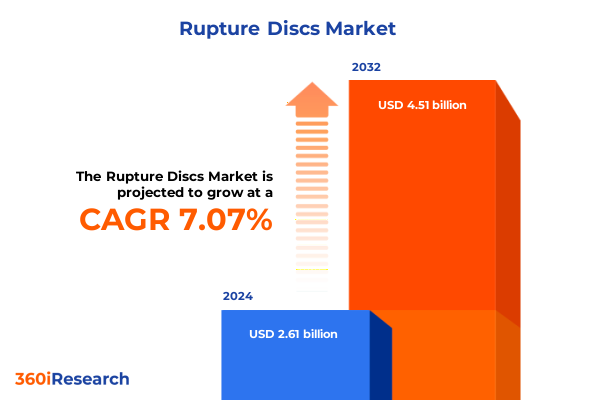

The Rupture Discs Market size was estimated at USD 2.79 billion in 2025 and expected to reach USD 2.99 billion in 2026, at a CAGR of 7.08% to reach USD 4.51 billion by 2032.

Exploring the Critical Role and Evolving Importance of Rupture Discs in Ensuring Process Safety, Operational Continuity, and Compliance Across Diverse Industrial Sectors

In the highly regulated and safety-driven world of pressure relief solutions, rupture discs serve as a critical last-line defense against overpressure events. Often integrated into pipelines, pressure vessels, and processing equipment, these non-reclosing devices provide instantaneous protection by bursting at a predefined set point to relieve excess pressure and prevent catastrophic failure. As industrial processes become more complex and operating conditions push the boundaries of temperature, pressure, and corrosive environments, the demand for rupture discs with precise performance characteristics and reliable burst accuracy has escalated.

Amid growing concerns over process safety and operational uptime, end users across chemical manufacturing, pharmaceuticals, oil and gas, power generation, and water treatment have intensified their focus on product traceability, material certification, and service support. At the same time, technological advancements in material science and quality management have opened new possibilities for customizing burst profiles and integrating monitoring capabilities. This executive summary distills the essential market dynamics, regulatory and tariff headwinds, segmentation nuances, regional variations, key competitive moves, and pragmatic recommendations that will enable decision makers to navigate the rupture disc landscape with clarity and confidence.

Uncovering How Technological Innovations, Regulatory Evolutions, and Supply Chain Diversifications Are Transforming the Rupture Disc Landscape to Meet Emerging Industrial Demands

Rupture disc technology is undergoing a notable shift fueled by breakthroughs in additive manufacturing, digital integration, and evolving regulatory mandates. Additive techniques now enable precise control of dome geometries and wall thicknesses, supporting tailored burst characteristics and reducing lead times for prototype validation. Concurrently, the introduction of smart pressure sensors capable of detecting pre-burst deformation has begun to transform traditional passive assemblies into predictive maintenance tools, improving system reliability and lowering unplanned downtime.

Moreover, quality standards are advancing in lockstep with regulatory updates. In July 2025, the ASME Boiler and Pressure Vessel Code Section VIII was published in its revised edition, introducing unified design classes and enhanced traceability protocols that raise the bar for pressure relief device validation and documentation. Similarly, global harmonization efforts around ISO 4126 and API Standard 520 have established more rigorous testing and reporting requirements. Together, these shifts are compelling manufacturers and end users alike to adopt integrated digital platforms for tracking material certifications, test data, and in-service performance metrics.

At the same time, geopolitical tensions and supply chain disruptions have prompted a reevaluation of sourcing strategies. Stakeholders are diversifying their supplier base across multiple regions, favoring manufacturers that can provide localized support and flexible production capacity. By embracing these transformative shifts, industry participants are not only enhancing their resilience to external shocks but also unlocking opportunities for premiumized, data-driven service offerings that align with the next generation of process safety expectations.

Assessing the Cumulative Impact of the 2025 United States Steel, Aluminum, and Alloy Tariffs on Rupture Disc Supply Chains, Material Costs, and Procurement Strategies

In March 2025, the United States reinstated a comprehensive 25 percent tariff on all steel and aluminum imports, eliminating prior country-specific exemptions and broadening coverage to include derivative products. This policy shift, enacted under Section 232 of the Trade Expansion Act, applies a mandatory 25 percent duty at the first point of entry or warehouse withdrawal, heightening raw material costs for critical components such as pipelines, vessels, and pressure relief devices. As a result, manufacturers of rupture discs, which often rely on stainless steel and nickel-based alloys, have faced immediate margin compression and accelerated procurement cycles to secure existing inventories.

