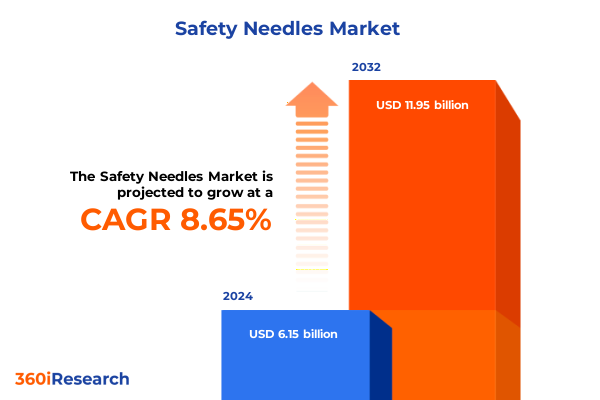

The Safety Needles Market size was estimated at USD 6.67 billion in 2025 and expected to reach USD 7.25 billion in 2026, at a CAGR of 8.67% to reach USD 11.95 billion by 2032.

Setting the Stage with Critical Overview of the Evolving Safety Needle Market Dynamics to Inform Strategic Initiatives and Stakeholder Priorities

The global safety needle market represents a critical convergence of medical innovation, regulatory imperatives, and end-user safety priorities. As healthcare systems worldwide intensify efforts to minimize needlestick injuries and prevent cross-contamination, safety-engineered needles have emerged as an indispensable component of modern clinical practice. This introduction frames the discussion by outlining the primary drivers that have propelled safety needles from niche technologies to standard-of-care solutions.

First, growing awareness of occupational hazards among healthcare professionals has catalyzed demand for devices that integrate passive or active safety mechanisms to shield exposed needles immediately after use. In parallel, patients receiving home-based therapies, including insulin administration, have become more discerning about device ergonomics and risk mitigation features. Concurrently, evolving regulations across major markets have raised the bar for compliance, quintupling the urgency for manufacturers to innovate beyond traditional needle designs.

By setting this context, stakeholders gain a nuanced understanding of the multifaceted dynamics-ranging from clinical best practices to patient empowerment-that collectively underscore the transformative potential of safety needles. This foundational overview lays the groundwork for subsequent sections, which delve deeper into market shifts, tariff impacts, segmentation nuances, regional profiles, competitive landscapes, and actionable recommendations.

Highlighting the Pivotal Technological Innovations and Regulatory Drivers Reshaping Safety Needle Solutions and Market Behavior on a Global Scale

Over the past decade, the safety needle landscape has undergone a remarkable transformation driven by converging technological advances and shifting regulatory landscapes. Innovations in passive safety technology, such as automatic needle retraction, have set new benchmarks for user protection and operational efficiency. Simultaneously, active safety systems that require user engagement to cover the needle tip have become more intuitive, reducing the likelihood of human error. Advances in materials science, including polymer coatings that facilitate smoother insertion and reduce patient discomfort, further underscore how engineering breakthroughs are redefining product expectations.

Regulatory bodies in North America and Europe have extended mandates requiring safety-engineered devices for specific procedures, fueling a wave of product approvals that emphasize both compliance and clinical efficacy. These mandates have not only raised the baseline for device performance but have also prompted harmonization efforts in emerging markets, where local regulatory frameworks are increasingly modeled after international guidelines. As a result, manufacturers are adopting modular design platforms to streamline global approvals and expedite time to market.

Looking ahead, integration with digital health ecosystems-such as connectivity solutions that track needlestick event data-is poised to drive the next frontier of innovation. This emerging intersection of smart device capabilities and traditional cartridge-based designs promises to deliver predictive analytics, enabling healthcare providers to proactively address risk patterns and optimize safety protocols. Such transformative shifts continue to elevate the safety needle market as a dynamic, innovation-driven segment within the broader medical devices arena.

Analyzing the Cumulative Impact of 2025 United States Tariff Policies on the Safety Needle Market Structure Supply Chain and Cost Dynamics

In early 2025, the United States implemented a new tranche of tariffs impacting raw materials and finished medical devices, including safety needles. This policy shift, aimed at bolstering domestic manufacturing, imposed incremental duties on imported stainless steel components, polymer casings, and fully assembled safety needle kits. As these tariffs took effect, manufacturers began to experience direct cost escalations along the supply chain, leading to strategic recalibrations in procurement and production models.

