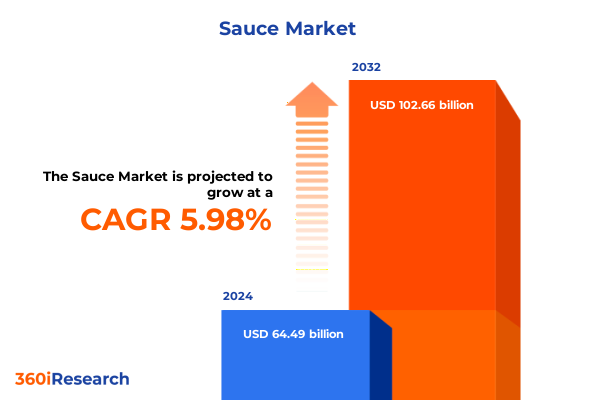

The Sauce Market size was estimated at USD 68.32 billion in 2025 and expected to reach USD 71.99 billion in 2026, at a CAGR of 5.98% to reach USD 102.66 billion by 2032.

Unlocking the Sizzling Surge in Consumer Appetite for Bold Flavors and Convenient Culinary Companions in the Modern Sauce Market

The global sauce landscape in 2025 has reached an inflection point, with industry insiders declaring this year to be the true “Year of the Sauce.” As consumers increasingly seek to elevate everyday meals with minimal effort, sauces have transcended their traditional role as mere condiments to become indispensable culinary companions. This shift is exemplified by the surge in both spicy chili crisps and umami-rich fermented blends, a trend underscored by leading analysts who note that sauces now sit at the intersection of flavor, convenience, and creativity-three cornerstones of modern eating habits.

Concurrently, the emphasis on home cooking amid economic and social pressures has driven the sauces market’s expansion beyond restaurant kitchens into household pantries. Major food and beverage players have reported significant gains in meals-at-home offerings, fueled in part by evolving tariff and cost structures that have made restaurant dining more expensive. For example, Campbell’s saw a notable 15% lift in its meals-at-home segment, with flagship sauces like Rao’s witnessing renewed popularity among consumers seeking restaurant-quality flavors at home. Moreover, curated sauce selections featured in prestigious food awards and consumer magazines-from lemony ponzus to spicy vodka blends-highlight the breadth of innovation captivating shoppers nationwide.

From Pantry Staple to Culinary Star How Innovation Health Trends and Digital Commerce Are Redefining Consumer Engagement with Sauces

Premiumization and authenticity have emerged as powerful drivers reshaping the sauce arena, as modern shoppers willingly invest in specialty blends and artisanal creations. Retailers report surging demand for elevated preserves and sauces, with consumers embracing small-batch and heritage products as affordable luxuries in a cost-sensitive environment. This so-called “little treat culture” has produced a boom in premium offerings-from truffle-infused mayonnaises to globally inspired harissas-underscoring a broader quest for culinary exploration at home.

Parallel to this premium shift, health and wellness priorities have catalyzed innovation in functional and clean-label sauces. “Swicy” and doomsday-staple trends spotlight new flavor frontiers-intense spice blends paired with gut-friendly, shelf-stable ingredients-that resonate with consumers balancing flavor cravings and health goals. Industry experts note that sauces delivering bold taste with minimal calories, such as mustard derivatives enriched with turmeric and garlic, are rapidly winning over health-conscious palates.

Meanwhile, the digital revolution continues to reshape market engagement, as e-commerce channels and social commerce amplify brand discovery and trial. Fast-food chains and direct-to-consumer sauce brands alike leverage AI-driven marketing and omnichannel fulfillment to meet consumers where they are, creating seamless journeys from online inspiration-often via influencer-curated recipes-to doorstep delivery. This convergence of digital capabilities and agile supply chains is fostering unprecedented responsiveness to emerging flavor trends and regional nuances.

Navigating the Turbulence of Elevated Trade Barriers Examining the 2025 United States Tariffs and Their Multi-Dimensional Impact on Sauce Industry Cost Structures

The cumulative impact of escalating trade barriers in 2025 has introduced new complexities in global ingredient sourcing and cost structures for sauce manufacturers. U.S. tariffs on imported chili products, soy derivatives, and specialty condiments have surged-exemplified by Fly By Jing’s 160% duty on its signature Sichuan chili crisp, up from 15%-dramatically raising landed costs for small and independent brands that rely on region-specific ingredients. This escalation has compelled producers to reengineer supply chains, negotiate new supplier agreements, or absorb margin pressures to maintain price accessibility.

Similarly, major legacy players are navigating incremental tariff impacts on staple ingredients such as tomatoes and garlic. Campbell’s, for instance, highlighted an estimated 3 to 5 cents per share drag on earnings from recent import levies, underscoring how macro trade policy shifts can ripple through product portfolios and financial performance. These cost headwinds have spurred industry dialogues on reshoring ingredients, investing in tariff mitigation strategies, and diversifying geographic footprints to balance protectionist pressures with consumer demand for global flavors.

