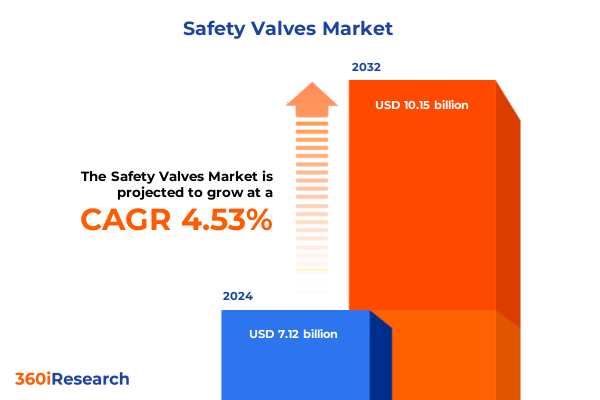

The Safety Valves Market size was estimated at USD 7.45 billion in 2025 and expected to reach USD 7.79 billion in 2026, at a CAGR of 5.93% to reach USD 11.15 billion by 2032.

A concise strategic overview revealing why safety valves now dominate cross-functional sourcing, compliance, and reliability conversations across industrial operators

The pressure-protection ecosystem for industrial assets sits at the intersection of engineering discipline, regulatory stewardship, and commercial supply-chain complexity. Modern safety valves-spanning spring-loaded direct-acting devices to pilot-operated systems-remain the final safeguard against overpressure events in processes across energy, chemical, and food manufacturing environments. Given their safety-critical role, these components are not commodity parts; their selection, installation, testing, and service all require coordinated competence across engineering, procurement, and reliability teams.

Against a backdrop of accelerating digital adoption and heightened trade policy volatility, stakeholders must balance lifecycle costs with demonstrable compliance to global standards. Operators are recalibrating sourcing practices, increasing emphasis on traceable materials, and demanding deeper evidence of conformity to industry codes. As a result, commercial decisions about safety valves are moving beyond unit price: they increasingly reflect total cost of ownership, supplier transparency, and the ability to integrate valves into predictive-maintenance ecosystems without compromising functional safety. In short, procurement and engineering leaders are now co-owning valve-sourcing strategies to protect processes, capital, and reputations.

How digitalization, advanced materials, and recent trade policy shifts are converging to fundamentally transform procurement, maintenance, and lifecycle economics of safety valves

The industry is undergoing transformative shifts driven by three converging forces: digital instrumentation, material and service specialization, and policy-driven supply-chain reorientation. Digital valve controllers, embedded sensors, and cloud-enabled diagnostics have migrated from pilot projects into mainstream asset-management practices, enabling condition-based maintenance programs that were previously impractical for distributed fleets. Vendors are packaging valve hardware with software tools that deliver health indices, recommended corrective actions, and seamless integration into distributed control systems, reshaping how operators budget for spare parts, labor, and outage planning. These connected capabilities are changing inspection cadences and raising expectations for remote diagnostics and secure data flows, especially in hazardous or geographically dispersed sites.

Concurrently, material science and service models have matured to address more demanding media and environmental objectives. New alloy and stainless-steel formulations, cryogenic-capable designs, and hydrogen-compatible materials are moving from niche to necessary in projects that touch low-carbon fuels, LNG, and hydrogen-ready power generation. As operators adopt higher-pressure service and alternative fuels, valve designs and maintenance protocols must be reviewed for embrittlement, seal integrity, and long-term reliability in novel chemistries. At the same time, aftermarket service offerings and lifecycle programs are differentiating vendors; companies that combine certified parts with digital monitoring and rapid local service capabilities are translating reliability into recurring revenue streams.

Finally, trade and industrial policy have forced rapid reassessment of supplier footprints and procurement resiliency. Recent U.S. trade actions affecting steel and aluminum have reintroduced tariffs and removed many exemptions, prompting domestic buyers and OEMs to review sourcing, requalify suppliers, and document material provenance more rigorously. These policy shifts are tightening margins for some import-dependent channels while creating opportunities for domestic fabricators and vertically integrated suppliers who can validate “melt-and-pour” origins and meet tighter traceability requirements. Together, these technological, materials, and policy vectors are remaking procurement strategies and narrowing the performance differential between product and service-led suppliers.