Domestic producers initially benefited from protective price differentials, allowing local capacity expansions and investments in automation without immediate displacement by lower-cost imports. Conversely, companies reliant on cross-border supply chains encountered margin compression and, in some instances, delayed product launches due to spikes in input costs. To mitigate these impacts, several global players accelerated diversification strategies, redirecting sourcing to tariff-exempt jurisdictions and optimizing manufacturing footprints across the Americas.

Moreover, the cumulative impact of these tariffs has extended beyond direct cost considerations. Shifts in inventory management practices emerged as companies adjusted reorder levels to account for longer lead times and potential duty adjustments. Simultaneously, end users-especially hospital networks with tight budgets-have begun negotiating value-based contracts that link device performance to overall procedural cost savings. This evolving landscape underscores that 2025 tariff policies have introduced a complex interplay of cost, compliance, and strategic sourcing imperatives that continue to shape market trajectories.

Diving into Essential Product Material Application and End User Segmentation Insights to Illuminate Growth Pathways for Safety Needle Solutions

Segmentation analysis reveals nuanced growth patterns and evolving user preferences across multiple dimensions. Based on product type, the market comprises devices engineered with active safety shields that require deliberate activation and passive systems that automatically deploy protective barriers. These variations cater to distinct clinical settings, wherein passive mechanisms find favor in high-throughput hospital environments, while active options are preferred in controlled outpatient and home-care scenarios.

Material composition also dictates performance characteristics and cost trade-offs. Metal-based needles remain the standard for their strength and precision, particularly in blood collection procedures where consistency is paramount. In contrast, plastic components are gaining traction for their lightweight profiles and enhanced biocompatibility, especially in applications such as insulin delivery, where patient comfort and portability are critical considerations.

The application spectrum further segments the market into blood collection, insulin delivery, and vaccination. Blood collection procedures demand ultra-sharp bevels and robust hub designs to minimize hemolysis and patient discomfort. Insulin delivery devices prioritize miniaturization, ease of use, and discreet form factors tailored for at-home administration. Vaccination applications, whether in mass immunization campaigns or routine clinical settings, emphasize sterile packaging, simplified activation steps, and prefilled formats to streamline large-volume throughput while adhering to stringent cold-chain requirements.

End users encompass clinics, home care settings, and hospitals, each with unique purchasing criteria. Clinics prioritize cost-effective solutions that balance safety features with budget constraints. Home care patients require devices that combine intuitive design with minimal learning curves. Hospitals, with their high procedural volumes, demand compliance-driven, standardized protocols supported by vendor training programs and bulk supply agreements.

Distribution channels span hospital pharmacies, online platforms, and retail pharmacy outlets. Within the online category, company-owned websites offer direct-to-consumer engagement and bundled service packages, while third-party platforms provide broader accessibility through integrated e-commerce marketplaces. This diverse channel landscape underpins a multi-faceted go-to-market strategy that aligns product variants with the purchasing behaviors of targeted end-user segments.

This comprehensive research report categorizes the Safety Needles market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Product Type

- Material

- Distribution Channel

- Application

- End User

Unpacking Regional Market Characteristics Across Americas Europe Middle East Africa and Asia Pacific with Focus on Growth Patterns and Adoption Trends

Regional insights highlight divergent adoption rates and market dynamics across three principal geographies. In the Americas, robust healthcare infrastructure and stringent occupational safety regulations have propelled early uptake of advanced safety needle systems. North American market leaders continually pilot next-generation devices in academic medical centers, while Latin American regions are gradually upgrading legacy stocks through government-supported tenders and public-private partnerships.

Europe, the Middle East, and Africa collectively exhibit a heterogeneous landscape. Western European countries benefit from unified Medical Device Regulations that foster rapid approval cycles and cross-border interoperability. In contrast, Middle Eastern markets are accelerating investments in healthcare modernization initiatives, where advisory bodies often incentivize local manufacturing collaborations. Sub-Saharan Africa, though constrained by resource limitations, has seen targeted donor-driven programs that facilitate access to safety needle kits in high-risk environments, such as HIV and tuberculosis screening centers.

