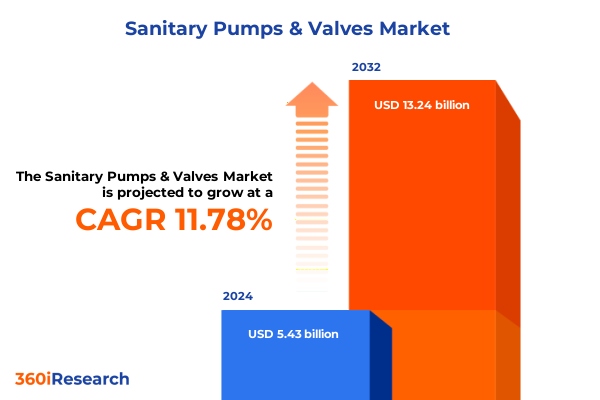

The Sanitary Pumps & Valves Market size was estimated at USD 6.06 billion in 2025 and expected to reach USD 6.76 billion in 2026, at a CAGR of 11.81% to reach USD 13.24 billion by 2032.

Discover the Critical Role of Sanitary Pumps and Valves in Ensuring Product Integrity and Operational Excellence Across Hygienic Industries

The sanitary pumps and valves sector represents a critical intersection of engineering precision and hygienic design, serving as the backbone of industries where product purity and regulatory compliance are paramount. In environments ranging from food and beverage production to pharmaceutical manufacturing and advanced water treatment, these mechanical components not only enable essential fluid handling but also safeguard product integrity and consumer safety. A meticulous understanding of material selection, sealing technologies, and sanitary standards is vital for organizations looking to maintain operational excellence and adhere to stringent quality requirements.

Over the past decade, tightening regulatory frameworks and rising consumer expectations have driven a heightened emphasis on hygienic design principles. This has led to innovative material science applications and refined manufacturing processes that minimize microbial entrapment and facilitate thorough cleaning protocols. Consequently, decision-makers must evaluate both established and emerging design philosophies to ensure that their equipment meets or exceeds the evolving standards set by regulatory authorities and industry watchdogs. In this executive summary, we explore the key market dynamics shaping the landscape, outline pivotal shifts to watch, and present strategic insights for leaders seeking to navigate this complex environment successfully.

Uncover the Key Technological and Regulatory Transformations Reshaping the Sanitary Pumps and Valves Landscape in the Modern Era

The sanitary pumps and valves market has entered an era defined by rapid technological advancements and evolving regulatory mandates that are fundamentally reshaping operational paradigms. Digitalization and the integration of Industry 4.0 principles have accelerated the adoption of smart sensors, remote monitoring, and predictive maintenance platforms. These innovations are enabling operations teams to detect performance anomalies in real time, thereby minimizing downtime and extending service life. Beyond these efficiency gains, data-driven maintenance frameworks are fostering proactive decision-making that aligns closely with cost containment and sustainability objectives.

Simultaneously, regulatory bodies worldwide are intensifying scrutiny over sanitation protocols and environmental impact, driving manufacturers to develop more robust hygienic designs and energy-efficient systems. Advanced manufacturing techniques such as additive manufacturing are facilitating rapid prototyping and customization, reducing lead times and enabling tailored solutions for specific end-use applications. Consequently, stakeholders must remain attuned to these transformative forces-embracing automation, leveraging data analytics, and adopting lean design principles-to maintain a competitive edge in a marketplace defined by continuous innovation and stringent compliance requirements.

Examine How Recent Tariff Adjustments in 2025 Are Reshaping Supply Chains and Cost Structures for Sanitary Pumps and Valves Across the United States

In 2025, a series of tariff adjustments implemented by the United States government has significantly influenced cost structures and supply chain strategies for sanitary pumps and valves. These measures, which targeted both finished goods and critical raw materials, have imposed upward pressure on procurement costs for businesses reliant on imported components. As a result, many organizations have faced the dual challenge of managing increased input expenses while safeguarding profit margins and maintaining stable pricing for end-customers.

