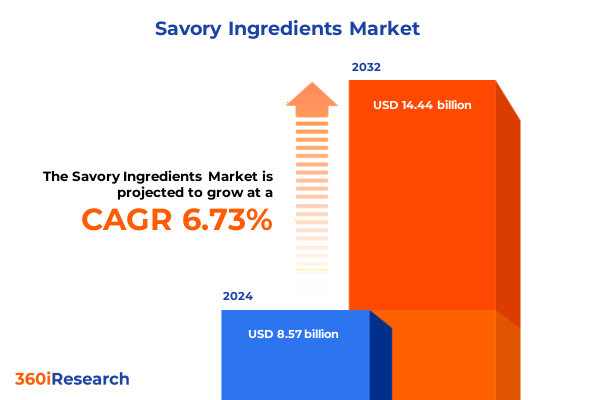

The Savory Ingredients Market size was estimated at USD 9.13 billion in 2025 and expected to reach USD 9.72 billion in 2026, at a CAGR of 6.77% to reach USD 14.44 billion by 2032.

Exploring the evolving landscape of savory ingredients and their strategic importance in driving innovation value and consumer engagement in global cuisines

The savory ingredients sector has experienced a remarkable transformation as global food manufacturers and processors intensify their focus on flavor innovation and product differentiation. Consumer palates have evolved beyond traditional tastes, driving demand for complex umami profiles that heighten sensory experiences and add value to end products. This heightened interest is underpinned by a broader shift toward clean-label formulations, natural sourcing, and transparent supply chains that resonate with health-conscious foodies and culinary professionals alike.

With an expansive portfolio ranging from hydrolyzed vegetable protein and monosodium glutamate to soy sauce, spices and herbs, and yeast extract, suppliers are actively diversifying their offerings to satisfy regional taste preferences and specialized applications. Within spices and herbs, herb blends, pepper, salt, and concentrated spice extracts are gaining prominence for their ability to impart nuanced character to a wide array of products. By harnessing these versatile ingredients, manufacturers can create signature lines that stand out on crowded shelves and align with evolving consumer lifestyles.

Looking ahead, the interplay between consumer demand for authenticity, regulatory scrutiny on labeling practices, and innovations in processing technologies will shape strategic priorities. As manufacturers strive to balance cost efficiency, supply chain resilience, and sustainability goals, the competitive landscape will reward those who can integrate flavor excellence with operational agility. This introduction lays the groundwork for a deeper exploration of transformative shifts, regulatory impacts, and actionable strategies guiding the next phase of growth.

Analyzing transformative shifts and technological advancements that are redefining savory ingredient development and unlocking new market opportunities worldwide

Recent years have witnessed transformative shifts that are redefining every facet of savory ingredient development, from raw material sourcing to advanced formulation techniques. One key driver is the rise of biotechnology and precision fermentation, which enable the production of high-purity taste enhancers and umami compounds with reduced reliance on traditional agricultural inputs. As sustainable manufacturing practices become a priority, these novel approaches are enhancing both cost efficiency and environmental stewardship.

Parallel to technological advances, consumer expectations regarding label transparency and natural provenance are fueling the adoption of clean-label alternatives. This shift has elevated plant-based protein concentrates and microbial-derived extracts as preferred options over conventional ingredients, particularly in applications spanning dairy analogs and meat substitutes. Additionally, digital tools such as AI-driven flavor analytics and predictive modeling are accelerating R&D cycles, empowering formulators to fine-tune taste profiles while maintaining nutritional standards.

Strategic collaborations between established flavor houses and agile start-ups are also emerging as a potent catalyst for innovation. By pooling expertise in sensory science, regulatory compliance, and market intelligence, these partnerships are unlocking novel spice extract blends and next-generation yeast derivatives that appeal to regional tastes. As the sector evolves, companies that can swiftly adapt to these technological and consumer-driven shifts will secure a competitive edge in an increasingly crowded marketplace.

Evaluating how 2025 United States tariffs reshape savory ingredient import flows supply chain resilience and cost structures across the global industry

The imposition of new United States tariffs in early 2025 has sent ripples through the savory ingredients supply chain, reshaping import flows and compelling stakeholders to reassess sourcing strategies. Tariffs on key components such as hydrolyzed vegetable protein and certain spice concentrates have increased landed costs, prompting downstream manufacturers to explore alternative suppliers and regional trade agreements. In response, some producers have accelerated domestic production capacities to mitigate exposure to fluctuating duty structures.

Consequently, import dynamics have shifted toward countries with preferential trade status or lower logistical expenses, as buyers seek to offset tariff-induced cost burdens. While this realignment has strengthened resilience for some, it has also introduced complexities in quality consistency and lead times. Margin pressures are palpable, leading many manufacturers to engage in collaborative cost-sharing arrangements with ingredient suppliers or invest in nearshoring initiatives to reduce transit-related risks.