Decoding Consumer Behavior Through Comprehensive Segmentation Insights Across Sauce Types Packaging Applications Distribution Channels and End User Groups

Insightful segmentation reveals the nuanced consumer behaviors fueling sauce innovation and distribution strategies. Within the domain of sauce types, categories ranging from barbeque and hot sauces to pasta and soy variants each present distinct growth vectors; dark and light soy sauces, for instance, appeal to both traditionalists and health-oriented shoppers. These type-based distinctions inform product development roadmaps and flavor profiling, ensuring targeted offerings that resonate with specific taste cohorts.

Packaging dynamics further shape consumer adoption and brand differentiation. Bottled presentations-whether glass for premium positioning or plastic for on-the-go convenience-sit alongside flexible pouches and single-serve sachets designed for meal kits and quick usage occasions. This packaging spectrum addresses consumer demands for portability, sustainability, and tactile brand experiences, guiding capital investments in packaging innovation and recycling initiatives.

Equally critical is application context: sauces designated for cooking merge seamlessly with household culinary routines, while dipping formats and marinade blends satisfy convenience and experiential dining occasions. Sub-categories such as meat- and vegetable-focused cooking sauces reflect cooking behavior patterns, shaping cross-category marketing and recipe integration. Distribution channels vary from entrenched offline networks-convenience stores, hypermarkets, supermarkets-to burgeoning online marketplaces offering subscription models and targeted promotions. Finally, segmentation by end users-ranging from foodservice operators to rural and urban households-illuminates distinct purchase drivers, feeding tailored sales strategies and channel-specific promotions.

This comprehensive research report categorizes the Sauce market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Type

- Packaging

- Distribution Channel

- End User

- Application

Mapping the Geographical Flavor Footprint How Regional Consumer Dynamics Shape Diverse Demand Profiles and Strategic Market Approaches

Regional dynamics continue to influence both product portfolios and go-to-market playbooks across the globe. In the Americas, escalating interest in private-label offerings and local fermented sauces underscores the value of competitive pricing paired with authentic flavor profiles. Retailers such as Trader Joe’s and regional producers are capitalizing on cost-effective local sourcing, introducing artisanal kimchi-based condiments and organic srirachas that align with consumer trust in home-grown brands.

In Europe, the Middle East, and Africa, a dual pursuit of health-centric formulations and cultural heritage flavors drives innovation. Consumers demonstrate a strong preference for clean-label, low-sodium sauces while simultaneously seeking products rooted in Mediterranean, Middle Eastern, and North African traditions-think tahini-infused dressings and harissa marinades. Retailers and foodservice operators respond with localized flavor collaborations and transparent sourcing narratives that resonate with discerning, heritage-seeking audiences.

Meanwhile, Asia-Pacific markets present a fertile frontier, characterized by rapid urbanization, rising disposable incomes, and expanding e-commerce infrastructure. Demand for ready-to-use cooking sauces is supported by a burgeoning meal kit sector, while home-grown favorites-from gochujang to teriyaki-are achieving cross-border appeal. Online segments in the region are projected to grow significantly, reflecting strong digital adoption and a preference for curated, international flavor assortments delivered directly to consumers’ doorsteps.

This comprehensive research report examines key regions that drive the evolution of the Sauce market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Spotlight on Leading Sauce Innovators Examining How Brand Heritage Culinary Storytelling and Strategic Partnerships Are Driving Competitive Advantage

Leading players in the sauce ecosystem are forging distinct competitive positions through innovation, acquisition, and culinary storytelling. Fly By Jing, for example, has garnered national attention by adhering to the highest ingredient standards for its Sichuan pepper-infused chili crisp, even as 160% tariffs challenge its price competitiveness. The brand’s commitment to ingredient integrity and cultural authenticity has solidified its cult status among adventurous home cooks.

Legacy incumbents like Campbell’s leverage established supply chains and home-grown sauce brands such as Rao’s to reinforce their meals-at-home segment, reflecting a strategic focus on premium and heritage flavors. The company’s recent acquisition of Sovos brands further diversifies its portfolio and responds to growing demand for gourmet simmer sauces among culinary enthusiasts.

Iconic condiment titans-including Heinz, Hellmann’s, Kikkoman, and Prego-continue to expand their offerings with global flavor extensions and limited-edition releases. High-profile launches, from truffle mayonnaise collaborations to yuzu ponzu dipping sauces, illustrate how these established brands harness their distribution scale to introduce niche variants that captivate both mass and specialty audiences.

This comprehensive research report delivers an in-depth overview of the principal market players in the Sauce market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- B&G Foods, Inc.

- Barilla G. e R. Fratelli S.p.A.

- Baumer Foods Inc.

- Campbell Soup Company

- Conagra Brands, Inc.

- Del Monte Foods, Inc.

- Dr Oetker

- General Mills Inc.

- George DeLallo Company, Inc.

- Hormel Foods Corporation

- Kikkoman Corporation

- Mars, Incorporated

- McCormick & Company

- McIlhenny Company

- Mizkan Holdings

- Nestlé S.A.

- NEXT!

- Northwest Gourmet Foods

- Orkla ASA

- PepsiCo, Inc.

- Remia International

- Southeastern Mills Inc.