In response to these developments, manufacturers and distributors have reexamined their sourcing strategies, with several opting to diversify supplier networks and bolster domestic production capabilities. This rebalancing has entailed deeper collaboration with local foundries and machine shops, as well as strategic partnerships aimed at offsetting tariff-induced cost burdens. Lead times have lengthened in certain segments, prompting industry participants to implement more sophisticated inventory management protocols. Consequently, supply chain resilience and agility have emerged as critical competitive differentiators in an environment where external policy shifts can swiftly alter the economic landscape.

Explore Comprehensive Segmentation Perspectives That Illuminate Distinct Market Dynamics Across Pump Types, Valve Designs, End Use Industries and Materials

A nuanced understanding of market segmentation is essential for identifying growth pockets and tailoring product portfolios to specific end-use requirements. When examining pump type, it is imperative to recognize the diverse operational characteristics across axial flow, centrifugal, and diaphragm units, as well as the breadth of positive displacement variants encompassing gear, lobe, piston, plunger, and screw configurations. Furthermore, reciprocating pumps-differentiated by piston and plunger designs-offer precision handling in high-pressure applications. These distinctions influence performance metrics such as flow rate, pressure tolerance, and maintenance intervals, guiding equipment selection for targeted process needs.

Equally important is the classification of valve type, where ball, butterfly, diaphragm, and plug variations deliver distinct benefits in terms of sealing performance, actuation speed, and hygienic compatibility. End use industry analysis reveals that chemical processing, food and beverage operations, mining, oil and gas production, pharmaceutical manufacturing, power generation, and pulp and paper facilities each impose unique fluid handling demands. Within the water and wastewater segment-comprising drinking water treatment, sewage treatment, and wastewater treatment-equipment requirements vary according to regulatory thresholds and the nature of the treated medium.

Application-based segmentation also sheds light on key usage scenarios such as boiler feed, chemical dosing, hygienic processing, process cooling, and slurry handling. Material selection plays a critical role in these contexts, with choices spanning alloy steel (including carbon and duplex variants), bronze, cast iron, plastic, and stainless steel. Understanding how each material performs under corrosive conditions, temperature fluctuations, and cleaning regimes is vital for aligning product specifications with operational objectives and longevity expectations.

This comprehensive research report categorizes the Sanitary Pumps & Valves market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Pump Type

- Valve Type

- Material

- End Use Industry

- Application

Gain a Deep Dive into Regional Market Variations and Growth Drivers Spanning the Americas, Europe Middle East Africa and Asia Pacific Domains

Regional dynamics within the sanitary pumps and valves sector present a complex tapestry of demand drivers, infrastructure developments, and regulatory nuances. In the Americas, the United States remains a dominant force, with investment in food and beverage production and stringent environmental regulations catalyzing modernization efforts. Canada’s emphasis on water treatment initiatives and Mexico’s growing pharmaceutical manufacturing base contribute to a diverse regional market characterized by both high-volume industrial projects and specialized hygienic systems.

The Europe, Middle East and Africa region exhibits similarly varied growth patterns. Western Europe’s robust regulatory environment fosters ongoing upgrades to existing processing plants, while emerging markets in Eastern Europe seek cost-effective solutions to support expanding chemical and power generation sectors. In the Middle East, strategic infrastructure investments are driving demand for reliable, low-maintenance equipment, and in Africa, water scarcity challenges have accelerated the deployment of advanced wastewater treatment facilities.

Asia-Pacific continues to register some of the highest growth rates globally, propelled by large-scale industrialization and rising consumer demand. China’s rapid expansion in food and beverage and petrochemical industries sustains strong uptake of both pumps and valves designed for hygienic applications. Meanwhile, India’s manufacturing renaissance, Southeast Asia’s burgeoning pharmaceutical sector, and Australia’s stringent quality standards collectively underscore the region’s critical importance for long-term market expansion.

