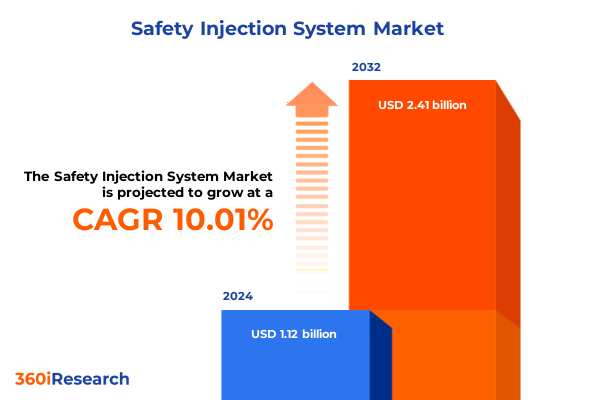

The Safety Injection System Market size was estimated at USD 1.21 billion in 2025 and expected to reach USD 1.34 billion in 2026, at a CAGR of 10.30% to reach USD 2.41 billion by 2032.

Pivotal Role of Safety Injection Systems in Enhancing Nuclear Reactor Safety Amid Evolving Global Energy Landscapes and Regulatory Demands

The evolution of nuclear energy infrastructure and the heightened scrutiny of safety regulations have underscored the critical function of Safety Injection Systems (SIS) within pressurized water reactors (PWRs) and other advanced designs. As essential components of the Emergency Core Cooling System (ECCS), SIS ensure rapid replenishment of reactor coolant inventory during loss-of-coolant accidents (LOCAs) by leveraging both high-pressure injection trains and passive safety features. Recent unreliability evaluations of High-Pressure Safety Injection (HPSI) systems across 62 U.S. commercial reactors demonstrated consistent performance trends over two decades, affirming the technological maturity of these systems but also highlighting areas for reliability enhancements as new reactor designs emerge.

Against the backdrop of expanding nuclear power capacity, industry stakeholders are now challenged to integrate innovative safety architectures-combining active, hybrid, and passive injection strategies-into both evolutionary large reactors and first-of-a-kind designs. In response, regulatory bodies have convened international forums to harmonize safety standards for Generation III+ and Generation IV technologies, ensuring that both legacy plants and emerging small modular reactors meet stringent defense-in-depth criteria. These global regulatory dialogues have catalyzed R&D investments into accumulator technologies, core makeup tanks, and in-containment refueling water storage tanks that form the backbone of modern SIS configurations.

Revolutionary Adoption of Passive and Hybrid Injection Architectures Coupled with Digital and Modular Innovations Shaping Future Nuclear Safety

The nuclear safety landscape has undergone transformative shifts driven by the advent of passive safety philosophies, digital instrumentation, and modular construction principles. Passive Safety Systems, as exemplified by the Westinghouse AP1000 design, now harness natural forces such as gravity and condensation to maintain core cooling for up to 72 hours without operator intervention. This passive approach, validated through rigorous U.S. NRC certification, has set a new benchmark in accident mitigation by reducing reliance on off-site power and active machinery.

Concurrently, the rise of Small Modular Reactors and non-water-cooled technologies has prompted the IAEA to assess the applicability of existing safety standards to these novel configurations. Its Safety Report No. 123 identified critical gaps in areas such as design extension conditions and human–system interface provisions, underscoring the need to expand regulatory frameworks to fully encompass passive injection strategies and modular factory-based construction models. These shifts are fundamentally altering how engineering teams and regulators conceptualize defense-in-depth, accelerating the adoption of hybrid injection schemes that blend high-pressure pumps with passive accumulator trains and in-containment storage solutions.

Increasing U.S. Steel and Aluminum Tariffs in 2025 Intensify Cost Pressures and Drive Supply Chain Resilience Strategies for Safety Injection Components

In 2025, the United States undertook sweeping tariff actions on steel and aluminum-a core material input for safety injection system components-under Section 232 of the Trade Expansion Act. On March 12, punitive 25% tariffs on all steel and aluminum imports were implemented, ending prior country-specific exemptions. This abrupt cost escalation disrupted global supply chains and prompted manufacturers of pressure vessels, accumulators, and piping assemblies to seek domestic sourcing alternatives or absorb increased material costs into project budgets.

Further compounding these challenges, on June 4, 2025, tariffs on steel and aluminum imports were elevated from 25% to 50%, intensifying cost pressures for safety injection system manufacturers and nuclear operators alike. The rate for U.K. imports remained at 25% pending the Economic Prosperity Deal, creating asymmetrical trade conditions that favored certain partners. These tariff escalations have reverberated through project schedules and capital expenditure forecasts, compelling industry participants to reassess supplier agreements, explore material substitution strategies, and strengthen supply chain resilience through localization initiatives.