Clear, practical implications for procurement and engineering teams arising from U.S. 2025 tariff actions that now demand material traceability and supply-chain redesign

The United States’ tariff actions in 2025 have had an outsized, immediate effect on the materials inputs that underpin safety-valve manufacture and distribution. By reasserting broad duties and curtailing previous exclusion processes, policymakers have elevated the cost and administrative burden of importing steel- and aluminum-containing products and their derivative articles. For many buyers, this has meant an urgent need to re-evaluate contract terms, verify country-of-origin documentation, and consider alternative suppliers or domestic sourcing to preserve project timelines.

Market participants are responding in several practical ways. Procurement teams are increasing hold-times for vendor approvals to complete “melt-and-pour” or smelt-and-cast proofing where exemptions are available, while legal and commercial teams are reviewing force‑majeure and price‑adjustment clauses to protect margins in multi-year contracts. Engineers are paying closer attention to material substitution pathways; in some applications, substituting to a different steel grade or alloy that is domestically sourced reduces tariff exposure without sacrificing functional safety, though it may require requalification. At the same time, service providers that maintain local inventories and offer in-country repair or recertification services are gaining negotiating leverage because they reduce import cycles and tariff leakage. These practical responses reflect a broader pattern: trade measures are accelerating localization of critical inputs, elevating suppliers that combine certified materials traceability with responsive aftermarket service offerings.

Actionable segmentation intelligence that links product architecture, pressure class, materials, sizing, connection types, and industry use-cases to streamline valve specification and supplier selection

A useful way to convert complexity into procurement certainty is to align product choices with the technical segmentation that governs specification, certification, and aftermarket support. Product-type decisions center on whether an application requires Direct Acting designs or Pilot Operated technology, and if pilot operation is selected engineers must determine whether single-stage or two-stage pilot systems better match the required modulation and seat tightness under expected service conditions. Pressure-rating classification-High, Medium, or Low-drives body design, material selection, and testing regimes, while material type narrows candidate suppliers to those who can validate alloy, carbon steel, or stainless-steel compositions for the expected temperature and media. Size selection-up to 2 inch, 2 to 4 inch, or above 4 inch-intersects with connection standards and likely dictates whether flanged, screwed, socket-weld, or welded end connections are appropriate for the piping system and maintenance model. End-use industry requirements are the final filter: chemical and petrochemical facilities emphasize corrosion resistance and compliance with API/ASME sizing and installation practices; food and beverage operators prioritize hygienic materials and low-emission tightness; oil and gas projects demand high-pressure-rated components and robust qualifications for offshore and cryogenic service; and power-generation assets often require ASME-certified valves with documented testing history. By translating these segmentation layers into procurement checklists and supplier scorecards, teams can reduce ambiguity in tendering, accelerate qualification of replacement parts, and ensure that lifecycle support contracts match the technical profile of each installed valve.

This comprehensive research report categorizes the Safety Valves market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Product Type

- Pressure Rating

- Material Type

- Size

- Connection Type

- End Use Industry

Distinct regional drivers across the Americas, Europe Middle East & Africa, and Asia-Pacific that determine sourcing, compliance, and aftermarket investment priorities for safety valves

Regional dynamics are shaping where engineering investment and inventory capacity will be concentrated going forward. In the Americas, near‑term activity is influenced by regulatory shifts, LNG project ramp-ups, and a durable aftermarket need driven by a large installed base of legacy assets. The growth in liquefied natural gas exports and associated midstream and downstream projects creates concentrated demand for high-pressure relief devices and reliable local service networks; operators and integrators in the region are prioritizing traceable supply chains and domestic repair capacity to shorten lead times and mitigate trade-policy risk.

Across Europe, the Middle East & Africa, regulatory rigor and decarbonization priorities are accelerating retrofits and the adoption of low-emission valve technologies. Stricter environmental directives and permit regimes have increased the emphasis on seat-tightness, fugitive-emission control, and certified testing, pushing asset owners to favor suppliers who can demonstrate compliance with regional directives and provide documentation for lifecycle emissions reporting. In EMEA, energy transition investments-particularly hydrogen pilots and low-carbon projects-are driving experimental specifications and selective procurement of hydrogen-compatible materials.

