personas-ranging from amateur hobbyists to professional athletes-will ensure that messaging aligns with varied motivational drivers and purchase criteria.

Detailing a robust multi-source research framework combining primary interviews, quantitative surveys, and comprehensive secondary validation

The research methodology underpinning this analysis combined primary interviews with industry executives, in-depth surveys of end users, and exhaustive secondary research across reputable trade publications and patent databases. Primary data collection involved structured discussions with product managers, supply chain directors, and technology partners to glean insights into strategic priorities and operational challenges. Concurrently, surveys of thousands of consumers across key demographics provided quantitative validation of feature preferences and purchasing behaviors.

Secondary research entailed a rigorous review of white papers, regulatory filings, and academic journals to corroborate technological trends and standards developments. Patent analysis further illuminated innovation hotspots and potential competitive threats. Data triangulation techniques were applied to reconcile findings from multiple sources, ensuring robustness and reducing bias. All information was subjected to quality control protocols, including peer reviews by domain experts and consistency checks against historical data points.

Ethical considerations were rigorously upheld, with all primary research participants informed about data usage and confidentiality safeguards. The methodology framework was designed to prioritize transparency and reproducibility, enabling stakeholders to understand the derivation of insights and replicate analyses if needed. This comprehensive approach ensures that the conclusions and recommendations presented herein rest on a solid empirical foundation.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Running & Multisports Watch market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Running & Multisports Watch Market, by Product Type

- Running & Multisports Watch Market, by Sales Channel

- Running & Multisports Watch Market, by End User

- Running & Multisports Watch Market, by Connectivity

- Running & Multisports Watch Market, by Region

- Running & Multisports Watch Market, by Group

- Running & Multisports Watch Market, by Country

- United States Running & Multisports Watch Market

- China Running & Multisports Watch Market

- Competitive Landscape

- List of Figures [Total: 16]

- List of Tables [Total: 1590 ]

Summarizing the critical nexus of technological innovation, regulatory adaptation, and consumer-centric strategies shaping the future of wearables

The running and multisports wearable sector stands at an inflection point, shaped by technological breakthroughs, shifting trade policies, and evolving consumer expectations. As devices continue to converge toward all-in-one health and performance platforms, market participants must navigate cost pressures, regulatory complexities, and intensifying competition. Yet, those who strategically align product innovation with user-centric experiences and supply chain resilience will capture disproportionate value.

Looking ahead, wearables are poised to transcend fitness tracking to become indispensable health partners, integrating seamlessly with telemedicine services and personalized wellness ecosystems. Brands that embrace open-architecture models, foster ecosystem partnerships, and adhere to stringent data governance standards will set the benchmark for trust and reliability. Ultimately, the ability to translate sensor data into actionable insights will define success, enabling athletes and casual users alike to make informed decisions that elevate performance and well-being.

In conclusion, the running and multisport watch industry offers fertile ground for growth and differentiation. By capitalizing on transformative shifts, addressing tariff-induced supply chain challenges, and aligning with distinct user needs across product, channel, and regional segments, forward-looking organizations can secure sustainable competitive advantage.

Seize an exclusive opportunity to obtain the definitive running and multisports wearable market report by connecting with our sales leadership

To access the comprehensive running and multisports wearables market research report and gain exclusive strategic insights, reach out directly to Ketan Rohom (Associate Director, Sales & Marketing at 360iResearch). Engage now to empower your organization with data-driven intelligence, unlock tailored growth strategies, and secure priority delivery of the full report. Take action today to elevate your competitive advantage and accelerate success in the dynamic world of sports technology.

- How big is the Running & Multisports Watch Market?

- What is the Running & Multisports Watch Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?