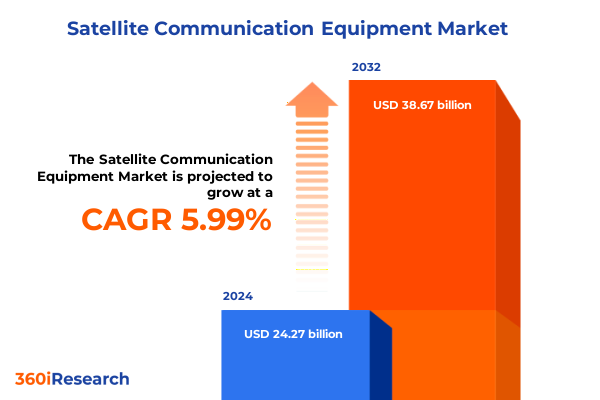

The Satellite Communication Equipment Market size was estimated at USD 25.31 billion in 2025 and expected to reach USD 26.39 billion in 2026, at a CAGR of 6.24% to reach USD 38.67 billion by 2032.

Unveiling strategic imperatives driving satellite communication equipment evolution as emerging technologies and shifting demand redefine global connectivity networks

As digital transformation accelerates across industries, satellite communication equipment stands at the forefront of redefining how data is transmitted and received across vast distances. The confluence of emerging technologies such as low Earth orbit constellations, advanced antenna designs, and software-defined network architectures has created an environment in which traditional paradigms of connectivity are being challenged. Against this backdrop, industry stakeholders must identify the critical strategic imperatives that will govern success in an increasingly competitive landscape characterized by rapid innovation and shifting customer expectations.

This introduction serves as a foundation for understanding the complex interplay between technological advancements, evolving regulatory frameworks, and dynamic market forces influencing satellite communication equipment. It underscores the necessity for decision-makers to embrace agility in their go-to-market strategies, cultivate partnerships that span the value chain, and anticipate the convergence of satellite and terrestrial networks. By recognizing these foundational imperatives, readers will be better equipped to interpret subsequent analyses and derive actionable insights that fuel sustainable growth.

Exploring revolutionary shifts in satellite communication ecosystems as mega-constellation deployment, hybrid network integration, and signal processing redefine capabilities

In recent years, the satellite communication landscape has undergone a profound transformation driven by the deployment of mega-constellations and the integration of hybrid satellite-terrestrial networks. These large-scale low Earth orbit deployments have dramatically reduced latency while increasing throughput, paving the way for applications that were previously constrained by inherent geostationary limitations. Concurrently, hybrid network architectures are bridging gaps between satellite and fiber or cellular networks, enabling seamless handoffs and ubiquitous coverage in ways that were inconceivable just a few years ago.

Furthermore, advances in signal processing techniques, including digital beamforming and adaptive modulation, have elevated system performance by improving spectral efficiency and enhancing link reliability. Edge computing capabilities are being embedded within satellite terminals to process data closer to end users, reducing backhaul demands and unlocking new applications in sectors ranging from defense surveillance to remote health care delivery. Together, these transformative shifts are redefining service capabilities and laying the groundwork for the next generation of resilient, high-performance communication infrastructures worldwide.

Assessing the multifaceted consequences of 2025 United States tariff implementations on satellite communication equipment supply chains, costs, and market resilience

The introduction of elevated tariff rates by the United States in 2025 has exerted significant pressure on the satellite communication equipment supply chain. Import duties imposed on key components-ranging from radomes and waveguide assemblies to high-precision electronic subassemblies-have increased landed costs and compressed supplier margins. As a result, many manufacturers have reevaluated their sourcing strategies to mitigate exposure to fluctuating trade policies and minimize the impact on end-user pricing models.

In response, several vendors have accelerated efforts to diversify their supplier base, seeking alternative manufacturing hubs and exploring nearshoring options to reduce lead times and currency risks. Additionally, component redesign initiatives are underway to incorporate domestically sourced materials and standardize interfaces, thereby fostering greater supply chain resilience. While these adjustments necessitate upfront investment in engineering and qualification processes, they ultimately contribute to a more robust ecosystem capable of absorbing future policy shifts and sustaining long-term industry growth.

