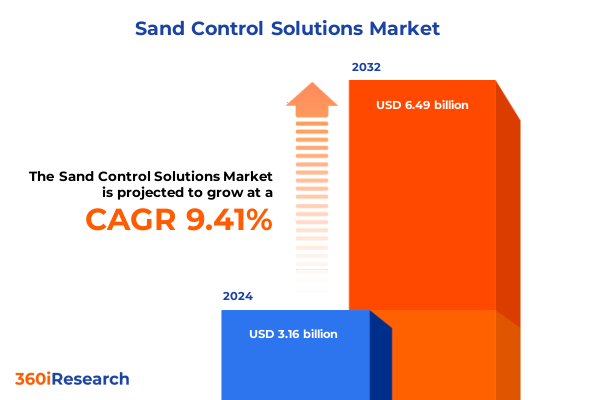

The Sand Control Solutions Market size was estimated at USD 3.45 billion in 2025 and expected to reach USD 3.77 billion in 2026, at a CAGR of 9.44% to reach USD 6.49 billion by 2032.

Revealing the Crucial Role of Advanced Sand Control Technologies in Sustaining Uninterrupted and Efficient Hydrocarbon Production Amid Evolving Industry Challenges

Sand particles infiltrating production wells can pose significant threats to operational stability, equipment integrity, and overall hydrocarbons recovery performance. In dynamic oil and gas landscapes where unconventional reservoirs and aging fields continue to challenge producers, effective sand control solutions have emerged as a foundation for sustaining uninterrupted production and preserving wellbore health. By deploying advanced materials, precision-engineered tools, and optimized completion strategies, operators can proactively mitigate formation damage, reduce intervention frequency, and extend asset life. This introduction outlines the central role of sand control technologies in addressing both routine and complex downhole sand management scenarios.

The advent of high-pressure fracturing techniques, deep-water production, and horizontal drilling has underscored the necessity for adaptable sand management frameworks. These frameworks encompass everything from resin-coated gravel packs tailored for complex geometries to specialized screens engineered for high-erosion environments. Concurrently, digital monitoring and predictive analytics are increasingly integrated to monitor sand ingress in real time, enabling rapid adjustments to completion parameters and fluid chemistries. Such innovations not only enhance operational resilience but also support sustainable resource extraction by minimizing environmental impacts associated with unplanned workovers.

Looking ahead, the confluence of material science advancements, data-driven completion optimization, and evolving regulatory requirements will define the next era of sand control excellence. As wells become more complex, stakeholders must understand both the technical underpinnings and strategic implications of their sand management choices. This report sets the stage for a comprehensive analysis of emerging shifts, tariff influences, segmentation insights, regional performance, corporate strategies, and strategic recommendations-delivering a coherent foundation for informed decision-making within the global sand control solutions domain.

Understanding the Pivotal Technological, Regulatory, and Operational Transformations Disrupting Traditional Sand Control Practices Across Global Oil and Gas Fields

In recent years, sand control solutions have undergone rapid evolution driven by technological breakthroughs, shifting regulatory landscapes, and heightened operational demands. The emergence of next-generation sand screens, increasingly sophisticated gravel-pack completions, and novel inflow control devices has transformed traditional reactive approaches into proactive sand management strategies. These devices leverage advancements in materials engineering-such as high-strength alloys and composite coatings-to resist erosion, withstand high differential pressures, and maintain permeability under dynamic loading conditions.

Simultaneously, regulatory frameworks across major producing regions are becoming more stringent, mandating thorough well integrity protocols and environmental stewardship practices. This regulatory tightening has prompted operators and service providers to collaborate on developing solutions that not only meet performance objectives but also comply with inspection requirements and sustainability targets. As a result, the integration of comprehensive monitoring systems-combining fiber-optic sensing, downhole cameras, and data analytics-has accelerated, enabling a shift from periodic intervention to continuous well surveillance.

