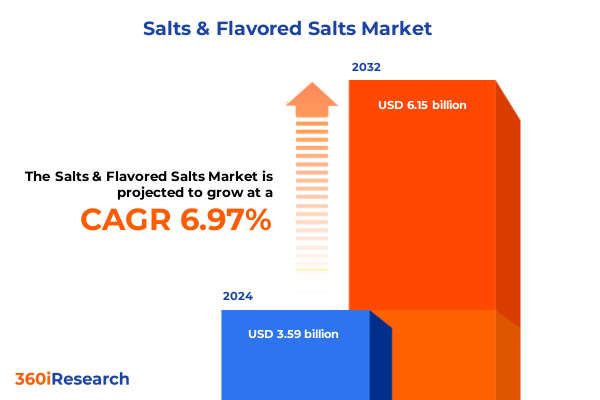

The Salts & Flavored Salts Market size was estimated at USD 9.30 billion in 2025 and expected to reach USD 9.76 billion in 2026, at a CAGR of 5.70% to reach USD 13.72 billion by 2032.

Introduction to an Evolving Salt Landscape Fueled by Demand for Authentic Flavors and Wellness-Driven Ingredient Innovation

Consumers are increasingly seeking authenticity and depth of flavor in their culinary experiences, fueling rapid growth in the demand for infused and specialty salts that deliver vibrant taste profiles and wellness benefits. The rise of versatile seasoning blends, such as black lime and Hawaij, underscores a broader shift toward ingredients that offer both functional health attributes and sensory intrigue, as interest in authentic spice blends surged by 26% over the last year alone.

Alongside adventurous flavor exploration, hydrating salts like Celtic sea salt have entered mainstream conversations about wellness, reflecting a 12.8% increase in interest for hydration-driven food and beverage innovations. Consumers view these salts as natural enhancers in functional beverages, tapping into a growing sober-curious movement that blends taste innovation with better-for-you positioning. Sustainability credentials are also commanding attention, with discussions of carbon footprint growing by 25% over two years and 55% of consumers willing to pay a premium for true eco-friendly products, highlighting the intertwining of environmental and personal well-being considerations.

As these consumer expectations evolve, producers are compelled to innovate across texture, flavor, and provenance, elevating the humble salt crystal into a stage for culinary creativity and health-driven positioning. This convergence of authenticity, functionality, and sustainability lays the foundation for the dynamic landscape of flavored and gourmet salts entering kitchens and retailers worldwide.

Premiumization and Clean-Label Mandates Propel Artisanal Salt Producers to Innovate with Advanced Processing and Direct Sales Channels

The specialty salt industry is undergoing transformative shifts as premiumization takes center stage, driving manufacturers to craft bespoke salt varieties that resonate with discerning consumers. From artisanal all-natural sea salts to herb- and spice-infused blends, the market is pivoting toward offerings that command a culinary narrative and articulate clear health benefits to justify premium positioning.

Clean-label credentials have become table stakes, catalyzing a wave of proprietary processing technologies such as Optically Clean® purification that remove impurities without additives, catering to both food industry partners and private-label brands seeking transparency in their ingredient sourcing. Simultaneously, the acceleration of e-commerce channels has expanded niche salt portfolios beyond specialty stores, enabling direct-to-consumer access to limited-edition finishing salts and seasonal flavor innovations like McCormick’s summer grilling collection of finishing salts, which rolled out nationwide to enthusiastic social media reception.

These macro trends are fueling a more dynamic supplier landscape, where legacy players and emerging artisanal brands alike are competing on flavor stories, production ethics, and texture variations. The net result is a market that thrives on novelty, where a single grain of flavored salt can transform a dish, and where health-forward attributes bolster consumer loyalty.

Navigating New Trade Barriers with Strategic Sourcing and Procurement Resilience to Mitigate Rising Tariff Pressures

Tariff policies enacted by the United States in 2025 have introduced new cost pressures across the salts and seasonings supply chain, with sweeping duties set to take effect on July 9 for countries without existing trade agreements. These measures, originating from disruptions in 2022 and reactivated after a 90-day pause, apply 10% baseline tariffs on key commodities including table salt and several spices, amplifying input costs for food manufacturers and distributors.

