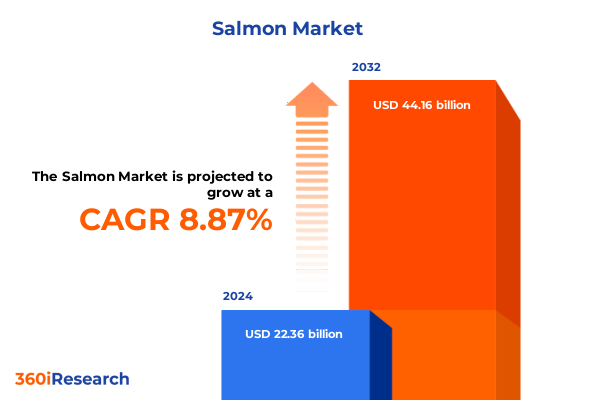

The Salmon Market size was estimated at USD 24.33 billion in 2025 and expected to reach USD 26.35 billion in 2026, at a CAGR of 8.88% to reach USD 44.16 billion by 2032.

Unveiling the Dynamic Growth Drivers and Fundamental Trends Shaping the Expanding Global Salmon Market Landscape in the Current Seafood Industry Era

The salmon market has emerged as a linchpin in global aquaculture and seafood consumption, propelled by the convergence of rising health consciousness and evolving culinary trends. Fuelled by a surge in demand for high-quality, omega-3-rich protein sources, salmon has transcended traditional niche status to become a mainstream staple. Over the past decade, average fish consumption per person has more than doubled since the 1960s, with aquaculture now accounting for a record 94.4 million tonnes, surpassing wild catch volumes for the first time in 2022. This shift underscores the critical role of controlled production methods in meeting growing protein needs while highlighting the ongoing debate over environmental footprints and ecosystem impacts.

Identifying the Pivotal Market Shifts and Emerging Industry Forces in the 21st Century Redefining Salmon Supply Chains and Consumer Preferences Worldwide

The salmon industry is navigating a period of transformative shifts as technological innovation and consumer preferences reshape supply chains from farm to fork. Precision aquaculture, including recirculating aquaculture systems and advanced genetic breeding programs, is gaining traction as producers seek to boost yield efficiency and reduce environmental strain. Concurrently, digital traceability platforms are emerging to verify product provenance, catering to ethically minded consumers and regulatory pressures. The integration of alternative feed sources, such as insect- and plant-based proteins, addresses sustainability concerns while enhancing nutrient profiles.

Analyzing the Comprehensive Consequences of Recent United States Tariffs on Salmon Trade Dynamics and Price Structures Through 2025

In early 2025, United States trade policy has introduced a series of tariffs that have cumulatively altered salmon trade dynamics and pricing structures. Beginning in March, imports from Canada and Mexico faced a 25 percent levy, alongside a baseline 10 percent tariff on key producers such as Chile and a 15 percent rate for Norwegian salmon. This complex regime spurred an unprecedented surge in front-loaded shipments, creating a temporary oversupply that drove prices down by up to 36 percent below three-year averages in Q1 2025. The United Nations Conference on Trade and Development warns that these measures will raise retail seafood prices domestically, exacerbating inflationary pressures and prompting key suppliers to seek alternative markets or invest in local production capacity.

Revealing Strategic Segmentation Insights Across Product Types, Distribution Channels, Production Methods, Species Differentiation, and Packaging Innovations

A nuanced segmentation of the salmon market provides critical perspectives on product innovation, distribution efficiencies, and consumer targeting. By product type, offerings range from value-added canned skinless boneless varieties to premium fresh whole and portion cuts, with specialized packaging modes such as modified atmosphere systems driving shelf-life improvements. Frozen formats, including individual quick frozen bulk or vacuum-sealed portions, cater to convenience-focused segments, while cold and hot smoked options address artisanal demand streams. Distribution channels span high-velocity supermarkets and hypermarkets, digital storefronts reshaping direct-to-consumer engagement, specialty stores offering curated experiences, and food service outlets leveraging product versatility to enhance menu innovations. Production methods frame the contrast between land-based farming and offshore aquaculture, as well as wild-caught harvests from gillnet and trawl operations that appeal to sustainability purists. Species diversification-Atlantic, Chinook, Coho, Pink, and Sockeye-enables producers to tap varied taste profiles and price tiers, while packaging advances in fresh keep, high oxygen and low oxygen modified atmosphere, and vacuum sealing optimize brand positioning across retail formats.

This comprehensive research report categorizes the Salmon market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Product Type

- Distribution Channel

- Production Method

- Species

- Packaging Type

Exploring Regional Variations in Salmon Consumption, Production, and Trade Flows Across Americas, Europe, Middle East & Africa, and Asia-Pacific Markets

Regional nuances exert profound influence on salmon market dynamics, reflecting localized production capacities, regulatory frameworks, and consumer behavior. In the Americas, abundant natural resources and established aquaculture hubs must contend with shifting U.S. import tariffs that drive supply chain realignments and accelerate domestic production investments. European markets, buoyed by record Scottish export performance and robust welfare standards, maintain leadership in value-added product innovation, supported by stringent traceability and eco-certification protocols. Meanwhile, the Asia-Pacific region is experiencing rapid aquaculture expansion to satisfy rising middle-class demand, with strategic investments in cold chain infrastructure and national efforts to elevate self-sufficiency in seafood consumption from just over half to near total market coverage within a decade.

