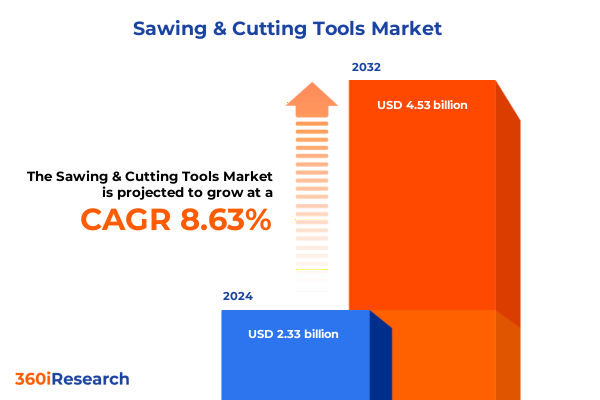

The Sawing & Cutting Tools Market size was estimated at USD 2.54 billion in 2025 and expected to reach USD 2.77 billion in 2026, at a CAGR of 8.61% to reach USD 4.53 billion by 2032.

Setting the Stage for Precision and Productivity in the Sawing and Cutting Tools Market through a Comprehensive Executive Overview

The sawing and cutting tools market occupies a critical position at the forefront of industrial manufacturing, construction, and precision engineering. As production processes grow increasingly complex, the demand for high-performance tools capable of delivering accurate, efficient cuts across a range of materials has never been greater. This report serves as a comprehensive executive summary designed to guide stakeholders through the major drivers, emerging trends, and competitive dynamics shaping the current landscape.

Throughout this overview, you will gain clarity on the transformative forces redefining the sector- from digital integration and advanced materials to evolving regulatory frameworks. Additionally, the analysis delves into the cumulative impacts of U.S. trade policies, critical segmentation insights across multiple dimensions, and key regional and company-level developments. By synthesizing these elements, this section lays the foundation for actionable recommendations and strategic planning aimed at fostering innovation, resilience, and market leadership.

Embracing Digital Transformation, Advanced Materials and Sustainability as Catalysts Redefining the Future of Sawing and Cutting Tool Applications

Industry 4.0 principles are rapidly permeating sawing and cutting tool applications, embedding intelligence into once-mechanical processes and enabling real-time performance monitoring. Through the integration of Internet of Things sensors and data analytics platforms, manufacturers can predict tool wear, optimize cutting parameters, and reduce unplanned downtime by up to 40 percent, which significantly elevates operational reliability and throughput. Concurrently, additive manufacturing (3D printing) technologies are reshaping tool design, allowing for custom geometries and integrated cooling channels that enhance heat dissipation and extend tool life by nearly 20 percent.

Advanced materials and cutting-edge coatings, including diamond-like carbon and nanocomposite formulations, are driving performance improvements across metal, composite, and high-strength alloys. These innovations deliver superior hardness, reduce friction, and dramatically improve cutting accuracy. Moreover, manufacturers increasingly favor hybrid solutions that combine the robustness of carbide with the resilience of ceramics, reflecting a broader push toward versatile, multi-functional tools that streamline supply chains and minimize inventory complexity.

Sustainability remains an overarching imperative. Tool producers and end users alike are embracing greener practices through recyclable blade materials, energy-efficient manufacturing processes, and reduced kerf widths that limit material waste. Green manufacturing initiatives, driven by stringent environmental regulations and corporate ESG commitments, are catalyzing the development of dry-cut tools that eliminate coolant use and reduce lifecycle carbon footprints. Taken together, these technological and environmental advances are redefining value creation in the sawing and cutting tools industry.

Assessing the Mounting Impact of Elevated United States Steel and Aluminum Tariffs through 2025 on Supply Chains, Costs and Competitive Dynamics

On June 4, 2025, the U.S. government raised Section 232 steel and aluminum tariffs from 25 percent to 50 percent ad valorem, applying the higher rate broadly while maintaining a reduced 25 percent rate for select steel and aluminum imports from the United Kingdom under the Economic Prosperity Deal. This escalation closed prior exemptions, enforced strict melted-and-poured rules, and expanded coverage to downstream products such as structural steel, engine parts, and industrial machinery components.