Looking ahead, the cumulative impact of these tariff measures will hinge on broader geopolitical developments and potential renegotiations of trade agreements. Companies that proactively diversify procurement, engage in strategic hedging, and optimize production footprints are better positioned to preserve profitability. The current tariff environment underscores the importance of agile supply chain management, robust risk assessment, and continuous dialogue with trade authorities.

Uncovering segmentation insights revealing how ingredient type form source application and distribution channel shape flavor innovation and market positioning

Granular segmentation analysis reveals distinct growth trajectories and innovation hotspots across multiple market dimensions. By ingredient type, hydrolyzed vegetable protein and monosodium glutamate continue to dominate in large-scale flavor applications, whereas soy sauce is experiencing renewed interest in niche sauces and marinades. Within spices and herbs, demand is fragmenting toward specialized herb blends, premium pepper varieties, refined salts, and concentrated spice extracts tailored for clean-label formulations.

Form factors further influence strategic choices, with dry powders offering stability for bakery and snack applications, while liquid concentrates and pastes deliver boosted flavor impact in sauces, dressings, and dairy products. Manufacturers are increasingly leveraging paste formulations in ready-to-serve soups and broths to streamline production processes and enhance shelf appeal. Source-based insights show a clear pivot toward microbial and plant-derived extracts, driven by sustainability goals and vegan-friendly positioning, while animal-based ingredients retain a foothold in premium meat products.

Application segmentation underscores that bakery producers are embedding savory enhancers to counterbalance sweetness, and dairy processors are integrating yeast extracts for dairy-free cheese analogs. In meat products, cover poultry, processed meat, red meat, and seafood applications, companies are customizing flavor matrices for texture optimization. Sauces and dressings-particularly cream-based, soy-based, and tomato-based variants-are adopting multifunctional ingredients to improve mouthfeel and reduce sodium content. Finally, distribution channels are adapting to omnichannel trends: food manufacturers and service providers maintain large-volume contracts, online channels including eCommerce platforms, manufacturer websites, and meal kit services cater to direct-to-consumer demands, and retailers from convenience stores to hypermarkets, specialty stores, and supermarkets curate premium private-label offerings.

This comprehensive research report categorizes the Savory Ingredients market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Ingredient Type

- Form

- Source

- Application

- Distribution Channel

Highlighting regional variations in consumer preferences policy landscapes and supply capabilities across Americas Europe Middle East Africa and Asia Pacific

Regional dynamics exert a profound influence on flavor preferences, regulatory compliance, and supply chain models. In the Americas, consumer affinity for bold, aromatic profiles is driving increased use of spice blends and concentrated extracts in snacks and meat marinades, while regulatory frameworks around clean-label claims continue to evolve. Canada and Brazil stand out as key hubs for sourcing plant-based proteins and microbial-derived enhancers, supporting the North American market’s shift toward sustainable ingredients.

Within Europe Middle East Africa, stringent regulations on labeling and permitted additive levels shape product development. The European Union’s emphasis on natural flavor definitions has catalyzed innovation in yeast extract analogs and botanical spice concentrates. Meanwhile, Middle Eastern and North African cuisines drive demand for specialty pepper cultivars and herb blends. Supply chains in this region are integrating digital traceability solutions to meet rigorous food safety standards and to bolster trust across cross-border transactions.

Asia Pacific remains a powerhouse for both production and consumption of savory ingredients, anchored by China’s fermentation expertise and Japan’s MSG heritage. Emerging markets such as India and Southeast Asia are witnessing a rise of local spice variants and heat-stable protein hydrolysates for ambient-ready meals. Concurrently, infrastructure investments in port modernization and cold chain networks are streamlining exports, enabling regional suppliers to compete more effectively on the global stage.

This comprehensive research report examines key regions that drive the evolution of the Savory Ingredients market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Revealing strategic initiatives partnerships and market reshaping moves among leading players driving growth and innovation in the savory ingredients sector

Competitive dynamics in the savory ingredients sector are being reshaped by strategic initiatives, cross-industry partnerships, and targeted investments. Leading players are augmenting their portfolios through mergers and acquisitions that bring complementary flavor technologies and expand geographic reach. Alliances with biotechnology firms and spice producers have accelerated the commercialization of novel umami compounds and clean-label spice extracts.

Simultaneously, product launches focused on plant-based and microbial-derived solutions are capturing buyer interest and commanding premium positioning. Companies are also investing in advanced application labs and sensory centers to co-develop tailored flavor systems with key customers. Collaborative research programs with academic institutions are further enhancing capabilities in enzyme optimization and fermentation processes.

Beyond innovation, major firms are reinforcing their supply chain networks by securing long-term contracts with growers, establishing regional production facilities, and deploying digital platforms for real-time performance monitoring. These integrated approaches are enabling swift responses to demand fluctuations, regulatory shifts, and sustainability mandates, thereby solidifying leadership positions in a rapidly evolving marketplace.

This comprehensive research report delivers an in-depth overview of the principal market players in the Savory Ingredients market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- Ajinomoto Co., Inc.

