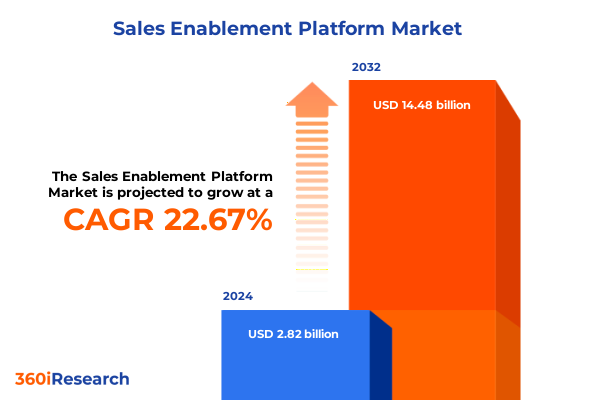

The Sales Enablement Platform Market size was estimated at USD 3.45 billion in 2025 and expected to reach USD 4.20 billion in 2026, at a CAGR of 22.73% to reach USD 14.48 billion by 2032.

Unleashing the Power of Intelligent Sales Enablement Platforms to Accelerate Revenue Growth and Drive Competitive Advantage in Today’s Complex Buying Environment

In today’s rapidly evolving commercial environment, sales organizations face an unprecedented level of complexity driven by digital transformation, shifting buyer expectations, and escalating competitive pressures. Modern buyers demand seamless, personalized experiences powered by timely, context-rich interactions. Consequently, sales teams must be equipped with sophisticated tools that not only streamline workflows but also deliver actionable insights at each stage of the buyer journey. These capabilities extend beyond content distribution to include AI-driven analytics, training modules embedded in the flow of work, and real-time performance dashboards that enhance decision-making. North American enterprises, in particular, have been at the forefront of adopting these platforms, with over seventy percent of leading organizations leveraging sales enablement solutions as a core component of their revenue strategies in 2024, underscoring their critical role in driving productivity and alignment across sales, marketing, and customer success functions.

Transformative Shifts Redefining Sales Enablement Through AI Personalization, Holistic Revenue Strategies, Seamless Integrations, and Mobility

The landscape of sales enablement is undergoing a fundamental transformation fueled by advances in artificial intelligence, integrated ecosystems, and a shift toward buyer-centric revenue models. AI-powered personalization engines are now capable of delivering micro-learning modules and content recommendations tailored to an individual seller’s performance gaps and a prospect’s unique profile. This level of specificity not only accelerates ramp time but also drives a 40 percent improvement in seller productivity compared to traditional training paradigms. Simultaneously, seamless integration between enablement platforms and cornerstone systems such as customer relationship management and marketing automation tools ensures that sellers operate within a unified interface, eliminating data silos and reducing context-switching by up to thirty percent.

Beyond technology, the conceptual shift toward holistic revenue enablement has gained traction, breaking down longstanding barriers between sales, marketing, and customer success. This integrated approach aligns messaging, content, and analytics across teams to deliver cohesive buyer experiences and maximize lifetime value. Organizations adopting this model report higher win rates and improved cross-sell performance, driven by consistent engagement strategies and shared intelligence. Moreover, mobility has become non-negotiable; mobile-first enablement solutions empower remote and field-based teams with instant access to critical content, interactive digital sales rooms, and on-the-go coaching, reinforcing productivity even outside the traditional office setting.

Assessing the Cumulative Effects of 2025 United States Tariff Measures on Supply Chains, Cost Structures, Operational Resilience, and Strategic Sourcing

In early 2025, a series of presidential directives and executive orders reshaped the United States’ approach to international trade, imposing broad ad valorem duties and sector-specific tariffs that have had cascading effects on corporate supply chains and operational cost structures. On April 2, 2025, the administration enacted a national emergency executive order to rebalance trade flows through a baseline ten percent reciprocal tariff on all imports, supplemented by higher duty rates on selected goods including steel, aluminum, and critical industrial components. This measure, combined with additional twenty-five percent border emergency tariffs on Canadian and Mexican imports announced on February 1, 2025, has compelled organizations to reassess sourcing strategies, expedite nearshoring initiatives, and renegotiate supplier agreements to mitigate margin erosion.

As tariff rates surged-ranging from fifteen to fifty percent on key categories according to recent analyses-manufacturers and technology vendors faced pronounced increases in input costs passed through to downstream consumers. Goldman Sachs economists warn that consumer spending could contract under the weight of elevated import duties, with estimates indicating that up to sixty-five percent of tariff-induced cost hikes may be transferred to end buyers. In response, many leading companies have diversified their procurement footprints, investing in vertical integration and strategic partnerships to shield their operations from volatile trade dynamics. The cumulative impact of these policies underscores the critical need for agile supply chain models and sales enablement tactics that can swiftly realign messaging and value propositions in the face of external cost pressures.