Illuminating equipment type, platform, frequency band, application, and service type segmentation perspectives driving targeted strategies in satellite communication markets

The satellite communication equipment landscape is characterized by multiple layers of segmentation that collectively shape market dynamics and strategic priorities. Equipment type segmentation divides the landscape into ground equipment offerings-such as antennas engineered for precise beam control, hub stations facilitating network aggregation, and satellite modems ensuring signal conversion-and user terminals encompassing broadband global area network terminals, satellite telephony devices, and very small aperture terminals further delineated into fixed installations and mobile units. Each of these equipment categories demands specialized engineering, certification pathways, and service infrastructures to meet the unique requirements of end users.

Beyond physical hardware, platform segmentation highlights distinct operational environments: aeronautical solutions enabling in-flight connectivity, fixed VSAT networks delivering broadband to remote stations, land mobile systems meeting critical communications in transit, and mobile VSAT services providing flexibility across moving platforms. Frequency band segmentation underscores the strategic trade-offs between C Band’s resilience to weather, Ka Band’s high throughput potential, Ku Band’s balance of capacity and coverage, and L Band’s ubiquitous availability for compact terminals.

Moreover, application segmentation reveals differentiated value propositions across aviation, broadcast and media distribution, defense and security operations, government communications, maritime connectivity, and oil and gas exploration-each with unique performance and regulatory demands. Finally, service type segmentation bridges the hardware and application layers by distinguishing between one-time equipment sales, ongoing maintenance and support contracts, and managed service offerings that encompass network monitoring and technical support. Together, these segmentation perspectives inform targeted go-to-market strategies and investment decisions that align with customer needs and operational constraints.

This comprehensive research report categorizes the Satellite Communication Equipment market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Equipment Type

- Platform

- Frequency Band

- Service Type

- Application

Analyzing distinctive regional dynamics across the Americas, Europe, Middle East & Africa, and Asia-Pacific illuminating investment priorities and growth enablers

Regional dynamics in satellite communication equipment demand continue to diverge based on distinct economic, regulatory, and infrastructure profiles. The Americas region remains a hotbed for innovation, with substantial investments in low Earth orbit constellations and a growing emphasis on enterprise broadband for remote mining, agriculture, and public safety applications. Favorable spectrum policies and a mature vendor ecosystem have helped accelerate technology trials, driving deeper penetration of VSAT and aeronautical solutions.

In Europe, the Middle East & Africa, regulatory harmonization efforts are reshaping market entry strategies, particularly in nations prioritizing national security communications and digital inclusion initiatives. Public sector tenders for defense-grade terminals and government broadband projects are catalyzing demand, while partnerships between regional satellite operators and global equipment providers are unlocking financing models tailored to sovereign requirements. Meanwhile, the Asia-Pacific region is witnessing robust growth driven by maritime logistics, offshore energy exploration, and rural connectivity programs. High-density shipping routes and resource extraction zones are fuelling demand for resilient communication infrastructures, complemented by strategic undersea cable investments that position satellite as a critical redundancy layer.

This comprehensive research report examines key regions that drive the evolution of the Satellite Communication Equipment market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Profiling leading satellite communication equipment innovators and challengers charting competitive positioning through strategic partnerships and pioneering technologies

An examination of leading industry players reveals a constellation of established incumbents and agile challengers shaping competitive dynamics. Major systems integrators have fortified their portfolios through mergers and alliances, enabling end-to-end offerings that span ground station hardware, user terminals, and managed network services. At the same time, specialist antenna manufacturers have leveraged breakthroughs in metamaterials and phased-array technologies to deliver cost-effective solutions optimized for emerging frequency bands and dynamic beam steering.

New entrants focused on software-defined payloads and virtualization have introduced disruptive business models that decouple hardware ownership from service delivery, empowering end users to scale up capacity on demand. Collaborations between satellite operators and cloud providers are further blurring traditional boundaries, with joint development efforts aimed at embedding network functions virtualization directly within space-borne assets. Collectively, these competitive moves underscore a market where technological prowess, ecosystem partnerships, and service differentiation are paramount catalysts for gaining market share.

This comprehensive research report delivers an in-depth overview of the principal market players in the Satellite Communication Equipment market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- Cobham Limited

- Eutelsat S.A.

- Gilat Satellite Networks Ltd.

- Hughes Network Systems, LLC

- Inmarsat Global Limited

- Intelsat, Ltd.