- DSM-Firmenich AG

- Döhler GmbH

- Firmenich International SA

- Givaudan SA

- Ingredion Incorporated

- International Flavors & Fragrances Inc.

- Kerry Group plc

- Lesaffre SA

- Sensient Technologies Corporation

- Symrise AG

- Tate & Lyle PLC

Proposing actionable recommendations to boost supply chain agility optimize cost control and foster collaborative innovation among leaders in savory ingredients

Industry leaders must prioritize initiatives that enhance supply chain agility, enabling rapid adaptation to regulatory changes and geo-economic uncertainties. By diversifying supplier bases across multiple regions and leveraging nearshoring opportunities, companies can reduce dependency on any single source and improve lead time reliability. Concurrently, optimizing cost control through collaborative cost-sharing arrangements with raw material suppliers will preserve margins without compromising quality.

Fostering collaborative innovation through open-innovation platforms and strategic alliances with biotechnology firms will accelerate the development of next-generation flavor enhancers. Investments in digital tools such as predictive analytics for demand forecasting and blockchain for traceability will strengthen operational resilience and bolster consumer trust. Furthermore, aligning product formulations with clean-label trends and sustainability commitments will resonate with evolving consumer expectations.

Finally, ongoing engagement with regulatory bodies and participation in industry associations will ensure that emerging standards are anticipated and incorporated into product roadmaps. By integrating these actionable recommendations, leaders can position their organizations to capitalize on growth opportunities, preempt disruptions, and deliver differentiated flavor solutions.

Outlining a rigorous research methodology combining data collection expert interviews and validation protocols to ensure credibility and deliver findings

The research methodology underpinning this analysis blends a rigorous approach to data collection, expert engagement, and validation protocols. Secondary research encompassed an exhaustive review of trade publications, regulatory filings, and company disclosures to map historical trends and identify prevailing market dynamics. This foundation was augmented by primary interviews with senior executives, R&D leaders, and procurement specialists from across the value chain, providing firsthand perspectives on strategic priorities and operational challenges.

Data triangulation was employed to reconcile quantitative insights with qualitative inputs, ensuring consistency and depth of analysis. Validation protocols included cross-referencing proprietary databases and third-party sources, as well as peer-review checkpoints with domain experts. Advanced analytical frameworks, including SWOT assessments and scenario planning, were utilized to evaluate potential market disruptions and strategic inflection points. This comprehensive methodology guarantees that findings are both credible and directly applicable to decision-making processes.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Savory Ingredients market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Savory Ingredients Market, by Ingredient Type

- Savory Ingredients Market, by Form

- Savory Ingredients Market, by Source

- Savory Ingredients Market, by Application

- Savory Ingredients Market, by Distribution Channel

- Savory Ingredients Market, by Region

- Savory Ingredients Market, by Group

- Savory Ingredients Market, by Country

- United States Savory Ingredients Market

- China Savory Ingredients Market

- Competitive Landscape

- List of Figures [Total: 17]

- List of Tables [Total: 1749 ]

Drawing conclusions on how evolving industry dynamics regulation and innovations are laying the groundwork for transformation and growth in savory ingredients

The savory ingredients industry stands at an inflection point where evolving consumer tastes, technological breakthroughs, and regulatory complexities converge to reshape competitive landscapes. Robust demand for natural umami enhancers and clean-label alternatives is prompting ingredient suppliers to innovate across source materials, formulation techniques, and product applications. Concurrently, tariff shifts and geopolitical developments are underscoring the importance of agile supply chain management.

Segmentation insights reveal that targeted approaches-whether by ingredient type, form, source, application, or distribution channel-are essential for capturing niche opportunities and sustaining differentiation. Regional variations further highlight the need for locally tailored strategies that align with policy frameworks and cultural expectations. Against this backdrop, leading companies are forging alliances, expanding production footprints, and investing in digital capabilities to outpace competitors.

In conclusion, success in the savory ingredients sector will be determined by an organization’s ability to balance innovation with operational excellence, adapt swiftly to external headwinds, and anticipate emerging consumer preferences. The insights presented herein offer a strategic roadmap for navigating uncertainty and unlocking the next phase of growth.

Inviting readers to connect with Ketan Rohom Associate Director Sales and Marketing to access savory ingredients research report for strategic decision making

For deeper insights and to secure the complete savory ingredients research report, we invite you to connect directly with Ketan Rohom, Associate Director Sales and Marketing at our organization. Engaging with Ketan will enable you to gain timely access to the full scope of analysis, detailed data exploration, and strategic recommendations tailored to your business objectives. Take this opportunity to equip your team with the intelligence required to navigate evolving market dynamics, leverage emerging trends, and outpace competitors. Contact Ketan today to unlock the comprehensive resource that will inform your next pivotal decisions and drive sustained growth in the savory ingredients space.

- How big is the Savory Ingredients Market?

- What is the Savory Ingredients Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?