This comprehensive research report examines key regions that drive the evolution of the Salmon market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Highlighting Leading Salmon Industry Players and Their Strategic Initiatives Driving Innovation, Market Expansion, and Competitive Differentiation Across Global Markets

Major industry players are deploying distinct strategies to capitalize on evolving market opportunities and mitigate tariff-induced disruptions. Companies such as Mitsubishi’s Cermaq Group are scaling production through targeted acquisitions in Norway and Canada, enhancing capacity by nearly 40 percent to reinforce supply resilience. Land-based pioneers like Atlantic Sapphire are diversifying feed procurement to offset rising costs under Canada–U.S. tariff measures, underscoring the importance of flexible sourcing. Traditional leaders, including Mowi and Lerøy Seafood Group, are advancing precision salmon genetics and expanding value-added product lines, while regional champions in Chile and North America pursue strategic collaborations to navigate volatile trade environments.

This comprehensive research report delivers an in-depth overview of the principal market players in the Salmon market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- Aqua Star, Inc.

- Bakkafrost P/F

- Big Sam's Snacks & Foods Pvt. Ltd.

- Cermaq Group AS

- Cooke Inc.

- Grieg Seafood ASA

- High Liner Foods Incorporated

- Kvarøy Arctic AS

- Lerøy Seafood Group ASA

- Maruha Nichiro Corporation

- Mowi ASA

- Multi X S.A.

- Norway Royal Salmon ASA

- Pacific Seafood Group, Inc.

- Pescafresh Seafood

- SalMar ASA

- Sterling Foods Private Limited

- Thai Union Group PCL

- Trident Seafoods Corporation

- Viciunai Group

Delivering Practical Recommendations for Industry Stakeholders to Optimize Salmon Supply Chains, Enhance Value Propositions, and Sustain Growth Amid Market Disruptions

Industry leaders should prioritize agility and diversification to sustain growth amidst policy and environmental uncertainties. Advancing recirculating aquaculture systems can reduce dependency on wild resources and insulate operations from import levies. Expanding into alternative markets and reinforcing omni-channel distribution helps offset regional tariff impacts while deepening consumer engagement. Collaborating with certification bodies to elevate sustainability credentials can unlock premium segments and bolster brand equity. Finally, investing in digital traceability and predictive analytics will empower proactive risk management, guiding supply chain optimization and ensuring responsiveness to emerging consumer demands.

Outlining Robust Research Methodologies and Analytical Frameworks Employed to Generate Comprehensive Salmon Market Insights and Validate Industry Data

The insights presented are underpinned by a rigorous research methodology combining primary and secondary data sources. Primary research involved in-depth interviews with industry executives, aquaculture specialists, and policy analysts to capture qualitative perspectives on market drivers and barriers. Secondary research encompassed a comprehensive review of trade publications, government databases, and academic journals to validate production, consumption, and trade statistics. Quantitative modeling techniques, including scenario analysis and sensitivity testing, were employed to assess the impact of tariff regimes and technological adoption on supply-demand balances. Data triangulation ensured consistency and reliability across all market segments, facilitating a holistic view of global salmon dynamics.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Salmon market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Salmon Market, by Product Type

- Salmon Market, by Distribution Channel

- Salmon Market, by Production Method

- Salmon Market, by Species

- Salmon Market, by Packaging Type

- Salmon Market, by Region

- Salmon Market, by Group

- Salmon Market, by Country

- United States Salmon Market

- China Salmon Market

- Competitive Landscape

- List of Figures [Total: 17]

- List of Tables [Total: 2703 ]

Summarizing Key Findings and Strategic Implications to Guide Stakeholders in Navigating the Evolving Global Salmon Market with Confidence

In summary, the salmon market is undergoing a period of unprecedented evolution, shaped by technological breakthroughs, shifting trade policies, and dynamic consumer preferences. The interplay of regional supply realignments and strategic corporate initiatives underscores the importance of adaptive approaches to production, distribution, and innovation. As the industry navigates tariff-induced price volatility and sustainability imperatives, stakeholders who embrace data-driven strategies and foster collaborative partnerships will be best positioned to capture emerging growth opportunities and drive long-term resilience across the global seafood landscape.

Engage with Associate Director Ketan Rohom to Secure Custom Salmon Market Research and Unlock Strategic Competitive Advantage

To gain unparalleled visibility into the complex trends, regional dynamics, and company strategies defining the salmon market, connect directly with Ketan Rohom, Associate Director of Sales & Marketing. His expertise in tailoring custom insights ensures you receive the most relevant data and strategic guidance for your unique business needs. Engage with Ketan to explore a detailed consultation that will position your organization at the forefront of market opportunities. Take the next step towards securing your comprehensive salmon market research report and empowering informed decision-making by reaching out to Ketan Rohom today.

- How big is the Salmon Market?

- What is the Salmon Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?