Leading aerospace and defense suppliers have already experienced the financial strains of these measures. RTX, for example, cited a $125 million hit this year and expects a cumulative impact of approximately $500 million in 2025 due to higher steel and aluminum costs, even as its overall sales projections climbed. Tool manufacturers reliant on imported raw materials have encountered similar pressures, with increased input costs eroding gross margins and prompting reassessments of pricing strategies.

Broader industry analyses project that the expanded tariffs could add more than $22 billion to U.S. steel and aluminum import costs and up to an additional $29 billion in duties on derivative products if fully priced in, elevating finished tool prices and compressing profit pools. Amid these shifts, companies are accelerating supply chain diversification and exploring nearshoring opportunities to mitigate tariff burdens and enhance operational resilience.

In construction, where steel-intensive frameworks and aluminum-based equipment are ubiquitous, the new duties have translated into significant cost increases for beams, rebar, and scaffolding. Despite intentions to bolster domestic production capacity, short-term reliance on imports remains high, perpetuating elevated material expenses and influencing long-term procurement strategies for contractors and tool providers alike.

Unpacking Critical Segmentation Insights Revealing Opportunities across Industries, Tool Types, Power Sources, Operation Modes and Distribution Channels

The market’s diverse end-use industries underscore a spectrum of performance requirements and regulatory considerations ranging from aerospace’s demand for micro-precision cutting on high-value alloys to medical and healthcare applications where sterilizable blades and consistent tolerances are paramount. In automotive manufacturing, high-volume circular saws and high-speed steel blades dominate assembly lines, while energy and power projects leverage large stationary bandsaws capable of slicing through thick metal pipes and structural tubing. Construction sites rely heavily on handheld reciprocating saws and jigsaws, demanding ergonomic designs that reduce operator fatigue and boost productivity over extended use.

Tool type variations reveal a nuanced preference hierarchy: table saws and circular saws are favored in controlled environments like workshops and factories for repeatable precision, whereas portable handsaws, jigsaws, and reciprocating saws see widespread adoption on dynamic job sites. Within power sources, corded electric tools maintain a strong foothold due to unlimited runtime and high torque outputs, yet the rise of cordless battery platforms-bolstered by advanced lithium-ion chemistries-continues to reshape handheld saw segments with enhanced mobility and quick-change battery systems.

Operational mode segmentation further delineates handheld devices, prized for on-the-go versatility and smaller footprint, from stationary saws that deliver larger cutting capacities and tighter dimensional accuracy. Market participants are also advancing specialized blade innovations, from bi-metal constructions delivering excellent flex strength to carbide-tipped and diamond-coated variants optimized for abrasive composites and hard minerals. Each blade type’s performance characteristics align directly with the demands of specific materials-wood, plastic, metal, or composite-showing that blade technology remains a core differentiator in value propositions.

Sales channel dynamics reflect an omnichannel ecosystem: direct sales and distributors provide established B2B support, while online retail channels, including manufacturer websites and digital marketplaces, drive broader reach and convenience. Specialty stores continue to offer curated product portfolios and expert advice, emphasizing the continued importance of end-user education and after-sales services in building brand loyalty.

This comprehensive research report categorizes the Sawing & Cutting Tools market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- End Use Industry

- Tool Type

- Power Source

- Operation Mode

- Cutting Material

- Blade Type

- Sales Channel

Deciphering Regional Market Dynamics across the Americas, Europe Middle East Africa and Asia Pacific to Guide Strategic Expansion Initiatives

In the Americas, North America leads with mature industrial bases and high adoption of automation technologies, driving demand for premium, sensor-equipped stationary saws in manufacturing and energy sectors. Latin America’s expanding infrastructure projects are boosting interest in cost-effective reciprocating and circular saw solutions, particularly in emerging economies where construction and automotive manufacturing volumes are on the rise.

The Europe, Middle East & Africa region exhibits diverse growth trajectories: Western Europe prioritizes sustainability and precision performance, fostering uptake of dry-cut and eco-friendly blades in industries such as aerospace and automotive. Central and Eastern European markets are witnessing robust investments in manufacturing modernization, while the Middle East’s oil and gas infrastructure projects call for heavy-duty band and table saws with corrosion-resistant blades. Africa’s nascent energy and construction developments are generating early-stage demand for versatile, entry-level saw systems.