In a further escalation, effective June 4, 2025, the tariff on steel and aluminum imports was raised to 50 percent-excluding only the United Kingdom under a temporary arrangement-and extended to include key nickel and cobalt alloys under reciprocal trade measures. This second wave of duties has added significant complexity to cost models for Hastelloy, Inconel, Monel, and other specialty alloys that underpin high-performance rupture disc applications. With global supply realignments in progress, manufacturers and end users are exploring near-term hedging strategies and localized production partnerships to mitigate further tariff volatility, while adapting procurement frameworks to reflect longer lead times and evolving trade policies.

Deriving Actionable Insights from Multifaceted Segmentation of the Rupture Disc Market by Type, Material Composition, End Use Industry, Connection Method, and Distribution Channel Dynamics

The rupture disc market can be understood through a multifaceted segmentation lens that reveals both specialized applications and cross-cutting trends. From a functional perspective, devices are classified by their operating principle, with forward acting designs optimized for immediate burst response under minimal backpressure and reverse buckling variants selected for stability in high backpressure scenarios. Material selection further diversifies offerings, spanning corrosion-resistant alloys such as Hastelloy and Inconel alongside Monel, nickel-based blends, and conventional stainless steel, each chosen for its unique temperature and chemical compatibility.

Beyond those classifications, end use industries play a defining role in shaping product specifications. Chemical plants demand discs that can withstand aggressive process streams, food and beverage processors prioritize sanitary construction, oil and gas facilities require high-pressure durability, while pharmaceutical, power generation, and water and wastewater sectors impose stringent validation and cleaning regimes. Connection interfaces likewise cater to varied installation footprints, with butt weld, flanged, lug type, and wafer type configurations enabling seamless integration. Across distribution channels, aftermarket distributors, digital platforms, and original equipment manufacturers collectively ensure availability, technical support, and tailored logistics solutions. This rich segmentation framework highlights niche growth pockets and guides strategic alignment between product design, service delivery, and customer requirements.

This comprehensive research report categorizes the Rupture Discs market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Type

- Material

- End Connection Type

- End Use Industry

- Distribution Channel

Highlighting Distinct Regional Dynamics Shaping Rupture Disc Adoption and Innovation Trends Across the Americas, Europe Middle East and Africa, and Asia-Pacific Markets

Geographic dynamics play a pivotal role in shaping how rupture disc technologies are adopted and developed across global markets. In the Americas, mature industrial infrastructures, stringent environmental and safety regulations, and a growing emphasis on energy transition initiatives have driven demand for high-performance materials and integrated monitoring capabilities. North American manufacturers are leveraging local alloy producers and advanced testing facilities to respond rapidly to project cycles and regulatory audits.

Across Europe, the Middle East, and Africa, regulatory harmonization under EU directives and regional safety authorities has fostered a robust aftermarket for pressure relief solutions, with European providers emphasizing certification and lifecycle support. In the Middle East, large-scale petrochemical expansions and infrastructure investments have spurred demand for locally stocked inventories and fast-track delivery programs. Meanwhile, Asia-Pacific markets are experiencing accelerated industrialization across China, India, and Southeast Asia, fueling growth in basic and specialized rupture disc applications alike. Cost competitiveness in these regions is matched by growing R&D investments, as local players ascend the value chain by developing custom alloys and digital service offerings. Collectively, these regional profiles underscore the importance of tailored market approaches and localized partnerships.

This comprehensive research report examines key regions that drive the evolution of the Rupture Discs market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Profiling Key Global Manufacturers and Emerging Innovators Driving Competitive Strategies, Product Development, and Strategic Collaborations in the Rupture Disc Industry

The competitive landscape of the rupture disc industry features longstanding global leaders alongside agile emerging players. Established manufacturers have doubled down on research and development, broadening their alloy portfolios and integrating digital diagnostics into traditional safety assemblies. These companies are forging strategic alliances with pressure vessel fabricators and engineering consultancies to embed rupture discs in turnkey safety solutions, while channel partners enhance aftermarket services through performance monitoring contracts.

Concurrently, regional specialists and new entrants are leveraging niche expertise in material science or rapid manufacturing to capture project-specific opportunities. Several innovators have introduced proprietary coatings and surface treatments to extend disc lifespan in corrosive environments. Others focus on tailored training and certification programs that deepen end-user engagement and foster loyalty. This dual dynamic-combining scale-driven research investments with focused, localized expertise-has intensified innovation cycles and driven competitive differentiation across the industry.

This comprehensive research report delivers an in-depth overview of the principal market players in the Rupture Discs market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- BS&B Innovations, Limited

- Continental Disc Corporation

- DonadonSDD Srl

- Emerson Electric Co.

- EnPro Industries, Inc.

- Fike Corporation

- Graco Inc.

- Leser GmbH & Co. KG

- Mersen Group

- Nohmi Bosai Ltd.

- OsecoElfab by Halma Plc

- Parker Hannifin Corporation

- Parr Instrument Co.

