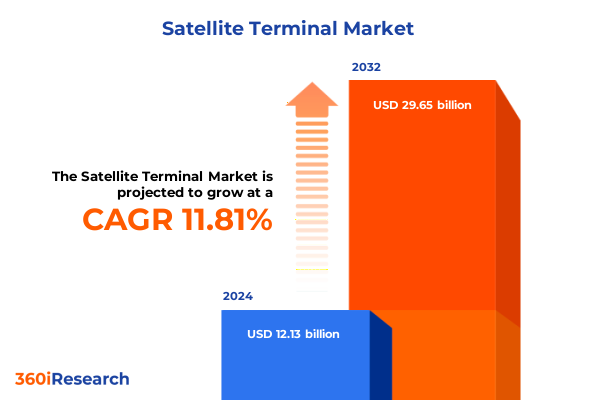

The Satellite Terminal Market size was estimated at USD 13.42 billion in 2025 and expected to reach USD 14.85 billion in 2026, at a CAGR of 11.98% to reach USD 29.65 billion by 2032.

Satellite Terminal Industry Emerges at the Forefront of Global Connectivity Transformation Fueling Next-Generation Communication

The satellite terminal sector has entered a new era of significance as global connectivity demands accelerate. Fueled by burgeoning low Earth orbit (LEO) constellations and the drive to bridge digital divides in remote regions, satellite terminals are no longer niche hardware but foundational infrastructure for next-generation communication networks. With space-based broadband providers deploying thousands of satellites and serving millions of users worldwide, terminals that reliably capture and transmit signals have become central to realizing the promise of ubiquitous high-speed connectivity.

Simultaneously, terrestrial network operators are embracing satellite integration to eliminate coverage gaps. Major mobile carriers have begun testing direct-to-device satellite services to eradicate “not spots” in rural and underserved urban areas, signaling a convergence of satellite and cellular technologies. As 5G evolves toward space-enabled extensions and IoT applications proliferate, the terminal has transformed into a multifaceted node that supports broadband, backhaul, telemetry, and emergency response functions across diverse environments.

Looking ahead, regulatory breakthroughs in large markets like India are poised to unlock vast new opportunities. The anticipated approval of satellite broadband licenses in populous nations underscores the terminal’s elevated strategic role for both commercial providers and governmental agencies seeking resilient, sovereign networks. In this dynamic context, understanding the satellite terminal ecosystem’s foundational drivers is essential for industry stakeholders aiming to capitalize on unprecedented growth potential.

Breakthrough Innovations and Technology Convergence Reshape Satellite Terminal Capabilities for Multi-Orbit and AI-Driven Networks

Advancements in satellite terminal technology are redefining the communications ecosystem by blending multi-orbit architectures with intelligent automation. Leading service providers are launching multi-orbit strategies that leverage geostationary, medium Earth orbit, and LEO satellites in concert, demanding terminals that seamlessly switch between networks for optimal performance and resiliency. This shift toward multi-orbit connectivity is accelerating the development of electronically steered antennas and software-defined modules that dynamically adapt beam patterns without mechanical repositioning.

Artificial intelligence and machine learning are further transforming terminal operations, enabling real-time signal optimization, predictive maintenance, and automated network orchestration. Industry collaborations with semiconductor and software leaders have produced AI-driven ground terminals capable of processing vast data streams at the edge, reducing latency and enhancing throughput for mission-critical applications such as defense communications and industrial IoT. Meanwhile, cloud-based ground station services are eroding traditional barriers to entry by virtualizing access to satellite networks, allowing users to spin up terminals on demand and scale capacity with unprecedented flexibility.

This convergence of AI, virtualization, and multi-orbit integration represents a fundamental transformation from static dish antennas to intelligent, software-centric platforms. As the industry prioritizes modular, upgradable designs, terminal manufacturers are responding with open architecture models that support rapid feature rollouts, cross-vendor interoperability, and standardized interfaces. These developments are setting the stage for a new class of resilient, future-proofed terminals that will underpin the next wave of space-enabled digital services.

