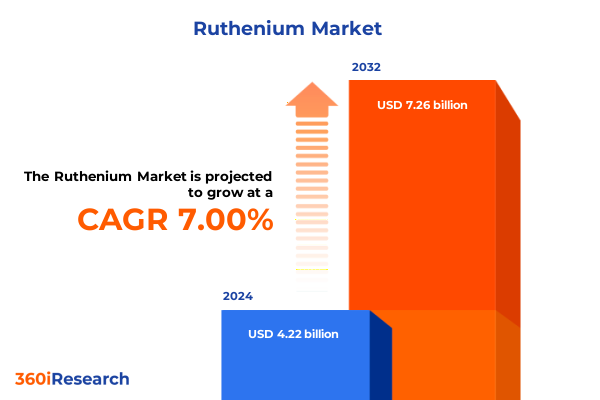

The Ruthenium Market size was estimated at USD 975.63 million in 2025 and expected to reach USD 1,049.98 million in 2026, at a CAGR of 7.80% to reach USD 1,651.12 million by 2032.

Exploring the Critical Role of Ruthenium in Modern Industry and Emerging Demand Drivers Shaping a Rapidly Evolving Global Market Landscape

Ruthenium, a critical member of the platinum group metals, boasts exceptional corrosion resistance, high melting point, and superior electrical conductivity that make it indispensable across diverse industrial sectors. Its catalytic performance underpins automotive emission control and various industrial chemical processes, while its stability in extreme conditions has spurred adoption in electrical contacts and resistance heating applications. Recent advances in electronics miniaturization and renewable energy technologies have further elevated ruthenium’s strategic importance, as manufacturers seek materials that deliver both performance and reliability in increasingly demanding environments.

Building on this foundational understanding, this executive summary offers a concise yet comprehensive overview of the factors shaping today’s ruthenium market. It synthesizes key developments in supply chain dynamics, regulatory influences, segmentation trends, regional consumption patterns, and competitive strategies. The goal is to provide decision-makers with clear, actionable insights that support informed planning and strategic investment in ruthenium applications and sourcing.

Uncovering the Technological Innovations and Regulatory Shifts Reshaping Ruthenium Supply Chains, Sustainability Efforts, and End-Use Applications Worldwide

Building on the foundational importance of ruthenium, emerging technological breakthroughs and evolving regulatory frameworks have triggered a series of transformative shifts across the value chain. Advanced atomic layer deposition techniques now enable ultra-thin ruthenium coatings that enhance semiconductor performance, while innovations in catalyst formulations are accelerating hydrogen production for clean energy applications. At the same time, the rapid adoption of electric vehicles has increased demand for high-reliability contacts, prompting manufacturers to pursue more efficient ruthenium-based alloys.

Simultaneously, heightened sustainability expectations and circular economy mandates have redefined sourcing strategies, with industry participants expanding scrap recovery and secondary refining initiatives. Geopolitical tensions and trade policy adjustments have further reshaped global supply routes, encouraging diversification away from traditional mining regions. Together, these forces have altered cost structures and supplier relationships, creating new competitive dynamics and setting the stage for the next phase of market evolution.

Analyzing the Cumulative Impact of 2025 United States Tariffs on Ruthenium Trade Flows, Cost Structures, Supply Chain Resilience, and Strategic Manufacturer Responses

In early 2025, the United States introduced additional duties averaging fifteen percent on imported ruthenium under its critical minerals strategy, aiming to incentivize domestic refining capacity and safeguard supply chain security. As a result, landed costs for foreign-sourced materials have risen markedly, compelling downstream manufacturers to adjust procurement strategies and renegotiate long-term supply contracts to mitigate price volatility. These measures have encouraged several key players to secure multi-year agreements with domestic recyclers and metal processors, effectively hedging against further tariff escalations.

The cumulative impact of these tariffs extends beyond cost inflation; it has reoriented trade patterns and stimulated investment in local recovery infrastructure. Domestic refining projects, previously delayed by lower import costs, are now moving forward with renewed urgency, supported by policy-driven incentives. While some end-use industries face short-term budgetary pressures, the evolving landscape offers the prospect of a more resilient, vertically integrated domestic supply chain that can reduce exposure to external shocks and foster long-term stability.

