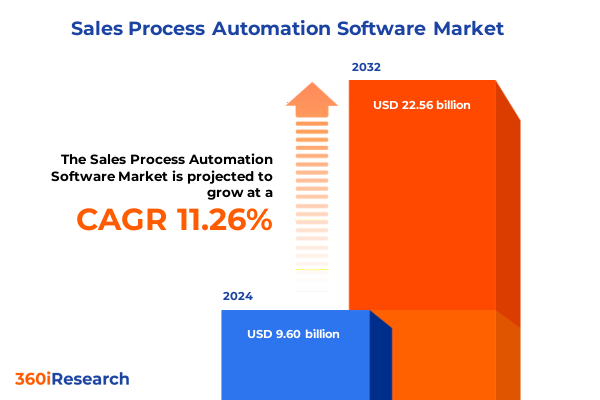

The Sales Process Automation Software Market size was estimated at USD 10.66 billion in 2025 and expected to reach USD 11.85 billion in 2026, at a CAGR of 11.29% to reach USD 22.56 billion by 2032.

Setting the Stage for the Future of Sales Process Automation Software by Exploring Market Drivers, Challenges, and Strategic Imperatives Driving Change

In an era defined by rapid digital transformation and heightened competitive pressures, sales process automation software has emerged as a foundational pillar for organizations striving to streamline workflows, enhance customer engagement, and accelerate revenue generation. Fueled by advances in artificial intelligence, cloud computing, and data analytics, the modern sales technology ecosystem enables sales teams to orchestrate complex customer journeys with unprecedented precision and agility. The convergence of these technologies is reshaping traditional selling approaches, demanding a comprehensive understanding of evolving market dynamics and strategic imperatives.

Against this backdrop, companies must not only evaluate the technical capabilities of automation platforms but also align investments with broader business objectives. Decision makers are increasingly focused on integrated solutions that offer seamless interoperability across customer relationship management, marketing automation, and enterprise resource planning systems. Moreover, the urgency to adopt user-centric designs and modular architectures underscores the need for scalable platforms that can support diverse operational models. As organizations chart their path forward, a clear grasp of the underlying trends, challenges, and opportunities will be essential for realizing the full potential of sales process automation.

Uncovering Transformative Shifts in Sales Process Automation with AI Integration, Digital Collaboration, and Proactive Engagement Models in Multiple Sectors

The sales process automation landscape is undergoing transformative shifts driven by the infusion of AI-powered functionalities, the proliferation of mobile and remote selling capabilities, and the demand for highly personalized customer experiences. Recent developments in machine learning have elevated the role of predictive analytics, enabling sales leaders to anticipate buyer intent based on real-time engagement signals and historical patterns. Concurrently, the rise of low-code and no-code frameworks is empowering nontechnical stakeholders to configure workflows and integrate disparate data sources without dependency on IT teams, accelerating time to value.

Furthermore, digital collaboration tools have redefined how geographically distributed teams interact, allowing seamless handoffs between sales, marketing, and service units. Embedded conversational interfaces and intelligent virtual assistants are reducing administrative burdens by automating routine tasks such as scheduling, data entry, and follow-up reminders. Consequently, organizations that leverage these innovations are witnessing improved pipeline visibility, higher win rates, and enhanced user adoption. The convergence of these forces marks a paradigm shift, where agility and customer centricity become indispensable for sustaining competitive advantage.

Analyzing the Cumulative Impact of 2025 United States Tariff Policies on Sales Process Automation Infrastructure Costs, Supply Chain Dynamics, and Strategic Deployment Decisions

The cumulative impact of United States tariffs in 2025 has reverberated across the sales process automation ecosystem, primarily through increased costs associated with on-premise infrastructure and server hardware. Import duties on data center equipment have risen substantially, prompting enterprises to reassess total cost of ownership and deployment strategies. As a result, many organizations have accelerated their migration to cloud-hosted platforms, which remain largely insulated from these border adjustments due to their subscription-based delivery model and absence of physical hardware dependencies.

Moreover, supply chain disruptions stemming from tariff-induced sourcing complexities have underscored the value of managed services offerings. Companies are leaning on external providers to manage installation, maintenance, and scalability of on-premise solutions, thereby mitigating risks tied to fluctuating input costs. In parallel, hybrid deployment models have gained traction as businesses seek to balance regulatory compliance and data residency requirements with the cost efficiencies of public cloud environments. These dynamics illustrate how trade policy shifts can reshape technology adoption decisions and drive innovation in service delivery frameworks.

Unlocking Strategic Insights Through Multi-Dimensional Segmentation of Sales Process Automation Software Enabling Tailored Solutions Across Components, Deployments, and Applications

A nuanced understanding of market segmentation reveals distinct performance drivers and adoption patterns across component, deployment mode, organization size, industry vertical, and application categories. From a component standpoint, demand for managed services continues to outpace traditional software licenses, as enterprises prioritize turnkey support and expertise to navigate complex implementations. Professional services engagements, meanwhile, are evolving beyond basic configuration to encompass change management, training, and ongoing optimization initiatives.

