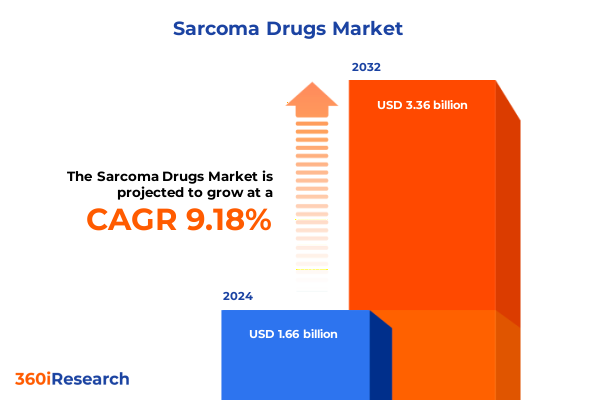

The Sarcoma Drugs Market size was estimated at USD 1.80 billion in 2025 and expected to reach USD 1.95 billion in 2026, at a CAGR of 9.32% to reach USD 3.36 billion by 2032.

Unveiling the critical drivers shaping the future of sarcoma drug development and market dynamics through a comprehensive lens

The evolving landscape of sarcoma drug development demands a holistic understanding of both scientific innovation and shifting stakeholder expectations. This analysis initiates with a foundation that contextualizes the complexities of sarcoma, a diverse group of malignancies arising in connective tissues, and maps the multifaceted forces shaping therapeutic progress. By framing the discussion around current research breakthroughs, regulatory dynamics, and patient advocacy trends, this introduction sets the stage for an informed exploration of market trajectories without relying on numerical forecasts.

Starting from the molecular underpinnings of sarcoma subtypes, it becomes clear that no single approach suffices to address the disease’s heterogeneity. As treatment paradigms broaden beyond conventional cytotoxic agents to include targeted and immune-mediated modalities, stakeholders-from clinical researchers to commercial strategists-must integrate insights across pharmacology, clinical development, and health economics. Emerging trial outcomes have reignited interest in novel antiangiogenic inhibitors alongside next-generation immunotherapies, illustrating a landscape in flux. Against this backdrop, our conversation embarks on dissecting transformative shifts, tariff-driven cost pressures, segmentation-specific considerations, and regional dynamics.

Bridging thought leadership and actionable guidance, this introduction underscores the imperative for decision makers to remain agile. With a focus on qualitative intelligence and thematic cohesion, the subsequent sections illuminate drivers, challenges, and opportunities that define the sarcoma drug ecosystem today.

Exploring transformative breakthroughs and emerging paradigms revolutionizing therapeutic approaches for sarcoma treatment worldwide

In recent years, sarcoma therapeutics have experienced a profound metamorphosis as the convergence of molecular biology and clinical innovation redefines treatment potential. Traditional chemotherapies, once the backbone of care, are now complemented by precision-driven targeted therapies that inhibit aberrant signaling pathways implicated in tumor angiogenesis and proliferation. Concurrently, the advent of checkpoint inhibitors and adoptive cell therapies has introduced a new frontier in immune modulation, with proof-of-concept trials demonstrating durable responses in select sarcoma subtypes.

This paradigm shift is driven by enhanced genomic profiling capabilities, which enable the classification of sarcoma into molecularly distinct cohorts amenable to bespoke interventions. The delineation of PDGF and VEGF pathways has spurred renewed investment in antiangiogenic strategies, while CDK4/6 and PARP inhibition approaches are emerging as critical avenues for targeting cell cycle dysregulation and DNA repair vulnerabilities, respectively. At the same time, cytokine therapies and cancer vaccines are progressing through early-phase trials, reflecting an intensified focus on harnessing the body’s immune machinery to overcome tumor-mediated immunosuppression.

Such transformative breakthroughs underscore a broader realignment in therapeutic intent: moving beyond uniform cytotoxic regimens toward an integrated arsenal that leverages combination approaches to optimize efficacy and minimize toxicity. As these innovations transition from research laboratories into clinical practice, stakeholders must navigate evolving regulatory frameworks, manage complex intellectual property landscapes, and anticipate the commercial implications of differentiated value propositions. Through this lens, the landscape of sarcoma drug development stands poised to redefine standards of care.

