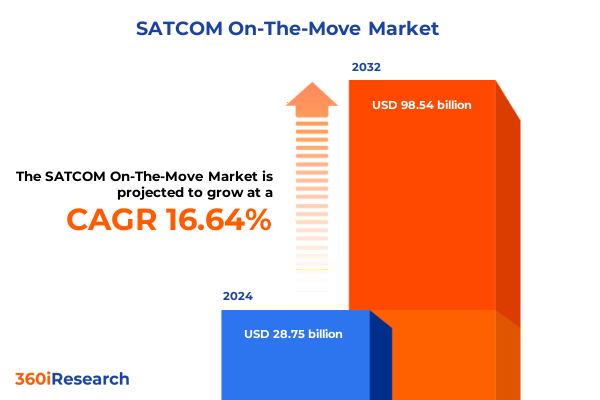

The SATCOM On-The-Move Market size was estimated at USD 33.41 billion in 2025 and expected to reach USD 38.84 billion in 2026, at a CAGR of 16.70% to reach USD 98.54 billion by 2032.

Establishing the Urgency of Maintaining Continuous Connectivity Across Air, Land, and Maritime Domains to Navigate Modern Mobile Communications Needs

Satellite communications on the move, commonly referred to as SATCOM On-The-Move, has become indispensable for modern operations spanning defense missions, maritime logistics, and airborne connectivity solutions. Originally conceived to enable continuous linkages for military convoys, vessels, and aircraft, SATCOM On-The-Move systems now address a broad spectrum of mobility requirements in commercial enterprises and emergency services. The core principle behind SATCOM On-The-Move is that a vehicle or platform equipped with agile satellite antennas can establish and maintain a stable connection with orbiting satellites while in transit, ensuring real-time data exchange and operational continuity.

Furthermore, the urgency of adopting robust SATCOM On-The-Move capabilities is underscored by ongoing network modernization efforts within the United States Army and allied forces. For example, the Army’s Phase Two Armored Formation Network On-The-Move Pilot demonstrated that integrated satellite and line-of-sight solutions significantly enhance command and control for armored brigades operating in distributed and contested environments. As mission profiles grow more dynamic and dispersed, stakeholders across commercial aviation, maritime transport, and oil and gas sectors increasingly seek seamless connectivity solutions that parallel these military benchmarks.

Charting the Rapid Technological Evolution and Multi-Orbit Network Innovations That Are Reshaping On-The-Move Satellite Communications

Over the past decade, the SATCOM On-The-Move landscape has undergone a fundamental transformation driven by advances in multi-orbit architectures and software-defined networking. Traditional geostationary satellites, once the backbone of mobile connectivity, are now complemented by medium Earth orbit and low Earth orbit constellations that deliver lower latency and higher throughput. Inmarsat’s forthcoming Orchestra network exemplifies this paradigm shift by integrating GEO Global Xpress, L-band ELERA, targeted LEO capacity, and terrestrial 5G into a dynamic mesh architecture, thereby enabling seamless switching between network layers to optimize performance and resilience.

In addition, virtualization and containerization technologies are reshaping ground segment operations by decoupling hardware dependencies and enabling flexible deployments in austere environments. Kratos Defense & Security Solutions, in collaboration with SES’s O3b mPOWER MEO constellation, demonstrated a fully virtualized SATCOM ground system that supports make-before-break handovers, critical for platforms traversing overlapping satellite footprints. As such, these integrated multi-orbit strategies and software-driven ground solutions are rapidly redefining mission-critical connectivity, empowering users to maintain high-bandwidth, low-latency links while on the move.

Unveiling the Far-Reaching Consequences of United States Trade Policies on On-The-Move Satellite Systems and Supply Chains

The introduction of sweeping tariffs on satellite communications equipment by the United States in 2025 has had a ripple effect across the SATCOM On-The-Move sector, elevating procurement costs and prompting strategic realignments in supply chains. Key components such as phased-array antennas, optical transceivers, and radomes-often sourced from Asia-were subject to duties ranging from 10 to 25 percent, forcing manufacturers to absorb price increases or seek alternative suppliers. Consequently, program timelines faced delays and some R&D initiatives, including beam-steering antenna projects, experienced budget cuts as companies grappled with higher input expenses and longer lead times.

Moreover, the cumulative impact of these tariffs extended beyond immediate cost pressures to influence strategic decisions on domestic manufacturing. For instance, Intellian established a U.S. production line for its ARC-M4 Block 1 hybrid terminals to mitigate exposure to import duties and enhance supply chain resilience for military and maritime partners. Similarly, Cobham Satcom’s tactical antenna range pursued Wideband Global SATCOM (WGS) certification to ensure continuity of military-grade terminal deployments, reaffirming the sector’s pivot towards localized production and government-backed validation processes.

