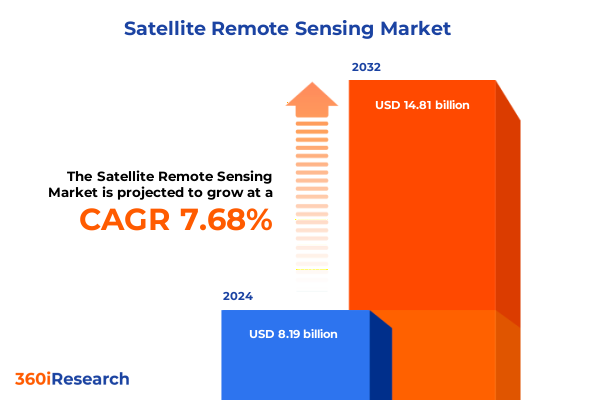

The Satellite Remote Sensing Market size was estimated at USD 8.81 billion in 2025 and expected to reach USD 9.45 billion in 2026, at a CAGR of 7.69% to reach USD 14.81 billion by 2032.

Pioneering the Future of Earth Observation through Satellite Remote Sensing: Unveiling Key Drivers, Trends, and Opportunities Across Advanced Technologies

In an era marked by rapid technological innovation and expanding use cases, satellite remote sensing has emerged as a cornerstone of modern data-driven decision-making. The convergence of advanced sensor technologies, proliferating small satellite constellations, and sophisticated data analytics has revolutionized the ability to observe, analyze, and interpret terrestrial and atmospheric phenomena at unprecedented scales and resolutions. Against this backdrop, stakeholders across agriculture, defense, environmental monitoring, and urban planning are leveraging satellite-derived insights to optimize resource allocation, enhance situational awareness, and drive sustainable outcomes.

As industry leaders navigate this dynamic environment, understanding the foundational drivers, key market forces, and strategic imperatives is essential for capitalizing on new opportunities. This executive summary introduces the critical themes and insights that underpin the satellite remote sensing ecosystem. It draws attention to transformative shifts reshaping the competitive landscape, examines the implications of United States tariff policies enacted in 2025, and presents granular segmentation and regional analyses. By synthesizing these elements, the summary offers an integrated perspective designed to inform high-stakes decision-making and chart a clear path forward for organizations invested in harnessing orbital data for strategic advantage.

Navigating Transformative Shifts in the Satellite Remote Sensing Landscape Driven by Technological Breakthroughs and Evolving Market Demands

Over the past several years, satellite remote sensing has undergone transformative shifts driven by miniaturization of satellite platforms, advancements in sensor performance, and the democratization of data processing tools. The advent of nano- and microsatellite constellations has lowered entry barriers, enabling a proliferation of smaller, more agile platforms capable of delivering high revisit rates and tailored mission profiles. Concurrently, the integration of hyperspectral imaging, synthetic aperture radar, and thermal infrared sensors into compact form factors has expanded the spectrum of measurable phenomena, from subtle vegetation stress signals to sub-pixel thermal anomalies.

In addition, the fusion of satellite imagery with artificial intelligence and machine learning algorithms has unlocked new levels of automation and predictive capability. Real-time change detection, anomaly recognition, and automated feature extraction have evolved from experimental use cases to operational standards, empowering end users to generate actionable insights with minimal latency. As a result, emerging applications such as precision agriculture yield estimation, infrastructure condition assessment, and early warning systems for natural disasters have witnessed accelerated adoption, setting the stage for next-generation service offerings.

Furthermore, evolving regulatory frameworks governing spectrum allocation, data privacy, and international collaboration are reshaping market access and partnership models. With governments and commercial entities recalibrating their strategies to accommodate stricter cybersecurity requirements and data sovereignty concerns, the landscape is poised for continued evolution. Stakeholders that proactively align with these regulatory imperatives and capitalize on technological convergence will define the competitive frontier of satellite remote sensing.

Assessing the Cumulative Impact of United States Tariffs in 2025 on Satellite Remote Sensing Supply Chains, Component Costs, and Strategic Partnerships

The imposition of additional tariffs by the United States in early 2025 has introduced a complex layer of cost considerations and supply chain realignments for satellite remote sensing stakeholders. Components such as advanced optical lenses, high-speed onboard processors, and radar electronics sourced from Asia and Europe now face incremental duties that have elevated procurement costs. Consequently, system integrators and assemblers have been prompted to reevaluate sourcing strategies, increase inventory buffers, and explore domestic or nearshoring alternatives to mitigate exposure to tariff-related volatility.