This comprehensive research report examines key regions that drive the evolution of the Sanitary Pumps & Valves market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Identify Leading Industry Players and Strategic Collaborations Driving Innovation and Competitive Advantage in the Sanitary Pumps and Valves Sector

The competitive landscape of sanitary pumps and valves is anchored by an array of global and regional players that span a spectrum of capabilities from commodity production to high-precision engineering solutions. Leading pump manufacturers have invested heavily in research and development to integrate smart monitoring systems, advanced sealing geometries, and modular designs that facilitate rapid maintenance and retrofitting. Parallel innovations in valve technology emphasize ease of validation and changeover, particularly in highly regulated industries where downtime carries significant financial and reputational risks.

Strategic partnerships and mergers have further reshaped the market, enabling cross-platform integration of fluid handling equipment and software analytics. Joint ventures between technology providers and established mechanical engineers are expanding the availability of turnkey packages that include installation, commissioning, and long-term service agreements. Additionally, aftermarket and service divisions have become pivotal revenue centers for many organizations, as clients increasingly seek end-to-end lifecycle support to maximize asset uptime and operational efficiency.

Beyond traditional players, a new wave of specialized firms is emerging with niche capabilities in advanced materials, additive manufacturing, and IIoT integration. These agile competitors leverage digital platforms to customize product offerings and deliver enhanced transparency throughout the supply chain. As barriers to entry shift toward software proficiency and data-driven service models, established companies must adapt by forging alliances or investing in in-house expertise to sustain market leadership.

This comprehensive research report delivers an in-depth overview of the principal market players in the Sanitary Pumps & Valves market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- Alfa Laval AB

- Dover Corporation

- Flowserve Corporation

- GEA Group Aktiengesellschaft

- GEMÜ Gebr. Müller Apparatebau GmbH & Co. KG

- Grundfos Holding A/S

- Hanningfield Process Systems Ltd.

- Inoxpa S.A.

- ITT Inc.

- Kieselmann GmbH

- KSB SE & Co. KGaA

- NETZSCH Holding GmbH

- Samson Aktiengesellschaft

- Spirax-Sarco Engineering PLC

- SPX Flow, Inc.

Adopt Proven Strategic Initiatives and Operational Enhancements to Capitalize on Emerging Opportunities and Navigate Market Disruptions Effectively

Leaders aiming to capitalize on emerging market opportunities should prioritize the adoption of intelligent monitoring technologies, which enable real-time visibility into equipment performance and predictive maintenance scheduling. Implementing robust data analytics platforms can reduce unplanned downtime and optimize spare parts inventories, delivering measurable cost savings and improved operational reliability. In parallel, diversifying supplier networks and fostering local manufacturing partnerships can mitigate the impact of external policy shifts and tariff fluctuations, ensuring more predictable procurement costs and supply chain resilience.

To differentiate product portfolios, companies should invest in modular design architectures that facilitate rapid changeovers and system upgrades. Enhancing collaboration between R&D, production, and service teams accelerates the time to market for novel hygienic solutions. Furthermore, embedding sustainability criteria into product development-through material innovations, energy-efficient drive systems, and compliance with circular economy principles-can address growing environmental concerns and regulatory expectations.

Operational excellence can be further augmented by strengthening aftermarket service capabilities. Offering tailored service contracts, digital troubleshooting tools, and remote support models reinforces customer loyalty and generates recurring revenue streams. Lastly, fostering partnerships with software providers and academic institutions can yield breakthrough advancements in fluid dynamics modeling and digital twin simulations, positioning industry leaders at the forefront of technological evolution.

Understand the Rigorous Multi-Tiered Research Framework That Validates Data Accuracy and Industry-Relevant Insights within the Sanitary Pumps and Valves Report

This report employs a rigorous, multi-tiered research framework designed to ensure the accuracy, relevance, and depth of insights presented herein. The methodology integrates extensive secondary research, drawing upon a diverse array of publicly available sources including technical journals, regulatory filings, patent databases, and industry white papers. Complementing this foundation, proprietary databases and trade association reports were analyzed to capture historical trends, technology roadmaps, and materials developments across sanitary pump and valve applications.