Delineating Demand Patterns across Ruthenium Applications, End-Use Industries, Product Types, Purity Grades, Forms, and Sales Channels to Unveil Market Dynamics

The ruthenium market’s complexity becomes apparent when exploring segmentation by application, end-use industry, product type, purity grade, form, and sales channel. Across chemical catalysts, both automotive and broader industrial processes rely on ruthenium’s exceptional catalytic properties. In the electrical contacts domain, precision connectors and robust switches benefit from its conductivity and durability, whereas decorative and industrial electroplating applications demand tailored plating solutions. Meanwhile, the investment segment spans bullion acquisitions and collectible coin offerings, and jewelry artisans incorporate ruthenium into everything from delicate necklaces to custom-crafted rings, underscoring its aesthetic and functional versatility.

Further segmentation underscores nuanced market dynamics. Key end-use industries-ranging from automotive and chemical manufacturing to consumer and industrial electronics as well as costume and fine jewelry-exert distinct requirements on supply specifications. Product forms such as double-sided or single-sided coated sheets, pellets, coarse and fine powders, and thick or thin wires align with diverse processing workflows. Purity grades extend from technical and industrial specifications to ultra-high purities surpassing 99.99 percent. Channels of distribution, whether through direct sales, authorized or independent distributors, or digital platforms hosted on manufacturer websites or general marketplaces, complete the landscape, driving segmentation strategies that optimize reach and customer engagement.

This comprehensive research report categorizes the Ruthenium market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Product Type

- Source

- Form

- Processing Technology

- End Use Industry

- Sales Channel

Highlighting Critical Variations in Regional Ruthenium Consumption, Market Drivers, and Strategic Priorities across Americas, EMEA, and Asia-Pacific Hubs

In the Americas region, established refining and recycling networks in the United States and Canada underpin steady growth in industrial catalysts for automotive emission control and chemical processing. Decorative electroplating and bullion investment demand is rising in Latin America, reflecting broader economic expansion and increasing interest in precious metals as asset classes. Robust downstream manufacturing capabilities, coupled with supportive trade policies, have fostered a dynamic market characterized by both mature supply chains and emerging niche applications.

Across Europe, the Middle East, and Africa, stringent European regulations drive innovation in low-carbon sourcing and circular economy models, while Middle Eastern energy advantages support large-scale slag recovery operations. Africa’s recycling infrastructure, though nascent, is progressively strengthening through international partnerships aimed at responsible sourcing and supply chain transparency. Together, these EMEA dynamics balance regulatory rigor with strategic resource development, positioning the region as a center for sustainable ruthenium processing and distribution.

This comprehensive research report examines key regions that drive the evolution of the Ruthenium market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Profiling Leading Ruthenium Market Players and Their Strategic Initiatives in Production, Innovation, Sustainability, and Global Expansion Tactics

Market leaders are deploying diverse strategies to secure competitive advantage in the ruthenium landscape. Major producers have expanded capacity through targeted investments in high-purity refining and advanced recycling facilities. Partnerships between primary metal processors and electronics manufacturers have emerged to develop application-specific alloys, while joint ventures with recycling specialists ensure access to secondary raw materials. Companies are also integrating digital traceability solutions to bolster supply chain transparency and meet evolving ESG standards.

Emerging entrants, including specialty chemical firms and innovative metalwork startups, are making inroads by focusing on niche segments such as ultra-high purity powders and precision-engineered coated sheets. These challengers often employ agile R&D approaches to shorten product development cycles and address specialized end-use requirements. As competition intensifies, the ability to combine operational scale with technical differentiation will be pivotal in defining market leadership and driving long-term growth trajectories.

This comprehensive research report delivers an in-depth overview of the principal market players in the Ruthenium market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- Advanced BioMatrix by Bico Group

- American Elements

- Anglo American Platinum Ltd.

- BASF SE

- China Rhenium Co.,Ltd.

- Clariant AG

- Colonial Metals Inc. by Ames Goldsmith Corporation

- Dowa Holdings Co., Ltd.

- FURUYA METAL Co., Ltd.

- Heraeus Group

- Impala Platinum Holdings Limited

- Indian Platinum Pvt. Ltd.

- Johnson Matthey plc

- KGHM Polska Miedź S.A.

- Lonmin Plc

- Materion Corporation

- N.E. CHEMCAT CORPORATION

- Norilsk Nickel Group

- Northam Platinum Limited

- Otto Chemie Pvt. Ltd.

- RICCA Chemical Company

- Shaanxi Kaida Chemical Co., Ltd.

- Sibanye Stillwater Limited

- Sumitomo Metal Mining Co., Ltd.

- TANAKA PRECIOUS METAL GROUP Co., Ltd.