- The Clorox Company

- The Flavour Base Sauce Company

- The Kraft Heinz Company

- The Tracklement Company Ltd.

- TW GARNER FOOD COMPANY

- Unilever Food Solutions

- Veeba Food Services Private Ltd

Strategic Imperatives for Industry Leaders Designing Agile Supply Chains Data-Driven Innovation and Omnichannel Engagement to Seize Emerging Opportunities

First, prioritize agile supply chain models that incorporate dual-sourcing strategies and real-time tariff analytics to mitigate cost pressures. By establishing alternative ingredient pipelines and leveraging regional manufacturing hubs, companies can maintain margin resilience and safeguard continuity in the face of evolving trade policies.

Second, accelerate digital transformation initiatives by integrating AI-driven consumer insights and predictive flavor modeling. Investing in data science capabilities-ranging from natural language analysis of social media chatter to machine learning for demand forecasting-will enable rapid identification of emerging taste profiles and hyper-personalized marketing campaigns.

Third, align R&D roadmaps with the escalating demand for clean-label, functional, and premium offerings. Collaborate with nutrition and food-science experts to infuse sauces with health-enhancing ingredients such as adaptogens, probiotics, and plant-based proteins, while maintaining artisanal flavor authenticity.

Fourth, harness omnichannel market activation by crafting seamless consumer journeys that bridge in-store experiential touchpoints (interactive sampling stations, chef demonstrations) with engaging online commerce environments (interactive recipe apps, subscription bundles). Finally, cultivate brand-partnership ecosystems-be it with culinary influencers, meal-kit services, or fast-food innovators-to co-create limited-edition releases that generate buzz and expand distribution horizons.

Rigorous Multi-Stage Methodological Framework Integrating Secondary Analysis Primary Stakeholder Interviews and Data Triangulation to Ensure Analytical Rigor

Our research methodology synthesizes multiple layers of qualitative and quantitative inquiry to ensure robust, defensible insights. We commence with an exhaustive secondary review of public filings, trade publications, and proprietary databases to frame market structure, historical performance, and competitive landscapes. This desk research establishes the foundational taxonomy-including segmentation by type, packaging, application, channel, and end user-for subsequent primary outreach.

Primary research comprises in-depth interviews with a cross-functional panel of industry stakeholders, spanning C-level executives at leading sauce manufacturers, procurement leads at major retail and foodservice operators, and domain experts in flavor innovation and packaging technology. These conversations validate secondary insights, unearth emerging trends, and quantify market drivers through demand-side and supply-side intelligence.

Finally, data triangulation techniques integrate findings from secondary sources and primary interviews with our proprietary quantitative models to ensure internal consistency and accuracy of conclusions. Analytical tools-ranging from scenario simulations to sensitivity analyses-rigorously test key assumptions, enabling strategic stakeholders to explore alternative market trajectories and stress-test their strategic roadmaps.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Sauce market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Sauce Market, by Type

- Sauce Market, by Packaging

- Sauce Market, by Distribution Channel

- Sauce Market, by End User

- Sauce Market, by Application

- Sauce Market, by Region

- Sauce Market, by Group

- Sauce Market, by Country

- United States Sauce Market

- China Sauce Market

- Competitive Landscape

- List of Figures [Total: 17]

- List of Tables [Total: 1749 ]

Synthesizing Critical Insights to Illuminate the Future Trajectory of the Sauce Market and Inform Strategic Decision-Making for Sustained Growth

The sauce industry’s evolution in 2025 underscores a profound alignment with consumer imperatives-bold flavor exploration, health-driven formulations, and seamless digital accessibility-thereby redefining sauces as indispensable culinary enablers rather than peripheral condiments. As protectionist trade policies and shifting supply chain dynamics challenge traditional cost structures, agile players adeptly leverage dual-sourcing, tariff intelligence, and regional manufacturing to sustain competitiveness. Meanwhile, the fusion of data analytics, AI-powered personalization, and omnichannel engagement has proven instrumental in translating emerging taste preferences into market winners.

Looking ahead, the confluence of premiumization, clean-label stewardship, and sustainability priorities will continue to shape brand differentiation and growth trajectories. Companies that embrace a holistic strategy-balancing functional health innovations, packaging advancements, and strategic partnerships-will be best positioned to capture value from evolving consumer aspirations. Ultimately, the future sauce leader will be defined not merely by distribution scale or heritage, but by the agility to anticipate change, the creativity to fuse global flavors, and the conviction to deliver authentic, value-driven culinary experiences.

Empower Your Strategic Planning with Expert-Driven Sauce Industry Intelligence Connect with Ketan Rohom to Secure Comprehensive Insights

For executives and strategists seeking to deepen their understanding of the dynamic sauce market and leverage actionable insights tailored to today’s accelerated pace, our comprehensive market research report presents the rigorous analysis, expert interviews, and proprietary data necessary to inform strategic decisions. To access this in-depth intelligence, connect with Ketan Rohom (Associate Director, Sales & Marketing) to secure your copy and empower your organization with clarity and confidence in navigating the evolving sauce landscape.

- How big is the Sauce Market?

- What is the Sauce Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?