Revealing How Platform Types, End Users, Frequency Bands, and Applications Coalesce to Define SATCOM on-the-Move Market Dynamics

Mobile satellite communication platforms are defined by their underlying technology, end-user requirements, frequency allocations, and application-specific demands. Platform types span airborne configurations-including fixed wing, rotary wing, and unmanned aerial vehicles-that necessitate lightweight, high-track-speed antennas; land mounts ranging from railcar systems to unmanned ground vehicles and vehicle-mounted solutions; and maritime installations with buoy-mounted and vessel-mounted terminals designed for dynamic sea conditions. End users embrace a spectrum of needs, from commercial enterprises and emergency services to government agencies at federal, state, and local levels, as well as military branches such as air force, army, and navy, and specialized sectors like maritime transport and oil and gas. These diverse segments impose unique performance benchmarks and regulatory constraints, shaping terminal ruggedization, security features, and service-level agreements.

Frequency bands further differentiate offerings: C band remains a workhorse for legacy connectivity, while X band supports military missions requiring anti-jam capabilities. Ku band and Ka band drive high-throughput applications, with Ka band terminals now available in conventional and high-throughput variants to address soaring data requirements. Applications range from broadcast and surveillance to critical navigation and communications, the latter subdivided into data, video, and voice services tailored to operational priorities. By interlinking these segmentation dimensions, stakeholders can pinpoint growth opportunities, optimize product roadmaps, and align network investments with the evolving demands of mobile satellite communications.

This comprehensive research report categorizes the SATCOM On-The-Move market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Platform Type

- Frequency Band

- End User

- Application

Comparing Regional Developments in the Americas, EMEA, and Asia-Pacific to Contextualize Satellite Communications on-the-Move Opportunities

Regional dynamics play a pivotal role in shaping SATCOM On-The-Move adoption and technological priorities. In the Americas, robust defense modernization initiatives, exemplified by the U.S. Army’s Capability Set 2025 On-The-Move pilots, are accelerating the procurement of multi-band, multi-orbit terminals. Concurrently, commercial ventures like SpaceX’s Starlink continue to expand regulatory footprints, securing five-year operational licenses in India and forging strategic partnerships to address remote connectivity challenges.

Meanwhile, Europe, the Middle East, and Africa exhibit a blend of legacy network upgrades and nascent multi-orbit trials. European consortiums evaluate non-terrestrial network integration to bolster resilience against spectrum congestion and geopolitical dependencies, while Middle Eastern maritime sectors invest in high-throughput maritime VSAT solutions for offshore energy platforms. In Africa, several nations accelerated regulatory approvals for Starlink amid broader trade negotiations, highlighting the strategic interplay between trade policy and connectivity objectives.

Asia-Pacific markets are marked by rapid digital transformation and infrastructure modernization. Australia’s defense satellite programs incorporate L-band ELERA terminals for distributed sensor networks, while India’s IN-SPACe granted operational licenses to multiple LEO operators, opening new avenues for rural broadband and enterprise backhaul services. This regional mosaic underscores how localized policy landscapes and technological investments drive differentiated demand for SATCOM On-The-Move capabilities.

This comprehensive research report examines key regions that drive the evolution of the SATCOM On-The-Move market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Highlighting the Strategies and Innovations of Leading SATCOM On-The-Move Providers Driving Competitive Advantage in Multi-Orbit Environments

Leading providers in the SATCOM On-The-Move arena are leveraging multi-orbit strategies, advanced antenna designs, and domestic production to secure competitive advantage. SpaceX’s Starlink continues to disrupt traditional models by advocating for reduced trade barriers and spectrum access fees in foreign markets, underpinning its global expansion strategy. Inmarsat is investing over $100 million to deploy 150 to 175 LEO satellites as part of its Orchestra initiative, enhancing latency, throughput, and resilience across maritime, aviation, and government segments.

On the ground segment, Kratos and SES have demonstrated fully virtualized SATCOM ground systems capable of supporting simultaneous MEO and GEO sessions with make-before-break handovers, a critical advancement for mobile operations. Intellian’s introduction of the v100NX convertible maritime VSAT antenna underscores the shift toward future-proof dual-band, multi-orbit tracking platforms designed for seamless GEO, MEO, and LEO transitions. Meanwhile, Cobham Satcom’s upgraded Tactical Tracker line, pending WGS certification, reinforces the emphasis on rapid deployment and interoperability with military satellite constellations.

This comprehensive research report delivers an in-depth overview of the principal market players in the SATCOM On-The-Move market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- Airbus U.S. Space & Defense, Inc.

