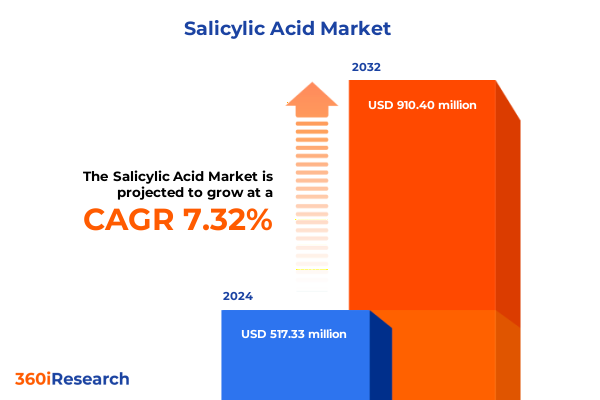

The Salicylic Acid Market size was estimated at USD 553.59 million in 2025 and expected to reach USD 592.73 million in 2026, at a CAGR of 7.36% to reach USD 910.40 million by 2032.

Understanding the Critical Role of Salicylic Acid in Modern Industries and the Unfolding Opportunities That Define its Strategic Market Importance

Salicylic acid has emerged as a pivotal compound with versatile applications spanning from skincare formulations to industrial processes. Often recognized for its keratolytic properties in acne treatment, it also serves as an essential precursor in the synthesis of plant growth regulators and other agrochemical formulations. As consumer demand evolves toward more effective, multifunctional ingredients, salicylic acid’s ability to deliver targeted benefits-from combating dandruff to catalyzing industrial reactions-positions it at the forefront of chemical innovation.

Transitioning beyond its traditional role, salicylic acid’s relevance is underscored by an increasing emphasis on clean-label personal care and pharmaceutical compliance. In recent years, manufacturers have responded to stringent purity requirements and sustainability goals by adopting greener synthetic routes and enhancing supply chain transparency. This shift amplifies the ingredient’s appeal within food and beverage applications, where regulatory bodies demand rigorous safety and quality controls, thereby cementing its status as a reliable preservative.

Drawing together these dimensions, the introduction of this report highlights salicylic acid’s critical role in shaping product performance, regulatory alignment, and technological advancement. The succeeding sections delve into the dynamic factors transforming this market, spotlighting emerging trends and strategic imperatives for stakeholders seeking to capitalize on the compound’s multifaceted potential.

Exploring the Major Technological, Regulatory, and Consumer Behavior Transformations That Are Redefining the Global Salicylic Acid Landscape in 2025

Over the past five years, remarkable technological advancements have revolutionized salicylic acid production, spurring a wave of innovation across the value chain. Emerging biocatalytic processes, for instance, have reduced environmental footprints by minimizing hazardous reagents and energy consumption. Concurrently, continuous-flow manufacturing platforms have gained traction, driving down operational costs and elevating product consistency. These innovations reflect a broader industry pivot toward sustainability without compromising performance.

At the regulatory frontier, stakeholders contend with an evolving landscape that demands higher purity thresholds and comprehensive safety documentation. Global standards such as the European Union’s Registration, Evaluation, Authorization and Restriction of Chemicals (REACH) and the United States Food and Drug Administration’s Pharmaceutical Ingredient Guidance have introduced stringent testing protocols and labeling requirements. As a result, manufacturers are investing heavily in compliance infrastructures, ensuring that salicylic acid formulations meet or exceed the most rigorous safety benchmarks.

Simultaneously, consumer preferences have shifted toward clean and transparent ingredient sourcing. End users now prioritize formulations verified as cruelty-free and free from residual solvents, compelling brands to emphasize traceability. This confluence of technological, regulatory, and consumer-driven forces is reshaping the salicylic acid arena, prompting market participants to adopt agile, future-proof strategies that address environmental sustainability, quality assurance, and shifting end-user expectations.

Analyzing How Escalating United States Tariffs Through 2025 Are Reshaping Import Dynamics, Cost Structures, and Sourcing Strategies for Salicylic Acid Supply Chains

In 2025, the United States’ tariff regime continues to exert significant influence on the salicylic acid supply chain, driving procurement strategies and cost structures. Under the Section 301 framework, the United States imposes a 25 percent duty on specific chemical imports originating from certain regions, disrupting traditional trade flows and prompting importers to reassess their sourcing locations. Although initially instituted in 2018, these tariffs have been periodically refined, reflecting evolving trade negotiations and geopolitical considerations.