Unveiling Actionable Insights from Functionality, Pricing, Deployment, Organizational Scale, and Industry Verticals to Guide Sales Enablement Strategies

An in-depth review of market segmentation reveals how different submarkets are shaping the adoption and evolution of sales enablement platforms. When examined through the lens of functionality, leading organizations prioritize integrated collaboration and communication modules alongside customer relationship management integration, which enable seamless handoffs between marketing and sales teams. Advanced content management and personalization capabilities further ensure that sellers deliver tailored messaging, while robust reporting, dashboards, and sales analytics provide leaders with real-time visibility into performance metrics. Additionally, specialized modules for sales performance management and training & coaching are driving continuous skill development and reinforcing alignment with organizational goals.

Turning to pricing models, the market exhibits a clear dichotomy: freemium offerings are rapidly gaining traction among small and medium enterprises seeking to pilot enablement tools with minimal upfront investment, whereas larger enterprises continue to favor subscription-based licensing for its predictable cost structure and access to enterprise-grade support. The deployment model also remains a critical differentiator. Cloud-based solutions dominate, thanks to their scalability, lower total cost of ownership, and seamless update cycles; however, on-premise deployments retain a foothold in highly regulated industries where data sovereignty and stringent security requirements necessitate on-site hosting.

Organizational size further influences platform selection strategies. Large enterprises leverage comprehensive suites to standardize enablement practices across global sales forces, while smaller firms lean toward modular, point-solution architectures that allow for incremental expansion as business needs evolve. Finally, vertical-specific trends are emerging: automotive and manufacturing sectors employ enablement platforms to streamline channel partner training, BFSI and healthcare organizations leverage them for compliance-driven education, IT & telecom companies emphasize rapid product launch readiness, and retail & e-commerce players integrate omnichannel content to support dynamic consumer journeys across digital and physical touchpoints.

This comprehensive research report categorizes the Sales Enablement Platform market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Functionality

- Pricing Model

- Deployment Model

- Organization Size

- Vertical

Highlighting Regional Adoption Patterns, Market Drivers, and Strategic Opportunities Across the Americas, Europe Middle East Africa, and the Asia Pacific Landscape

Regional adoption patterns highlight nuanced market dynamics and strategic imperatives across three major geographies. In the Americas, North America leads with a mature ecosystem underpinned by advanced technology infrastructure, extensive CRM integrations, and an emphasis on AI-driven analytics embedded within sales workflows. The United States alone accounted for more than sixty-eight percent of deployments in 2025, reflecting early adoption of enablement solutions among Fortune 500 enterprises and digitally advanced midsized firms.

In Europe, Middle East, and Africa, regulatory frameworks such as GDPR-coupled with stringent data protection standards-have spurred demand for localized, secure sales enablement offerings. Germany’s manufacturing and engineering sectors constitute a significant share of regional use cases, while the UK and France demonstrate robust growth in healthcare, education, and public sector deployments. Multilingual support and compliance-centric features remain key differentiators for vendors seeking to gain traction across this diverse landscape.

Asia-Pacific emerges as the fastest-growing region, driven by mid-market digitization in India and Southeast Asia, mobile-first user preferences, and government-backed digital transformation initiatives. Companies in Japan and Australia are investing heavily in AI-integrated training modules, while China’s rapidly expanding software market fuels demand for cloud-native enablement architectures. This region’s appetite for scalable, low-code customization and multilingual interfaces underscores its unique role as an innovation incubator for next-generation platform capabilities.

This comprehensive research report examines key regions that drive the evolution of the Sales Enablement Platform market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Profiling Market Leaders and Disruptive Innovators Shaping the Future of Sales Enablement Through Advanced Analytics, AI Integration, and Unified Ecosystems

A diverse ecosystem of established leaders and emerging disruptors is defining the competitive contours of the sales enablement market. Seismic, Showpad, and Highspot remain at the forefront, each delivering robust content management engines, AI-powered recommendation systems, and enterprise-grade security controls to support global deployments. Seismic’s integration with Microsoft Viva exemplifies how platform synergies enhance daily workflows by embedding enablement capabilities directly within collaboration tools.

Highspot and Showpad distinguish themselves through user experience and guided selling approaches, with Highspot’s unified analytics surfacing actionable recommendations and Showpad’s interactive presentation frameworks driving real-time buyer engagement. Momentum’s AI-native orchestration layer and Allego’s mobile-first coaching modules appeal to midmarket and field-centric sales teams, offering streamlined pathways to remote training and content distribution. Meanwhile, Salesforce’s Sales Hub and HubSpot’s CRM-integrated enablement tools bridge marketing and sales functions, providing seamless data flows and automation triggers that accelerate lead conversion and intelligence sharing across organizational silos.

Emerging players such as Mindtickle and Outreach have carved out niches in sales readiness and engagement automation. Mindtickle’s gamified learning experiences and conversation intelligence modules enhance rep proficiency through continuous feedback loops, while Outreach’s workflow automation and multichannel engagement features enable consistent buyer follow-up and campaign optimization. This blend of innovation underscores a broader industry shift toward platforms that combine deep analytics, intuitive UX, and extensible ecosystems capable of adapting to evolving go-to-market strategies.