- Alico Systems Inc.

- ASELSAN A.Ş.

- Ball Corporation

- Boeing Company

- Celera Motion by Novanta Company

- Cobham Ltd.

- Comtech Telecommunications Corp.

- DataPath, Inc.

- EchoStar Corporation

- EM Solutions Pty Ltd.

- General Dynamics Mission Systems, Inc.

- Gilat Satellite Networks Ltd.

- Honeywell International Inc.

- Inmarsat Global Ltd. by Viasat Inc

- Intelsat S.A.

- Iridium Communications Inc.

- KVH Industries, Inc.

- L3Harris Technologies, Inc.

- Leonardo DRS

- ND SatCom

- Raytheon Technologies Corporation

- Satcube Inc.

- SES S.A.

- SpaceX

- Synertone Communication Corporation

- Thales Group

- VectorNav Technologies, LLC

Delivering Tactical Guidance on Supply Chain Fortification, Technology Investments, and Strategic Partnerships to Enhance Mobile SATCOM Resilience

To navigate the evolving SATCOM On-The-Move landscape, industry leaders should fortify their supply chains by diversifying component sources and investing in local manufacturing capabilities, reducing exposure to tariff fluctuations and geopolitical risks. Furthermore, establishing strategic partnerships with multi-orbit satellite operators and ground segment specialists can accelerate the adoption of dynamic mesh networks and virtualization architectures, driving service differentiation and performance consistency.

In addition, allocating R&D resources toward compact, software-defined terminals with rapid beam-switching capabilities will address customer demands for agility and network resilience. Finally, engaging with regulators and standards bodies to shape open architectures and interoperability frameworks will ensure seamless integration across GEO, MEO, LEO, and terrestrial networks, maximizing the value of hybrid connectivity solutions.

Outlining the Rigorous Mixed-Method Approach Combining Primary Interviews and Secondary Data Triangulation to Ensure Analytical Rigor

This analysis integrates a rigorous mixed-method research framework grounded in primary stakeholder interviews and comprehensive secondary data triangulation. Initially, subject-matter experts, including defense procurement officers and commercial network architects, were engaged to validate technology trends and procurement drivers. These qualitative insights were complemented by secondary sources such as government publications, industry press releases, and peer-reviewed journals to ensure a balanced perspective.

Data triangulation was achieved by cross-referencing vendor announcements, regulatory filings, and defense pilot program reports, enabling the synthesis of nuanced market dynamics. This approach was further strengthened by continuous expert consultations conducted throughout the research cycle to corroborate findings and refine strategic recommendations.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our SATCOM On-The-Move market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- SATCOM On-The-Move Market, by Platform Type

- SATCOM On-The-Move Market, by Frequency Band

- SATCOM On-The-Move Market, by End User

- SATCOM On-The-Move Market, by Application

- SATCOM On-The-Move Market, by Region

- SATCOM On-The-Move Market, by Group

- SATCOM On-The-Move Market, by Country

- United States SATCOM On-The-Move Market

- China SATCOM On-The-Move Market

- Competitive Landscape

- List of Figures [Total: 16]

- List of Tables [Total: 1908 ]

Synthesizing Core Insights on Market Shifts, Policy Impacts, and Technological Advancements to Articulate the Future of Mobile SATCOM

The SATCOM On-The-Move domain is undergoing a profound transformation fueled by multi-orbit network integration, evolving regulatory landscapes, and strategic supply chain realignments. Technological innovations-from dynamic mesh architectures to virtualization on the ground-are reshaping connectivity paradigms and expanding the addressable use cases across defense, commercial, and government sectors. Trade policies and tariff regimes have prompted a strategic pivot toward domestic manufacturing and diversified procurement models, underscoring the sector’s resilience and adaptability.

Looking ahead, the convergence of GEO, MEO, LEO, and terrestrial networks will continue to drive performance advancements, while collaborative frameworks among regulators, operators, and technology providers will be critical to unlocking the full potential of SATCOM On-The-Move. Stakeholders who proactively embrace these shifts and prioritize agility in their technology roadmaps will establish leadership positions in this dynamic communications landscape.

Encouraging Immediate Engagement with Ketan Rohom to Secure Access to the Comprehensive SATCOM On-The-Move Research Report for Strategic Advantage

To take decisive action and gain an authoritative edge, contact Ketan Rohom, Associate Director, Sales & Marketing, to purchase the comprehensive SATCOM On-The-Move research report. Engage now to unlock strategic insights, detailed segmentation, and actionable recommendations tailored to your organization’s needs. Secure your copy today and position your team at the forefront of mobile satellite communications innovation.

- How big is the SATCOM On-The-Move Market?

- What is the SATCOM On-The-Move Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?