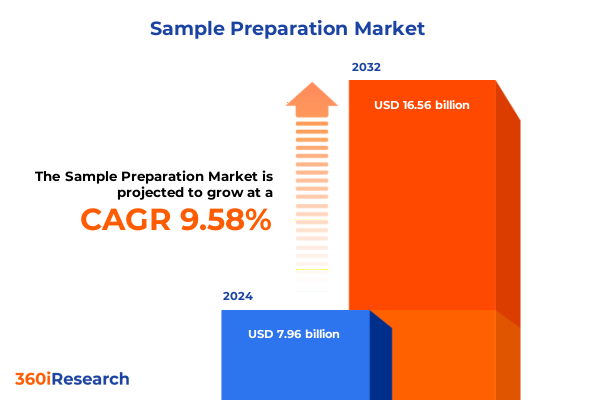

The Sample Preparation Market size was estimated at USD 8.71 billion in 2025 and expected to reach USD 9.54 billion in 2026, at a CAGR of 9.60% to reach USD 16.56 billion by 2032.

Unlocking Foundational Laboratory Performance through Strategic Sample Preparation Practices Across Diverse Scientific Workflows

The field of sample preparation serves as the foundational stage in any analytical workflow, defining the accuracy and reliability of downstream results. In an era marked by rapid scientific advancement and tightening regulatory frameworks, practitioners across sectors recognize that robust pre-analytical processes are essential for delivering reproducible data. From academic laboratories pioneering novel research to clinical diagnostics teams seeking faster turnarounds, the optimization of extraction, purification, and concentration techniques directly influences the quality of analytical outputs.

Moreover, sample preparation has evolved beyond mere volume reduction and contaminant removal to become a strategic lever for enhancing laboratory efficiency and sustainability. As laboratories contend with increasing sample volumes, diverse matrices, and stringent quality requirements, the selection of appropriate technologies and protocols gains critical importance. Consequently, understanding the technical, operational, and economic implications of different sample preparation approaches is indispensable for scientists and decision-makers aiming to maintain both high throughput and data integrity.

Seismic Technological And Operational Advances Are Driving Automation, Digital Integration, And Sustainability In Sample Preparation Workflows

The landscape of sample preparation has undergone significant transformation driven by advances in automation, digital integration, and sustainability imperatives. High throughput demands have accelerated the adoption of automated platforms, enabling laboratories to shift from manual pipetting and centrifugation towards robotics-driven workflows that deliver enhanced reproducibility and reduced human error. This shift not only optimizes resource utilization but also empowers technicians to focus on method development and data interpretation rather than repetitive manual tasks.

Alongside automation, digitalization has emerged as a pivotal force reshaping operational paradigms. The integration of laboratory information management systems (LIMS) with extraction and purification modules creates seamless data flows, ensuring traceability and compliance while facilitating real-time monitoring of process parameters. In parallel, efforts to minimize the environmental footprint of sample preparation have led to the exploration of greener solvents and minimized consumable usage. Collectively, these technological and procedural shifts underscore an industry-wide commitment to elevating both performance and sustainability in sample handling.

Evaluating How 2025 United States Tariff Adjustments Are Forcing Strategic Restructuring Of Sample Preparation Procurement And Supply Chains

In 2025, the cumulative effect of revised tariffs instituted by the United States government has reshaped procurement strategies for laboratory consumables and instrumentation. By imposing increased duties on imported sorbents, cartridges, and specialized reagents, tariffs have elevated the total landed cost of critical sample preparation components. As a result, laboratory managers are compelled to reevaluate sourcing models, exploring regional suppliers or nearshore manufacturing partners to mitigate exposure to import levies and supply chain uncertainties.

Furthermore, the cost pressures stemming from these tariff measures have prompted consolidation in reagent purchases and greater collaboration with distributors capable of offering bundled agreements. In some instances, organizations have accelerated the development of in-house production capabilities for standard solvents and buffer systems to insulate operations from escalating import fees. These strategic responses highlight a broader trend toward supply chain resilience, where agility and diversification become essential in counterbalancing the financial impact of trade policy shifts.