In Asia-Pacific, an active program of new-build projects, expansion of petrochemical and power-generation capacity, and ambitious hydrogen initiatives are lifting demand for both standard and advanced safety valves. Several large-scale hydrogen and renewable‑energy projects in the region are catalyzing demand for cryogenic and hydrogen-ready valve designs, and local manufacturers are increasingly competing on cost and lead time while improving technical capabilities to serve complex projects. Taken together, regional differences are becoming a stronger determinant of supplier selection: operators expect local inventory depth and documented compliance for their specific regulatory environments, and vendors that can align regional footprints with responsive aftermarket networks will capture disproportionate share of project-level spend.

This comprehensive research report examines key regions that drive the evolution of the Safety Valves market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

How strategic acquisitions, digital product ecosystems, and local service specialists are redefining competitive advantage among suppliers of safety-critical pressure-protection products

Competitive dynamics are bifurcating between legacy OEMs that offer certified hardware plus global service networks and an emerging tier of specialized providers that combine product niches with lifecycle services. Established industrial vendors are leveraging digital ecosystems and expanded portfolios to embed valve health analytics and aftermarket contracts into long-term customer relationships. Recent strategic activity in the sector-specifically targeted acquisitions of pressure-management specialists-illustrates a consolidation trend where firms seek to offer end-to-end overpressure protection solutions, spanning rupture discs to pilot-operated relief valves and field service capabilities. These moves accelerate time‑to‑market for integrated offerings and enlarge installed-base coverage, enhancing recurring-revenue profiles for acquirers.

At the same time, lean, regionally focused manufacturers are winning specification opportunities by pairing competitive lead times with rapid local repair and certification services. Their value proposition emphasizes interchangeability to API/ASME dimensions, fast turnaround for reconditioning, and willingness to collaborate on digital retrofits. For buyers, the practical consequence is a more complex sourcing landscape: award decisions increasingly weigh the full suite of capabilities-material traceability, code compliance, local service, digital monitoring, and contractual flexibility-rather than simply unit cost. As a result, commercial teams that can model total lifecycle outcomes and stress-test supplier continuity under tariff scenarios will improve both operational resilience and procurement outcomes.

This comprehensive research report delivers an in-depth overview of the principal market players in the Safety Valves market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- AGF Manufacturing, Inc.

- Alfa Laval AB

- Baker Hughes Company

- Bosch Rexroth AG

- Bourke Valves

- Callidus Process Solutions Pty Ltd.

- Cebeco Pty Ltd.

- Conval Inc.

- Curtiss-Wright Corporation

- Danfoss A/S

- Dante Valve

- Emerson Electric Co.

- Fetterolf Corporation

- Forbes Marshall Pvt. Ltd.

- General Electric Company

- Goetze KG Armaturen

- Hayward Industries, Inc.

- IMI Hydronic Engineering International SA

- LESER GmbH & Co. KG

- Mercer Valve Co., Inc.

- Mercury Manufacturing Company

- Ogontz Corp.

- Powerflo Solutions

- Score Group Limited

- SLB Limited

- Spirax Sarco Limited

- Storm Industries, Inc.

- The Weir Group PLC

- Watts Water Technologies, Inc.

- Western Process Controls

Actionable, high-impact recommendations for procurement, reliability, and supplier teams to convert trade and technology disruption into sustained reliability and commercial advantage

Industry leaders should treat the current environment as an opportunity to convert short-term disruption into structural advantage by pursuing three pragmatic actions. First, they should formalize cross-functional specification teams that bring procurement, reliability engineering, and legal counsel together before issuing tenders. This reduces rework, ensures material certificates align with code requirements, and accelerates approval of substitute suppliers when trade policy or lead times create supply risk. Second, operators should accelerate pilot programs that retrofit safety valves with non-intrusive diagnostics; even limited deployments that demonstrate measurable reductions in unplanned maintenance and clearer prioritization of spares can justify broader rollouts and reshape spare‑parts strategies. Third, companies should renegotiate long-term service agreements to include performance-based SLAs that reward uptime and parts availability, and include clear pass-through terms for tariffs or duties to avoid margin compression.