Assessing the ripple effects of newly imposed United States drug tariffs in 2025 on supply chains and stakeholder economics

The enforcement of new United States tariffs on pharmaceutical imports during 2025 has introduced complex challenges across the sarcoma drug supply chain, compelling stakeholders to reassess sourcing strategies and cost structures. Tariffs applied to active pharmaceutical ingredients sourced predominantly from India and China have generated ripple effects, impacting manufacturing timelines and prompting distributors to evaluate inventory buffers to maintain uninterrupted access for patients.

Healthcare providers and payers are now confronting higher list prices for select agents, which has intensified negotiations around formulary placement and patient assistance programs. These economic headwinds have magnified concerns regarding treatment adherence, as co-payment burdens may rise for therapies reliant on imported raw materials. Manufacturers have responded by exploring in-house API production capabilities, entering toll-manufacturing agreements within the United States, or securing alternative suppliers to mitigate exposure to tariff-induced cost escalations.

Moreover, the tariff environment has accelerated strategic partnerships between biopharmaceutical companies and contract manufacturing organizations that can guarantee domestic API output, thereby preserving price stability and ensuring regulatory compliance. Regulatory affairs teams have also ramped up engagement with customs and trade experts to navigate classification nuances, seeking exemptions and streamlined clearance pathways. In essence, the 2025 tariff regime has reshaped stakeholder priorities, compelling a shift toward supply chain resilience and localization strategies to safeguard continuity of care for sarcoma patients.

Deciphering detailed segment-specific insights into sarcoma therapies based on pharmacological class, clinical indication, administration pathways, end users, and treatment combinations

A nuanced examination of sarcoma drug segmentation illuminates critical disparities in development trajectories, adoption patterns, and resource allocation across pharmacological classes, indications, administration methods, end-user settings, and treatment modalities. Within the realm of drug classes, the antiangiogenic category has bifurcated into platelet-derived growth factor inhibitors and vascular endothelial growth factor antagonists, each following distinct developmental pathways informed by target validation and resistance mechanisms. Chemotherapy remains anchored by legacy modalities like alkylating agents and anthracyclines, even as antimetabolites and topoisomerase inhibitors evolve to offer more favorable tolerability profiles.

Indication-specific considerations further refine strategic outlooks, as bone sarcomas such as chondrosarcoma, Ewing sarcoma, and osteosarcoma necessitate tailored regimens in contrast to gastrointestinal stromal tumors, Kaposi sarcoma, and diverse soft tissue variants including leiomyosarcoma, liposarcoma, rhabdomyosarcoma, and synovial sarcoma. These distinctions inform clinical trial design, dosing algorithms, and biomarker-driven enrollment criteria. Administration pathways ranging from oral formulations to intravenous, intramuscular, and subcutaneous delivery modes impose additional layers of complexity related to patient convenience, adherence, and site-of-care economics.

End users feature equally varied imperatives: hospitals and specialty clinics prioritize infusion protocols and inpatient monitoring capabilities, while ambulatory surgical centers and home care settings seek compact, patient-managed therapies. Finally, monotherapy strategies compete with combination regimens that blend chemotherapy with immunotherapy or targeted agents, each converging on multi-mechanistic approaches to mitigate resistance and maximize response durability. This segmentation matrix underscores the imperative for granular intelligence to inform tailored market entry, clinical positioning, and stakeholder engagement plans.

This comprehensive research report categorizes the Sarcoma Drugs market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Drug Class

- Route Of Administration

- Treatment Modality

- Indication

- End User

Illuminating regional dynamics influencing sarcoma drug accessibility and adoption trends across the Americas, EMEA, and Asia-Pacific markets

Regional dynamics exert a profound influence on the accessibility, regulatory approval timelines, and clinical uptake of sarcoma drugs. In the Americas, robust health technology assessment frameworks and reimbursement pathways have catalyzed early adoption of innovative therapies, particularly within the United States and Canada. Patient advocacy groups in this region have successfully lobbied for expanded access programs, driving momentum for breakthrough designations and accelerated review processes.

Conversely, the Europe, Middle East & Africa landscape presents heterogeneity in regulatory regimes and reimbursement calculus. While European Union member states often share centralized marketing authorizations, national-level pricing negotiations and health economic assessments introduce variability in time-to-market and formulary availability. In the Middle East, nascent patient registries and evolving insurance models are shaping market entry strategies, whereas African markets grapple with infrastructure constraints that limit widespread deployment of complex infusion-based treatments.