In deployment modes, cloud-based solutions dominate the landscape thanks to their rapid scalability and subscription pricing, yet hybrid models are emerging as a compelling compromise for organizations with stringent data residency or latency requirements. On-premise options maintain a foothold within highly regulated industries, where full control over sensitive customer data remains paramount. Organizations of varying sizes are also exhibiting divergent behaviors. Large enterprises leverage comprehensive suites to unify global operations, while small and medium-sized enterprises gravitate toward modular, cost-effective offerings that can be easily configured to specific sales processes.

Industry vertical segmentation underscores that BFSI institutions are at the forefront of automation investments, driven by stringent compliance mandates and the need for advanced sales analytics. Healthcare and manufacturing sectors are following suit as they seek to streamline complex sales cycles and integrate with broader supply chain systems. Across applications, lead management capabilities featuring automated scoring and distribution rules have become table stakes for improving conversion rates, while predictive forecasting and collaborative forecasting tools are empowering sales leaders to align resources with market demand proactively.

This comprehensive research report categorizes the Sales Process Automation Software market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Component

- Industry Vertical

- Application

- Deployment Mode

- Organization Size

Decoding Regional Nuances in Sales Process Automation Adoption by Examining Trends, Regulations, and Technological Maturation Across Americas, EMEA, and Asia-Pacific Markets

Regional analysis highlights that the Americas region retains its leadership position in sales process automation adoption, driven by mature cloud infrastructures, robust investment appetites, and a proliferation of technology startups. Regulatory frameworks and high digital literacy levels within North America continue to foster experimentation with cutting-edge tools, while Latin America’s growing e-commerce activities are generating new demand for automated sales workflows.

Conversely, Europe, the Middle East, and Africa (EMEA) are characterized by a diverse regulatory mosaic and varied levels of digital maturity. The General Data Protection Regulation (GDPR) has served as both a catalyst for improved data management practices and a barrier to cloud-centric deployments in certain jurisdictions. Simultaneously, government-led digital transformation initiatives in the Gulf Cooperation Council (GCC) and South Africa are driving broader adoption of end-to-end automation across financial services and telecommunications sectors.

In the Asia-Pacific region, rapid economic expansion and a surge of small and medium-sized enterprises have fueled interest in modular and scalable automation platforms. Cloud-based subscriptions are on the rise, particularly in Southeast Asia, where local providers are intensifying competition through regionally optimized offerings. Meanwhile, hybrid deployments are gaining traction within industries that require strict compliance, such as healthcare in Australia and manufacturing in Japan.

This comprehensive research report examines key regions that drive the evolution of the Sales Process Automation Software market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Evaluating Leading Sales Process Automation Providers by Exploring Innovative Offerings, Partnership Ecosystems, and Competitive Differentiators Shaping Market Leadership Dynamics

Leading vendors in the sales process automation segment are differentiating their offerings through strategic investments in AI-driven capabilities, deep industry-specific integrations, and expansive partner ecosystems. Established global providers capitalize on their broad product portfolios to deliver comprehensive suites that encompass CRM, ERP, and marketing automation, enabling seamless data flow and unified insights. These incumbents often leverage their extensive consulting networks to support complex multi-year transformation programs.

At the same time, emerging challengers are carving out niches by focusing on specialized functionalities such as conversational AI for guided selling, low-code workflow orchestration, and advanced sales analytics. Partnerships between platform specialists and third-party integrators are also reshaping the competitive landscape, offering customers a combination of best-of-breed tools and tailored implementation expertise. Furthermore, acquisitions of boutique AI startups by larger players underscore the strategic importance of predictive and prescriptive analytics in next-generation sales platforms.

Innovation cycles are accelerating as vendors vie to embed augmented reality tools for interactive product demonstrations and incorporate blockchain-based verification for secure data exchanges. These developments point to a future where competitive differentiation will hinge not only on core automation features but also on value-added services that enhance user engagement, compliance adherence, and cross-functional collaboration.

This comprehensive research report delivers an in-depth overview of the principal market players in the Sales Process Automation Software market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- ACG Infotech Ltd.

- ActiveCampaign, LLC

- Adobe Inc.

- Ayoka, L.L.C.

- Brevo

- Bullhorn, Inc.

- CirrusPath, Inc.

- Consensus Sales, Inc

- Copper CRM, Inc.

- Growbots

- HubSpot, Inc

- Infor

- Insightly, Inc.

- InsightSquared

- Intuit Inc.

- Keap

- LeadSquared

- PandaDoc Inc.

- Pegasystems Inc.

- Pipedrive

- Sage Group PLC

- Salesforce, Inc.

- VanillaSoft, Inc.

- Zapier Inc.

- Zoho Corporation

Formulating Actionable Strategic Recommendations to Accelerate Sales Process Automation Innovations, Enhance Competitive Agility, and Optimize Operational Excellence for Industry Leaders

Industry leaders aiming to harness the full potential of sales process automation should prioritize the development of AI-enhanced forecasting models that leverage diverse data sources, including behavioral signals, social media insights, and macroeconomic indicators. By investing in scalable data architectures and robust governance frameworks, organizations can ensure the integrity and accuracy of these predictive engines. Moreover, integrating automation platforms with customer success and marketing solutions will foster a unified view of the buyer journey, enabling proactive interventions at critical touchpoints.