Primary research was conducted through structured interviews and surveys with senior executives, product managers, and field engineers at leading pump and valve manufacturers, as well as with end users across key industries such as food and beverage, pharmaceuticals, and water treatment. On-site visits to manufacturing facilities and treatment plants provided additional contextual insights into operational challenges and best practices. Data triangulation techniques were applied to reconcile quantitative findings with qualitative feedback, thereby enhancing the robustness of conclusions.

Quality assurance protocols included multiple rounds of peer review and fact-checking by subject matter experts. All insights underwent validation against third-party benchmarks to ensure consistency and mitigate potential biases. While this report does not project future market sizes, the comprehensive analysis of current dynamics, segmentation patterns, regional drivers, and competitive strategies offers a solid foundation for informed decision-making and strategic planning.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Sanitary Pumps & Valves market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Sanitary Pumps & Valves Market, by Pump Type

- Sanitary Pumps & Valves Market, by Valve Type

- Sanitary Pumps & Valves Market, by Material

- Sanitary Pumps & Valves Market, by End Use Industry

- Sanitary Pumps & Valves Market, by Application

- Sanitary Pumps & Valves Market, by Region

- Sanitary Pumps & Valves Market, by Group

- Sanitary Pumps & Valves Market, by Country

- United States Sanitary Pumps & Valves Market

- China Sanitary Pumps & Valves Market

- Competitive Landscape

- List of Figures [Total: 17]

- List of Tables [Total: 1590 ]

Synthesize Core Findings to Highlight Critical Insights and Strategic Imperatives That Will Influence Future Growth Trajectories in the Sanitary Pumps and Valves Market

In summary, the sanitary pumps and valves market is entering a period characterized by accelerated technological innovation, heightened regulatory scrutiny, and evolving supply chain dynamics. The integration of digital monitoring and predictive maintenance capabilities has emerged as a pivotal strategy for enhancing operational efficiency and reducing lifecycle costs. Concurrently, recent tariff adjustments have underscored the importance of supply chain diversification and domestic manufacturing resilience.

Segmentation analysis reveals that performance requirements differ markedly across pump types, valve configurations, end use industries, and material selections. Regional variations further accentuate these distinctions, with growth trajectories in the Americas, Europe, Middle East and Africa, and Asia-Pacific influenced by distinct investment priorities and regulatory regimes. Meanwhile, leading companies continue to expand their competitive moats through strategic partnerships, modular product architectures, and enhanced aftermarket service offerings.

For industry stakeholders, these findings underscore the need to embrace a holistic approach-one that combines advanced technology adoption, sustainable design principles, and agile supply chain management. By aligning strategic initiatives with the insights detailed in this report, decision-makers can position their organizations to thrive amid evolving market landscapes and capture long-term value.

Connect Directly with Ketan Rohom to Secure Comprehensive Market Intelligence and Tailored Strategic Guidance for Sanitary Pumps and Valves Investments

If you’re seeking unparalleled depth and actionable intelligence to guide your strategic investments in sanitary pumps and valves, I invite you to discuss your requirements with Ketan Rohom, Associate Director of Sales & Marketing. His expertise in aligning bespoke market research with specific business objectives will ensure you receive precisely tailored insights that address your operational challenges and growth ambitions. Engaging with Ketan will provide you direct access to exclusive data analysis, personalized consultation sessions, and ongoing support throughout your decision-making process.

By connecting with Ketan, you will gain clarity on how to position your organization for success in rapidly evolving regulatory and technological environments. His proven track record in facilitating informed purchasing decisions means you’ll benefit from a streamlined acquisition experience and immediate guidance on how to leverage the report’s findings. Reach out today to secure your copy of the comprehensive sanitary pumps and valves market research report and unlock the strategic intelligence needed to outpace competitors and drive sustainable growth.

- How big is the Sanitary Pumps & Valves Market?

- What is the Sanitary Pumps & Valves Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?