Operationally, the proliferation of deepwater exploration, multi-lateral drilling campaigns, and high-rate gas completions has pushed sand control applications into more challenging environments. These demands have spurred a rise in bespoke tool designs and tailored fluid chemistries that can adapt to variable formation characteristics on a well-by-well basis. Collectively, these transformative shifts signify a broader trend: the sand control landscape is no longer static but is characterized by rapid iteration, multidisciplinary innovation, and collaborative development models that position the industry for sustained performance gains.

Examining the Cumulative Impact of Newly Imposed United States Tariffs on Key Sand Control Equipment and Components Throughout 2025 and Beyond

Throughout 2025, newly enacted United States tariffs on critical sand control components have introduced material cost pressures and supply chain complexities for both domestic and international operators. These levies, targeting imported screens, control devices, and specialized resin-coated materials, have led to elevated procurement expenses and heightened scrutiny of sourcing strategies. Operators have been compelled to reassess vendor relationships, negotiate pricing structures, and explore alternative supply routes to mitigate the cumulative impact of additional duties on completion budgets.

Moreover, this tariff landscape has driven service companies and original equipment manufacturers to innovate around domestic fabrication capabilities and localized assembly processes. By investing in state-side manufacturing footprints and optimizing logistics networks, many stakeholders have sought to attenuate exposure to import tariffs. These initiatives often entail collaborations between engineering teams and local fabricators to qualify new material certifications, conduct performance validation tests, and ensure adherence to stringent regulations.

Concurrently, the tariff-induced cost environment has underscored the importance of total cost of ownership considerations. Stakeholders are increasingly leveraging life-cycle analysis tools to understand the interplay between upfront capital investments, maintenance requirements, and potential downtime risks. As a result, the market is witnessing a shift toward sand control solutions that balance robust technical performance with streamlined manufacturing and service delivery models-thereby enabling operators to navigate tariff headwinds without compromising operational integrity.

Uncovering Market Segmentation Dynamics Through Analysis of Type Variations, Distribution Channels, and End User Profiles Impacting Sand Control Adoption

A nuanced understanding of market segmentation reveals distinct performance drivers and technology adoption patterns across diverse user and channel categories. Based on type, the landscape encompasses Frac Pack operations that demand resilient proppant retention mechanisms under high-pressure fracturing conditions, Gravel Pack solutions engineered to stabilize wellbores in unconsolidated formations, Inflow Control Devices designed to balance reservoir inflow profiles in complex lithologies, and Sand Screens optimized for high-erosion gas and water injection wells. Each of these product families brings unique operational advantages and technical trade-offs, requiring operators to align solution selection with well completion objectives.

Shifting focus to distribution channels, original equipment manufacturers and distributors play a critical role in bringing advanced sand control tools to market, offering integrated procurement services and technical support. In parallel, oilfield service companies leverage their field execution expertise to tailor these solutions within end-to-end completion programs, ensuring seamless integration with fracturing and well stimulation workflows. The interplay between OEM-led innovation and service provider field experience shapes the go-to-market dynamics, influencing lead times, training protocols, and after-sales support structures.

Finally, end users span independent operators seeking cost-effective and scalable offerings, international oil companies prioritizing global standards and consistent performance across diverse basins, and national oil companies emphasizing technology transfer and local content development. These varied requirements drive differentiated procurement criteria-from technical customization and carbon footprint considerations to regional sourcing mandates-highlighting the strategic importance of segmentation-based insights in crafting targeted solutions and service models.

This comprehensive research report categorizes the Sand Control Solutions market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Type

- Distribution Channel

- End User

Evaluating Regional Performance Trends and Growth Drivers Across the Americas, Europe Middle East & Africa, and Asia-Pacific Sand Control Markets

Regional performance in sand control solutions exhibits pronounced variability, shaped by distinct market maturity, regulatory regimes, and resource profiles. In the Americas, a surge in shale gas and tight oil drilling has fueled widespread adoption of high-efficiency screens and gravel packs, supported by established supply chains and a robust service infrastructure. Operators in this region increasingly prioritize integrated digital monitoring and rapid deployment capabilities to maintain cost discipline amidst fluctuating commodity prices.