Deeply Exploring How Technology, End-Use, Product, And Mode Dimensions Intersect To Shape Tailored Sample Preparation Protocols

The sample preparation landscape is multifaceted, with each technological cluster offering unique advantages. Dispersive solid phase extraction provides flexibility in handling heterogeneous matrices, while liquid-liquid extraction differentiates itself through automated and manual protocols that balance throughput and operator control. Protein precipitation methods leverage the solvent properties of acetonitrile or methanol to facilitate rapid protein removal, catering to workflows that demand speed without compromising sample integrity. Solid phase extraction, encompassing cartridge, disk, and plate formats, delivers highly selective purification solutions adaptable to a range of analyte polarities.

Beyond technology, end-use segments define specific performance metrics and compliance requirements. Academic research laboratories prioritize methodological versatility to accommodate exploratory studies, whereas clinical diagnostics settings emphasize high reproducibility and regulatory validation. Contract research organizations allocate resources toward scalable protocols that can be standardized across multiple projects, while environmental testing facilities and food and beverage laboratories focus on matrix-specific challenges. Pharmaceutical and biopharmaceutical entities demand stringent quality controls and traceability for compound screening and biomarker quantification.

The product dimension further distinguishes between consumables and instruments. Consumables such as kits, prepacked cartridges, and solid phase extraction sorbents enable modular workflow deployment, facilitating rapid method setup and minimizing cross-contamination. Instrument offerings span centrifuges, evaporators, and pressurized systems, each providing precise control over extraction parameters and solvent removal. Overlaying these considerations, the operational mode-whether automated, manual, or semi-automated-shapes throughput, cost efficiency, and human resource allocation, necessitating careful alignment with laboratory objectives.

This comprehensive research report categorizes the Sample Preparation market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Technology

- End Use

- Product

- Mode

Analyzing Regional Adoption Patterns And Regulatory Drivers Across The Americas, EMEA, And Asia-Pacific Sample Preparation Markets

Regional dynamics exert a profound influence on the adoption and evolution of sample preparation techniques. In the Americas, well-established research infrastructures and robust clinical diagnostics networks drive investment in high-throughput automation. Regulatory harmonization across key North American markets further accelerates method standardization and quality assurance practices. In contrast, emerging laboratories in Latin America are gradually integrating modular consumables and compact instrumentation to address budget constraints while maintaining compliance with environmental and food safety regulations.

Within Europe, Middle East & Africa, stringent environmental directives and progressive clinical standards encourage laboratories to implement advanced purification protocols that reduce solvent waste and enhance traceability. The region’s diverse economic landscapes foster both cutting-edge research facilities in developed markets and resource-optimized laboratories in frontier economies. Meanwhile, Asia-Pacific countries exhibit rapid expansion fueled by pharmaceutical manufacturing hubs and growing academic research funding. Investments in scalable automation platforms and localized consumable production reflect a strategic emphasis on reducing lead times and strengthening supply chain resilience in response to geopolitical uncertainties.

This comprehensive research report examines key regions that drive the evolution of the Sample Preparation market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Illuminating How Leading Industry Players Are Differentiating Through Integrated Platforms, Advanced Consumables, And Strategic Supply Partnerships

Across the competitive landscape, leading companies are leveraging innovation and strategic partnerships to enhance their market positioning. Instrument manufacturers are unveiling next-generation centrifuges and integrated pressurized systems that support real-time process monitoring and customizable method parameters. Meanwhile, consumables providers are expanding their portfolio of sorbent chemistries and prepacked cartridges, enabling laboratories to tailor extraction selectivity to emerging analyte classes.

Collaborations between technology firms and reagent suppliers are yielding comprehensive workflow solutions, where end-to-end platforms integrate extraction, purification, and concentration modules under unified software control. Additionally, distributors with global footprints are capitalizing on tariff-induced procurement challenges by negotiating regional manufacturing agreements and volume-based contracts. These strategic moves underscore a competitive environment where agility, innovation, and supply continuity define the companies at the forefront of sample preparation advancements.

This comprehensive research report delivers an in-depth overview of the principal market players in the Sample Preparation market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- Agilent Technologies, Inc.