Asia-Pacific markets offer divergent trajectories: mature ecosystems like Japan and South Korea demonstrate high receptivity to both targeted and immunotherapeutic modalities, backed by strong domestic biopharma investment. In emerging markets across Southeast Asia and Oceania, however, price sensitivity and logistics infrastructure impose pragmatic limits on the penetration of high-cost, parenteral therapies. These regional distinctions necessitate bespoke licensing agreements, differentiated pricing models, and strategic alliances with local distributors to optimize uptake and ensure equitable patient access across geographies.

This comprehensive research report examines key regions that drive the evolution of the Sarcoma Drugs market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Highlighting leading pharmaceutical innovators driving sarcoma drug advancements through strategic collaborations, pipelines, and competitive positioning

Competitive positioning within the sarcoma drug domain is shaped by a constellation of established pharmaceutical giants and nimble biotech innovators advancing differentiated pipelines. Several multinational firms have fortified their portfolios through strategic collaborations, securing co-development deals to combine targeted agents with immunotherapies. Licensing partnerships have also proliferated, enabling smaller biotechs to leverage global commercial infrastructure while retaining milestone-based incentives tied to clinical outcomes and regulatory achievements.

Venture-backed biotech companies are driving first-in-class and best-in-class concepts, focusing on novel mechanisms such as selective CDK4/6 inhibitors and mTOR pathway modulators. These entities often pursue expedited clinical pathways by capitalizing on orphan drug designations and rare pediatric disease incentives. Simultaneously, established players reinforce their market dominance by acquiring promising candidates, forging joint ventures around cell therapy platforms, and investing in next-generation delivery technologies to enhance patient convenience and adherence.

Additionally, contract manufacturing and research organizations are emerging as strategic assets, offering end-to-end capabilities from early-stage molecule screening to late-phase clinical manufacturing. Their role in optimizing production yields, ensuring regulatory compliance, and reducing time-to-market has become integral to the broader ecosystem. Collectively, these corporate maneuvers delineate a competitive map where innovation velocity, regulatory acumen, and commercial agility converge to determine leadership in sarcoma therapeutics.

This comprehensive research report delivers an in-depth overview of the principal market players in the Sarcoma Drugs market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- Abbott Laboratories

- AbbVie Inc.

- AgonOx

- Amneal Pharmaceuticals LLC

- Aurobindo Pharma Limited

- Baxter International Inc.

- Bayer AG

- Bristol-Myers Squibb Company

- Daiichi Sankyo Company, Limited

- Eisai Co., Ltd.

- Eli Lilly and Company

- F. Hoffmann-La Roche Ltd.

- Fresenius Kabi AG

- GlaxoSmithKline PLC

- Hikma Pharmaceuticals PLC

- Ipsen Pharma

- Johnson & Johnson Services, Inc.

- Karyopharm Therapeutics Inc.

- Lupin Limited

- Merck & Co., Inc.

- Novartis AG

- Pfizer Inc.

- Sun Pharmaceutical Industries Limited

- TRACON Pharmaceuticals, Inc.

- Viatris Inc.

Delivering actionable strategic guidance for industry stakeholders to navigate complex sarcoma drug market challenges and capitalize on growth opportunities

Industry leaders must adopt a multi-pronged strategy to thrive in the evolving sarcoma drug landscape. Prioritizing resilient supply chains is essential; stakeholders should secure diversified API sources, explore in-region manufacturing partnerships, and invest in digital tracking systems to ensure continuity. Concurrently, robust clinical development programs must integrate adaptive trial designs that accommodate histology-agnostic indications and leverage real-world evidence to strengthen safety and efficacy profiles.

Commercial strategies should hinge on patient-centric models that lower barriers to treatment uptake. This involves developing tiered pricing frameworks that reflect regional reimbursement capabilities, structuring outcomes-based agreements with payers, and expanding patient support services that address adherence challenges. Collaborative dialogue with advocacy groups and medical societies can amplify educational initiatives, cultivating awareness around emerging therapies and facilitating earlier diagnosis in underserved subpopulations.