- Umicore N.V.

- Xi'an Function Material Group Co., Ltd.

Strategic Imperatives for Industry Leaders to Bolster Ruthenium Supply Chains, Foster Innovation, Embrace Sustainability, and Seize Emerging Growth Opportunities

To navigate the evolving ruthenium landscape, industry leaders should prioritize supply chain diversification by cultivating relationships with multiple domestic and international recyclers. Investing in scrap recovery and on-site refining capabilities can insulate operations from tariff-driven cost fluctuations, while strengthening ties with end-use partners ensures alignment on quality and performance requirements. Simultaneously, organizations must leverage digital platforms to enhance supply visibility and compliance, enabling real-time tracking of material origin and purity across complex logistics networks.

Innovation remains a critical driver of competitive differentiation. Developing proprietary ruthenium-enhanced alloys for emerging applications-such as next-generation data storage media or advanced catalyst systems for green hydrogen production-can unlock premium pricing and high-margin opportunities. Engaging collaboratively with regulatory bodies to shape sustainable sourcing frameworks and certification standards will further solidify market positioning. By executing these recommendations in concert, stakeholders can fortify resilience, accelerate growth, and secure leadership in the ruthenium sector.

Ensuring Research Rigor through a Comprehensive Methodology Involving Quantitative Data Analysis, Expert Interviews, and Multi-Source Validation Frameworks

This research employs a rigorous, multi-stage methodology to ensure the accuracy and reliability of findings. Initially, comprehensive secondary data review was conducted, drawing on publicly available trade databases, government policy documents, and industry white papers. Data triangulation techniques validated key inputs by cross-referencing multiple sources, while analytical frameworks were applied to identify pivotal market drivers and risk factors.

Primary research activities complemented secondary insights through structured interviews with senior executives, technical experts, and downstream users across the ruthenium ecosystem. Qualitative feedback was synthesized with quantitative analyses to refine segmentation models and regional assessments. The final phase involved expert panel validation to corroborate interpretations and ensure that conclusions reflect real-world market conditions and emerging trends.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Ruthenium market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Ruthenium Market, by Product Type

- Ruthenium Market, by Source

- Ruthenium Market, by Form

- Ruthenium Market, by Processing Technology

- Ruthenium Market, by End Use Industry

- Ruthenium Market, by Sales Channel

- Ruthenium Market, by Region

- Ruthenium Market, by Group

- Ruthenium Market, by Country

- United States Ruthenium Market

- China Ruthenium Market

- Competitive Landscape

- List of Figures [Total: 18]

- List of Tables [Total: 1113 ]

Summarizing Ruthenium Market Opportunities, Challenges, and Strategic Insights to Empower Decision-Makers Across the Precious Metals Ecosystem

In summary, the ruthenium market is undergoing a period of significant transformation driven by technological advancements, regulatory pressures, and strategic policy interventions such as the 2025 United States tariffs. Segmentation analysis reveals a highly multifaceted landscape, with diverse applications ranging from advanced catalysis to precision electroplating and investment instruments. Regional dynamics underscore the importance of tailored strategies, as consumption patterns and sourcing structures vary markedly between the Americas, EMEA, and Asia-Pacific.

Moving forward, stakeholders who embrace supply chain diversification, invest in circular economy initiatives, and innovate application-specific solutions will be best positioned to capitalize on emerging opportunities. Strong partnerships with recycling specialists, engagement with policy-makers, and adoption of digital traceability platforms will further reinforce competitive advantage. These strategic insights lay the groundwork for informed decision-making, enabling organizations to navigate market complexities and drive sustained growth in the evolving ruthenium ecosystem.

Engage with Ketan Rohom to Access In-Depth Ruthenium Market Intelligence and Unlock Strategic Opportunities through a Comprehensive Research Report

If you are ready to gain a comprehensive understanding of the ruthenium market’s intricate dynamics and leverage strategic insights for your organization, reach out to Ketan Rohom (Associate Director, Sales & Marketing) to secure the full market research report. This in-depth analysis will equip you with actionable intelligence on supply chain resilience, segmentation strategies, regional opportunities, and competitive benchmarking tailored to elevate your business decisions.

Act now to unlock expert perspectives on emerging trends, tariff impacts, and industry best practices that will empower you to navigate market complexities and capitalize on growth prospects. Engage with Ketan Rohom today to access the complete report and drive your ruthenium initiatives forward with confidence.

- How big is the Ruthenium Market?

- What is the Ruthenium Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?