As a direct consequence, collaborations between satellite manufacturers and local electronics producers have intensified, reflecting a strategic shift toward building resilient supply networks within the continental United States. This transition has not only localized critical production capacities but also catalyzed innovation in materials science, as firms invest in alternative composites and additive manufacturing techniques to reduce reliance on tariff-impacted imports. Moreover, downstream service providers are adjusting pricing models to absorb a portion of these cost pressures, leading to more transparent contract structures and performance-based service agreements that share risk across the value chain.

Looking ahead, the cumulative impact of these tariffs underscores the importance of proactive financial planning and dynamic sourcing strategies. Companies that successfully navigate this environment will harness scenario modeling and real-time market intelligence to anticipate cost fluctuations, optimize procurement cycles, and maintain competitive pricing for satellite-enabled services. As a result, the capacity to adapt swiftly to evolving trade policies will become a defining capability for industry leaders in the remote sensing arena.

Revolutionizing Market Understanding through Multi-Dimensional Segmentation Insights Spanning Sensor Types, Platforms, Applications, and End Users

A multi-dimensional segmentation framework reveals nuanced insights that can inform tailored go-to-market strategies and product roadmaps. Within the sensor type dimension, hyperspectral offerings encompass short-wave infrared and visible–near infrared capabilities, while LiDAR systems span airborne and spaceborne configurations. Optical payloads break down into multispectral, panchromatic, and very high resolution variants, and synthetic aperture radar instruments operate across C-band, L-band, and X-band frequencies. Complementing these, thermal infrared modules deliver long-wave and mid-wave infrared imagery for specialized heat-signature analysis.

Examining platform segmentation, large satellites continue to serve high-duty-cycle, global monitoring requirements, whereas medium satellites strike a balance between payload capacity and cost efficiency. The burgeoning cohort of small satellites-subcategorized into micro, mini, and nano classifications-has unlocked new paradigms in constellation design, enabling high revisit rates and on-demand data collection tailored to specific mission objectives.

In application-driven analysis, the agriculture vertical leverages crop monitoring with growth stage assessment and NDVI analysis, alongside precision farming, soil health evaluation, and yield forecasting. Defense and intelligence operations capitalize on missile detection, reconnaissance, surveillance, and signals intelligence capabilities. Disaster management services encompass damage assessment, early warning, and post-event recovery support. Environmental monitoring spans climate tracking, forest health and biomass estimation, pollution surveillance, and water resource management. Mapping and surveying solutions address cadastral, hydrographic, and topographic requirements. Oil and gas sectors employ exploration, offshore oversight, and pipeline leak and right-of-way monitoring. Telecommunications actors rely on network planning and spectrum utilization strategies, while urban planning initiatives utilize infrastructure monitoring, land-use modeling, and smart city integration.

End-user segmentation highlights academia and research institutions, including universities and dedicated research centers, alongside commercial entities such as agricultural service providers, energy and utilities firms, and mapping and GIS consultancies. Government and defense stakeholders, comprising civil, defense, and intelligence agencies with subdivisions across air force, army, and navy units, represent significant demand drivers in both national security and public service domains.

This comprehensive research report categorizes the Satellite Remote Sensing market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Sensor Type

- Platform

- Application

- End User

Exploring Key Regional Insights Revealing Distinct Growth Dynamics Across Americas, Europe Middle East Africa, and Asia Pacific Satellite Remote Sensing Markets

Regional dynamics in the satellite remote sensing market reveal a tapestry of strategic priorities, regulatory landscapes, and investment profiles. In the Americas, robust government funding for defense and environmental monitoring programs coexists with a thriving commercial scene centered on precision agriculture and energy infrastructure services. The United States leads innovation in small satellite constellations and advanced analytics platforms, while Canada’s focus on forestry and Arctic surveillance underscores unique resource-driven applications. Across Latin America, public–private partnerships are driving expansion in natural disaster management and land-use mapping initiatives.

In the Europe, Middle East and Africa region, a diverse array of regulatory approaches and strategic imperatives shape market adoption. Western European states emphasize cross-border data sharing frameworks and sustainability mandates, supporting climate monitoring and urban resilience programs. The Middle East is witnessing rapid deployment of optical and radar systems to optimize water resource management, agricultural productivity, and security surveillance, fueled by sovereign wealth fund investments. In Africa, collaboration between international development agencies and local governments is enhancing capabilities for deforestation tracking, wildlife conservation, and disaster response, often through blended financing mechanisms.