Moving to Europe, Middle East & Africa, the market is characterized by stringent well integrity standards, deepwater exploration projects, and substantial national oil company involvement. Sand control deployments here often emphasize reliability under extreme temperature and pressure conditions, with significant investments in material science innovations to meet environmental and regulatory requirements. Collaborations between international technology providers and regional stakeholders facilitate technology transfer and capacity building.

In Asia-Pacific, rapid offshore development in Southeast Asia, Australia, and India has stimulated demand for versatile infill screens and adaptive inflow control devices capable of operating across a wide range of geological settings. The region’s focus on local content and joint venture partnerships has accelerated the establishment of regional fabrication hubs and enhanced training programs. By examining these regional distinctions, stakeholders can identify growth avenues aligned with localized challenges and strategic priorities.

This comprehensive research report examines key regions that drive the evolution of the Sand Control Solutions market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Analyzing Strategic Movements, Partnerships, and Innovations Unveiled by Leading Players Shaping the Competitive Landscape of Sand Control Solutions

Leading players in the sand control arena are actively pursuing strategic partnerships, targeted acquisitions, and internal innovation to strengthen their competitive positions. Major equipment manufacturers have expanded research and development budgets to advance composite material formulations, aiming to improve erosion resistance and extend tool longevity. Concurrently, several service companies have established co-development agreements with specialty polymer suppliers to optimize resin-coated gravel solutions for specific reservoir chemistries.

Moreover, industry frontrunners have invested in digital platforms that enable remote well monitoring and predictive maintenance analytics. These platforms utilize real-time sensor data to forecast sand intrusion events, allowing operators to preemptively adjust injection rates or deploy isolation tools. By integrating these digital capabilities with their traditional downhole hardware portfolios, companies are creating differentiated service offerings that emphasize reliability and data-driven performance.

In addition to technology and digital strategy, M&A activity has reshaped the competitive landscape. The acquisition of niche sand screen innovators by larger conglomerates has broadened product lineups and facilitated global distribution synergies. Joint ventures between established players and emerging technology firms have also emerged, pooling resources to expedite field trials and regulatory approvals. These corporate maneuvers underscore the strategic imperative of aligning technical prowess with market access in order to capture value across the sand control value chain.

This comprehensive research report delivers an in-depth overview of the principal market players in the Sand Control Solutions market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- Anton Oilfield Services Group

- Archer Limited

- Baker Hughes Company

- China Oilfield Services Limited

- China Oilfield Services Limited

- Expro Group

- Halliburton Company

- Helmerich & Payne, Inc.

- National Oilwell Varco, Inc.

- Oil States International Inc.

- RGL Reservoir Management Inc.

- Schlumberger Limited

- Tenaris S.A.

- Weatherford International plc

- Weir Group plc

Delivering Actionable Recommendations to Optimize Operational Efficiencies, Mitigate Tariff Challenges, and Drive Innovations in Sand Control Deployment

To navigate the evolving sand control landscape effectively, industry leaders should focus on enhancing local manufacturing capabilities to insulate against tariff volatility. Establishing or expanding domestic fabrication and assembly operations will mitigate import duties and compress supply lead times. Complementing these efforts with strategic inventory management and flexible logistics networks can further reduce exposure to trade-related disruptions.

In parallel, operators and service providers must deepen collaboration on digital integration, combining downhole performance data, predictive analytics, and automated control systems. By deploying smart monitoring solutions that tie seamlessly into completion designs, stakeholders can optimize sand management protocols in real time, thereby reducing unplanned interventions and extending well productivity windows. Additionally, joint development initiatives with material suppliers will accelerate the rollout of next-generation composites and coatings tailored for specific well conditions.

Finally, companies should adopt a segmentation-driven go-to-market approach, aligning product portfolios with the nuanced needs of independents, international oil companies, and national operators. Tailored solutions that address local content requirements, environmental compliance mandates, and reservoir complexities will foster deeper customer engagement and drive long-term partnership value. This multifaceted strategy, anchored in supply chain resilience, digital sophistication, and market segmentation focus, equips decision-makers to convert challenges into sustainable competitive advantages.