As a consequence, U.S. companies have experienced a pronounced increase in landed costs, compelling them to negotiate extended contracts with alternative suppliers in markets such as Southeast Asia and Eastern Europe. Concurrently, the shift has catalyzed investment in domestic manufacturing capacity, with some producers repatriating portions of their supply chains to mitigate tariff exposure. This nearshoring trend not only reduces import-related duties but also shortens lead times and enhances supply chain resilience in the face of global disruptions.

Moreover, downstream stakeholders-particularly in pharmaceutical and personal care sectors-are adapting formulation practices to accommodate cost volatility. By optimizing batch sizes and diversifying procurement contracts, these companies maintain continuity of supply while safeguarding margins. Taken together, the cumulative impact of U.S. tariffs underscores the imperative for proactive risk management and strategic sourcing, as organizations navigate a complex interplay of trade policy and market demand.

Comprehensive Examination of Salicylic Acid Market Segmentation Revealing Nuanced Trends Across Industries, Applications, Forms, Grades, and Distribution Pathways Impacting Demand

A nuanced understanding of salicylic acid’s market dynamics is revealed when examining end use industry trends. Within the agrochemicals sector, demand increases as formulators leverage the compound’s role in synthesizing plant growth regulators. In food and beverage applications, its antimicrobial properties are harnessed to enhance preservation, while industrial users exploit its chemical reactivity in downstream syntheses. Personal care brands continue to rely on salicylic acid for targeted exfoliation and scalp treatments, and the pharmaceutical industry remains a steady consumer for its established efficacy in topical and oral medications.

Exploring application-based segmentation illuminates further insights. Over-the-counter skincare solutions dominate acne treatment formulations, driven by elevated consumer focus on clear skin solutions, whereas anti-dandruff shampoos incorporate salicylic acid for its scalp-renewal capabilities. In hair care products, it serves to reduce buildup and irritation, while wart removal patches employ its keratolytic action to facilitate tissue exfoliation. The resulting diversity in use cases highlights the ingredient’s adaptability across consumer and industrial formulations.

Assessing form-related preferences reveals that granules are favored for ease of transport and accurate dosing in industrial applications, while powders remain popular among formulators seeking flexibility in blending. Solution-based formats simplify integration into liquid products, and suspensions are utilized where controlled release functionality is paramount. Furthermore, grade differentiation shapes market focus: cosmetic grade meets stringent cosmetic ingredient standards, pharmaceutical grade adheres to the most rigorous purity requirements, and technical grade supports large-scale industrial processes.

Finally, distribution channels evolve in tandem with purchasing behaviors. Traditional offline models rely on direct sales agreements for high-volume buyers and established distributor relationships for broader reach. In contrast, online channels are gaining momentum; company websites offer tailored sales experiences and rapid replenishment, while e-commerce platforms provide convenience and access for niche formulators and smaller enterprises. This comprehensive segmentation analysis underscores the multifaceted demand landscape and the critical importance of aligning product strategies with end-user requirements.

This comprehensive research report categorizes the Salicylic Acid market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Form

- Grade

- Product Type

- End Use

- Distribution Channel

Deep Dive into the Regional Market Dynamics of Salicylic Acid Across the Americas, Europe Middle East and Africa, and the Asia Pacific to Highlight Strategic Growth Drivers

Across the Americas, the United States represents the most mature market for salicylic acid, buoyed by substantial investments in personal care innovation and pharmaceutical manufacturing. Canadian demand is similarly influenced by stringent health and safety mandates, while Latin American markets are witnessing robust growth in industrial and agrochemical applications as agricultural intensification gains momentum. Throughout the region, stakeholders prioritize supply chain stability and regulatory compliance to navigate volatile currency fluctuations and trade policy shifts.

In Europe, Middle East and Africa, Europe stands out with its advanced research infrastructure and comprehensive regulatory frameworks that drive demand for high-purity grades. The Middle East’s expanding personal care sector and Africa’s emerging pharmaceutical manufacturing capabilities contribute to a gradually increasing uptake of salicylic acid. Meanwhile, Europe’s emphasis on sustainability has encouraged the adoption of greener production techniques, reinforcing the continent’s role as a leader in environmental stewardship.

The Asia Pacific region remains a cornerstone of global salicylic acid activity, encompassing both leading producers and receptive end-use markets. China and India dominate production volumes, leveraging cost efficiencies and extensive chemical manufacturing networks. At the same time, the Asia Pacific personal care segment is experiencing rapid innovation, with local brands incorporating salicylic acid into diverse skincare products. In Southeast Asia, rising disposable incomes and growing awareness of dermatological treatments are fueling new consumption patterns, solidifying the region’s significance within the broader market.