The Asia-Pacific region represents a convergence of ambitious national space programs, burgeoning commercial ventures, and a rising appetite for data-driven governance. China and India continue to expand their satellite constellations across sensor modalities, prioritizing dual-use applications that serve both civilian and defense agendas. Southeast Asian nations are investing in flood forecasting and coastal management systems, while Australia and New Zealand advance precision agriculture and bushfire monitoring initiatives. With many economies pursuing sovereign capabilities and industry partnerships, the region is poised for accelerated growth and deeper integration of satellite-derived intelligence into public and private sector operations.

This comprehensive research report examines key regions that drive the evolution of the Satellite Remote Sensing market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Highlighting Prominent Players Shaping the Satellite Remote Sensing Sector with Innovative Portfolios, Strategic Collaborations, and Technological Leadership

Leading companies in the satellite remote sensing domain differentiate themselves through strategic portfolios, cross-sector partnerships, and continuous technology refinement. Heritage aerospace prime contractors have expanded their offerings by integrating advanced sensor suites and analytics platforms, securing long-term service agreements with national defense and civil agencies. In parallel, agile newcomers specializing in small satellite design have cultivated niche expertise in rapid-launch constellations, leveraging economies of scale and modular architectures to meet evolving revisit and coverage requirements.

Collaborative ventures between traditional aerospace firms and data analytics startups have given rise to end-to-end solutions encompassing data acquisition, processing, and delivery. These partnerships blend proven spacecraft manufacturing capabilities with cutting-edge machine learning on the ground, creating differentiated products such as real-time change detection services and multisource data fusion platforms. Additionally, vertical integrators focusing on sector-specific use cases-ranging from oil and gas pipeline monitoring to precision viticulture-have harnessed domain knowledge to tailor remote sensing offerings that address unique operational challenges.

Strategic investments in R&D centers, technology incubators, and academic collaborations are further bolstering companies’ innovation pipelines. By sponsoring university labs and engaging in joint development agreements, organizations are accelerating breakthroughs in areas such as quantum-enhanced imaging, edge computing onboard satellites, and resilient RF communications. These initiatives not only secure competitive advantage but also reinforce barriers to entry, as advanced capabilities take years to mature and commercialize.

This comprehensive research report delivers an in-depth overview of the principal market players in the Satellite Remote Sensing market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- Airbus SE

- BlackSky Technology Inc.

- Capella Space Corp.

- Deimos Imaging SLU

- Earth-i Ltd.

- European Space Imaging

- ICEYE Ltd.

- ImageSat International N.V.

- L3Harris Technologies, Inc.

- Lockheed Martin Corporation

- Maxar Technologies Inc.

- Northrop Grumman Corporation

- Planet Labs PBC

- Planetary Resources, Inc.

- Satellogic Inc.

- Skybox Imaging, Inc.

- Thales Group

- Umbra Lab, Inc.

- UrtheCast Corp.

Implementing Actionable Recommendations for Industry Leaders to Capitalize on Emerging Trends, Mitigate Risks, and Drive Sustainable Growth in Remote Sensing

To maintain leadership in this rapidly evolving market, industry stakeholders should prioritize the integration of advanced analytics with sensor development roadmaps, ensuring that data products deliver actionable intelligence rather than raw imagery. Investing in artificial intelligence frameworks that can scale across diverse sensor modalities will be critical to differentiate service offerings and meet growing demand for automated insights. Furthermore, organizations should strengthen supply chain resilience by diversifying component sourcing, expanding domestic manufacturing partnerships, and employing scenario-based procurement planning to navigate tariff fluctuations and geopolitical uncertainties.

In parallel, forging cross-industry alliances and co-development partnerships can accelerate the deployment of specialized applications in sectors such as environmental monitoring, infrastructure management, and public safety. By co-creating solutions with end users, companies will generate higher-value service propositions and foster longer-term contractual relationships. Equally, aligning product strategies with evolving regulatory and data governance frameworks-particularly in areas like spectrum allocation and privacy compliance-will reduce market entry friction and support sustainable expansion across geographies.

Lastly, establishing flexible business models that combine subscription-based access, performance-linked pricing, and data-as-a-service frameworks will enable providers to address diverse customer budgets and risk profiles. Coupled with transparent service level agreements and user-centric support, these approaches will enhance customer loyalty and unlock recurring revenue streams essential for funding next-generation satellite programs.