- Bio-Rad Laboratories, Inc.

- Danaher Corporation

- Merck KGaA

- PerkinElmer, Inc.

- QIAGEN N.V.

- Shimadzu Corporation

- Tecan Group AG

- Thermo Fisher Scientific Inc.

- Waters Corporation

Empowering Laboratory Leaders To Drive Operational Resilience By Combining Modular Automation, Digital Oversight, And Sustainable Procurement

Industry leaders should prioritize the adoption of modular automation platforms that accommodate diverse extraction chemistries without requiring extensive retraining. By aligning capital investments with flexible technologies, laboratories can swiftly pivot between protocols for protein precipitation, solid phase extraction, or liquid-liquid workflows. Simultaneously, organizations must cultivate strategic relationships with multiple consumable suppliers to cushion against pricing volatility driven by trade policy changes.

Furthermore, implementing a digital backbone that unites LIMS, instrument control, and data analytics empowers decision-makers to monitor workflow efficiency and detect deviations in real time. This approach not only enhances compliance but also identifies optimization opportunities at the process level. Finally, integrating sustainability metrics into procurement and operational reviews positions laboratories to meet evolving environmental standards while reducing long-term costs associated with solvent disposal and consumable waste.

Detailing A Robust Mixed-Methods Research Approach Integrating Expert Interviews, Literature Analysis, And Data Triangulation

This analysis is grounded in a systematic methodology that blends primary and secondary research. Expert interviews were conducted with laboratory managers, process engineers, and procurement directors across academia, diagnostics, and industrial sectors to capture firsthand insights on evolving workflows and pain points. Secondary sources, including peer-reviewed journals, technical whitepapers, and industry standards documentation, provided contextual understanding of technological capabilities and regulatory landscapes.

Data triangulation was performed by cross-referencing qualitative inputs with publicly available equipment specifications, patent filings, and trade publications. The segmentation framework was validated through iterative review sessions with subject matter experts to ensure accurate categorization of technologies, end uses, products, and operational modes. This multi-layered approach ensures that the findings reflect both the strategic imperatives and operational realities of contemporary sample preparation.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Sample Preparation market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Sample Preparation Market, by Technology

- Sample Preparation Market, by End Use

- Sample Preparation Market, by Product

- Sample Preparation Market, by Mode

- Sample Preparation Market, by Region

- Sample Preparation Market, by Group

- Sample Preparation Market, by Country

- United States Sample Preparation Market

- China Sample Preparation Market

- Competitive Landscape

- List of Figures [Total: 16]

- List of Tables [Total: 1590 ]

Synthesizing The Imperative For Adaptive, Sustainable, And Digitally Enabled Sample Preparation To Secure Future Analytical Excellence

Sample preparation stands at the nexus of scientific innovation and operational efficiency, influencing the fidelity of every downstream analysis. As laboratories navigate shifting trade policies, technological breakthroughs, and heightened regulatory requirements, the ability to adapt extraction and purification workflows remains a critical differentiator. By embracing automation, diversifying supply chains, and leveraging digital integration, stakeholders can ensure not only compliance but also sustained throughput and data quality.

Looking ahead, the convergence of green chemistry principles and advanced robotics will redefine the boundaries of what is achievable in sample handling. Decision-makers equipped with comprehensive insights and agile strategies are poised to lead their organizations into a new era of analytical excellence, where precision, sustainability, and speed coalesce to drive breakthrough discoveries and operational success.

Elevate Your Sample Preparation Strategy with Customized Market Intelligence and Direct Support from Our Sales Leadership

If your organization is ready to transform its analytical workflows with precise insights and comprehensive market intelligence in sample preparation, reach out to Ketan Rohom, Associate Director, Sales & Marketing. His expertise in aligning research with strategic priorities ensures seamless delivery of actionable data that supports informed decision-making. Engage with Ketan to explore tailored solutions, gain exclusive access to in-depth analysis, and secure the competitive advantage your team demands. Contact him today to discuss how this report can drive your next phase of growth in an evolving laboratory landscape.

- How big is the Sample Preparation Market?

- What is the Sample Preparation Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?