In parallel, suppliers should invest in proving material provenance by documenting melt-and-pour or smelt-and-cast histories, enlarging local repair capacity in priority regions, and offering modular digital on-ramps that simplify integration with customer asset‑management systems. For both buyers and sellers, scenario planning that models tariff outcomes and expedited qualification pathways will materially reduce project execution risk and protect operational continuity. Taken together, these steps translate uncertainty into a set of executable commercial and technical mitigations that reduce downtime risk and preserve asset safety performance.

Concise explanation of the mixed-methods research approach, standards validation, and source triangulation used to produce the technical and commercial insights in this report

The research behind these insights combines primary interviews with engineering leads, procurement directors, and aftermarket managers across industrial operators and valve manufacturers, complemented by a structured review of industry standards and company disclosures. Technical validation included assessment of standards such as the API sizing and flanged valve specifications and ASME code implications for certification and testing protocols. Vendor-product reviews prioritized documented conformance to recognized codes, available digital monitoring capabilities, and the scope of regional service networks. Trade-policy analysis relied on primary government proclamations and regulatory guidance to understand near-term duty application and exemption processes.

Secondary-sourced information included manufacturer product literature, trade‑press coverage of strategic M&A and product launches, and public energy-industry reporting that contextualizes demand drivers such as LNG project ramp-ups and hydrogen deployment. Data integrity safeguards included cross-referencing manufacturer claims against certification statements and regulatory filings where available, and triangulating regional demand narratives against authoritative energy and trade-policy announcements. This mixed-methods approach yields an evidence-based set of practical recommendations while ensuring the technical conclusions reflect documented code requirements and observable supplier behavior.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Safety Valves market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Safety Valves Market, by Product Type

- Safety Valves Market, by Pressure Rating

- Safety Valves Market, by Material Type

- Safety Valves Market, by Size

- Safety Valves Market, by Connection Type

- Safety Valves Market, by End Use Industry

- Safety Valves Market, by Region

- Safety Valves Market, by Group

- Safety Valves Market, by Country

- United States Safety Valves Market

- China Safety Valves Market

- Competitive Landscape

- List of Figures [Total: 18]

- List of Tables [Total: 1272 ]

A strategic conclusion that reframes safety valves from commoditized spares into monitored, certifiable assets integral to operational resilience and regulatory compliance

Safety valves will remain central to industrial risk management, but the nature of that role is changing. Instead of being treated as reactive spare items, safety valves are increasingly specified, procured, and managed as networked, monitored assets whose reliability is critical to uptime, regulatory compliance, and emissions control. This reorientation changes how teams evaluate vendors, how inventories are stocked, and how lifecycle costs are managed. In a world of heightened trade-policy uncertainty and accelerated energy transition, operators who align technical specifications with service continuity and documented material provenance will materially reduce project risk and accelerate maintenance predictability.

The imperatives are straightforward: prioritize vendors that demonstrate code compliance and traceable materials, pilot digital condition monitoring where it yields clear reductions in planned shutdowns, and redesign commercial agreements to include tariff contingencies and responsive local service. By doing so, organizations will protect plant safety while creating commercial advantages through improved asset availability and lower unplanned-maintenance exposure. This pragmatic shift-from parts procurement to asset stewardship-will define the next chapter of reliability engineering for process industries.

Secure immediate, enterprise-ready access to the full safety valve market research package by speaking with Ketan Rohom for tailored purchasing and briefing options

If your team requires a comprehensive, actionable intelligence package to navigate the current safety-valve landscape, request the full market research report to gain access to primary interviews, vendor-level product breakouts, supply-chain mapping, and tailored opportunity matrices. The report provides executive-ready decks, downloadable data tables, and customizable annexes that help commercial teams accelerate sourcing decisions, refine aftermarket strategies, and quantify supplier risk under evolving trade policy and materials constraints.

For a direct purchase conversation and to discuss licensing options, bespoke briefings, or enterprise subscriptions, contact Ketan Rohom, Associate Director, Sales & Marketing. He can arrange a short briefing to walk through how the research aligns with your strategic priorities and can set up immediate access to the sections most relevant to procurement, engineering, and M&A diligence. Take the next step to secure the competitive insights your organization needs to convert disruption into advantage and ensure continuity for critical pressure-protection assets.

- How big is the Safety Valves Market?

- What is the Safety Valves Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?