Outlining a Robust Research Methodology Ensuring Data Accuracy, Comprehensive Market Analysis, and Objective Insights in Satellite Remote Sensing Studies

The research approach underpinning this analysis combines rigorous secondary research with targeted primary engagements to ensure data accuracy, relevance, and depth. Initially, extensive literature reviews of industry white papers, patent filings, regulatory documents, and technical publications provided foundational context on sensor technologies, platform architectures, and application trends. This secondary research phase also included an examination of trade journals, governmental space agency releases, and academic conference proceedings to capture the latest breakthroughs and strategic initiatives.

To validate and enrich these insights, a series of in-depth interviews were conducted with key stakeholders such as satellite system integrators, sensor component manufacturers, data analytics specialists, and end-user representatives across agriculture, defense, and environmental sectors. These discussions illuminated real-world operational challenges, technology adoption barriers, and emerging demand drivers. Additionally, quantitative surveys of procurement officers and technical leads offered granular perspectives on investment priorities, procurement timelines, and performance expectations.

Finally, the triangulation of secondary and primary data enabled the development of a robust segmentation framework and the identification of regional and company-level insights. Statistical techniques were applied to detect correlation patterns and market dynamics, while qualitative analysis of expert interviews provided strategic context. Rigorous data verification processes, including cross-referencing multiple sources and conducting follow-up validations, underpinned the credibility and objectivity of the final deliverables.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Satellite Remote Sensing market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Satellite Remote Sensing Market, by Sensor Type

- Satellite Remote Sensing Market, by Platform

- Satellite Remote Sensing Market, by Application

- Satellite Remote Sensing Market, by End User

- Satellite Remote Sensing Market, by Region

- Satellite Remote Sensing Market, by Group

- Satellite Remote Sensing Market, by Country

- United States Satellite Remote Sensing Market

- China Satellite Remote Sensing Market

- Competitive Landscape

- List of Figures [Total: 16]

- List of Tables [Total: 4293 ]

Concluding with Strategic Reflections on the Future Trajectory of Satellite Remote Sensing and Its Role in Addressing Global Challenges and Market Needs

The satellite remote sensing landscape stands at a pivotal juncture, where the intersection of advanced sensor innovation, agile satellite platforms, and sophisticated data processing is reshaping how organizations perceive and act upon geospatial information. The confluence of regulatory shifts, tariff-driven supply chain realignments, and intensifying competition underscores the need for strategic agility and continuous innovation. Those that proactively embrace end-to-end integration-from satellite design to AI-powered analytics-will unlock new revenue streams and deliver higher-value outcomes for their customers.

Looking forward, the maturation of next-generation technologies such as quantum-enhanced imaging, on-orbit data processing, and hyperspectral constellations will catalyze further expansion of satellite-enabled services. Meanwhile, the growing emphasis on sustainability and climate resilience is likely to drive increased demand for environmental monitoring and natural disaster response capabilities. Companies that harness these trends through collaborative ecosystems, adaptive supply chains, and customer-centric business models will solidify their positions as market leaders.

Ultimately, the value proposition of satellite remote sensing lies in its ability to transform raw data into strategic insight, enabling stakeholders to make informed decisions in complex and dynamic environments. By aligning technological innovation with market requirements and regulatory imperatives, the industry can continue to deliver mission-critical solutions that address global challenges, optimize resource stewardship, and foster resilience across sectors.

Engaging with Ketan Rohom for Personalized Guidance and Next Steps to Secure Your Comprehensive Satellite Remote Sensing Market Research Report

To obtain an in-depth and actionable satellite remote sensing market research report tailored to your strategic objectives, we encourage you to connect directly with Ketan Rohom, Associate Director, Sales & Marketing. Leveraging extensive industry expertise and a proven track record of guiding decision-makers, Ketan can provide personalized insights and demonstrate how the report’s rigorous analysis can support your organization’s growth initiatives. Engaging with Ketan ensures you receive dedicated support in understanding licensing options, report customization opportunities, and deployment strategies that align with your operational requirements. By partnering with Ketan, you will gain immediate access to executive-level summaries, detailed data appendices, and interactive dashboards, enabling faster time-to-insight and more confident strategic decisions. Reach out today to explore how this comprehensive market intelligence can position your business ahead of evolving competitive dynamics, technical advancements, and regulatory changes in the satellite remote sensing landscape.

- How big is the Satellite Remote Sensing Market?

- What is the Satellite Remote Sensing Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?