Asia-Pacific remains the fastest-expanding region, driven by large-scale urbanization in China and India, coupled with government incentives for indigenous manufacturing. Automated sawing cells and high-throughput table saw lines are increasingly deployed in electronics and automotive plants across East Asia. Simultaneously, Southeast Asian nations are emerging as assembly hubs for consumer appliances, reinforcing demand for both manual and pneumatic cutting tools that balance cost and reliability.

Across these regions, localization of manufacturing, coupled with regional compliance requirements, underscores the importance of adapting product portfolios to meet country-specific standards and preferences. Strategic partnerships with regional distributors and service networks emerge as crucial enablers for market penetration and after-sales support.

This comprehensive research report examines key regions that drive the evolution of the Sawing & Cutting Tools market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Illuminating Competitive Company Profiles and Strategic Initiatives Shaping the Evolution of the Sawing and Cutting Tools Industry Landscape

Major industry leaders continue to shape the competitive landscape through sustained R&D investments, portfolio expansions, and strategic alliances. Stanley Black & Decker, for example, has strengthened its cordless sawing offerings under the DEWALT and Black+Decker brands, leveraging proprietary battery technologies and user-centric ergonomics to maintain leadership in both professional and consumer segments. Bosch Power Tools has prioritized the roll-out of new 18V cordless saws equipped with BITURBO brushless motors, tapping into robust sales growth in North America and capitalizing on digital integration at trade shows such as World of Concrete.

Makita has expanded its Li-ion platform beyond traditional corded fixtures, targeting emerging markets with an extensive range of portable saws and jigsaws that emphasize lightweight design and extended runtime. Hilti continues to dominate the heavy-duty stationary saw segment with its high-precision, high-torque solutions tailored for concrete and metal cutting in construction and energy projects. Festool’s premium-focused strategy underscores tight tolerances, integrated dust extraction systems, and seamless CAD/CAM compatibility, serving high-end woodworking and aerospace applications.

Emerging specialists such as Lenox Tools and Eberle punch in with targeted innovations, including advanced blade geometries for composite materials and digitally encoded consumables that enable automated blade tracking and predictive reorder processes. Their agility contrasts with the scale-driven strategies of larger conglomerates, creating a dynamic competitive landscape where niche expertise and brand reputation both play pivotal roles.

This comprehensive research report delivers an in-depth overview of the principal market players in the Sawing & Cutting Tools market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- Apex Tool Group LLC

- Black+Decker

- Diablo Tools

- Emerson Electric Co.

- Hilti Corporation

- Hitachi Koki Co. Ltd.

- Irwin Tools

- Klein Tools Inc.

- Lowe's Companies Inc.

- Makita Corporation

- Milwaukee Tool

- Snap-on Incorporated

- Stanley Black & Decker Inc.

- Starrett Company

- Techtronic Industries Co. Ltd.

- Vermont American

Developing Actionable Strategic Recommendations to Drive Innovation Enhance Resilience and Foster Growth in the Sawing and Cutting Tools Sector

Industry leaders should prioritize a dual approach of expanding digital capabilities while safeguarding supply chain resilience. Investing in IoT-enabled tooling and predictive analytics platforms not only elevates product value but also fosters long-term user engagement through data-driven maintenance services. Concurrently, diversifying sourcing strategies by integrating nearshore suppliers and regional manufacturing hubs will mitigate tariff exposure and logistical disruptions.

To capture emerging end-use segments, organizations must align R&D roadmaps with market-specific needs-developing diamond-coated blades for composite-heavy aerospace applications and ergonomic handheld saws for construction professionals. Collaborating with end users through co-development initiatives will accelerate innovation cycles and ensure solutions resonate with real-world operational challenges. Such partnerships can also deepen brand loyalty by positioning companies as co-creators rather than mere suppliers.

Optimizing distribution networks across direct sales, distributor channels, and digital marketplaces will enhance market accessibility. Tailoring channel strategies to regional purchasing behaviors, supported by virtual training platforms and interactive product demonstrations, can bridge knowledge gaps and drive adoption. Finally, embedding sustainability criteria into product design and manufacturing processes will resonate with regulatory bodies and environmentally conscious customers, reinforcing brand equity while addressing global carbon reduction goals.