Strategic Implications and Operational Disruptions from 2025 United States Trade Tariffs on Satellite Terminal Supply Chains

The imposition of elevated U.S. tariffs on key satellite terminal components has exerted significant pressure on global supply chains and cost structures. Under Section 301 of the Tariff Act, semiconductor products-integral to RF front-ends, power amplifiers, and signal processors-saw their tariff rates doubled from 25% to 50% effective January 1, 2025, introducing up to a 50% surcharge on critical integrated circuits used in terrestrial and airborne terminals. These higher duties prompted terminal assemblers to reevaluate sourcing strategies, triggering shifts toward alternative suppliers in South Korea, Taiwan, and Europe to mitigate margin erosion and ensure component availability.

Manufacturing disruptions cascaded downstream, slowing terminal production timelines just as the LEO satellite broadband market reached a pivotal growth phase. Companies faced delayed certifications and extended testing cycles for redesigned hardware configurations, pushing back commercial deployments and government procurements. Moreover, retaliatory trade measures and customs scrutiny in key export markets created additional bureaucratic hurdles, undermining U.S. firms’ competitive positioning abroad. Analysts estimate that the cumulative impact of these tariff-driven complications has materially increased unit costs and elongated go-to-market schedules, challenging the momentum of emerging terminal technologies.

In response, the U.S. government has engaged in diplomatic initiatives to alleviate market friction for national champions in the satellite domain. State Department communications reveal concerted efforts to encourage regulatory approvals of domestic satellite operators, including policy advocacy for leading broadband networks in nations subject to U.S. tariffs. These strategic interventions underscore the critical linkage between trade policy and space-based connectivity objectives, highlighting the need for industry leaders to navigate evolving geopolitical dynamics alongside technical innovation.

Deconstructing the Satellite Terminal Market Through Comprehensive Multi-Dimensional Segmentation Revealing Targeted Opportunities

Analyzing the satellite terminal market through the lens of terminal type segmentation uncovers differentiated growth reservoirs and technology requirements. Fixed ground terminals, for instance, prioritize extended aperture antennas and high throughput capacity, catering to backhaul and enterprise broadband applications. In contrast, manpack, portable, and transportable units emphasize rapid deployment and ergonomic design, addressing emergency response and mobile command scenarios. Very small aperture terminals strike a balance by enabling residential and small business broadband access in remote settings where large infrastructure is impractical.

When assessed by frequency band, distinct performance characteristics emerge. C band and Ku band terminals deliver robust capacity for long-distance links and maritime connectivity, whereas Ka band systems excel at high-data-rate, low-latency broadband services ideal for consumer and enterprise segments. L band and X band terminals remain critical for resilient military communications, IoT telemetry, and low-data-rate monitoring, leveraging their superior atmospheric penetration and spectrum availability.

Further refinement arises when examining connectivity mode and application dimensions. Fixed connectivity underpins backbone networks and corporate teleports, while mobile and portable configurations serve growing demands in logistics, vehicle-mounted communications, and field instrumentation. On the application front, terminals designed for backhaul must support continuous, high-throughput performance, whereas IoT and telemetry-focused units favor low-power, intermittently active operation. Lastly, end-user segmentation illuminates tailored value propositions: commercial operators drive cost optimization and scalability, consumer segments demand user-friendly, plug-and-play setups, and government users require hardened, secure, and ITAR-compliant designs with rigorous lifecycle management.