Insight into Tailored Safety Injection Solutions Driven by System Sophistication, Application Demands, and Diverse End-User Requirements

Segmentation by System Type reveals that while active safety injection trains with high‐pressure pumps continue to serve as a foundation for emergency response, hybrid designs are gaining traction by combining mechanical injection with passive accumulator injection phases. This layered approach optimizes response time and redundancy, catering to operators seeking to balance proven performance with innovative passive features. Meanwhile, purely passive injection solutions are emerging in next‐generation SMRs and experimental reactors, where simplicity and extended grace periods without power or human intervention are prioritized.

Application-driven segmentation highlights the distinct requirements across Defense installations, Industrial Facilities, Nuclear Power Plants, and Research Reactors. Defense and industrial end users emphasize compact, rapidly deployable injection modules, while commercial nuclear plants focus on large‐scale accumulator capacities and automated depressurization sequences. Research reactors, with their varied cooling loops and experimental fuel geometries, demand customizable injection architectures capable of handling diverse transient scenarios.

When considering End User differentiation, Government Agencies and Research Institutions require transparency in system diagnostics and modularity for multiple reactor types, whereas Industrial Operators and Power Generation Companies prioritize durability and serviceability. Within Power Generation Companies, the diversity of reactor technologies-from Boiling Water Reactors and Pressurized Water Reactors to Fast Breeder and Heavy Water Reactors-drives a nuanced approach to core makeup tank sizing, accumulator pressure profiles, and emergency recirculation pathways.

This comprehensive research report categorizes the Safety Injection System market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Reactor Type

- System Type

- Installation & Commissioning

- End User

Dynamic Regional Growth Patterns Boost Safety Injection Advancements from North America to Europe, Middle East, Africa and Across Asia-Pacific

In the Americas, regulatory momentum and life-extension programs continue to underpin demand for advanced injection modules. The U.S. nuclear fleet’s reliance on HPSI systems is complemented by Canada’s robust refurbishment initiatives in Ontario, where CANDU reactor life extensions leverage renewed accumulator and injection pump arrays to meet environmental targets at reduced lifecycle costs.

Within Europe, Middle East & Africa, ambitious new builds and strategic modernizations are reshaping safety injection priorities. The U.K.’s Hinkley Point C project, despite cost escalations and schedule shifts, underscores the scale of safety injection integration, encompassing miles of pipeline and multiple independent injection trains. French EPR and Finnish Olkiluoto deployments, together with Middle Eastern APR1400 installations at Barakah, are catalyzing regional supply chain expansions and post-2025 procurement realignments.

Asia-Pacific continues to lead in capacity growth and regulatory strengthening, with China’s CAP series and India’s expansion of VVER‐1200 units driving large-scale accumulator manufacturing and fluidic device innovations. Complementing these deployments, the IAEA’s Regulatory Infrastructure Development Project for Asia and the Pacific initiated in December 2024 enhances harmonization of safety injection protocols, fostering regional collaboration to ensure consistent performance metrics across diverse reactor types.

This comprehensive research report examines key regions that drive the evolution of the Safety Injection System market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Frontline Innovations by Westinghouse, Framatome, KHNP, and Rosatom Driving Next-Generation Safety Injection System Performance

Leading the passive safety revolution, Westinghouse’s AP1000 features gravity-driven Core Makeup Tanks and accumulators delivering sustained injection without AC power, backed by Design Certification from the U.S. NRC. The AP1000’s in-containment refueling water storage tank and automatic depressurization sequences exemplify simplified safety architectures that reduce seismic building volumes and maintenance complexity.

Framatome’s EU-APWR deploys a compact four-train Direct Vessel Injection topology and advanced accumulators equipped with passive flow dampers, enabling high initial flow followed by regulated core reflooding without conventional low-head injection pumps. This streamlined design supports single-failure criteria and integrates seamlessly into Generation III+ reactor platforms.

Korea Hydro & Nuclear Power’s APR1400 combines an in-containment refueling water storage tank with a first-of-its-kind fluidic device in its safety injection tanks, optimizing flow rates during blowdown and long-term reflood phases. The APR1400’s comprehensive PRA validation and digitalized instrumentation systems further strengthen its safety injection reliability, earning international certifications from KINS, FANR, and the U.S. NRC.

Rosatom’s VVER-1200 platforms incorporate digital Multi-D AI analytics and advanced fuel flow control mechanisms, facilitating predictive maintenance and enhanced injection system diagnostics. These innovations, while subject to export constraints, highlight emerging synergies between digital transformation and safety injection performance in modular reactor exports to Bangladesh, Turkey, and beyond.

This comprehensive research report delivers an in-depth overview of the principal market players in the Safety Injection System market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- Andritz AG

- Babcock & Wilcox Nuclear Energy, Inc.

- Celeros Flow Technology, LLC

- CNNC Sufa Technology Industry Co., Ltd.

- Crane Nuclear, Inc.

- Curtiss-Wright Corporation

- Doosan Enerbility Co., Ltd.

- Ebara Corporation

- Emerson Electric Co.

- Flowserve Corporation

- Framatome SA

- GE Hitachi Nuclear Energy, LLC

- HMS Group PJSC

- Jiangsu Shentong Valve Co., Ltd.