Detailing the Rigorous Research Methodology Employed to Ensure Data Integrity, Comprehensive Market Coverage, and Reliable Insights in Sand Control Analysis

This report synthesizes data collected through a rigorous mixed-method research framework encompassing both primary and secondary sources. Primary insights were obtained through in-depth interviews with technical directors, completion engineers, procurement managers, and regulatory specialists across major producing regions. These qualitative engagements ensured nuanced understanding of operational pain points, adoption drivers, and emerging solution expectations.

Secondary research involved comprehensive analysis of industry publications, patent filings, white papers, and technical presentations from leading conferences. Publicly available regulatory documents and tariff schedules were systematically reviewed to map recent policy developments and their implications for equipment sourcing. Data triangulation methods were employed to cross-validate findings, ensuring consistency between qualitative interviews and documented performance metrics.

Furthermore, the study leveraged a proprietary framework to categorize sand control technologies by operational context, material composition, and digital integration levels. Each category underwent technical validation through laboratory reports and field case studies. The methodological approach prioritized transparency, data integrity, and replicability, offering stakeholders confidence in the reliability of insights and the robustness of the analytical conclusions.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Sand Control Solutions market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Sand Control Solutions Market, by Type

- Sand Control Solutions Market, by Distribution Channel

- Sand Control Solutions Market, by End User

- Sand Control Solutions Market, by Region

- Sand Control Solutions Market, by Group

- Sand Control Solutions Market, by Country

- United States Sand Control Solutions Market

- China Sand Control Solutions Market

- Competitive Landscape

- List of Figures [Total: 15]

- List of Tables [Total: 636 ]

Summarizing Key Findings and Strategic Outlook Highlighting Critical Opportunities and Challenges in the Evolving Sand Control Technology Landscape

The analysis presented herein outlines a landscape in which sand control solutions are rapidly advancing from basic mechanical barriers to integrated, data-driven systems. Key findings reveal that technological innovation, tariff dynamics, and segmentation nuances collectively shape the market trajectory. Market segments based on product type, distribution channel, and end-user profile each exhibit distinct value propositions and operational considerations, underscoring the importance of targeted strategies.

Regional distinctions further refine the competitive picture: the Americas prioritize shale-focused high-efficiency tools, EMEA emphasizes extreme environment reliability, and Asia-Pacific demands adaptable solutions under local content imperatives. Corporate strategies range from digital platform integration to cross-sector partnerships and M&A, reflecting a drive toward comprehensive capability portfolios. Collectively, these insights highlight critical opportunities in domestic production expansion, digital transformation, and segmentation-aligned solution development.

In conclusion, stakeholders equipped with a holistic view of technology trends, tariff impacts, and market segmentation are best positioned to capture value and foster innovation. By leveraging these strategic outlook elements, decision-makers can navigate evolving challenges, align resources effectively, and harness emerging opportunities in the dynamic sand control domain.

Encouraging Industry Professionals to Engage with Ketan Rohom for Exclusive Access to Comprehensive Sand Control Solutions Market Research Insights

For decision-makers seeking to maintain a competitive edge and secure a deeper understanding of sand control solutions, reaching out to Ketan Rohom, Associate Director of Sales & Marketing, provides an efficient gateway to acquire comprehensive market research insights. Ketan’s expertise in aligning technical knowledge with strategic market intelligence ensures that every inquiry is met with tailored guidance on choosing the right data package. Engaging with him allows professionals to explore detailed segments, analyze tariff implications, assess the competitive landscape, and validate actionable recommendations specific to their operational needs. By establishing this direct connection, organizations can expedite the procurement process and gain immediate access to a wealth of qualitative and quantitative findings. Initiating a conversation with Ketan opens the door to customized briefing calls, demo presentations, and supplementary data overviews designed to support informed decision-making. As the industry navigates new challenges and opportunities in sand control deployment, direct engagement with Ketan equips stakeholders with the clarity and confidence required to drive strategic initiatives. Contacting him today sets the foundation for long-term insight partnerships and ensures your organization stays ahead in a rapidly evolving market environment

- How big is the Sand Control Solutions Market?

- What is the Sand Control Solutions Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?