This comprehensive research report examines key regions that drive the evolution of the Salicylic Acid market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Insightful Profile of Leading Salicylic Acid Manufacturers and Their Strategic Initiatives in Innovation, Partnership, and Sustainability That Are Shaping Competitive Industry Trajectories

Leading companies within the salicylic acid sector are distinguished by their commitment to innovation, quality, and sustainability. Eastman Chemical Company has pioneered biocatalytic production methods that reduce environmental impact while maintaining stringent purity standards. This approach not only addresses regulatory demands but also resonates with eco-conscious customers seeking responsible sourcing. Concurrently, BASF has fortified its market position through strategic partnerships that augment its pharmaceutical-grade capabilities, ensuring uninterrupted supply for critical healthcare applications.

Lanxess AG continues to differentiate itself by expanding its technical grade portfolio, catering to industrial customers that require consistent performance in large-scale processes. The company’s investments in advanced manufacturing facilities underscore its focus on operational excellence and cost efficiency. Vishnu Chemicals, an established exporter, leverages flexible production systems to meet fluctuating global demand, enabling swift adjustment of volume allocations across regions in response to market signals.

Tokyo Chemical Industry has built a robust reputation for supplying ultra-high-purity salicylic acid, capturing the niche research and development segment where precision is paramount. The company’s rigorous quality controls and transparent batch testing protocols bolster customer confidence in pharmaceutical and personal care contexts. Collectively, these market leaders demonstrate a balanced approach, combining capacity expansion with continuous enhancement of quality and sustainability credentials to secure a competitive edge.

This comprehensive research report delivers an in-depth overview of the principal market players in the Salicylic Acid market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- Allmpus Laboratories Private Limited

- Alta Laboratories Ltd

- Avantor Inc.

- BASF SE

- Bayer AG

- Cayman Chemical

- CDH Fine Chemicals

- Emco Dyestuff Pvt Ltd.

- Hebei Jingye Medical Technology Co., Ltd.

- Hubei Artec Biotechnology Co.

- Kose Corporation

- Lifevision Healthcare

- Merck KGaA

- Sansho Pharmaceutical Co., Ltd.

- Seqens Group

- Shandong Xinhua Longxin Chemical Co. Ltd.

- SimSon Pharma Limited

- Thermo Fisher Scientific Inc.

- Unilong Industry Co., Ltd.

- Unilong Industry Co., Ltd.

Strategic and Actionable Recommendations for Industry Leaders to Navigate Supply Chain Disruptions, Regulatory Shifts, and Emerging Opportunities in the Evolving Salicylic Acid Market Environment

Industry players should prioritize diversification of their supply chains to mitigate tariff-related risks and potential geopolitical disruptions. Establishing strategic partnerships with suppliers in emerging production hubs can reduce dependence on single-source regions and enhance negotiation leverage. In parallel, implementing flexible procurement frameworks that accommodate fluctuating import duties will enable seamless operational adjustments.

Investing in sustainable manufacturing practices presents a dual benefit: it aligns with escalating regulatory requirements and appeals to environmentally conscious consumers. Companies should explore advancements in green chemistry, such as biocatalytic synthesis, while upgrading waste management protocols to achieve higher resource efficiency. By demonstrating measurable emission reductions and responsible resource usage, organizations can fortify their brand reputation.

Collaborative research and development initiatives are essential to maintain a technological edge. Engaging with academic institutions and contract research organizations can accelerate the discovery of novel derivatives and application-specific formulations. Additionally, strengthening digital distribution channels through enhanced e-commerce platforms and data-driven customer engagement strategies will capture growing demand from smaller end users and niche formulators.

Finally, continuous monitoring of regulatory shifts and proactive dialogue with trade associations are imperative. This vigilance allows timely adaptation to new compliance standards, ensuring uninterrupted market access. By integrating these recommendations, industry leaders can sustain growth, preserve margin stability, and capitalize on the evolving salicylic acid landscape.

Detailed Overview of the Rigorous Research Methodology Employed to Gather, Validate, and Analyze Critical Data Ensuring Robustness and Credibility in the Salicylic Acid Market Study

The research underpinning this analysis was conducted through a multi-stage methodological framework designed to ensure depth, accuracy, and rigor. Initially, an extensive secondary research phase was undertaken, drawing on technical journals, regulatory filings, and published corporate documents to establish a foundational understanding of salicylic acid applications, production routes, and market drivers. This phase included comprehensive review of health authority guidelines, environmental compliance records, and industry association publications.