Spice giant McCormick anticipates annual tariff-related expenses of up to $90 million, underscoring the scale of this impact on companies that cannot domestically source certain ingredients. The company is exploring diversified sourcing and analytics-driven procurement to offset these costs, while some foodservice operators are experimenting with menu adaptations and ingredient substitutions to maintain margin integrity amidst supply chain uncertainty.

As a result, stakeholders across the value chain are proactively seeking tariff exemptions, local ingredient partnerships, and logistical optimizations. The cumulative effect of these tariffs is reshaping sourcing strategies and elevating the urgency for resilient procurement frameworks that can mitigate policy-driven volatility.

Comprehensive Market Segmentation Uncovers Diverse Salt Varieties, Applications, Formats, and Distribution Pathways

Market segmentation by product type reveals a nuanced landscape that encompasses flavored salt, gourmet salt, sea salt, and table salt, each satisfying distinct consumer and industrial use cases. Within flavored salt, the portfolio extends to citrus, fruit, herb, and spice infusions, with citrus variants like lemon, lime, and orange emphasizing bright acidity and versatile seasoning applications. Fruit-infused salts, featuring apple, raspberry, and strawberry notes, cater to dessert and beverage garnishing, while herb-infused versions leverage basil, oregano, and rosemary to nod toward Mediterranean culinary traditions. Spice-infused salts utilize chili, paprika, and pepper to introduce heat and depth, reflecting consumer appetite for bold taste experiences.

Application-based segmentation highlights the breadth of salt usage across cosmetics, foodservice, household, industrial, and pharmaceutical domains. In cosmetics, salts serve as exfoliants and mineral-rich additives; in foodservice, they function as precision seasonings; in household applications, they appear in finishing salts and DIY beauty treatments; industrial and pharmaceutical uses rely on purity specifications and functional attributes.

Form factors further differentiate the market, from crystal and flake to granular, powder, and rock varieties that address processing needs, textural preferences, and presentation aesthetics. Distribution channels, spanning convenience stores, online retail, specialty stores, and supermarket hypermarkets, shape access points and highlight the growing importance of omnichannel strategies to meet consumers where they shop.

This comprehensive research report categorizes the Salts & Flavored Salts market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Product Type

- Application

- Form

- Distribution Channel

Uneven Regional Growth Trajectories Reflect North American Bold Flavor Trends, EMEA Artisanal Preferences, and APAC’s Rapid Premiumization

Regional dynamics underscore differentiated growth drivers across the Americas, EMEA, and Asia-Pacific. In the Americas, consumer affinity for bold flavors and premium culinary experiences has spurred demand for infused and finishing salts, driven by robust e-commerce penetration and foodservice innovation in the United States and Canada, where truffle and smoked salts resonate strongly with home cooks and chefs alike.

Europe, the Middle East, and Africa feature a rich artisanal salt heritage, with markets such as the United Kingdom’s Maldon brand expanding capacity to meet international demand and consumers showing heightened interest in organic and provenance-driven sea salts. Sustainability and clean-label credentials carry particular weight, shaping both retail assortments and foodservice partnerships.

Asia-Pacific is emerging as the fastest-growing region, propelled by urbanization, rising disposable incomes, and health-conscious consumption patterns in countries like China, India, and Japan. Flavored sea salts that blend traditional Asian spices with exotic infusions appeal to local palates, while government policies supporting organic agriculture further elevate demand for premium and natural salt products.

This comprehensive research report examines key regions that drive the evolution of the Salts & Flavored Salts market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Key Industry Players Blend Scale, Technology, and Artisanal Craftsmanship to Capture Diverse Salt Market Segments

The competitive landscape of salts and flavored salts is characterized by a mix of global conglomerates and specialized artisan producers. McCormick & Company leverages its extensive distribution network and R&D capabilities to introduce limited-edition finishing salts that capitalize on seasonal and social media-driven trends. SaltWorks stands out with its proprietary Optically Clean® technology and diversified portfolio of artisan sea salts and infusions, catering to both industrial clients and premium retail channels.

Morton Salt and Cargill offer scalable flavored salt solutions to food manufacturers, balancing cost efficiencies with flavor innovation, while San Francisco Salt Company and Jacobsen Salt Co. deliver handcrafted, region-specific salts that emphasize organic sourcing and small-batch quality. Emerging players like HimalaSalt, The Spice Lab, and Bitterman and Sons are gaining traction through niche flavor combinations and strategic private-label partnerships, further intensifying market competition.