- L3Harris Technologies, Inc.

- Raytheon Technologies Corporation

- SES S.A.

- Telesat Canada

- Viasat, Inc.

Delivering strategic imperatives for industry leaders to harness emerging technologies, mitigate regulatory challenges, and cultivate sustainable growth in satellite communications

Industry leaders must prioritize a multifaceted strategy that balances near-term resilience with long-term innovation imperatives. Investing in modular antenna architectures and open radio access network principles will enable rapid adaptation to shifting spectrum allocations and emerging frequency bands. Concurrently, strengthening local manufacturing capabilities through joint ventures and licensing agreements can mitigate the impact of trade uncertainties while fostering greater supply chain transparency.

Engagement with regulatory bodies is equally crucial; proactive participation in spectrum standardization forums and government working groups will help shape favorable policy outcomes. Companies should also expand managed service portfolios, leveraging network monitoring and advanced analytics to deliver turnkey propositions that reduce operational complexity for end users. Finally, cultivating an ecosystem of technology partners-from semiconductor vendors to cloud-native software developers-will accelerate time to market and unlock synergistic innovation across the satellite communication value chain.

Detailing the comprehensive research framework integrating primary stakeholder interviews, secondary data analysis, and rigorous validation protocols

This analysis is underpinned by a rigorous research framework combining qualitative and quantitative methodologies. Primary data was obtained through structured interviews with senior executives, technical specialists, and procurement officers spanning satellite operators, equipment manufacturers, and end-user organizations. Secondary data sources included public filings, regulatory databases, and technical white papers from industry consortia and standardization bodies.

To ensure data integrity, findings were validated through a multi-tiered peer review process involving domain experts in RF engineering, supply chain management, and policy analysis. Market trends and technology roadmaps were cross-referenced against patent filings and academic publications to confirm the trajectory of innovation. This comprehensive approach guarantees that the insights presented herein are both credible and actionable for decision-makers navigating the complex satellite communication equipment environment.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Satellite Communication Equipment market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Satellite Communication Equipment Market, by Equipment Type

- Satellite Communication Equipment Market, by Platform

- Satellite Communication Equipment Market, by Frequency Band

- Satellite Communication Equipment Market, by Service Type

- Satellite Communication Equipment Market, by Application

- Satellite Communication Equipment Market, by Region

- Satellite Communication Equipment Market, by Group

- Satellite Communication Equipment Market, by Country

- United States Satellite Communication Equipment Market

- China Satellite Communication Equipment Market

- Competitive Landscape

- List of Figures [Total: 17]

- List of Tables [Total: 1590 ]

Synthesis of evolving trends and strategic considerations offering a cohesive roadmap for stakeholders navigating the satellite communication equipment landscape

The convergence of advanced satellite architectures, evolving regulatory landscapes, and demand-driven service models is redefining the competitive contours of the equipment market. Through a holistic examination of transformative technology shifts, tariff-driven supply chain adaptations, nuanced segmentation insights, and region-specific dynamics, this summary has charted the critical inflection points that will guide future investment and innovation.

Stakeholders equipped with these synthesized findings can develop roadmaps that balance agility with strategic foresight-aligning product development pipelines, distribution networks, and service offerings to capitalize on emerging opportunities. As the industry continues to evolve, maintaining a vigilant posture toward technological breakthroughs, policy developments, and competitive moves will be essential for sustaining growth and securing market leadership.

Engage with Ketan Rohom for tailored insights and actionable guidance to secure your competitive advantage in the dynamic satellite communication equipment market

For a comprehensive exploration of the strategic imperatives, technological breakthroughs, and actionable pathways outlined in this executive summary, we invite you to connect directly with Ketan Rohom, Associate Director of Sales & Marketing, to secure your copy of the full market research report. His expertise in satellite communication trends and deep understanding of industry dynamics will ensure you receive tailored guidance that aligns with your organization’s unique priorities and objectives.

By engaging with Ketan, you will gain access to exclusive data-driven insights, customized scenario analyses, and one-on-one consultations designed to help you navigate regulatory headwinds, accelerate innovation, and optimize your competitive positioning. Reach out today to embark on a collaborative journey toward unlocking new growth opportunities in the rapidly evolving satellite communication equipment market.

- How big is the Satellite Communication Equipment Market?

- What is the Satellite Communication Equipment Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?