This comprehensive research report delivers an in-depth overview of the principal market players in the Sales Enablement Platform market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- Allego, Inc.

- Ambition, Inc.

- Bigtincan Holdings Limited

- Brainshark, Inc.

- Clearslide, Inc. (a division of Upland Software, Inc.)

- Document Sciences Corporation (a part of OpenText)

- Enable Us, Inc.

- Highspot, Inc.

- LevelJump, Inc.

- Mediafly, Inc.

- Mindtickle, Inc.

- Paperflite, Inc.

- Percolate Industries, Inc.

- Qorus Software Ltd.

- Quark Software Inc.

- SAP SE

- Savo Group, Inc.

- Seismic Software, Inc.

- Showpad, Inc.

- Upland Software, Inc.

Implementing Strategic Priorities to Enhance AI-Driven Personalization, Integrate Ecosystems, Optimize Operational Efficiency, and Navigate Complex Trade Dynamics

To capitalize on these insights, industry leaders should prioritize the integration of AI-driven personalization engines that tailor content and coaching to individual seller needs while elevating buyer engagement. Investing in platform interoperability through open APIs and CRM connectors will eliminate data static, enabling a single source of truth that drives consistent, real-time decision-making. Embracing cloud-native architectures not only reduces infrastructure overhead but also supports rapid feature rollouts critical for maintaining a competitive edge.

Furthermore, organizations must adopt agile supply chain strategies to mitigate the impact of fluctuating tariff environments- diversifying supplier bases, exploring nearshoring opportunities, and leveraging digital procurement tools to enhance visibility and resilience. Equally important is fostering a culture of continuous learning; embedding micro-training modules, role-playing simulations, and real-time feedback loops within the sales workflow will accelerate skill development and ensure alignment with evolving sales methodologies. Finally, executive sponsorship and cross-functional governance models are essential for sustaining enablement initiatives, ensuring that sales, marketing, and customer success teams collaborate toward shared performance objectives.

Leveraging Primary Interviews, Rigorous Secondary Research, Data Triangulation, and Quantitative Analysis to Ensure Comprehensive and Objective Market Insights

This analysis synthesizes insights derived from a structured research framework combining primary and secondary methodologies. Primary data collection involved in-depth interviews with C-level executives, sales leaders, and technology buyers across diverse industries to capture firsthand perspectives on adoption drivers and strategic priorities. Secondary research encompassed a review of publicly available executive orders, regulatory announcements, vendor whitepapers, and third-party industry reports from reputable outlets.

Data triangulation techniques were employed to validate findings, reconciling qualitative inputs with quantitative indicators such as deployment metrics, platform utilization rates, and tariff rate schedules. The segmentation framework was rigorously tested against real-world use cases to ensure relevance and completeness. Throughout this process, strict compliance with data privacy and ethical guidelines was maintained, ensuring the integrity and objectivity of the final insights.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Sales Enablement Platform market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Sales Enablement Platform Market, by Functionality

- Sales Enablement Platform Market, by Pricing Model

- Sales Enablement Platform Market, by Deployment Model

- Sales Enablement Platform Market, by Organization Size

- Sales Enablement Platform Market, by Vertical

- Sales Enablement Platform Market, by Region

- Sales Enablement Platform Market, by Group

- Sales Enablement Platform Market, by Country

- United States Sales Enablement Platform Market

- China Sales Enablement Platform Market

- Competitive Landscape

- List of Figures [Total: 17]

- List of Tables [Total: 954 ]

Synthesizing Insights to Empower Informed Decisions, Foster Innovation, and Position Organizations for Sustainable Growth in the Evolving Sales Landscape

Bringing together the critical findings on technological innovation, regulatory shifts, and market dynamics underscores the transformative potential of sales enablement platforms. By adopting AI-powered personalization, unified ecosystems, and mobile-first delivery, organizations can unlock new avenues for revenue growth and operational excellence. Concurrently, proactive strategies to address tariff-induced cost pressures and supply chain vulnerabilities will safeguard profit margins and sustain competitive positioning. As enterprises navigate this complex landscape, a coherent enablement strategy-underpinned by data-driven insights and cross-functional collaboration-will serve as the cornerstone for sustainable success in the evolving realm of sales.

Connect with Ketan Rohom to Access Exclusive Market Research Insights and Drive Strategic Success with a Comprehensive Sales Enablement Platform Report

To unlock the full potential of these strategic insights and gain a competitive edge, reach out directly to Ketan Rohom, Associate Director of Sales & Marketing. He will guide you through the process of acquiring the comprehensive market research report that offers a detailed roadmap for implementing and optimizing sales enablement initiatives. With his expertise, you’ll be equipped to make data-driven decisions, mitigate risks posed by evolving trade policies, and capitalize on emerging technological advancements. Don’t miss this opportunity to transform your sales operations with proven methodologies and actionable intelligence-connect with Ketan Rohom today to secure your report and begin accelerating your organization’s growth trajectory.

- How big is the Sales Enablement Platform Market?

- What is the Sales Enablement Platform Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?