This comprehensive research report categorizes the Satellite Terminal market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Terminal Type

- Frequency Band

- Connectivity Mode

- Application

- End User

Regional Dynamics of Satellite Terminal Adoption and Investment Trends Spanning Americas, EMEA, and Asia-Pacific Markets

The Americas region leads in satellite terminal innovation and adoption, propelled by robust aerospace ecosystems in the United States and Canada. North American providers dominate mega-constellation deployments, creating a thriving demand for ground infrastructure and aftermarket support services. Latin American countries are increasingly integrating satellite broadband to overcome geographic connectivity barriers, prompting flexible leasing models and turnkey terminal solutions tailored to emerging market dynamics.

Europe, the Middle East & Africa (EMEA) showcases diverse adoption drivers, from commercial maritime networks linking shipping lanes to government-led initiatives focusing on remote education and healthcare. Western European nations benefit from regulatory harmonization under international telecommunications unions, fostering cross-border collaborations and shared ground station networks. In the Middle East & Africa, investment corridors prioritize strategic connectivity projects that bolster digital resilience and national security, leading to partnerships between satellite operators and regional telecommunications incumbents.

Asia-Pacific represents the fastest-growing frontier for terminal applications. The region’s vast archipelagos and rural hinterlands drive substantial demand for fixed and portable solutions that can rapidly extend broadband access. China’s strategic investments in space infrastructure and indigenous terminal manufacturing capacity have accelerated domestic deployment, while India’s regulatory reforms open paths for global operators to serve its significant unserved population. Across Asia-Pacific, integrated satellite-terrestrial hybrid networks are emerging to alleviate spectrum scarcity and support next-generation IoT ecosystems.

This comprehensive research report examines key regions that drive the evolution of the Satellite Terminal market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Profiling Leading Satellite Terminal Innovators Driving Multi-Orbit Solutions, Ground Infrastructure, and Disruptive Connectivity Models

SpaceX’s Starlink stands at the vanguard of the consumer and enterprise terminal market, offering user terminals characterized by ease of installation, automatic beamforming, and continuous firmware updates over its proprietary network. With over 7,300 satellites operational, Starlink terminals support real-time broadband connections that rival terrestrial alternatives in remote areas. Backed by rapid launch cadence and vertical integration, their terminals have become synonymous with consumer-grade satellite internet globally.

Amazon’s Project Kuiper is scaling manufacturing of multi-beam user terminals designed for seamless integration with cloud-hosted networking stacks. Following its inaugural launch of 27 satellites in April 2025, Kuiper terminals are being field-tested for optimized performance across home and enterprise scenarios. Amazon’s deep logistics and cloud infrastructure promise accelerated distribution and scalable support services, positioning Kuiper as a direct challenger to established LEO offerings.

Traditional satellite service operators and infrastructure providers continue to enhance their terminal portfolios in response. OneWeb’s lightweight ground units target the maritime and aviation markets, emphasizing low profile, fast acquisition, and integration with existing VSAT network management systems. Telesat’s Lightspeed initiative is developing high-throughput Ka band terminals alongside teleport integrations to support value-added services in EMEA and Asia-Pacific regions. Meanwhile, Intelsat’s upcoming multi-orbit managed terminal solutions aim to deliver unified connectivity across GEO and LEO networks, leveraging hybrid beamforming and cloud-based orchestration.

This comprehensive research report delivers an in-depth overview of the principal market players in the Satellite Terminal market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- Addvalue Technologies Ltd

- Cobham Limited

- Comtech Telecommunications Corp.

- Gilat Satellite Networks Ltd.

- Hughes Network Systems, LLC

- Intellian Technologies, Inc.

- KVH Industries, Inc.

- Kymeta Corporation

- RTX Corporation

- ST Engineering Antenna Systems Pte Ltd

- Viasat, Inc.

Proactive Strategies for Industry Leaders to Capitalize on Technological Advancements and Mitigate Policy-Driven Challenges

To navigate the confluence of technological complexity and trade policy volatility, industry leaders should prioritize diversified supply chain resilience by qualifying secondary component sources and advancing in-house assembly capabilities. Establishing strategic partnerships with semiconductor foundries and antenna manufacturers outside traditional supply hubs can mitigate tariff risks and ensure uninterrupted production.