Subsequently, primary research engaged a curated panel of industry experts, including senior executives at chemical manufacturers, procurement specialists, R&D leaders, and regulatory affairs consultants. Through a series of structured interviews and focused questionnaires, insights were gathered on strategic priorities, supply chain challenges, and emerging technological trends. These qualitative inputs were systematically triangulated against secondary data to validate key findings and identify any discrepancies.

Quantitative analysis was performed by synthesizing import export records, production capacity information, and distribution channel metrics. Advanced data analytics tools facilitated the normalization of disparate datasets, ensuring comparability across regions and segmentation criteria. Rigorous data cleaning procedures were applied to eliminate anomalies and enhance reliability. Throughout this process, the research team adhered to strict quality control measures and engaged third-party reviewers to confirm methodological integrity.

This holistic approach provides stakeholders with a robust, evidence-based assessment of the salicylic acid market, combining empirical data with expert perspectives to guide strategic decision-making and risk management.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Salicylic Acid market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Salicylic Acid Market, by Form

- Salicylic Acid Market, by Grade

- Salicylic Acid Market, by Product Type

- Salicylic Acid Market, by End Use

- Salicylic Acid Market, by Distribution Channel

- Salicylic Acid Market, by Region

- Salicylic Acid Market, by Group

- Salicylic Acid Market, by Country

- United States Salicylic Acid Market

- China Salicylic Acid Market

- Competitive Landscape

- List of Figures [Total: 17]

- List of Tables [Total: 1749 ]

Consolidated Conclusions Highlighting Key Findings, Industry Implications, and Future Outlook for Stakeholders Operating Within the High-Potential Salicylic Acid Market Environment

This comprehensive examination of the salicylic acid market highlights the compound’s strategic importance across diverse applications and regions. Key findings underscore the transformative impact of green manufacturing technologies and the critical need for regulatory alignment to satisfy evolving purity and safety standards. The analysis reveals that U.S. tariff measures continue to disrupt traditional supply chains, prompting accelerated nearshoring and diversification strategies that reconfigure global trade patterns.

Segmentation insights demonstrate how end use industries-from agrochemicals to personal care-leverage differentiated forms and grades to meet specific functional requirements. The interplay between offline and online distribution channels further emphasizes the importance of adaptive sales strategies to capture both large-scale industrial customers and emerging digital-first formulators. Regional perspectives expose the Americas, EMEA, and Asia Pacific as distinct yet interconnected markets, each driven by unique regulatory, economic, and consumer dynamics.

Competitive benchmarking illustrates that leading manufacturers succeed by balancing capacity expansion with sustainable practices and strategic collaborations. Their collective focus on innovation and environmental stewardship has set new industry benchmarks. Drawing on these insights, the report offers actionable recommendations designed to help stakeholders navigate supply chain volatility, capitalize on emerging growth pockets, and enhance organizational resilience.

Taken together, these conclusions provide a clear roadmap for decision-makers seeking to harness the full potential of salicylic acid, ensuring they remain agile and well-positioned for continued market success.

Take Action Today to Enhance Your Competitive Edge and Capitalize on Salicylic Acid Market Insights by Connecting Directly with Our Associate Director of Sales and Marketing

Gain unparalleled market intelligence by engaging directly with Ketan Rohom, Associate Director, Sales & Marketing, to secure your comprehensive salicylic acid research report. This exclusive opportunity empowers you to obtain critical insights, data analyses, and actionable strategies tailored to your organization’s needs. By reaching out today, you will access a detailed assessment of market drivers, segmentation nuances, regional dynamics, and competitive benchmarking, all structured to enhance your decision-making processes.

Position your company ahead of industry trends by leveraging expert guidance during your purchasing journey. Ketan Rohom will provide you with a personalized consultation, addressing your specific challenges and strategic objectives. Through this collaboration, you can ensure the report’s findings align seamlessly with your growth roadmap and investment priorities.

Act now to capitalize on timely market shifts, mitigate emerging risks, and unlock new growth avenues. Connect with Ketan Rohom to transform data into decisive action and accelerate your success in the dynamic salicylic acid landscape.

- How big is the Salicylic Acid Market?

- What is the Salicylic Acid Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?