In parallel, companies must focus on delivering intuitive user experiences that drive rapid adoption. Streamlining process flows through embedded guided selling prompts and contextual recommendations reduces training overhead and empowers sales teams to adopt new tools more willingly. To further accelerate value realization, partnering with experienced managed services providers can help organizations manage phased rollouts, mitigate implementation risks, and maintain ongoing system optimizations.

Finally, it is essential to establish continuous feedback loops that capture user sentiment and operational metrics, feeding them back into iterative improvement cycles. Through regular performance reviews and cross-functional collaboration, leaders can identify emerging pain points, refine automation rules, and ensure that technology investments remain aligned with evolving business goals.

Detailing a Rigorous Research Methodology Integrating Primary Interviews, Secondary Data Triangulation, and Expert Validation to Ensure Comprehensive Analysis Integrity

Our research methodology is grounded in a rigorous combination of primary and secondary research techniques to ensure a comprehensive and balanced analysis. Primary research involved in-depth interviews with senior sales executives, technology decision makers, and implementation partners, providing firsthand perspectives on current challenges, technology preferences, and adoption barriers. These insights were supplemented by structured surveys targeting end users across multiple industries and geographic regions to capture quantitative measures of satisfaction and feature utilization.

Secondary research initiatives encompassed a thorough review of publicly available information, including corporate annual reports, regulatory filings, investor presentations, and industry white papers. We also analyzed patent filings and press releases to identify emerging innovations and strategic partnerships. This triangulated approach allowed us to cross-validate findings and detect discrepancies, thereby enhancing the reliability of our conclusions.

Expert validation sessions were conducted with independent consultants and academic researchers specializing in sales technology and process optimization. Feedback from these sessions informed our segmentation criteria, refined market definitions, and substantiated critical assumptions. This multi-tiered methodology framework underpins the analytical rigor and actionable relevance of the insights presented in this report.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Sales Process Automation Software market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Sales Process Automation Software Market, by Component

- Sales Process Automation Software Market, by Industry Vertical

- Sales Process Automation Software Market, by Application

- Sales Process Automation Software Market, by Deployment Mode

- Sales Process Automation Software Market, by Organization Size

- Sales Process Automation Software Market, by Region

- Sales Process Automation Software Market, by Group

- Sales Process Automation Software Market, by Country

- United States Sales Process Automation Software Market

- China Sales Process Automation Software Market

- Competitive Landscape

- List of Figures [Total: 17]

- List of Tables [Total: 1749 ]

Synthesizing Key Findings and Strategic Implications from Comprehensive Analysis to Illuminate the Future Trajectory of Sales Process Automation Software Adoption

The evolving landscape of sales process automation software underscores a pivotal moment for organizations seeking to elevate their commercial operations. Key transformative forces such as artificial intelligence, cloud migration, and data-driven decision making are redefining the benchmarks of sales effectiveness and customer engagement. Moreover, external factors like the 2025 tariff adjustments have accelerated hybrid deployment adoption and underscored the importance of flexible service models.

Segmentation insights reveal that no single approach uniformly suits all use cases; instead, success hinges on aligning component choices, deployment modes, organizational capabilities, and industry-specific requirements. Regional nuances further emphasize that strategic localization and compliance considerations must inform technology roadmaps. Meanwhile, the competitive landscape continues to intensify as incumbents and agile challengers innovate through partnerships, M&A, and advanced analytics.

Looking ahead, organizations that proactively implement the recommendations outlined in this report-focusing on AI-driven forecasting, seamless integration, user-centric design, and continuous feedback loops-will be best positioned to realize sustained growth. By synthesizing these findings, executives can craft holistic strategies that not only optimize existing workflows but also unlock new opportunities for revenue acceleration and differentiation.

Driving Strategic Engagement: Connect with Ketan Rohom to Access Specialized Market Research Insights and Empower Informed Decisions on Sales Process Automation Strategies

Elevate your strategic decision-making and secure a competitive edge by partnering directly with Ketan Rohom, the Associate Director of Sales & Marketing at 360iResearch. As a seasoned leader in guiding global enterprises through the complexities of sales process automation software evaluation and procurement, Ketan offers personalized support to help you navigate critical vendor comparisons, integration best practices, and technology roadmaps tailored to your organization’s unique needs.

By engaging with Ketan, you gain exclusive access to in-depth insights, customization options, and early-release data that empower you to optimize your sales processes, reduce operational inefficiencies, and drive measurable ROI. Reach out today to schedule a confidential consultation, explore flexible licensing packages, and receive a comprehensive preview of the latest research findings. Take the next strategic step toward future-proofing your sales operations and unlocking sustained growth momentum with expert guidance from Ketan Rohom

- How big is the Sales Process Automation Software Market?

- What is the Sales Process Automation Software Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?