Furthermore, innovators should invest in precision medicine platforms that harness biomarker-driven screening to identify responsive cohorts, thereby enhancing clinical trial success rates and market access. Embracing digital health tools-such as remote monitoring applications and telemedicine channels-can extend care beyond traditional infusion centers, aligning treatment modalities with patient lifestyles. These recommendations collectively equip industry stakeholders with actionable insights to mitigate risk, maximize resource allocation, and accelerate the delivery of life-changing sarcoma therapeutics.

Outlining rigorous research methodology integrating primary stakeholder interviews, secondary literature analysis, and data triangulation approaches

This analysis is founded on an integrative research methodology that synthesizes primary and secondary data sources to ensure comprehensive and reliable insights. Primary intelligence was gathered through structured interviews with oncology thought leaders, clinical trial investigators, payers, and patient advocacy representatives, enabling a firsthand understanding of unmet needs, treatment patterns, and economic drivers. This qualitative input was augmented by in-depth consultations with regulatory affairs experts to map evolving approval frameworks and tariff implications.

Secondary research encompassed a rigorous review of peer-reviewed journals, white papers, conference proceedings, and non-proprietary industry reports, carefully filtered to exclude sponsored market forecasts. Data triangulation techniques were applied to cross-verify clinical pipeline progress, competitive developments, and regional adoption trends. Patent databases, clinical trial registries, and global pharmacovigilance resources provided additional layers of validation around efficacy outcomes and safety signals.

Collectively, these methodologies ensure that the insights presented are grounded in evidence and reflect the current state of sarcoma drug development. By integrating diverse stakeholder perspectives with objective literature analysis, the report delivers a nuanced, multidimensional view of market dynamics and strategic imperatives.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Sarcoma Drugs market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Sarcoma Drugs Market, by Drug Class

- Sarcoma Drugs Market, by Route Of Administration

- Sarcoma Drugs Market, by Treatment Modality

- Sarcoma Drugs Market, by Indication

- Sarcoma Drugs Market, by End User

- Sarcoma Drugs Market, by Region

- Sarcoma Drugs Market, by Group

- Sarcoma Drugs Market, by Country

- United States Sarcoma Drugs Market

- China Sarcoma Drugs Market

- Competitive Landscape

- List of Figures [Total: 17]

- List of Tables [Total: 2067 ]

Concluding insights synthesizing key takeaways to reinforce strategic imperatives for future developments in sarcoma therapeutics

In conclusion, the sarcoma drug landscape is at an inflection point defined by scientific breakthroughs, regulatory evolution, and economic headwinds. From the rise of targeted and immune-based therapies to the strategic realignment triggered by U.S. tariffs, stakeholders must remain vigilant in adapting to a complex matrix of clinical, commercial, and logistical variables. The segmentation insights reveal critical paths for product differentiation, while regional analyses underscore the necessity of tailored market entry and pricing strategies.

Competitive dynamics illustrate that collaboration-whether through licensing, joint ventures, or contract manufacturing-remains pivotal for sustaining innovation momentum. The actionable recommendations emphasize supply chain fortification, patient-centric commercialization, and precision medicine integration as cornerstones for success. Supported by a robust research methodology, these findings coalesce into a strategic blueprint that equips decision makers to navigate uncertainties and harness opportunities within the sarcoma therapeutics domain.

By synthesizing key takeaways and aligning them with organizational priorities, this executive summary serves as a springboard for informed strategy development, empowering stakeholders to accelerate the translation of scientific advances into transformative patient outcomes.

Engage with Ketan Rohom to secure comprehensive sarcoma drug market insights and elevate strategic decision-making for your organization today

To explore this market further and obtain an in-depth report that unpacks the complex variables driving sarcoma drug development, reach out directly to Ketan Rohom, Associate Director, Sales & Marketing at 360iResearch. Ketan offers personalized guidance to tailor the report scope for your strategic needs. Engage now to gain early access to proprietary analyses, detailed segmentation matrices, and expert projections that will position your organization at the forefront of sarcoma therapeutics innovation. Partner with Ketan to secure your competitive advantage and accelerate evidence-based decision making through a comprehensive, custom market intelligence package.

- How big is the Sarcoma Drugs Market?

- What is the Sarcoma Drugs Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?