The Asia-Pacific region stands out for its dynamic growth trajectories. In East Asia, high-volume production capabilities and a mature medical device ecosystem have enabled rapid scalability of new safety technologies. Southeast Asian nations are experiencing increasing demand driven by expanding private healthcare segments and government mandates aimed at reducing needlestick injuries among frontline workers. Meanwhile, South Asia’s large patient population continues to present both challenges and opportunities, as affordability considerations guide the selection of entry-level safety devices alongside premium offerings.

Collectively, these regional variations underscore the importance of tailored market entry strategies, regulatory navigation, and partnership ecosystems that can adapt to local healthcare priorities and funding mechanisms.

This comprehensive research report examines key regions that drive the evolution of the Safety Needles market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Profiling the Competitive Landscape with Detailed Overviews of Leading Innovators Strategic Collaborations and Product Differentiation Approaches

The competitive landscape is defined by a blend of established medical device conglomerates and specialized innovators. Leading global device manufacturers continue to invest heavily in next-generation safety mechanisms, leveraging in-house R&D centers to optimize needle geometry, safety shielding efficiency, and user ergonomics. Collaborative ventures with material science firms have yielded breakthroughs in polymer-metal hybrid constructions, offering enhanced durability without sacrificing biocompatibility.

Mid-sized companies differentiate through niche focus areas, such as prefilled vaccination needle assemblies or integrated blood collection sets with on-board safety compartments. These players often adopt agile operating models, enabling rapid prototyping and pilot deployments in partnership with regional healthcare systems. As a result, the market features a rich tapestry of offerings, from single-use autoneedles to multi-event safety syringes designed for sustained clinical programs.

Strategic alliances between device firms and health technology startups are increasingly common, driven by mutual objectives to integrate digital monitoring features. By embedding near-field communication tags or RFID chips into device hubs, companies can deliver end-to-end traceability solutions that support inventory management and safety compliance reporting. Larger manufacturers, in turn, secure distribution rights for these smart-enabled products, reinforcing their portfolios with data-driven differentiators.

Recent mergers and acquisitions have further consolidated capabilities, with major players acquiring specialty safety needle manufacturers to expand their presence in key regional markets. Such transactions catalyze cross-pollination of best practices and accelerate regulatory submissions across multiple jurisdictions. This evolving competitive ecosystem underscores that both scale and specialization are critical for sustaining growth and responding to rapid shifts in clinical and regulatory landscapes.

This comprehensive research report delivers an in-depth overview of the principal market players in the Safety Needles market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- AdvaCare Pharma

- Argon Medical Devices, Inc.

- Artsana Group

- B. Braun SE

- Becton, Dickinson and Company

- Boston Scientific Corporation

- Cardinal Health, Inc.

- Cartel Healthcare Pvt. Ltd.

- Eli Lilly and Company

- Gerresheimer AG

- Hindustan Syringes and Medical Devices Ltd.

- Medtronic PLC

- Merit Medical Systems, Inc.

- Nanchang Kindly(KDL) Medical Technology Co., Ltd.

- Nipro Corporation

- Novo Nordisk A/S

- Retractable Technologies, Inc.

- Retrago Technologies

- Smiths Medical, Inc.

- Socorex Isba SA

- Sol-Millennium Medical Inc.

- Terumo Europe NV

- UltiMed, Inc.

Presenting Actionable Strategic Recommendations to Enable Industry Leaders to Navigate Market Complexities Accelerate Adoption and Maximize Innovation

To navigate the evolving safety needle market, industry leaders should prioritize integrated innovation approaches that balance engineering excellence with end-user experience. Cultivating collaborative R&D partnerships with materials experts can unlock next-generation designs that enhance both safety and usability. Concurrently, embedding digital health features, such as usage tracking and compliance analytics, will differentiate offerings and support value-based contracting models with large healthcare systems.

Operationally, manufacturers are advised to evaluate their global sourcing networks in light of recent tariff changes. Establishing alternative supply routes and nearshoring key production processes can mitigate cost volatility while preserving agility. Aligning procurement strategies with long-term regulatory forecasts, rather than reactive cost containment, ensures that product pipelines remain compliant and resilient to policy shifts.

On the commercial front, segment-specific value propositions are paramount. Tailoring messaging that addresses the unique priorities of clinics, hospitals, and home care caregivers will drive stronger engagement. Providing modular training programs and digital learning modules for hospital staff, as well as simplified instructional content for patients administering home injections, amplifies product uptake and fosters brand loyalty.