Investing in modular, software-defined terminal architectures is essential for rapid adaptation to multi-orbit frameworks and evolving frequency allocations. Companies should cultivate open API ecosystems and engage in cross-industry consortia to develop interoperability standards, accelerating customer deployments and reducing time-to-market for feature enhancements.

Finally, operators and OEMs alike must engage proactively with regulatory bodies to shape market access policies and spectrum allocation frameworks. Collaborative advocacy-rooted in transparent technical data and use-case evidence-can align government objectives around connectivity sovereignty with commercial innovation goals, fostering an environment conducive to sustainable terminal adoption.

Rigorous Mixed-Method Research Framework Ensures Data Integrity and Analytical Rigor in Satellite Terminal Market Insights

This research integrates a mixed-method approach, combining primary interviews with terminal designers, service operators, and regulatory experts alongside secondary data synthesis from reputable news outlets and government publications. Interview subjects included engineering leads from multi-orbit satellite initiatives and supply chain managers at major aerospace firms, ensuring diverse stakeholder perspectives inform the analysis.

Quantitative data was corroborated through cross-referencing tariff schedules published by the U.S. Trade Representative’s office and supply chain documentation from component distributors. Market dynamics were contextualized using open-source intelligence on constellation deployments and carrier trials, validated against industry news reports and technical white papers.

Findings were triangulated through iterative peer review and expert validation sessions to uphold data integrity and analytical rigor. The research framework emphasizes transparency in assumptions, reproducibility of analysis, and continuous refinement in line with emerging developments through mid-2025.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Satellite Terminal market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Satellite Terminal Market, by Terminal Type

- Satellite Terminal Market, by Frequency Band

- Satellite Terminal Market, by Connectivity Mode

- Satellite Terminal Market, by Application

- Satellite Terminal Market, by End User

- Satellite Terminal Market, by Region

- Satellite Terminal Market, by Group

- Satellite Terminal Market, by Country

- United States Satellite Terminal Market

- China Satellite Terminal Market

- Competitive Landscape

- List of Figures [Total: 17]

- List of Tables [Total: 954 ]

Consolidating Insights to Illuminate Future Paths for Satellite Terminal Ecosystem Development and Strategic Growth Imperatives

As satellite connectivity transcends traditional boundaries, terminal technology emerges as the critical junction between orbital networks and end users. The interplay of AI-driven optimizations, multi-orbit integration, and policy shifts demands a strategic pivot from legacy hardware toward agile, software-centric solutions. Stakeholders who align their innovation road maps with modular architectures and resilient supply chains will set the benchmark for market leadership.

Market segmentation reveals a nuanced landscape where fixed, mobile, and portable terminals each address distinct use-case clusters, while regional dynamics underscore the need for localized deployment strategies. The United States, Europe, and Asia-Pacific each present unique regulatory and operational imperatives, reinforcing the importance of tailored market approaches.

Ultimately, the convergence of disruptive innovation and evolving trade frameworks will define the trajectory of satellite terminal adoption. Organizations that leverage actionable insights, foster cross-sector collaboration, and anticipate policy developments will be best positioned to unlock the full potential of a truly connected world.

Secure Your Strategic Edge in the Satellite Terminal Market by Partnering with Ketan Rohom to Access an In-Depth Industry Report

To secure your vantage point in the rapidly evolving satellite terminal landscape, connect directly with Ketan Rohom, Associate Director of Sales & Marketing, to explore comprehensive market insights tailored to your strategic goals.

Don’t miss the opportunity to harness data-driven intelligence and unlock actionable intelligence that will empower your organization’s next steps in satellite communications. Reach out to discuss how this in-depth research report can inform procurement decisions, technology road maps, and partnership strategies to keep you ahead of industry shifts.

- How big is the Satellite Terminal Market?

- What is the Satellite Terminal Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?