- REMBE GmbH Safety+Control

- SGL Carbon SE

- Shanghai Huali Safety Devices Co., Ltd

- Sinocera PVG New Material Co., Ltd.

- STRIKO Verfahrenstechnik GmbH

- Technetics Group

- V-TEX Corporation

- Visilume Ltd

- Zenith Safety Systems

- ZOOK Enterprises, LLC.

Implementing Actionable Strategies and Best Practices for Industry Leaders to Optimize Rupture Disc Development, Supply Resilience, and Regulatory Compliance Excellence

To capitalize on evolving market conditions and fortify operational resilience, industry leaders should adopt a series of targeted measures. First, investing in advanced materials research and pilot testing can unlock next-generation burst performance, particularly under extreme service conditions. Second, integrating digital sensing and data analytics within rupture disc assemblies will enable predictive maintenance and strengthen safety case documentation. Third, diversifying the supply base across multiple regions and leveraging strategic local partnerships will mitigate tariff exposure and enhance responsiveness to demand fluctuations.

In parallel, companies should engage proactively with standardization bodies to shape emerging regulations and ensure timely alignment with new code requirements. Strengthening after-sales service networks-through training, field audits, and lifecycle management programs-will drive customer retention and open pathways for recurring revenue. Finally, adopting circular economy principles, such as refurbishment and recycling initiatives for spent discs, can generate environmental benefits while reducing material costs, reinforcing a sustainable value proposition in the eyes of end users.

Detailing the Rigorous Multimodal Research Methodology Employed to Deliver Comprehensive and Validated Insights into the Dynamic Rupture Disc Market Landscape

This analysis is grounded in a comprehensive research methodology that blends qualitative and quantitative approaches. Primary data was gathered through in-depth interviews with industry experts, including design engineers, safety managers, and procurement specialists, to capture firsthand perspectives on emerging challenges and best practices. Secondary research encompassed a thorough review of technical standards, regulatory publications, engineering journals, and patent filings to map innovation trajectories and regulatory shifts.

Data triangulation and validation steps involved cross-referencing supplier specifications, field performance case studies, and trade policy announcements. Market segmentation was refined through comparative analysis of product catalogs, manufacturing footprints, and distribution networks. Finally, findings were subjected to expert review panels, ensuring methodological rigor and practical relevance. By combining diverse information sources and stakeholder insights, this methodology delivers actionable, evidence-based guidance tailored to the dynamic rupture disc landscape.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Rupture Discs market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Rupture Discs Market, by Type

- Rupture Discs Market, by Material

- Rupture Discs Market, by End Connection Type

- Rupture Discs Market, by End Use Industry

- Rupture Discs Market, by Distribution Channel

- Rupture Discs Market, by Region

- Rupture Discs Market, by Group

- Rupture Discs Market, by Country

- United States Rupture Discs Market

- China Rupture Discs Market

- Competitive Landscape

- List of Figures [Total: 17]

- List of Tables [Total: 954 ]

Concluding Insights Emphasizing Strategic Imperatives and Future Focus Areas for Stakeholders Navigating the Evolving Rupture Disc Market Environment

In today’s process safety environment, rupture discs have evolved beyond simple mechanical safeguards to become pivotal assets in risk management, operational efficiency, and compliance assurance. The interplay of technological innovation, regulatory tightening, and tariff volatility underscores the need for a holistic approach to product development and supply chain strategy. Segmentation insights reveal targeted growth opportunities, while regional dynamics highlight the value of localized partnerships and tailored service offerings.

As competitive intensity rises, companies that proactively embrace advanced materials, digital integration, and sustainable practices will differentiate themselves and build lasting customer trust. Meanwhile, ongoing engagement with standards bodies and agile supplier diversification will safeguard against external disruptions. By synthesizing these strategic imperatives, stakeholders can navigate the rupture disc market with strategic clarity and position their organizations for robust performance in an increasingly complex industrial landscape.

Take the Next Step Toward Enhanced Operational Safety and Market Leadership with a Customized Rupture Disc Research Report from Associate Director Ketan Rohom

If you are ready to strengthen your strategic decision making and gain a definitive edge in pressure relief device selection and deployment, we invite you to secure a tailored research report that distills the most critical insights and actionable guidance on the global rupture disc market. Reach out directly to Ketan Rohom, Associate Director of Sales & Marketing, to discuss your organization’s unique requirements and discover how this in-depth analysis can support your objectives-from optimizing material procurement and navigating tariff complexities to enhancing compliance processes and accelerating innovation cycles.

Engaging with this report will empower you with the clarity and confidence needed to drive operational safety, improve supply resilience, and position your company at the forefront of a dynamic industry environment. Contact Ketan Rohom today to embark on a customized research partnership that aligns with your strategic priorities and delivers the competitive intelligence essential for sustained growth.

- How big is the Rupture Discs Market?

- What is the Rupture Discs Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?