This comprehensive research report delivers an in-depth overview of the principal market players in the Salts & Flavored Salts market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- Akzo Nobel N.V.

- Badia Spices, Inc.

- Cargill, Incorporated

- Goya Foods, Inc.

- Himalayan Chef LLC (brand owner)

- Hindustan Salts Limited

- ITC Limited

- Jacobsen Salt Co.

- K+S Aktiengesellschaft

- Maldon Crystal Salt Company Limited

- McCormick & Company, Incorporated

- Morton Salt, Inc.

- Murray River Salt Pty Ltd

- Redmond, Incorporated (maker of Redmond Real Salt)

- Saltverk EHF

- SaltWorks, Inc.

- Selina Naturally LLC (Celtic Sea Salt)

- Tata Consumer Products Limited

- The Cornish Sea Salt Company Ltd

- Urban Platter Private Limited

Actionable Strategies for Industry Leaders to Enhance Supply Chain Resilience, Amplify Brand Authenticity, and Accelerate Direct Consumer Engagement

Industry leaders must pursue multi-faceted strategies to thrive in this evolving market. First, forging strategic partnerships with local producers can secure tariff exemptions and reinforce supply chain resilience, mitigating policy-driven disruptions. Second, investing in clean-label processing innovations and transparent sourcing certifications will align brand positioning with consumer demands for sustainability and authenticity. Third, expanding direct-to-consumer channels through e-commerce platforms and subscription models can deepen customer engagement and capture premium margins. Fourth, leveraging data-driven consumer insights to tailor limited-edition and regionally inspired flavors will foster brand loyalty and generate buzz among culinary enthusiasts. Finally, prioritizing research into functional health attributes, such as mineral content and hydration benefits, will differentiate offerings in a crowded market and unlock new applications in wellness and personal care.

Robust Dual-Phase Research Methodology Integrating Secondary Intelligence and Primary Industry Interviews for Holistic Market Insights

This research synthesizes insights derived from a rigorous dual-phase methodology. Initially, comprehensive secondary research was conducted across industry publications, trade data, and regulatory filings to identify macro-level trends, tariff policies, and regional market dynamics. Subsequently, primary qualitative interviews with salt producers, foodservice operators, and ingredient distributors were carried out to validate key findings and uncover emerging opportunities. Data triangulation techniques were applied to reconcile discrepancies between sources and ensure robust accuracy. The resulting analysis integrates segmentation frameworks, competitive benchmarking, and regulatory impact assessments, providing a holistic view of the salts and flavored salts market ecosystem.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Salts & Flavored Salts market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Salts & Flavored Salts Market, by Product Type

- Salts & Flavored Salts Market, by Application

- Salts & Flavored Salts Market, by Form

- Salts & Flavored Salts Market, by Distribution Channel

- Salts & Flavored Salts Market, by Region

- Salts & Flavored Salts Market, by Group

- Salts & Flavored Salts Market, by Country

- United States Salts & Flavored Salts Market

- China Salts & Flavored Salts Market

- Competitive Landscape

- List of Figures [Total: 16]

- List of Tables [Total: 1590 ]

Strategic Outlook on Emerging Opportunities Amidst Premiumization, Sustainability Mandates, and Trade-Driven Market Dynamics in the Salt Sector

The salts and flavored salts market is poised for continued expansion, driven by consumer demand for authentic, health-enhancing, and sustainably sourced seasonings. Premiumization trends and clean-label imperatives are catalyzing innovation across flavor profiles, processing technologies, and distribution strategies. While tariff-induced cost pressures present near-term challenges, they also underscore the importance of agile sourcing frameworks and local partnerships. Regional growth trajectories reveal distinct opportunities: the Americas for bold flavor experimentation, EMEA for provenance-driven artisan salts, and APAC for rapid premium market adoption. By harnessing actionable insights, industry stakeholders can navigate policy disruptions, differentiate through functional attributes, and capitalize on evolving consumer preferences to secure competitive advantage.

Unlock Exclusive Strategic Insights and Drive Competitive Advantage by Engaging with Our Sales & Marketing Lead to Secure This In-Depth Market Report

Reach out to Ketan Rohom, Associate Director Sales & Marketing, to discover how this comprehensive report can empower your strategic decisions and elevate your competitive edge.

- How big is the Salts & Flavored Salts Market?

- What is the Salts & Flavored Salts Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?