From a geographic perspective, forging local partnerships in high-potential markets can accelerate market entry and regulatory acceptance. Engaging with government agencies, professional associations, and non-governmental organizations to co-develop safety initiatives enhances credibility and broadens distribution reach. Through these strategic imperatives, industry leaders can effectively chart a path toward sustainable growth and elevated patient safety outcomes.

Detailing the Rigorous Research Methodology Employed to Ensure Data Integrity Comprehensive Analysis and Robust Validation of Safety Needle Market Findings

This report’s findings are underpinned by a rigorous research methodology designed to ensure comprehensive coverage and analytical integrity. Primary research comprised in-depth interviews with key stakeholders, including clinical procurement officers, frontline healthcare professionals, materials scientists, and regulatory affairs experts. These interviews elucidated pressing challenges, such as sterilization protocols and ergonomic design preferences, providing a granular understanding of user-driven innovation priorities.

Secondary research involved a thorough review of published regulatory frameworks, trade policy announcements, and peer-reviewed clinical studies to contextualize market shifts. Detailed patent landscaping and technology pipeline assessments were conducted to identify emergent safety mechanisms and digital health integrations. Furthermore, supply chain analyses mapped the flow of critical inputs from raw material suppliers to finished device manufacturers, highlighting cost drivers and lead time considerations.

Quantitative validation was achieved through surveys of healthcare institutions across target regions, capturing data on procurement volumes, safety incident reduction metrics, and adoption barriers. Rigorous triangulation of these primary and secondary inputs ensured that insights are both statistically robust and reflective of on-the-ground realities. Finally, executive workshops synthesized findings into scenario-based models, enabling stakeholders to stress-test strategic options under varying market, regulatory, and tariff environments.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Safety Needles market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Safety Needles Market, by Product Type

- Safety Needles Market, by Material

- Safety Needles Market, by Distribution Channel

- Safety Needles Market, by Application

- Safety Needles Market, by End User

- Safety Needles Market, by Region

- Safety Needles Market, by Group

- Safety Needles Market, by Country

- United States Safety Needles Market

- China Safety Needles Market

- Competitive Landscape

- List of Figures [Total: 17]

- List of Tables [Total: 1113 ]

Summarizing Core Insights and Implications to Provide a Concise Roadmap for Stakeholders Seeking to Capitalize on Emerging Opportunities in Safety Needle Solutions

This executive summary has articulated the confluence of technological innovation, regulatory evolution, and market segmentation shaping the safety needle market’s trajectory. By examining the transformative shifts in device design, the multifaceted impact of 2025 United States tariff policies, and the granular insights across product, material, application, end-user, and distribution dimensions, stakeholders are equipped with a nuanced perspective on growth drivers and challenges.

Regional analysis across the Americas, EMEA, and Asia-Pacific underscores the necessity of customized market entry strategies that reconcile global best practices with local healthcare priorities. Concurrently, profiling leading companies reveals a competitive environment defined by both scale-driven consolidation and specialized niche excellence, bolstered by strategic alliances and digital health integrations.

Actionable recommendations highlight the importance of synergy between R&D collaborations, diversified sourcing strategies, and segmented go-to-market approaches. Combined with our thorough research methodology, these insights form a cohesive roadmap for industry participants aiming to drive innovation, enhance safety outcomes, and secure market leadership.

Inviting Decision Makers to Collaborate for Exclusive Access and Strategic Advantages Through Personalized Consultation and Premium Market Research

Engaging directly with Ketan Rohom, Associate Director of Sales & Marketing, will grant your team privileged access to in-depth competitive intelligence and tailored strategic insights. By partnering with an expert who intimately understands the evolving safety needle landscape, decision makers can leverage unparalleled guidance to refine product positioning, optimize market entry strategies, and accelerate adoption among key stakeholders. This personalized consultation ensures that your organization remains at the forefront of regulatory compliance, emerging technological advances, and distribution innovations that shape the market’s future trajectory. Secure your copy of the full market research report today to unlock proprietary data visualizations, executive briefings, and scenario-driven analyses designed to support critical investment decisions and drive sustainable growth across product lines.

- How big is the Safety Needles Market?

- What is the Safety Needles Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?