- KSB SE & Co. KGaA

- Mitsubishi Heavy Industries, Ltd.

- Rolls-Royce plc

- Shanghai Electric-KSB Nuclear Pumps & Valves Co., Ltd.

- Toshiba Energy Systems & Solutions Corporation

- Velan Inc.

- Westinghouse Electric Company LLC

Drive Market Leadership by Embracing Passive Injection Alliances, Digital Twins, Regulatory Collaboration, and Material Diversification

Industry leaders should pursue strategic partnerships with passive safety technology providers to accelerate deployment of gravity-driven core makeup systems and condensed automatic depressurization units. Establishing joint ventures with accumulator manufacturers can optimize design customization and localize production to mitigate tariff-driven material cost volatility.

Adoption of digital twin frameworks and AI-driven monitoring-leveraging analytics platforms interoperable with SIS diagnostics-can enhance predictive maintenance, reduce unplanned outages, and extend component lifespan. Integrating these solutions within existing operator control rooms fosters real-time decision support, aligns with evolving regulatory expectations for digital safety reporting, and elevates operational resilience.

Leverage cross-sector forums and IAEA-sponsored initiatives to standardize passive injection performance metrics and harmonize defense-in-depth protocols across reactor classes. By contributing to working groups on design extension conditions and human–system interface standards, organizations can shape future regulatory guidance and preemptively address gaps identified for emerging reactor designs.

Finally, diversify material sourcing by engaging with specialty steel and aluminum producers outside traditional supply chains, and explore advanced composite alternatives for accumulator and piping assemblies. Such material innovation partnerships will buffer against further tariff disruptions, reduce lead times, and enhance corrosion resistance under extended service conditions.

Comprehensive Triangulation of Industry Reports, Regulatory Data, and Expert Inputs Underpins Rigor in Safety Injection System Analysis

This analysis synthesizes primary and secondary research methodologies to ensure robust and unbiased insights. Unreliability evaluations of High-Pressure Safety Injection systems were derived from SPAR models and industry data spanning 1998–2022 extracted from the Institute of Nuclear Power Operations’ IRIS database, as detailed in the Idaho National Laboratory’s technical report. These quantitative assessments were augmented by reactor performance statistics obtained through the IAEA’s Power Reactor Information System annual publications, providing comprehensive operating experience metrics and design characteristic dashboards.

Expert interviews with technical leads from reactor vendors, utility safety managers, and regulatory authorities informed qualitative perspectives on passive safety adoption, digital integration, and supply chain resilience. Publicly available fact sheets, white papers, and certification documents-such as U.S. NRC NUREG reports and White House proclamations on trade measures-provided authoritative context for tariff impacts. All data points were triangulated through cross-referencing proprietary interviews, open-source literature, and validated news reports to deliver a coherent, fact-based market intelligence narrative.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Safety Injection System market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Safety Injection System Market, by Reactor Type

- Safety Injection System Market, by System Type

- Safety Injection System Market, by Installation & Commissioning

- Safety Injection System Market, by End User

- Safety Injection System Market, by Region

- Safety Injection System Market, by Group

- Safety Injection System Market, by Country

- United States Safety Injection System Market

- China Safety Injection System Market

- Competitive Landscape

- List of Figures [Total: 16]

- List of Tables [Total: 795 ]

Strategic Synthesis Confirms Passive-Active Hybrid Designs and Supply Chain Resilience as Pillars of Future Safety Injection Excellence

The convergence of passive safety paradigms, digital innovation, and shifting trade dynamics has reshaped the strategic contours of the global safety injection system market. As nuclear operators chart pathways toward extended plant lifetimes and new build deployments, they must integrate gravity-driven core makeup, advanced accumulators, and in-containment storage alongside automated depressurization sequences.

Simultaneously, tariff-induced material cost volatility and regional supply realignments necessitate localization strategies and alliances with alternative steel and aluminum suppliers. By deploying AI-enabled diagnostics and engaging proactively in regulatory standardization efforts, industry leaders can bolster resilience and drive performance gains. Ultimately, the capacity to blend proven active injection trains with resilient passive architectures will determine competitive differentiation in this critical safety segment, ensuring robust defense-in-depth for both current fleets and next-generation nuclear technologies.

Unlock Bespoke Safety Injection System Insights and Drive Strategic Decisions with Our Expert Sales Leadership

To explore how our comprehensive analysis of safety injection system market dynamics can empower your strategic decisions, reach out to Ketan Rohom, Associate Director of Sales & Marketing. With deep expertise in nuclear safety technologies and an unwavering commitment to delivering actionable market intelligence, Ketan can guide you through the report’s key findings, bespoke insights, and tailored opportunities. Connect with Ketan today to learn how this research can support your organization’s innovation roadmap and competitive positioning in the rapidly evolving safety injection systems landscape.

- How big is the Safety Injection System Market?

- What is the Safety Injection System Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?