Detailing a Rigorous Research Methodology Combining Qualitative Expertise and Quantitative Validation to Ensure Robust Sawing Tool Market Insights

This research combined a multi-stage methodological framework to ensure depth, reliability, and actionable insights. Initially, secondary data sources including industry publications, regulatory filings, and peer-reviewed journals were analyzed to map macroeconomic indicators, trade policies, and material science advancements. Concurrently, tariff schedules and official proclamations issued by the U.S. government guided the assessment of trade impacts.

In the primary research phase, in-depth interviews were conducted with senior executives from leading tool manufacturers, distributors, and end-user organizations across key geographies. These qualitative discussions illuminated emerging use cases, procurement challenges, and technology adoption barriers. The insights were then triangulated with quantitative shipment and revenue data drawn from proprietary industry databases to validate trends and refine market segmentation definitions.

Data integrity was upheld through rigorous cross-validation between source documents, ensuring consistency across material specifications, pricing dynamics, and regional growth rates. Advanced statistical techniques, including regression analysis and sensitivity testing, were employed to examine correlations between tariff fluctuations and cost structures. This mixed-methods approach underpins the robustness of the findings and provides a solid foundation for strategic decision-making.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Sawing & Cutting Tools market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Sawing & Cutting Tools Market, by End Use Industry

- Sawing & Cutting Tools Market, by Tool Type

- Sawing & Cutting Tools Market, by Power Source

- Sawing & Cutting Tools Market, by Operation Mode

- Sawing & Cutting Tools Market, by Cutting Material

- Sawing & Cutting Tools Market, by Blade Type

- Sawing & Cutting Tools Market, by Sales Channel

- Sawing & Cutting Tools Market, by Region

- Sawing & Cutting Tools Market, by Group

- Sawing & Cutting Tools Market, by Country

- United States Sawing & Cutting Tools Market

- China Sawing & Cutting Tools Market

- Competitive Landscape

- List of Figures [Total: 19]

- List of Tables [Total: 1749 ]

Concluding Insights Emphasizing Strategic Imperatives and Key Takeaways for Stakeholders Navigating the Evolving Sawing and Cutting Tools Market

As the sawing and cutting tools market evolves under the influence of technological breakthroughs, regulatory realignments, and shifting end-use demands, stakeholders face a landscape rich with opportunities and complexities. Precision, productivity, and sustainability emerge as the pillars that will define competitive advantage. Organizations that harness digital capabilities, develop advanced materials, and navigate trade dynamics with agility will be best positioned to lead in this environment.

Innovative product development, underpinned by strategic partnerships and customer-centric research, will be critical to addressing specialized cutting requirements across aerospace, healthcare, and heavy industry. At the same time, a nuanced appreciation of regional market characteristics-ranging from mature North American manufacturing to the rapid urbanization of Asia-Pacific-will guide effective localization of offerings and distribution strategies.

Ultimately, the successful synthesis of technological innovation, supply chain resilience, and sustainability commitments will chart the course for market leadership. By aligning organizational investments with these imperatives, decision-makers can capitalize on emerging growth vectors while reinforcing operational robustness against policy and economic volatility.

Engage with Ketan Rohom to Secure Comprehensive Market Intelligence and Leverage Cutting Edge Insights for Strategic Advantage in Sawing Tools

For tailored insights, deep data analysis, and strategic guidance that align with your organization’s growth objectives in the dynamic sawing and cutting tools market, connect directly with Ketan Rohom, Associate Director of Sales & Marketing at 360iResearch. Ketan brings a proven track record of helping industry leaders translate market intelligence into actionable strategies that drive product innovation, optimize supply chains, and enhance competitive advantage. By engaging with him, you’ll unlock exclusive access to detailed research findings, customized consultancy packages, and ongoing support designed to empower your decision-making.

Don’t miss the opportunity to partner with an expert who understands the nuances of sawing tool market trends, regulatory shifts, and technological advancements. Reach out to Ketan Rohom to purchase the full market research report and discover how you can leverage these insights to capture new revenue streams, mitigate risks, and position your organization for sustainable growth in 2025 and beyond.

- How big is the Sawing & Cutting Tools Market?

- What is the Sawing & Cutting Tools Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?